A Potential Petrodollar Shock with a Huge Impact on

Markets

By Victor

Sperandeo with the Curmudgeon

Introduction:

We explore a scenario where Saudi Arabia, acting alone or

with all of OPEC, could replace the U.S. dollar as the currency used to price

its oil, thereby causing a dollar crash that would have a shock effect on many

markets.

Biden, Oil Prices and Saudi Arabia:

On his first day of office, President Biden issued an

executive order canceling the Keystone XL pipeline making good on his

promise to the climate activists who helped get him elected, but inviting a

lawsuit brought by 21 states who say they will be hurt economically by Bidens

decision.

That along with other anti-fossil fuel policies to effectuate

the green new deal helped lift oil prices to + 50% this year. Biden

then asked the Saudis to increase oil production to drive prices down [1.]. The Saudis said no.

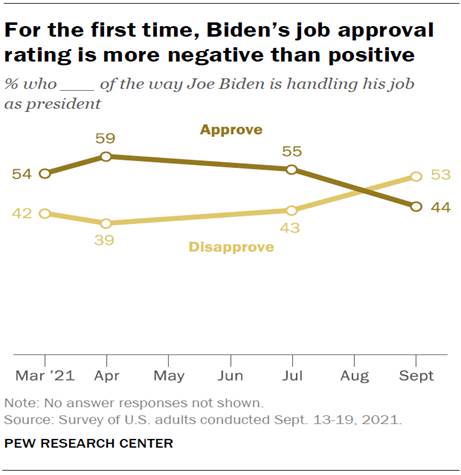

Note 1. Rising oil prices and

foreign policy blunders have sent Bidens approval ratings to the low-to-mid

40% level as per this graph:

On June 18th, the WSJ reported that the Biden administration instructed

the Pentagon to remove approximately eight Patriot anti-missile

batteries from countries including Iraq, Kuwait, Jordan and Saudi Arabia. The Terminal High Altitude Area Defense (THAAD)

anti-missile system was also withdrawn from Saudi Arabia and jet fighter

squadrons assigned to the region were also reduced. Those assets had been moved into Saudi Arabia

following a 2019 strike on their oil production facilities. While claimed by

Houthi forces in Yemen, U.S. officials assessed that Iran was behind that 2019

attack.

On September 11, 2021, the FBI released the first document

related to the 9/11 attacks after Biden ordered the declassification of more

records. Of consequence was a memo

detailing "significant logistic support" that two of the Saudi

hijackers received in the U.S.

After the U.S. defense support was reduced, the Saudis have

been looking for one or more partners to protect themselves and the kingdoms

oil reserves. For example:

1. On September 14th, Greece announced it would be sending U.S.-made Patriot anti-missile batteries

and soldiers to staff them to Saudi Arabia, to replace U.S. manned Patriots the

Biden administration withdrew in April.

In an opinion piece, Kenneth R. Timmerman of the NY Post wrote:

When Greece steps up

to fill the vacuum left by a U.S. pullout, it gives you a measure of just how

far the United States has retreated from the world stage over the past nine

months. This is not the Greece of Alexander the Great, but todays Greece.

Nearly bankrupt just a few years ago, Greece has now replaced the United States

as defender of the worlds largest oil producer. Ouch.

2. Saudi Arabia

has asked Israel about the possibility of procuring their missile

defense systems, because of the U.S. defense systems the Kingdom has for so

long relied upon have been removed. The

Saudis are considering either the Iron Dome, produced by Rafael, which

is better against short range rockets, or the Barak ER, produced by IAI,

which is designed to intercept cruise missiles. Israeli defense sources told Breaking Defense that such a deal would

be realistic, as long as both nations received approval of Washington. One source added that Saudi interest in the Israeli

(defense) systems has reached a very practical phase.

Victors Opinion:

If this tit for tat continues, one day soon well see Saudi

Arabia ending the Petro Dollar [2.] monopoly of the

U.S. They very well could persuade OPEC

to ditch the dollar or take unilateral action to do so.

Note 2. Petrodollars are U.S.

dollars paid to an oil-exporting country for the sale of crude oil. The

petrodollar system is an exchange of oil for U.S. dollars between countries

that buy oil and those that produce it.

Oil importing countries pay for that commodity in U.S. dollars, which

bolsters the greenback as the worlds reserve currency.

In my view, Saudi Arabia will look to a basket

of currencies plus Gold/Silver to set the price of oil, as no other

countrys fiat money today can be a reserve currency to replace the

dollar. To be a reserve currency, a

large and liquid debt market is required to invest in. You also need open and transparent capital

markets. Chinas Yuan is out of contention on that basis, even though China is

the worlds second largest economy and closing the GDP gap with the U.S.

A hypothetical Petrodollar replacement basket could be: Gold 10%, Silver 5%, U.S. Dollar 15%, China Yuan 15%,

Euro 15%, Japanese Yen 15%, British Pound 4%, Canadian dollar 4%, Australian

Dollar 4%, Russian Ruble 4%, Mexican Peso 2.5 %, Brazilian Real 2.5 %, Swiss

Franc 2 %, Swedish Krona 2%.

Naturally if a currency was devalued too much in a year, the Saudis

could lower the weight, and increase the percentage of stable or appreciating

currencies.

Sidebar NOPEC and Ending the Petrodollar Hegemony:

In June 2019, Reuters reported that Saudi Arabia was

threatening to sell its oil in currencies other than the dollar if

Washington passes a bill exposing OPEC members to U.S. antitrust lawsuit. The No

Oil Producing and Exporting Cartels Act (NOPEC) was a U.S. Congressional

bill, never enacted, designed to remove the state immunity shield and to allow

OPEC, and its national oil companies to be sued under U.S. antitrust law for

anti-competitive attempts to limit the world's supply of petroleum and its

consequent impact on oil prices.

Should this Petrodollar replacement occur, it would cause

severe havoc in the U.S. and the rest of the western world. The dollar would

sharply decline and that would cause U.S. inflation to spike. Stocks would

immediately decline, while gold prices would increase sharply as markets went

into chaos.

Is such a potential shock likely? I believe so, but

governments have a lot of power to get around problems. One should be aware

that Saudis de facto iron man leader, Mohammed Bin Salman al Saud (MBS) -pictured

below, could make this decision for the Kingdom without OPEC's approval.

If it was announced on a weekend, many world equity markets would be limit down

on Monday.

In addition, the dollars invested in Reverse Repos

(started in March 2021) are up 1,000 % from $134 Billion on 3/31/21 to $1,313

trillion on 9/24/21. This is causing the credit markets to tighten and yields

to rise.

What happens when the Fed unwinds the air on this balloon?

The dollar declines!

Conclusions:

The Petro dollar release valve described above could

be the catalyst to cause inflation to rise and equity bull markets to collapse.

All of this Fed

money printing and manipulation of fiat dollars would embarrass a sorcerer from

the 14th century. It adds up to the

magic of trying to make something from nothing without any consequences.

End Quote:

Only the naive inflationists could

believe that government could enrich mankind through fiat money. Ludwig Von Mises

Stay healthy, enjoy life, success, good luck and till next

time

.

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies

and government policies. Victor started

his Wall Street career in 1966 and began trading for a living in 1968. As

President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the

firm's research and development platform, which is used to create innovative

solutions for different futures markets, risk parameters and other factors.

Copyright © 2021 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the original

posted article(s).