BLS Fake Job Reports; Excess Liquidity Boosted U.S.

Economy in 2023

By Victor Sperandeo

with the Curmudgeon

No Hard Landing for U.S. Economy:

"Yellen claims economy is in 'soft landing' thanks to

jobs report, gas prices.” U.S.

Treasury Secretary Janet Yellen appeared on CNN News Central on Friday to boast

about lowering gas prices and the most recent jobs report, which included

216,000 added jobs. According to the Queen Yellen, any

fears of a recession are "unwarranted."

"Well, there has been a lot of pessimism about the

economy; it's really proven unwarranted. A year ago, most forecasters believed

we would fall into a recession. Obviously, that hasn’t happened. We have a

good, strong labor market," Yellen said. "What we’re seeing now, I

think we can describe as a soft landing. And my hope is that it will, it will

continue," she added.

Yellen’s remarks were stimulated by Friday’s headline

non-farm payroll number of +216,000 jobs added in December, as reported by the BLS. That easily topped the estimated payroll

number which was +170,000.

The

unemployment rate was unchanged at 3.7%, but it would’ve been higher if not for

the sharp drop of 676,000 in the labor force. Importantly, the labor force

participation rate declined to 62.5%, which was down from 62.8% from the

previous month. That is lower than the long-term

average of 62.84%. The

employment-population ratio at 60.1%, also decreased by 0.3% in December. Check out these charts from the BLS:

What Yellen did not mention was that the change in total

nonfarm payroll employment for October was revised down by 45,000 (from

+150,000 to +105,000) and the change for November was also revised down by

26,000 (from +199,000 to +173,000). With these revisions, employment in October

and November combined is 71,000 lower than previously reported. Taken together, the 165,000 average monthly

increase in payrolls for October and November was roughly half the pace of

mid-2022. So, was Friday’s jobs

report really that great?

Victor’s Analysis of BLS Job Reports:

At year end, the “seasonal adjustments (SA)” should match the

“non-seasonal adjustments (NSA).” For

2023, there were +2,532,000 SA new jobs created versus +2,427,000 NSA jobs

added. That’s a difference of 105,000 jobs. The December SA number was

+216,000, but NSA was -167,000! Yet

there’s a more important employment statistic.

What is the standout

statistic is the BIRTH/DEATH MODEL (BDM) was reported as 50% of the new jobs added

in 2023 or +1,266,000 phantom jobs created.

BDM jobs are not surveyed or counted. Instead, they are estimated via an

historic algorithm that was originally created in the Reagan administration but

altered since then.

The BLS

changes the BDM criteria over time to show what it wants (???). For example,

here were the changes made during the COVID-19 pandemic:

“The labor

market experienced widespread disruption at the onset of the pandemic, leading

to a breakdown in the historical relationship between business openings

(births) and closings (deaths). To better reflect the net effect of the

contribution of business births and deaths to the estimates during the

pandemic, BLS implemented special procedures to the net birth-death model in

March 2020. Effective with the release of October 2021 preliminary estimates,

BLS determined that adjustments to its birth-death methodology were no longer

necessary. Therefore, the birth-death contribution to establishment survey

estimates beginning with October 2021 are forecast using the methodology used

prior to the onset of the of the COVID-19 pandemic.”

-->In

reality, the BDM is a guess and has little to do with reality.

Victor believes that BDM jobs could have DECLINED in

2023, instead of adding 1.266 million new jobs. The model takes estimated

businesses that closed (died) versus new ones that are opening (birth).

With business bankruptcies running at the highest rate since

2009-2011, he asks how can the 2023 BDM numbers be correct? How can new companies be formed in this

environment and at a very high rate? If you tried raising capital last year you

would understand that Venture Capitalists and Private Equity investors don’t

want to even look at most deals as they’ve become very risk averse.

To add to the BLS report skepticism, the headline number of

jobs added in 10 of 11 months last year were adjusted lower by in the

following months. Evidently, the BLS playbook is that headline numbers

are better than estimates, then the next month the former is adjusted lower.

