Gold/Silver,

U.S. Dollar, BRICS/OPEC+ Currency, CBDCs

By Victor

Sperandeo with the Curmudgeon

Introduction:

One of the most perplexing financial questions this

year is about the precious metals: “Why have Gold and Silver performed so

poorly?”

Gold was always considered as a hedge against

inflation, market volatility and geopolitical instability which should’ve

enhanced its appeal in 2022 as a “safe haven.”

Yet despite stubbornly high inflation (>8% in the U.S.; >10% in

the UK) and Russia’s war in Ukraine, Gold/Silver and mining shares have been

horrible investments this year.

Let’s first look at the rise of the U.S. dollar (DXY)

as the main culprit for the abysmal performance of the precious metals in

2022. Then we’ll examine other important

currency related issues and close with a question about totalitarianism.

Reasons for a Strong U.S. Dollar:

The super strong U.S. dollar -highest in over 20

years- is mainly why Gold and Silver have performed horribly in 2022 (see 2022

YTD Performance Comparison below).

Gold and Silver, which are priced in dollars, are

inversely correlated to the DXY. We have

addressed this issue earlier this year in “The

U.S. Dollar’s Strength Explained,” but let’s re-examine the case

now.

The dollar has been super strong because of the historic

rise in U.S. interest rates in the shortest time in the entire history of

America. For years, real U.S. interest

rates were negative but that’s changing very fast. [Negative real interest rates were

orchestrated by the Fed, but it’s really a tax that does not need a legislative

vote.]

The U.S. dollar index has hit

new 20+ year highs because its component currencies are all hitting several

multi-decade new lows! The dollar going up is the reverse of the currencies

in the DXY [1.] going down. The interest rate differentials between the

U.S. and the countries in the dollar index are very high and thereby contribute

to the strong U.S. dollar.

……………………………………………………………………………………………...

Note 1. The Euro is 57.6% of the DXY, the Japanese Yen 13.6%, and the

British Pound 11.9%. Therefore, 83.1% of

the currencies in the dollar index are in deep declines making new multi-decade

lows which causes the DXY to be at multi-decade highs.

……………………………………………………………………………………………...

Jeff Snider, Chief

Strategist for Atlas Financial and co-host of the popular Eurodollar University

podcast, says there is a U.S. dollar

shortage. I can’t understand this so

can’t comment. But it is being used as justification for a strong dollar by

some very knowledgeable people.

Other reasons for the strong dollar are Russia’s war

in Ukraine, the political safety of the U.S. due to its military, and that the

dollar is still the world’s reserve currency (although this is in the process

of changing in my opinion).

-->Therefore, capital is flowing into the U.S.

dollar due its “safe haven” status and higher real interest rates in the

U.S. Rising (real and nominal) bond yields

and strength in the U.S. dollar have greatly diminished Gold’s appeal as an

investment.

When the dollar declines Gold and Silver will be much

higher in our opinion.

Gold, Gold, You’re Making Me Old!

The above subhead was stated by the late and great Dow

Theorist Richard Russell in the Feb 22, 2008 issue of his Dow Theory

Letters (which the Curmudgeon subscribed to for many years). Gold’s current price action has been extremely

frustrating, if not torturous, for those looking to Gold as an inflation hedge.

In particular, Gold rose strongly from the late 1970s till January 1980 as

inflation accelerated above 8%.

In response to a Curmudgeon request, Jason Goepfert

of Sundial Capital (we highly recommend readers subscribe to his Sentiment Trader

service) provided the table below. It shows the returns for gold

after any month in which the CPI Y/Y was 8% or higher.

Since 1976, Gold prices were an average of 27.4% higher a year after CPI was first

reported as 8% or higher. Yet it was positive after only 49% of the signals,

due to some of the previous gains being extremely high.

2022 YTD Performance Comparison:

·

As of Friday’s close, the

continuous futures contract for Gold (currently at $1,662.50) has declined

-9.2% this year.

