CPI

Revisited, Market Comments, Higher Rates Increase Deficit and Debt

By Victor Sperandeo

with the Curmudgeon

January CPI Report Overstated:

The BLS reported on Tuesday, February 13th

that the CPI increased 0.3% in January on a seasonally adjusted basis, with a

3.1% YoY (52 week) rate of increase before seasonal adjustment.

The Street and Victor were looking for a 2.9% YoY CPI rate of

change. The higher than forecast CPI increase caused a one-day equity market

sell-off (S&P 500 fell 1.4%), which was followed by a strong “snap back”

rally on Wednesday (S&P up nearly 1%).

Last week’s Curmudgeon

post pointed out that the biggest subjective component of the CPI is

Shelter and it’s over-stated. We wrote:

“Shelter uses a

“Medicine Man” statistic called Owners’ Equivalent Rent (OER), which is

the amount of rent that a homeowner would be paid if they were renting out

their own home in the market. It accounts for 23~24% of the CPI and is

calculated by splitting the non-recurring cost of buying a home real estate

into rental payments. increases. due to

Owner Equivalent Rent (OER).”

In a “Thoughtful Money”

interview last week after the CPI report was released (go to the 20-minute

mark), Lance Roberts, principal at the RIA money management firm of RIA, told

Adam Taggart that he researched the CPI Shelter calculation.

“We analyzed the data

and there was a big divergence in shelter between Owners’ Equivalent Rent and

actual rent…and so the shelter component of CPI went up a lot, but the actual

rents that the people are paying is actually going

DOWN and there is a huge oversupply of multi-family apartments… so rents are

going to continue under pressure.

Roberts added that he excludes Housing and Health care when

he calculates the U.S. inflation rate.

Personally, he has not experienced ANY increase in the rent he pays for

his dwelling.

Victor’s Opinion:

Sadly, the BLS rigging of the economic data is why Victor

advises to never trust any data put out by the U.S. government, unless you

verify it yourself.

The reason for the rigging of the CPI is that the Fed does

not want to lower rates until May/June to help their masters who are in power.

A decline in rates would cause a

huge rally in financial assets and thereby raise consumer prices due to the “wealth

effect.”

Market Comments:

Victor says that the equity markets understand this and will

disregard any seemingly bad news in the short run. He opines: U.S. government officials will do whatever it

takes for their masters to retain power.

The

Curmudgeon notes that stock market valuations are very high. The S&P 500

P/E is currently at a sky high 21.5

times 12-month forward earnings which is well above the ballpark fair

value at 15.8x. The S&P’s 12

month trailing P/E is at 27.17x - the highest level since 2021.

More

importantly, equity market sentiment is extremely bullish, which is often

a contrary indicator of future price direction. For example:

·

Last week’s Investors

Intelligence sentiment survey showed the highest percentage of bulls since

the summer of 2021.

·

Market strategists have been

raising year-end price targets for the S&P 500. On Sunday, Goldman Sachs lifted its end

of 2024 S&P 500 price target to 5,200 on the assumption of rising corporate

profits.

·

U.S. Equity fund flows have been strong with a net

$6.78 billion in inflows during the past week. This is also a contrary indicator as

investors tend to buy at or near market tops.

·

The CBOE equity

put/call ratio is about as low as it gets historically, meaning more bets on

rising stock prices than falling.

·

BofA’s February Global Fund Manager Survey revealed the greatest global growth expectations in two

years, falling cash levels, and the highest allocation to U.S. stocks since

late 2021.

·

A soft landing is the

consensus call—for the first time in nearly two years, a

majority of respondents see no global recession in the next 12 months. There doesn’t seem to be a cloud in the sky.

Also, the U.S.

bond market didn’t get the memo about a rigged and overstated CPI. The 10-year T-Note yield was 4.14% just

before the CPI report was released on Tuesday, popped to 4.31% shortly

thereafter, and finished the week at 4.284% (Source: Market Watch).

That’s show in this chart:

Impact of Higher Rates on U.S. Treasury Borrowing Costs and

Debt:

As U.S. Treasury yields have increased to multiyear highs,

the U.S. government has been forced to pay a lot more in interest which is

adding to the budget deficit and national debt.

The federal government is expected to pay an additional $1.1

trillion in interest over the coming decade, according to the Congressional

Budget Office’s latest estimates. Interest costs are on pace to surpass defense

this year as one of the largest government expenses in the budget. Only Social

Security and Medicare are forecast to be bigger burdens in the coming years.

The U.S. is expected

to spend $870 billion, or 3.1% of gross domestic product, on interest payments

this year. That is nearly double the annual average of 1.6% of GDP since

2000. And interest costs are projected to reach 3.9% of GDP by 2034.

Investors now assume the U.S. government will run a

permanently larger deficit than it has in the past, eventually putting pressure

on the economy and financial markets.

As interest costs rise, the government must issue more debt

to pay bondholders. That in turn boosts spending on interest even further and

increases issuance. Federal debt held by the public (see chart below) is

projected to increase from a record $26 trillion in 2023 to $48 trillion by

2034, according to the CBO, more than eight times the amount outstanding in

2008. That would bring debt from 97% of gross domestic product today to 116%.

Campbell Harvey, director of research at Research Affiliates

and a professor at Duke University’s Fuqua School of Business, echoed what the

Curmudgeon has been saying for years: “The debt will become a problem, but it’s

very hard to know exactly when.”

“All else equal, a bigger government deficit means higher

short-term and long-term interest rates,” said Lee Ferridge,

head of macro strategy for North America at State Street Global Markets. “That

means lower growth, and in theory, that means lower asset values as well.”

End Quote:

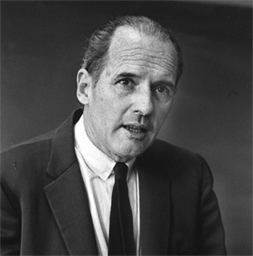

Where we are now is best expressed by the late Carroll

Quigley:

“The powers of financial capitalism had a far-reaching aim,

nothing less than to create a world system of financial control in private

hands able to dominate the political system of each country and the economy of

the world as a whole. This system was to be controlled

in a feudalist fashion by the central banks of the world acting in concert, by

secret agreements arrived at in frequent meetings and conferences.”

……………………………………………………………………………………………………..

Carroll Quigley was an

American historian and theorist of the evolution of civilizations. He is

remembered for his teaching work as a professor at Georgetown

University, and his seminal works, The Evolution of Civilizations: An

Introduction to Historical Analysis, and Tragedy and Hope; A History Of The

World In Our Time.

He stated that an Anglo-American banking elite have worked

together for centuries to spread certain values globally. You can listen to

his 1974 “Tragedy and Hope” podcast here.

………………………………………………………………………………………………………………………………………………………….

Wishing you good health, success, and good luck. Till next

time….

The

Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2024 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).