Despite Fed’s Efforts, Inflation is Still

Out of Control

By Victor

Sperandeo with the Curmudgeon

Introduction:

To a very large degree, the Fed controls the amount of money and credit in the U.S. financial

system. The U.S. central bank determines the cost of credit via the Fed Funds

rate, the money supply through open-market operations, creates excess bank

reserves by buying or borrowing Treasury bills from commercial banks, and uses

the Reverse Repo facility

(where the Fed borrows money from its primary dealers) to control short term

liquidity.

Their short-term manipulation of the credit markets is all

about central planning and is the opposite of “free markets.”

“Philosopher Kings” in

Control:

In recent years, U.S. government agencies (like the BLS)

distort the economic numbers they release to try to maneuver the people to act

the way the “Philosopher Kings” at the Fed want

them to do. That’s done to accomplish their goals, which are not publicly

disclosed (which is why we continue to assert the Powell led Fed has a hidden agenda.

Their main goal is to keep the established political system

going, and to re-elect, or change the parties in power to what the wealthiest

entities want.

If making money is your goal, you should never believe the

Fed’s words as they want an outcome that likely won’t help the average person.

Follow what they actually do, rather than what they

say they might do.

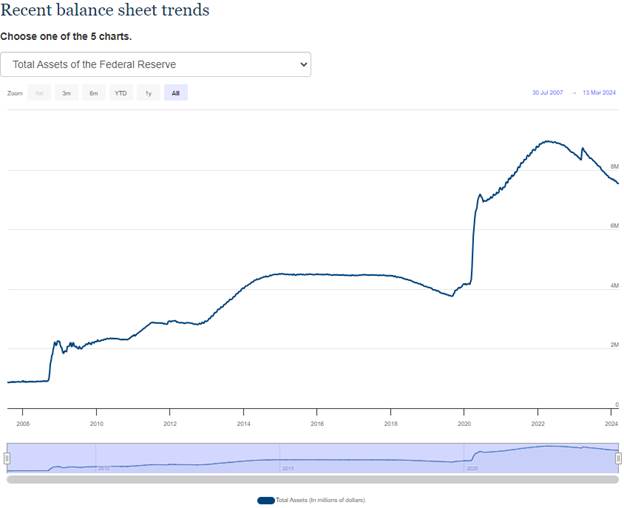

Fed’s Balance Sheet and

Quantitative Tightening (QT):

Let’s look at one example to prove my point – the Fed’s Balance Sheet.

One of the main tools of controlling the financial system and

the economy is the amount of money on the Fed’s Balance Sheet.

The Fed’s balance sheet is important for monetary policy

because it influences longer-term interest rates that the Fed Funds rate

doesn’t directly control. When the Fed wants to stimulate the economy, they buy

more assets and grow their portfolio. When they want to restrict growth, they

let assets roll off and shrink their balance sheet.

The Fed began Quantitative

Tightening (QT) in June 2022 to reduce its bloated balance sheet which had

soared since the great financial crisis starting in September 2008. The QT process was to NOT reinvest billions

of dollars of maturing fixed income securities each month, so they would “roll

off” the Fed’s balance sheet. Since the

June 2022 QT start, the Fed has reduced its total net assets from $9 trillion

to $7.539 trillion as of 3/7/24. That

amounts to $1.461 trillion or 16.233%.

The ballooning of the Fed’s balance sheet since the great

recession and its subsequent decrease under QT is shown in this graph:

Source: U.S. Federal Reserve Bank

Yet as the Curmudgeon noted in an earlier post today,

there’s a tremendous amount of

liquidity in the global financial system, with barrel full of excess

commercial bank reserves. That reality

is despite the shrinking of the Fed’s balance sheet via QT!

One would’ve expected the exact opposite! We explained that

dichotomy in this post: Clandestine Role of the Fed

in Increasing Liquidity. Also see: Curmudgeon: Interest Rates

Rise; Fed Balance Sheet Shrinks, Global Liquidity Flatlines

The Fed and U.S.

Government Agencies (BLS, BEA, etc.):

Here are a few recent Sperandeo/Curmudgeon blog posts

describing the collusion between the Fed

and the BLS regarding jobs numbers and the CPI:

- 2024 BLS and Fed

Subterfuge; Inflation Gauges, Fed Funds Forecast & Impact on the

Markets

- CPI Revisited, Market

Comments, Higher Rates Increase Deficit and Debt

- Finagling the CPI;

S&P 500 at New High with Ultra Complacency

- January New Jobs

Conundrum and Outlook for the Markets

- Sperandeo/Curmudgeon:

BLS Fake Job Reports; Excess Liquidity Boosted U.S. Economy in 2023

Inflation is Still Out

of Control:

Under the Biden administration, inflation, as measured by the

CPI, has been 5.68% annually at a compounded rate. Recall, the Fed’s annual inflation rate

target is 2%, based on the PCE (Personal Consumption Expenditure index),

which it believes is more accurate than the CPI.

Anyone who thinks that inflation is going to be under control

should look at President Biden’s recently released U.S. budget proposal of $7.3

trillion for fiscal year 2025 which begins on Oct. 1st. The typical 5.4% budget

increase is now proposed to be +13.3%!

Victor’s Conclusions:

1. Clearly, the Fed’s agenda is to keep those it wants in

political power. Businesses which are failing daily are just collateral damage

resulting from the Fed’s monetary policy. As the Curmudgeon

noted in the earlier referenced post, this year’s global tally of corporate

defaults stands at 29, which is the highest year-to-date count since the 36

recorded during the same period in 2009.

2. U.S. government spending continues to increase at alarming

rates with the budget deficits defying gravity. That has resulted in total U.S.

federal debt increasing by $1 trillion every 90 days!

End Quote:

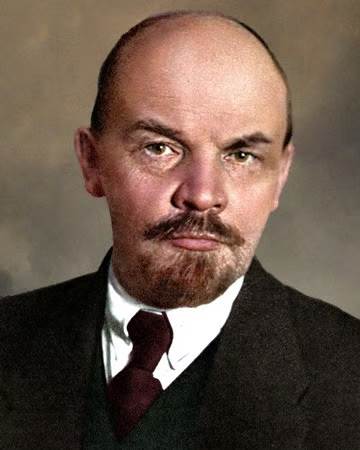

Russian tyrant Vladimir

Lenin, the leader of the Bolshevik

Revolution in Russia, is often

quoted as saying that inflation is a way

to crush the bourgeoisie and destroy the capitalist system. However, there

is no clear evidence that he actually said this exact

phrase. Some sources attribute a similar quote to him, but others suggest that

it was a paraphrase or a misattribution. In any event, the quote reflects

Lenin's view that inflation can be

used as a political weapon to confiscate the wealth of the citizens.

Vladimir Lenin was a Russian revolutionary, politician, and political

theorist. He served as the first and founding head of government of Soviet

Russia from 1917 until his death in 1924, and of the Soviet Union from 1922 to

1924.

……………………………………………………………………………………………………………

Be well, good luck,

success and till next time……………………………….

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2024 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).