·

Silver Continuous Contract

(currently at $19.4 and +3.8% on Friday) has declined -16.93% this year.

·

VanEck Gold Miners ETF (GDX)

(owned by the Curmudgeon) was +5% on Friday to close at $24.34, but it is down

-24.50% YTD. Worse, it’s lost -41.5%

from its April 18th high of $41.61.

·

The DXY closed lower at

111.88 on Friday (-1.01 or -0.89% on the day) but is +16.58% YTD and +19.47%

the last year.

·

The long-term U.S. Bond ETF

(TLT) is down an incredible -37.14% YTD.

·

The iShares TIPS Bond ETF

(TIP), claimed to be a better inflation hedge than Gold, is down -13.45% YTD.

Here’s an interesting chart comparing the inverted

TIPs yield with the price of Gold in 2022:

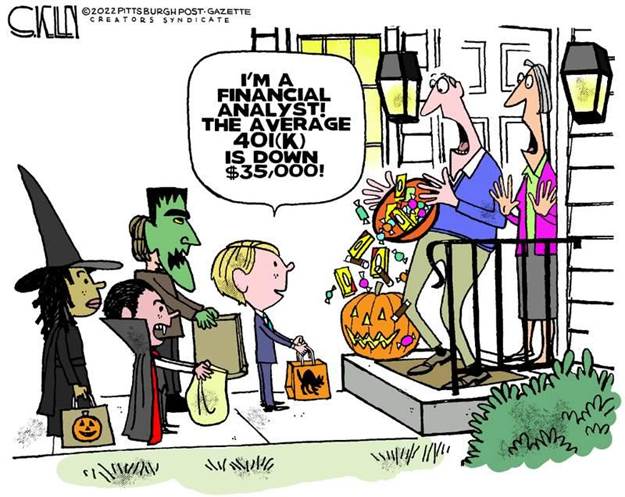

Indeed, the Fed’s recent jumbo rate rises (after

years of a free money party) and seemingly never-ending hawkish drumbeat have

called all assets to plummet in price this year. We discussed that in detail in last week’s

twin posts which you can read here

and here. It’s

best illustrated by this cartoon which is just in time for Halloween trick or

treat:

………………………………………………………………………………………………

Manipulation of the Gold Price?

We’ve previously

discussed manipulation of the Gold market

to keep prices down, but let’s now provide additional clarity and color.

JP Morgan was accused

of “spoofing” or manipulating the price of gold by putting in massive orders.

Then, they quickly pulled the orders before they are executed. Even though the

orders weren’t real, they still had a “cause and effect” on the markets.

“Our job was to do whatever it takes to make money,”

former trader John Edmonds said in a court case accusing three of his former

colleagues of committing systematic fraud. “Everyone at the time did it on the

desk and it worked.”

JPMorgan’s former global head of the precious metals

trading desk Michael Nowak, precious metal trader Gregg Smith and hedge fund

salesman Jeffrey Ruffo have been charged by the Justice Department with

racketing and conspiracy charges and are now on trial for the crimes.

Edmonds claimed he learned how to “spoof” trades

during his time at JPMorgan where he executed as many as 400 of the fraudulent

trades — he added it was “expected” of everyone on the desk. Prosecutors allege the precious metals desk

made as many as 50,000 spoof trades under Nowak’s watch. “I saw people trading

for 20 years doing this,” Edmonds said. “How could I not do it?”

Edmonds, who said the fraud was committed between

2008 and 2016, was the first to plead guilty to market manipulation in 2018.

Other investment banks engaged in similar practices.

Deutsche Bank, HSBC, and UBS reached agreements with the Commodity Futures

Trading Commission (CFTC) in 2018 to settle claims that their traders used

spoofing to manipulate precious metals futures prices – paying $30 million,

$1.6 million, and $15 million, respectively – in order to

avoid admitting wrongdoing and the possibility of a prolonged court battle.

Has the gold market spoofing continued? We believe it has and the practice has been

tacitly approved by the U.S. government and its agencies (CFTC and SEC) to

depress gold and silver prices.