We’ve already cited October and November 2023 downward revisions as examples of

this BLS chicanery.

The higher reported number is important, in that all eyes are

on it, especially the Fed, who believes it shows strength in the U.S. economy.

Yet no one seems to care about downward revisions as they do not affect

policy. In fact, the FED NEVER retracted

their projections due to an adjusted jobs number.

-->Bottom line is that economic numbers put out by

U.S. government agencies like the BLS and BEA should be carefully analyzed

rather than believed at face value.

Reverse Repos and BTFP Added Liquidity to U.S. Economy:

The New York Fed [1.] conducts repo

and reverse repo operations each day as a means to help keep the federal

funds rate in the target range set by the Federal Open Market Committee

(FOMC). Repos drain

money from the financial system while Reverse Repos put it back in. We explained Reverse Repos in depth in this

post-- “RRP’s: Wall Street Newcomers Need a Monetary

Education!”

Note 1. The NY Fed, along with

all 12 Fed regional banks and the FOMC, are said to be an

"independent/quasi" government agency that sets monetary policy. It

is NOT supposed to be influenced by the Executive, Legislative or Judicial

branches of the U.S. Federal government.

However, many cynics (including Victor and the Curmudgeon) suspect the

Fed’s December projection of three rate cuts this year has to do with 2024

being an election year, where politicians strive to make the economy look

good. Other skeptics note that lower Fed

Funds rates would help the Treasury’s massive financing, which relies heavily

on short-term T-bills. In fact, it’s

been suggested that U.S. Treasury Secretary Yellen requested the “Fed pivot”

last month to lower U.S. government debt service costs at future Treasury

auctions.

.............…...…......................…......................…........................……

The Reverse Repo Facility is currently

$694,478 billion, down from its high on January 3, 2023 of $2,188 trillion. The

difference of $1.494 trillion is now in the real economy.

REVERSE REPO CHART (NY FED):

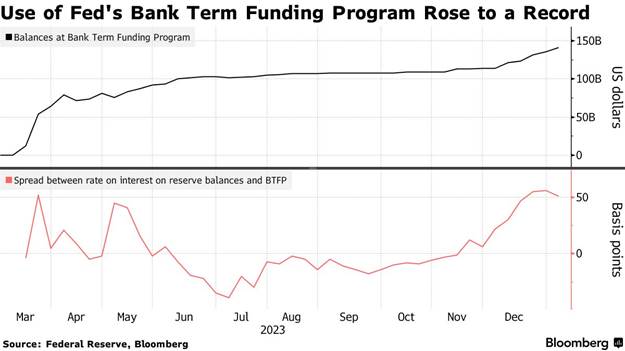

Meanwhile, the Bank Term Funding Program (BTFP), was

set up in March 2023 to bail out U.S. regional banks. It had $71.837

billion on April 12,2023, but now has $141,202 billion (as of January 3,

2024. So, it has virtually doubled in

the last eight months, as per this chart:

The Bank Term Funding Program (BTFP) was set up in

March 2023 to bail out U.S. regional banks via loans of up to one year. It had

$71.837 billion on April 12, 2023, but as of January 3, 2024, it reached a

record high of $141,202 billion. That compares to the previous all-time high of

$136 billion, reached in the week ended Dec. 27.

So, in just eight months BTFP loans outstanding have

virtually doubled!

..…..……..……..……..……..……..……..……..………..…..……..……..…….……..………..

In conclusion and independent of the Fed’s “higher for

longer” rhetoric, it was excess liquidity -not higher interest rates -

that caused U.S. real GDP growth to remain above trend, at an estimated 2.5%

annual rate in 2023. We noted in last

week’s column that annualized real GDP was +2.05% from 2000 to 2023.

