How Will the Fed and ECB Cope with Stagflation?

By the Curmudgeon

Introduction:

“If it is not transitory, and I hope it is, then the

weed of inflation grows and kills the garden.”

Richard Fisher, Former President and CEO, the Federal Reserve Bank of

Dallas

The prospect that inflation’s recent spike may be

more than transitory, coupled with the possibility the economy will grow

slowly, has raised the specter of “stagflation.”

This article examines the case for persistent

stagflation in the U.S. and Europe. We

also suggest it could get much worse if global central banks maintain their ultra-easy

monetary policies.

Backgrounder:

The 1970s were characterized by low economic growth

combined with higher inflation, commonly known as “stagflation.” According to Edward McQuarrie, a professor at

Santa Clara University’s Leavey School of Business, stagflation in the U.S. was

from 1966 through 1982. “The mid-1960s are when the inflation that we associate

with the 1970s actually began, and the ills we associate with the 1970s didn’t

end until 1982,” he says.

Over that 17-year period (from 1966 through 1982),

inflation was much higher than during the post WW II period up until then, and

real GDP growth was much lower. The consumer-price index averaged 6.8%

annualized, for example, four times the 1.7% rate over the 1947-1965 period.

Real GDP grew at just a 2.2% annualized rate between 1966 and 1982, less than

half the 4.5% annualized rate over the 1947-1965 period.

Image Credit: Alex Hughes Cartoons

…………………………………………………………………………………………………

The current mix of persistently loose monetary,

credit, and fiscal policies has led to inflation accelerating. At the same time, concern over the Delta

variant has precipitously slowed the U.S. economy. For example, Friday’s jobs report had many

fewer jobs added than expected while wages rose across the board (see Peter

Boockvar’s comments below).

Also, Federal unemployment benefit programs under the

CARES Act ended on September 4, 2021, which will decrease aggregate demand for

many consumers. Don’t forget that consumer

spending makes up about 70% of U.S. GDP.

Compounding the problem, medium-term negative

supply shocks (e.g., semiconductors) will reduce potential economic growth

and increase production costs. That’s a

recipe for 1970s stagflation.

Consumer Confidence at Multi-Month Low:

The Conference Board’s Consumer Confidence Index declined

to 113.8 (1985=100) in August, down from 125.1 in July. The Expectations Index—based on consumers’

short-term outlook for income, business, and labor market conditions—fell to

91.4 from 103.8.

“Consumer confidence retreated in August to its

lowest level since February 2021 (95.2),” said Lynn Franco, Senior Director of

Economic Indicators at The Conference Board. “Concerns about the Delta

variant—and, to a lesser degree, rising gas and food prices—resulted in a less

favorable view of current economic conditions and short-term growth prospects.

Spending intentions for homes, autos, and major appliances all cooled somewhat;

however, the percentage of consumers intending to take a vacation in the next

six months continued to climb. While the resurgence of COVID-19 and inflation

concerns have dampened confidence, it is too soon to conclude this decline will

result in consumers significantly curtailing their spending in the months

ahead.”

BoA Global Research – Stagflation Trades Gather Momentum:

In a report last week, BofA strategists said

the latest evidence suggests inflation will not be transitory and there are stagflation

risks that could complicate the Fed’s normalization of interest rates.

Investors have swept into assets perceived to perform

well on slowing growth and rising inflation, with tech stocks seeing their

biggest inflows in six months and large outflows from U.S. government

debt. At $2.5 billion, tech stocks saw

the biggest inflows since March 2021, while outflows from U.S. Treasuries rose

to $1.3 billion for the week – their highest since February 2021 - as "stagflation"

trades gathered momentum.

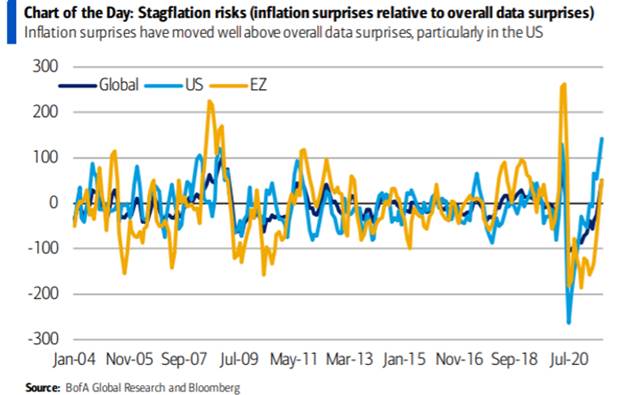

The chart below looks at the global economy,

including the U.S. and Eurozone, showing “inflation surprises have moved well

above overall data surprises.” That’s particularly so in the U.S., according to

the BoA report.