Gold/Silver Coins vs Futures Prices:

One to nine 2022 1 oz American Gold Eagle Coins are priced at

$1,878.94 via eCheck/wire. Compare that

to spot Gold and Dec 2022 Gold futures latest closing prices of 1,657.90 and

$1,662.50 (+25.70 on Friday), respectively.

U.S. minted American Silver Eagles, currently priced

at about $31, trade at a +67% premium to December 2022 Silver futures.

Why do you think there’s such a huge premium for

precious metals coins vs the spot or futures price of same?

The Gold Standard Revisited:

The U.S. won’t return to the gold standard, which it

abandoned officially in August 1971. The

St. Louis Fed explained why in a November 2017 blog post:

“For every Federal Reserve dollar that was issued,

the Reserve Bank had to have 40 cents worth of gold in its vault downstairs in

the basement,” explained David Wheelock, vice president and deputy director of

research.

“The U.S. mines a lot of gold, but we’re not the

biggest producer,” [Note 2.] Wheelock said. “The bigger suppliers of

gold would have more control over our monetary policy, and there’s no reason to

have it because we can get the advantages of the gold standard and avoid the

disadvantages without being on a gold standard.”

Note 2. Largest Producers of Gold by Country (as of June 2022):

Country Tonnes

China

332.0

Russian Federation 330.9

Australia 315.1

Canada 192.9

United States 186.8

Ghana

129.2

Peru 127.3

Mexico 124.5

A New BRICS + OPEC+ Currency?

What is less talked about are the BRICS nations

(Brazil, Russia, India, China, and South Africa), along with OPEC+, getting close

to creating a new currency to pay for oil. The new currency would be backed by

commodities.

That would be the end of recycled Petrodollars and

would have a profound negative effect on the U.S. economy.

A stronger dollar reduces demand for oil by making

the fuel more expensive for buyers using other currencies so there’s incentive

for countries to pay for oil in a currency other than the U.S. dollar (Russia

demands payment of its oil in Rubles).

There’s also a speculation that the U.S. is

attempting to decrease demand for oil to not only lower inflation, but to make

Russia weaker. Our declared enemy is Russia/Putin, so the inside chatter of

crashing demand is partially political.

If that’s true, it seems to be stupid in my opinion.

Will Global Central Banks Control What People Buy?

The deputy managing director of the International

Monetary Fund (IMF) recently explained how Central Bank Digital Currencies

(CBDC) can be programmed to determine what people are allowed to

buy and insisted they should be used alongside a China-style Social Credit

Score system. Unlike cryptocurrencies,

which are private, Central Bank Digital Currency (CBDC) will be issued and

controlled by the central banks themselves.

In many ways, it’s the same as banknotes, but that every single

transaction will be monitored for compliance.

Opinion: If any western

Central Banks try to pursue the CBDC I believe the dollar will crash shortly

thereafter! It will end freedom as we

know it. Let’s just say this will make

virtually all people into serfs.

Are We Becoming a Totalitarian Society?

According to the famous political scholar Hannah

Arendt (1906 -1975), a totalitarian society is one in which an

ideology seeks to displace all prior traditions and institutions, with the goal

of bringing all aspects of society under control of that ideology. The state

literally defines and controls reality. Truth is whatever the rulers decide it

is. Here are two quotes that should

make you afraid that the U.S. is turning into a Totalitarian Society:

“Before mass leaders seize the power to fit reality

to their lies, their propaganda is marked by its

extreme contempt for facts as such, for in their opinion fact depends entirely

on the power of man who can fabricate it.”

“The true goal of totalitarian propaganda is not

persuasion, but organization of the polity... What convinces masses are not

facts, and not even invented facts, but only the consistency of the system of

which they are presumably part.”

― Hannah Arendt, The Origins of

Totalitarianism

………………………………………………………………………………………………….

Be well, stay healthy, try to cope with the financial

chaos the Fed has created. Wishing you peace of mind, and till next time………

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2022 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).