The 2022 Gold Conundrum – Investment Bank

Manipulation or Strong U.S. Dollar?

By the

Curmudgeon with Victor Sperandeo

Introduction:

Many investors have been puzzled, as to why Gold has not rallied in the

last two years as a result of accelerating inflation

and geopolitical crisis’ like the war in Ukraine that could easily spread to

Eastern Europe. As we will show, gold historically does very well when

inflation climbs above 3% (it’s close to 9% in the U.S. now. Yet Gold has declined year to date (see chart

below).

Disclaimer: The Curmudgeon is baffled and

hugely disappointed by the weakness in gold and precious metal mining shares

which he owns. Victor also owns physical

gold and silver.

Mainstream media cites the super strong dollar and rising interest rates.

Amid growing recession risks, investors have opted for the U.S. dollar instead

of precious metals. But there is another

possible reason: the gold market has been manipulated!

Discussion:

An eye-opening article by the well-known Peter Hambro was published

by British economics and politics news site Reaction. The article titled “Don’t forget the golden rule: whoever has the gold

makes the rules” is intriguing for a number of reasons. It pulls no punches in highlighting the

manipulation of the gold price and naming the types of entities responsible,

while explaining some of the mechanisms used in the fractional-reserve London

paper gold game.

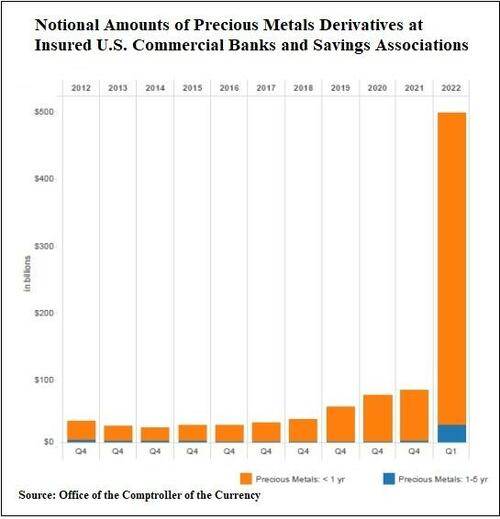

The chart below from the US Office of the Comptroller of the Currency

(OCC), now shows the massive extent to which gold bullion banks such as JP

Morgan have amassed precious metals derivatives contracts to hold down the gold

price.

Hambro describes this manipulation

of the gold price using derivatives as a ‘tinder-box’, which ‘disinformation

[has] for many years kept the lid on.” But who, you might ask, is directing

this disinformation and this gold price manipulation? According to Hambro, it’s the Bank for

International Settlements (BIS) in Switzerland, i.e., the central banks’ central

bank.

Hambro states that: “Since 2018 the Financial Stability Desks at the

world’s central banks have followed the Bank for International Settlements’

(BIS) instruction to hide the perception of inflation by rigging the gold

market.” But since the central banks

‘need cover’ and ‘cannot be seen’ to be rigging the gold price, Hambro adds: “The

only way to achieve the cover is by smashing the price of physical gold by the

alchemical production of ‘paper gold’.”

“With the help of the futures markets and the connivance of the Alchemists,

the bullion traders – yes, that includes me, I was Deputy Managing Director of Mocatta & Goldsmid – managed to create an

unshakeable perception that ounces of gold credited to an account with a bank

or bullion dealer were the same as the real thing. “And much easier, old chap!

You don’t have to store or insure it.”

The gold credit that Hambro is referring to here is the LBMA's infamous

‘unallocated gold’, with ‘the futures markets’ being the COMEX.

The BullionStar website has for years been

saying the very same thing. In particular, see here and here.

A Bloomberg article titled, “JPMorgan Gold Desk Ripped Off Market for Years, Jurors

Told,” states that “the precious-metals business at

JPMorgan Chase & Co. operated for years as a corrupt group of traders and

sales staff who manipulated gold and silver markets for the benefit of the bank

and its prized clients, a federal prosecutor told jurors in Chicago. The government says Nowak’s business operated

as a criminal enterprise, manipulating prices from 2008 to 2016 by placing thousands

of trade orders that were never intended to be executed.

“This case is about a criminal conspiracy inside one of Wall Street’s

largest banks,” said Lucy Jennings, a prosecutor with the Justice Department’s

fraud section. “To make more money for themselves, they decided to cheat.”

Spoofing, banned by law in 2010,

involves huge orders that traders cancel before they can be executed in a bid

to push prices in the direction they want to make

their genuine trades profitable. While canceling orders isn’t illegal, it

is unlawful as part of a strategy intended to dupe others. High Frequency Traders (HFT)

have also been accused of spoofing and front running customer orders.

“When this trick works, there is somebody else on the other side of the

deal that lost,” Jennings told jurors in her opening statement. “Somebody got

ripped off.” She added, “We will prove that all three defendants knew from day

one that this trading was wrong and did it anyways.”

Commodities manipulation and in particular spoofing have become a major

focus of the Justice Department, which has brought several other cases in

recent years, including against NatWest and former traders at Deutsche

Bank and UBS.

JPMorgan agreed in 2020 to pay more

than $920 million and admitted to wrongdoing to settle with the DOJ and Commodity

Futures Trading Commission (CFTC) over the conduct of the traders

who have pleaded guilty or are facing trial.

Image Credit: Mining Weekly

……………………………………………………………….………….

Curmudgeon’s Analysis:

https://www.gold.org/goldhub/research/gold-outlook-2022

- chart4

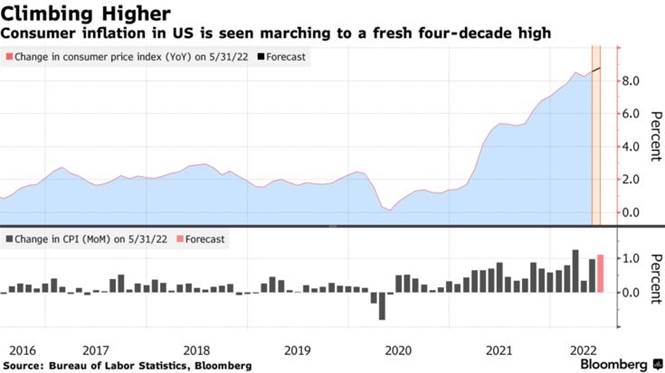

Gold normally performs well during periods of high

inflation. In years when inflation was higher than 3%, gold’s price

increased 14% on average.

The charts below show the rapid increase in inflation this year while gold

(and mining shares) have declined. What

a contrast and departure from historical correlations!

......................................................................................................................…

Six Month Chart of Spot Gold Price (2022):

Source: Trading

Economics

Curmudgeon Conclusions:

The main reason we see for

gold’s historically horrible performance in 2022 (with inflation accelerating

to almost 9%) is the market’s belief that real U.S. interest rates

will rise significantly (although they are currently still negative). However, the ECB and BoJ are still pursuing ultra-easy

monetary policies, which have caused their currencies to decline to

multi-decade lows against the U.S. dollar.

As a result, institutional investors have been selling foreign

currencies to buy: the U.S. dollar on Forex markets, dollar derivatives, or

“strong dollar” ETFs.

Hence, the U.S. dollar (and NOT Gold) has become the

investment of choice during this global inflationary period.

…………………………………………………………………………………

Be well, stay healthy, try to find diversions to uplift

your spirits (Curmudgeon goes to live concerts and MLB games), wishing you

peace of mind, and till next time………

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2022 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).