BoA said the

“worsening Covid situation” could lead to “further deterioration of supply

bottlenecks and higher inflation.”

“The risk is increasing that Covid, as a negative and

more persistent supply shock, leads to stagflation, in turn making Fed policy

normalization challenging,” the strategists wrote. “The market does not appear

to be too concerned about Covid and inflation risks.”

The bank sums it up somewhat cryptically (emphasis

added):

“On recession = bubble: global macro unambiguously

stagflationary; but markets trading "H2

growth pause to pass with Delta" and/or "poor macro = no taper = age

of infinite central bank liquidity to continue" despite inflation surge

(EU PPI +12.1% YoY, highest since 1970s); risk of Fed-induced bubble to keep

growing in absence of >1 million payrolls & >$3tn Democratic

reconciliation fiscal package.”

Mario Monti’s Opinion:

Former Italian Prime Minister Mario Monti told CNBC

Saturday that he believes the greatest threat to Europe’s economic recovery

from the coronavirus pandemic is “stagflation.”

Monti, now the president of Italy’s Bocconi

University, said the “huge mass” of accommodative monetary policy by central

banks and fiscal stimulus from governments, implemented to support economies

amid the coronavirus pandemic, “may well fire more inflation.”

Monti said that economies, not only in the EU, could

start to experience elements of “stagflation” similar to

that seen in many countries in the 1970s.

Therefore, it will be “very important to manage wisely and in a

coordinated manner this transition from a needed abundance of monetary and

financial support to a more ordinary situation.”

Muted Policy Response Augurs for More Inflation:

After Friday’s disappointing jobs report, it seems

the Fed will defer tapering and maintain its accommodating, easy monetary

policy (“free money party”) for longer than it should. Of course, that risks ever higher inflation (i.e.,

it is not likely to be “transitory”).

As we’ve stated many times, each Fed chairperson

seems to be more dovish than the previous one.

That’s depicted below:

Image Credit: Hedgeye

……………………………………………………………………………………………….

If inflation stays higher than targeted and the Fed

tapers QE too soon it could cause bond, credit, and stock markets to crash.

That would subject the economy to a hard landing, potentially forcing the Fed

to reverse itself and resume QE. Of

course, the Fed has done that before, but the next downturn would be bigger and

much more threatening.

Fiscal policies are also likely to remain loose,

judging by the Biden administration’s $3.5 trillion infrastructure plan. Also, the likelihood that weak Eurozone

economies will run large fiscal deficits through 2022 while the inflation is accelerating

(Euro-area inflation was 3% YoY in August,

up from 2.2% in July and a 10 year high).

Another Wage-Price Spiral?

One defining characteristic of the 1970s was cost-push

inflation, when wages—employers’ biggest cost—and overall consumer prices

chased each other higher, says Peter Boockvar, chief investment officer

at Bleakley Advisory Group. “We are beginning to see tinders

of a wage-price spiral,” he says, pointing to a 0.6% rise in average

hourly earnings from July, a 4.3% increase in wages from a year earlier, and

comments on Thursday from the National Federation of Independent Business

(NFIB) report on small businesses.

50% of small business owners reported unfilled job

openings in August on a seasonally adjusted basis). August's reading is 28

percentage points higher than the 48-year average of 22%.

“Small employers are struggling to fill open

positions and find qualified workers resulting in record high levels of owners

raising compensation. Owners are raising

compensation in an attempt to attract workers and these costs are being passed

on to consumers through price hikes for goods and services, creating inflation

pressures,” NFIB chief economist Bill Dunkelberg said in a statement.

Conclusions:

Nouriel Roubini argues that persistent

negative supply shocks threaten to reduce potential growth, while the

continuation of loose monetary and fiscal policies could trigger a de-anchoring

of inflation expectations. The resulting wage-price spiral would then usher in

a medium-term stagflationary environment worse than

the 1970s – when the debt-to-GDP ratios were lower than they are now. That is

why the risk of a stagflation inspired debt crisis will continue to loom

over the medium term.

How will the Fed and ECB respond if the markets

suffer a shock (or meltdown) amid a slowing economy and higher inflation?

End Quote:

“As I watch the asset bubbles get bigger and bigger,

I can't help but think of Alan Greenspan's parting words before he left the

Fed: ‘History has not dealt kindly with the aftermath of protracted periods of low-risk

premiums.’”

……………………………………………………………………………………………….

Stay healthy, enjoy

life, success, good luck and till next time….

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been

involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies

and government policies. Victor started

his Wall Street career in 1966 and began trading for a living in 1968. As President

and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's

research and development platform, which is used to create innovative solutions

for different futures markets, risk parameters and other factors.

Copyright © 2021 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).