Fed Induced “Free Money Party” Creates Record Unicorn

Stock Offerings

By the

Curmudgeon

Introduction:

We examine the massive

increase in new stock issuance as well as the explosion in VC backed start-ups

and unicorns (private companies valued at $1 Billion or more) with astronomical

valuations. In the past, this would be a

red flag or dire warning because the new supply of equity would overwhelm the

demand. But as we’ve said so many times:

this time is different. Or is it?

Fresh Supply of Stock

Increasing Rapidly:

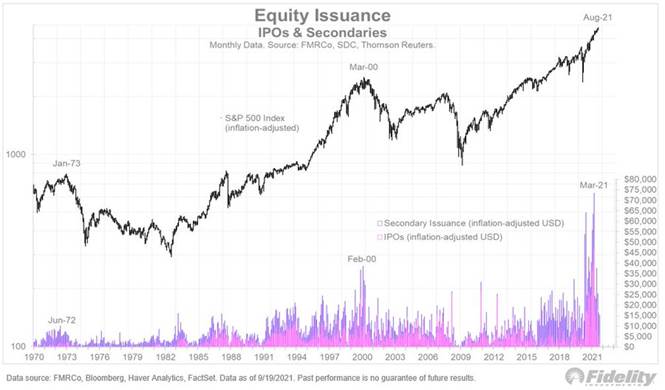

New equity offerings have

soared in recent months. The number of IPOs is going through the roof, as are

secondary stock offerings. One must go

all the way back to 2000 to get anything close to what we are seeing today in

this space.

Chart

courtesy of Jurrien Timmer of Fidelity

..….…....…....…..….…....…....…....….…....…..….…..….…....…....…....…..…....…....…

The Curmudgeon wrote about IPO extravaganza last December: Will

Another Huge IPO Bubble Lead to Another Huge Crash? It's only got worse since then. However, the new supply of stock has been

easily absorbed via the Fed induced "free money party" which flows

into stock and bond markets.

Start-up Funding and Unicorns

Shatter Records:

VC markets are flush with

cash, largely due to the Fed’s largesse.

In Q2 - 2021, funding to startups shattered past records, reaching $156B

— an astonishing 157% increase year-over-year. [Source: CBINSIGHTS]

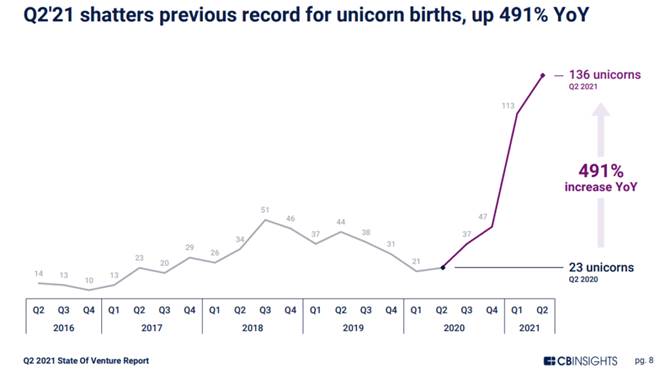

Furthermore, the number of

unicorns is increasing exponentially.

And they’re being assessed at higher and higher valuations. In the 2nd

Quarter, 136 new unicorns were birthed globally — nearly 6x (or 600%) the 23

unicorns born a year ago in Q2 -2020, and already higher than the 128

unicorns created in all of 2020.

