Will Another

Huge IPO Bubble Lead to Another Huge Crash?

By the Curmudgeon

Introduction:

The IPO market is

soaring. Last week, super strong buying

sent food delivery start-up DoorDash stock up 86% in its trading debut

Wednesday. Vacation home rental stalwart

Airbnb shares more than doubled in their debut a day later. DoorDash is currently valued at $56 billion,

just shy of General Motors while Airbnb is worth over $83 billion, more than

FedEx Corp.

Airbnb CEO

Brian Chesky was at a loss for words in a

Bloomberg TV appearance when he was told of the company’s opening share

price. Perhaps that’s because Airbnb’s

annual revenue growth slowed from 80% during 2016 to 31% during 2019. Bookings tanked

early in the pandemic, and revenue in the first nine months of 2020 was down

32% from the year-earlier period.

Valuations of recent IPOs are

at their highest levels since the dot-com bubble, relative to the companies’

revenue, sparking concerns among investors about the level of froth in the

market.

The financial asset mania doesn’t stop with the IPO market. For example,

Special-purpose acquisition company (SPAC) Social Capital Hedosophia Holdings II (NYSE:IPOB)

soared more than 18% on Monday, solely due to stating the ticker symbol it will

have following its pending merger with real estate disruptor Opendoor Technologies.

In this post, we examine signs

of speculative excess that have ALWAYS preceded a MAJOR stock market crash

(think the DOT COM bubble bursting).

Next is our assessment of the frothy IPO market with lots of statistics

to prove our point. We conclude with a note about zombie companies and a few

closing quotes on the IPOs.

Warning Signs Abound:

Signs of financial euphoria

are everywhere. Here are just a few:

·

19 stocks have doubled on their first day of trading in

2020, the most since 2000, the peak of dot-com mania.

· November

was the best return in history for US small caps with the Russell 2000 +18.3%

for that month. It’s

now at the most overbought level in 20 years.

·

The S&P 500 is trading at over 40 times EPS, and next

year's 26 times EPS number is probably too low (unless earnings surprise to the

upside).

·

Option traders are in the greatest call-buying frenzy

since July 2000 (see Chart 1. below)

·

Record-high $14 billion net inflows to value vs. growth

ETFs in recent weeks.

· Exchange-traded

funds (ETFs) are on pace to add $466 billion, the biggest year of inflows ever

(see Chart 2. below). At the current pace there will be more assets in passive

equity funds than active by 2022.

· B of A

Research’s Bull & Bear Indicator jumped to 5.8 (8=sell signal) while

inflows triggered a sell signal for Emerging Market equities.

·

Wall Street brokerage firms/investment banks are also

bullish: B of A Research’s Sell-Side

Indicator is the closest to a sell signal since 2007.

Chart 1. U.S. Call/Put Volume Source:

B of A Research

…………………………………………………………………………………………………………….

Chart 2. U.S. ETF Inflows in 2020

have surpassed their 2017 all-time high

Source: B of A Research

…………………………………………………………………………………………………………...

Assessing the IPO Stock Mania:

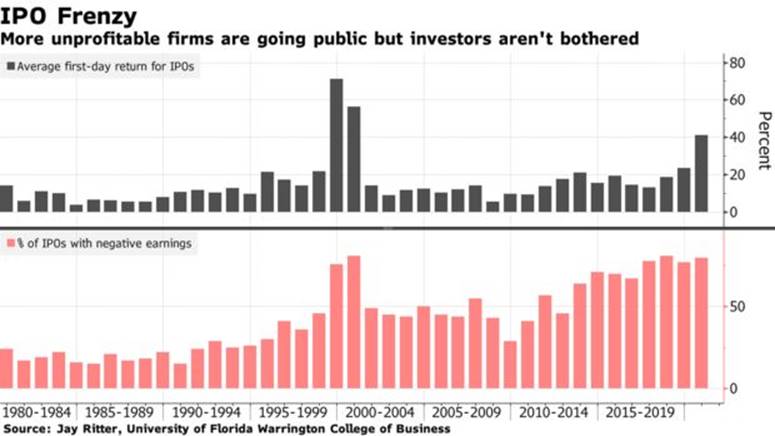

Speculators have valued newly public

(loosely defined) tech companies at a median of 23.9 times the revenue

(NOT earnings) reported in the 12 months before going public, according to

University of Florida Business school Professor Jay Ritter, who tracks

initial public offerings. That measure is by far the highest of the past two

decades. The valuations imply

investors are counting on years of continued rapid growth by these companies,

hoping some will dominate their industries and churn out large profits, he

said.

The result has been that the

market capitalizations of many money-losing high-flying IPOs are now greater

than giant, highly profitable stalwarts of corporate America. For example,

Airbnb is worth more than Marriott International Inc., Hilton Worldwide

Holdings Inc. and Hyatt Hotels Corp. combined, by market capitalization. It’s worth about the same as online travel giant Booking

Holdings Inc., a slower-growth company that had more than double Airbnb’s

revenue in the 12 months through September and had a $1.3 billion profit. DoorDash

is worth nearly double fast-food operator Yum Brands Inc., the owner of Pizza

Hut, Taco Bell, and KFC.