Curmudgeon – Excess Liquidity is Disappearing:

Recently, there’s been a reduction in excess liquidity

which has pushed up U.S. Treasury dealer financing costs. “Excess liquidity

parked at the Fed in RRPs by money-market funds has been switched to buying

T-bills being auctioned,” Bespoke Investment Group wrote in a client

note this past week. The reduction in excess liquidity also has pushed up

dealer financing costs, such that a Treasury position yields about 1.45% less

than what dealers pay to finance it, according to Randall W. Forsyth in

the January 8, 2024 issue of Barron’s.

Along with rising dealer financing costs, quantitative

tightening (QT) continues to drain liquidity from the financial

system. Minutes of the FOMC’s December

policy meeting, released this past week, showed several Fed officials thought

it was appropriate to discuss slowing the pace of the runoff of maturing

securities (QT) and to provide advance guidance to the markets.

Deutsche Bank strategists

see the Fed beginning to phase out QT in June as it starts to cut rates in

response to a “material” rise in unemployment, they wrote in a client note this

past week.

Also, the BFTP program is scheduled to end in March,

which will reduce liquidity if it is not extended. As noted above, a total of

$141.2 billion of BFTP loans were outstanding as of January 3rd, a record for

the facility.

Incredibly, the stated U.S. federal debt is now $34

trillion, an increase of $1 trillion just since mid-September! The total is

120% of the size of the U.S. economy. That’s at a time of full employment and

no declared war, circumstances that would suggest a balanced budget, or even a

surplus, something last seen in the early 2000s.

Can you imagine the increase in the national debt, due to

trillion dollar+ budget deficits, if there was a real

recession?

Curmudgeon on the Markets:

Mr. Forsyth wrote that “the 4th-quarter rallies in bonds and

stocks were helped by adjusting the mix of the Treasury’s borrowing to

short-term bills. These were scooped up by money-market funds, whose assets

have swelled to a record just shy of $6 trillion as savers and investors have

taken advantage of 5%-plus yields, the highest since 2007, while large banks

continue to pay next to nothing on deposits.”

However, with increased Treasury borrowing in 2024, and

excess liquidity evaporating, tailwinds for financial markets in 2023 may turn

into headwinds in 2024.

Victor’s Conclusions:

The U.S. economy is much weaker than reported. This is not

necessarily bearish for stocks as it gives the Fed a reason to lower rates,

especially in an election year.

Moreover, the key strength in the economy, which is not

talked about in the media, is the bulk of the 70+ million retired boomers who

have been spending their savings (401k, IRA’s and

pension checks) and enjoying life before they die. With a lot of pent-up demand from the COVID

lock down, they are spending big time on entertainment, restaurant meals and

travel. Also, income disability recipients went from 8 million before COVID to

40+ million now.

That is why U.S. GDP is outpacing GDI (gross domestic income)

and the U.S. service sector is doing well while manufacturing is not.

End Quote: “Beware of

ignorance when in motion; look out for inexperience when in action and beware

of the majority when mentally poisoned with misinformation, for collective

ignorance does not become wisdom.”

by William J. H. Boetcker (1873–1962) who was an

American religious leader and influential public speaker. An outspoken

political conservative, Rev. Boetcker is perhaps best remembered for his

authorship of a pamphlet entitled The Ten Cannots, originally published

in 1916, that emphasizes freedom and responsibility of the individual to

himself.

The Ten Cannots are as follows:

- You

cannot bring about prosperity by discouraging thrift.

- You

cannot strengthen the weak by weakening the strong.

- You

cannot help little men by tearing down big men.

- You

cannot lift the wage earner by pulling down the wage payer.

- You

cannot help the poor by destroying the rich.

- You

cannot establish sound security on borrowed money.

- You

cannot further the brotherhood of man by inciting class hatred.

- You

cannot keep out of trouble by spending more than you earn.

- You

cannot build character and courage by destroying men's initiative and

independence.

- And you

cannot help men permanently by doing for them what they can and should do

for themselves.

……………………………………………………………………………………………………………

Best of luck, good health, and success in the new year. Till next time………….

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2024 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).