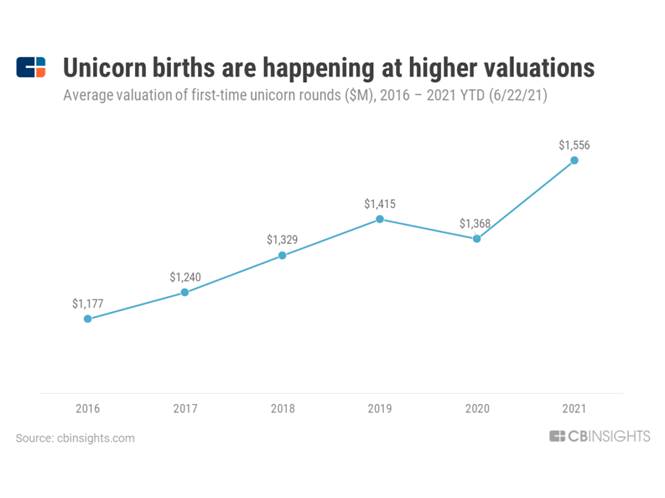

Unicorn

births are at record valuation levels in 2021, increasing from an average

of $1.18B in 2016 to $1.56B so far this year as shown here:

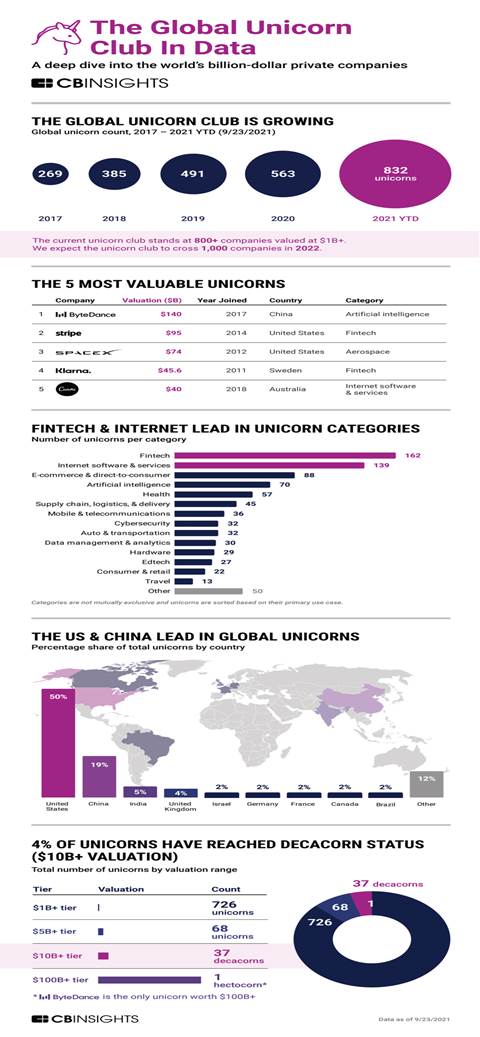

CBINSIGHTS says the global unicorn

club is bigger than it's ever been, with 800+ private companies

topping $1B valuations. The total count

of unicorns has already jumped 48% from 2020 year-end to 2021 year-to-date,

with 354 current unicorns reaching their $1B+ valuation this year alone. At this rate, CBINSIGHTS forecasts the

world’s unicorn count will be above 1,000 in 2022.

Over 4% of Billion+ dollar

companies have reached decacorn (>= $10B) status. While the majority of unicorns are valued in the $1B – $5B range,

there are currently 37 companies with valuations between $10B and $100B.

Half of the world’s unicorns

are based in the U.S., with China taking second place at 19%. Of current

unicorns minted in 2021, 30 are based in China. This is depicted in the

following charts:

The top 10 unicorn investors,

based on the total number of current

unicorns they’ve invested in,

are:

1. Tiger Global Management

2. SoftBank Group

3. Coatue Management

4. Tencent Holdings

5. Sequoia Capital China

6. Accel

7. Sequoia Capital

8. Andreessen Horowitz

9. DST Global

10. Insight Partners

10. Fidelity Investments

U.S. based Tiger Global

Management has the most current unicorn companies in its portfolio, with

more than 120 current unicorns backed. Japan-based SoftBank Group comes in

second place, backing 77 unicorns, followed by Coatue Management, with 61. Over

350 institutional investors boast at least 5 unicorns in their portfolios.

Demand for Equities Absorbs

Increased Supply:

With massive stock inflows

from retail investors and companies continuing to buy back shares, the new IPOs

and secondaries have been easily absorbed.