Ritter commented in a Bloomberg article that “80% of the

companies that went public this year were unprofitable in the 12 months prior

to their IPO.” Yet the Renaissance IPO

ETF (IPO) is up 111.52% year to date (YTD). This ETF has 48 holdings with over

10% in both Uber Technologies (UBER) and Moderna (MRNA). It has $670 million in

assets with a somewhat-high expense ratio of 0.60%.

“I have a great deal of difficulty

understanding the valuations of some of these companies,” Prof. Ritter said.

The difference in enthusiasm for the unprofitable young companies and old

corporate giants with consistent profits is “night and day,” Ritter added.

There’s more

IPO madness: Software company Snowflake Inc., which went public in September,

is worth more than 200 times the $489 million in revenue it made in the 12

months through October. Data-analysis firm Palantir Technologies Inc., which

went public in September at a roughly $21 billion valuation, is now worth $50

billion, or 50 times its revenue.

At least three

electric-vehicle companies valued at over $2 billion have gone public this year

with no revenue, while numerous other tiny companies with large private

valuations in the electric-vehicle sector are planning public listings.

What’s going

on here? For most of the 2010s, the median multiple

for a tech company after its first day of trading hovered around 6 times its

revenue in the prior 12 months. The same measurement for stocks on the Nasdaq

Composite Index is 4.3, according to FactSet.

Old pros would expect the new

supply of stock issued in the form of IPOs and secondary offerings to be a

negative headwind for equities this week. Not in a mania. This week, the market has absorbed the new

supply in a manner that hasn't deterred the bullish

trend. For example, Tesla (TSLA)

was +1.8% this week despite selling $5 billion of common stock!

Conclusions:

We’re

stumped. With so many Americans

suffering financially due to the pandemic lockdowns and with the real U.S.

economy not expected to recover till 2022 (B of A Research says that it will

not reach the measly 1.7% trend GDP growth until 2022 or beyond), how could

such exuberant speculation be occurring?

ShadowStats’ John Williams

writes, “Severe systemic structural damage from the shutdown will forestall

meaningful economic rebound into 2022 or beyond, irrespective of coronavirus

treatments and vaccines.”

Indeed, the economic data has

weakened recently with the second surge of the virus and new lockdown orders

(especially in California). The number of Americans filing for first-time jobless

claims surged to 835,000 for the week ended Dec. 5th, up from

716,000 the week before. The next U.S.

economic number to watch is Industrial Production, to be reported on Dec. 16th.

Meanwhile, coronavirus related

government stimulus payments have resulted in 16% of OECD companies becoming

"zombies" (income doesn't cover debt

payments), which means that even in an economic rebound, revenues go to balance

sheet repair instead of capex. The only cure for zombies is significantly more

aggregate demand, but that won’t happen with stay at home

health orders in effect.

Closing Quotes:

“The valuations are better in the

public markets than private markets, which was not the case in ’19 or ’18,”

Rajeev Misra, who runs SoftBank Group Corp.’s $100

billion Vision Fund, said in a conversation with an analyst at New Street

Research LLP last month. “The public markets are very buoyant.” [SoftBank was by far the largest investor in

startups in the past few years, flooding companies like WeWork,

Uber and DoorDash with cash.]

“While we are generally a bit

skeptical of ‘irrational exuberance’ claims, IPO behavior is starting to

look very frothy,” said stock market research firm Bespoke.

“A lot of entrepreneurs now

realize it’s a very receptive and attractive public market,” said Rich Wong,

a partner at venture-capital firm Accel, an early investor in Slack

Technologies Inc. and Facebook Inc. If the rally stays apace, 2021 “will

definitely be the most active IPO market in the last 20 years,” he said.

“There is no doubt that the

emergence of a much larger cohort of retail investors-slash-traders are moving

markets. There seems to be an entire

subculture of people that sort of follow the same things, talk to each other on

social media and drive enthusiasm for individual issues. And sometimes it makes

no fundamental sense to anybody, said Art Hogan, chief market strategist

at National Securities Corp.

“This doesn’t end well

historically, but for the time being it’s the nature of the beast. But it didn’t take long after 2000 to see that cohort of day trader

types fade into the sunset, not really come back until really March and April

of this year when things exploded again,” Hogan added.

……………………………………………………………………………………………………….

Good health, stay calm and

safe, persevere under lockdowns and till next time….

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative (non-correlated)

investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned

(since 1971) to profit in the ever changing and arcane world of markets,

economies and government policies.

Victor started his Wall Street career in 1966 and began trading for a

living in 1968. As President and CEO of Alpha Financial Technologies LLC,

Sperandeo oversees the firm's research and development platform, which is used

to create innovative solutions for different futures markets, risk parameters

and other factors.

Copyright © 2020 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).