Companies in the S&P 500

spent nearly $199 billion on share repurchases in this year’s second quarter,

according to data released Thursday by S&P Dow Jones Indices. That figure

is up nearly 12% from the first quarter’s total and 124% from the pandemic-era

low set in 2020’s second quarter.

Low interest rates and high

public stock prices have contributed to a resurgence of VC backed funds that

invest in start-ups.

What Could Go Wrong?

Is there anything that might

curtail the demand for stocks and private companies? It certainly won’t be the timid Fed taper

that’s expected by the end of 2021. Inflation doesn’t seem to be a worry

(for now), nor does a U.S. or China economic slowdown seem to be a cause

for concern.

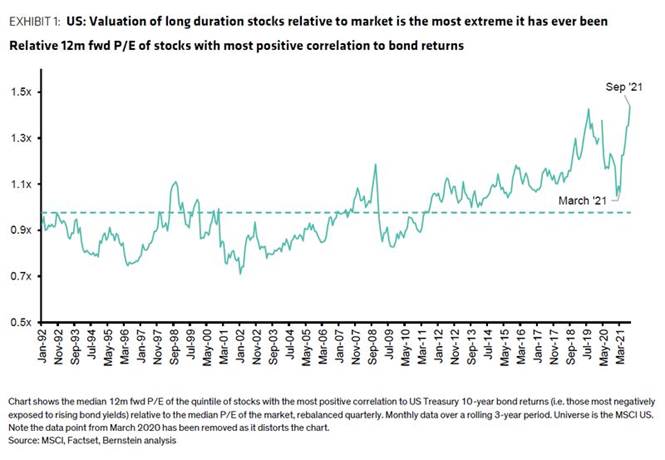

Valuations have

been sky-high for years, but that didn’t stop massive stock inflows this

year. U.S. stocks that are most

correlated to bonds are 30% more expensive than the market overall, Sanford

Bernstein’s quant team said. “This poses

a major risk for portfolio managers,” strategists led by Sarah McCarthy wrote

in a note to clients.

Meanwhile,

the dippers had voracious appetites this week.

Retail investors were buying the dip in some of their favorite

names as big tech stocks took a beating Monday and Tuesday in a global selloff

spurred by the debt crisis at China Evergrande Group. That didn’t deter the

dippers. As the S&P 500 experienced

its biggest drop since May, individual investors snapped up north of $3 billion

in equities Monday and Tuesday, according to Vanda Research.

Conclusions:

Victor has repeatedly stated

that an unexpected negative event (or shock) which the Fed could not control

would end the bull market in financial assets.

His piece this week, “A Potential Petrodollar Shock with a Huge

Impact on Markets,” depicts a scenario where the Saudi’s might replace

the U.S. dollar as the currency used to price oil. That would cause a dollar crash and limit

down moves in many financial markets.

Nouriel

Roubini has repeatedly warned of a stagflation

inspired debt crisis and persistently above Fed target

inflation. In his latest blog post, the esteemed economist

expects “a full stagflation with much lower (economic) growth and higher

inflation.” Furthermore, he states, “The

temptation to reduce the real value of large nominal fixed-rate debt ratios

would lead central banks to accommodate inflation, rather than fight it and

risk an economic and market crash.”

End Quotes:

“There are plenty of

indicators that inflation may be more widespread and persistent than many

originally anticipated…. Stocks which are long duration, expensive and crowded

are most at risk from an inflection in inflation expectations.”

Quant team at Sanford C. Bernstein

“The Panglossian scenario that

is currently priced into financial markets may eventually turn out to be a pipe

dream. Rather than fixating on Goldilocks, economic observers should remember

Cassandra, whose warnings were ignored until it was too late.”

Stay healthy, enjoy life, success, good luck and till next time….

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies

and government policies. Victor started

his Wall Street career in 1966 and began trading for a living in 1968. As

President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the

firm's research and development platform, which is used to create innovative

solutions for different futures markets, risk parameters and other factors.

Copyright © 2021 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the original

posted article(s).