Gold vs.

Bitcoin – Which One Will Survive?

By

Victor Sperandeo with the Curmudgeon

Introduction:

This week we take a break from our seemingly

never-ending revelations and documentation of the many mania/bubbles in various

asset markets. Our analysis this week is on Gold as a store of value vs Bitcoin

as a pure speculation. But first, let’s look at the relationship between character, trust,

credit, and money.

The Importance of Character and Trust:

There’s an interesting story about JP Morgan and Andrew

Carnegie from the Panic of 1873. Carnegie was a client of the

Morgan’s, with $50,000 on deposit plus some stocks. After selling his $10,000

interest in a railroad, Carnegie supposedly came by the office to pick up a

check for $60,000. To his surprise, JP Morgan handed over a check in the amount

of $70,000, explaining that the bank had underestimated how much cash Carnegie

had on deposit.

Given what seemed like an obvious over payment,

Carnegie initially refused to take the extra funds. He said, “Will you please

accept these ten thousand dollars with my best wishes?” But Morgan replied,

“No, thank you. I cannot do it.”

A clue as to why JP Morgan would so magnanimously pay

Carnegie more than he expected, is found in his famous 1912 testimony before

Congress, when he emphasized how character was most important.

“Before money, or anything else. Money cannot buy

it,” he said. JP Morgan acted the way he did with Carnegie because he

wanted to preserve his reputation of high character. Character, after all, was

in his mind crucial to creditworthiness.

Why is character so important? Because credit is

all about trust. When a bank extends credit to a debtor, the bank is

trusting that he will honor his word and repay the debt on time. It doesn’t matter if the debtor is wealthy. If he is dishonest,

he’ll have a hard time getting credit.

As JP Morgan said later in his testimony: “A man I do

not trust could not get money from me on all the bonds in Christendom.”

JP Morgan on Money and Gold:

Q: But the basis of banking is credit, is it not?

JPM: Not always. That is an evidence of the banking,

but it is not the money itself. “Money

is gold, nothing else.”

JP Morgan makes a clear distinction between money and

credit. Gold, unlike credit, is not dependent on a third party “coming

through.” Gold is a physical good, while

credit is essentially a promise. Gold can never default, but credit is only as

good as the character of the borrower.

Morgan added: “…and nothing else,” because all other

assets in the banking system at the time—including dollar bills—were forms of

credit, whose value depended on the debtor paying it back. Gold was and is the

only financial asset that bears zero counter-party risk.

Although JP Morgan spoke these words over a century

ago, this essential difference between credit and money (gold) remains true

today.

GOLD is Money!

Here are 10 attributes of Gold which conclusively

proof its really money:

1. MEDIUM OF EXCHANGE

Gold can be used to buy and sell products and

services relatively easily. If you want to buy a cup of coffee for $2.50 you

can easily sell/exchange an ounce of gold for dollars to pay ~$2.50 in fiat

currency... as virtually anyone will change dollars for gold.

2. UNIT OF ACCOUNT OR A MEASURE OF EXCHANGE VALUE

The unit of account in financial accounting refers to

the words used to describe the specific assets and liabilities that are

reported in financial statements, rather than the units or tools used to

measure them.

Money is used as the common benchmark to designate

the prices of goods throughout the economy. Unit of account, or measure of

value, means money is functioning as the measuring unit for prices. In other

words, prices of goods are stated in terms of the monetary unit.

3. LEGAL TENDER

You can legally pay U.S. government debts in gold,

although this is not done often.

4. STANDARD OF VALUE

A standard of value is an agreed-upon worth for a

transaction in a medium of exchange, such as in U.S. dollars or in gold.

A standard of value is needed so the value of goods

and services can be “consistently” determined.

Without a standard of value, other ways of exchanging

goods may arise, such as a barter system.

5. STORE OF VALUE

Gold acts as a store of value because its value is

adjusted by inflation. In the 108.25 years since January 1913 (when the U.S.

government OFFICIAL statistics were first published on the CPI):

·

The CPI has appreciated 3.07%

compounded annually, while Gold has appreciated 4.17% per year (from $20.67 to

$1715.6 an ounce) or +35.8% more per year than the CPI.

·

Something that was valued at

$100 dollars in 1913 is now valued at $2640.01, while $100 Gold then is now

valued at $8,331.28 as of March 31, 2021.

6. FUNGIBLE

Examples of fungible goods include oil, bonds, gold

and other precious metals, money, and unopened items of consumer products on

store shelves such as boxes of oatmeal or cereal. They possess fungibility (the

ability of a good or asset to be interchanged with other individual goods or

assets of the same type) if they have identical value and properties of other

items; For example, diamonds are not fungible due to differences in quality.

7. PORTABLE

You can carry or move gold coins reasonably easily.

Five 1 oz coins are worth ~$9,000 today.

8. DURABLE

Gold does not rust or erode its character over time.

9. DIVISABLE

Gold can come or be changed in different weights,

e.g., 10 oz., 1 oz., 0.5 oz., etc.

10. INTRINSIC VALUE

Gold has intrinsic value in that it has

established costs: discovery, mining/digging to get it, minting, etc. The

result is a real item that has a cost value. The “general” cost to

derive/manufacture an ounce of gold is estimated to be $1,200 per oz by most

miners.

Gold as a store of value has a history or over 5,000

years. As far back as 4000 B.C., the

yellow metal was used to make decorative objects, according to the National

Mining Association.

Also, there is evidence of a gold/silver value

ratio around that same time period, according to

the code of Menes, the founder of the first Egyptian

dynasty. It’s stated in this code that “one part of gold is equal to two and one half parts of silver in value.” That is the

earliest documentation of a value relationship between gold and silver.

For more of my thoughts on Gold, please read: A

Historical Review of Money and Gold in the U.S., Q&A

On Gold—Past, Present and Future, How

to View Gold and Why It Might Be Bottoming Now! and Why

Gold Is More Than a “Pet Rock.”

Assessment of Bitcoin:

Bitcoin is a cryptocurrency (crypto) created in 2009.

Market places called “bitcoin exchanges” allow people to buy or sell bitcoins

using different national currencies, e.g., US dollars, Euro’s, Yen, etc.

Bitcoin can be used anonymously to conduct

transactions between any account holders, anywhere and anytime across the

globe, which makes it attractive to criminals and terror organizations as there’s no paper trail to track.

It is a digital concept, rather than a real object.

There is no intrinsic value. Instead, it is pure SPECULATION! Bitcoin’s primary value is its SCARCITY in

that a limited quantity is created, e.g., about 21 million Bitcoins.

You also need electricity/battery power and a

computer/smart phone to hold and use Bitcoins.

Lots of things could go wrong:

·

If your computer crashes, you

may lose your bitcoins temporarily or maybe forever.

·

If you lose or forget your

password, you could lose your bitcoins.

·

Other ways of losing your

bitcoins are possible.

…………………………………………………………………………………….

NOTE: In sharp contrast, Gold never disappears.

It has unquestionable staying power as we’ve

previously stated.

……………………………………………………………………………………..

Bitcoin is now being used as a medium of exchange. An

increasing number of companies are accepting payments in Bitcoin. A January 2020 survey by HSB revealed that

36% of small-medium businesses in the U.S. accept Bitcoin. The most popular companies

accepting Bitcoin payments worldwide today are Wikipedia, Microsoft,

and AT&T.

Just before opening day, the Oakland A’s announced they had sold a

luxury suite for the 2021 season for one Bitcoin. Cryptocurrency broker Voyager Digital Ltd.,

a publicly traded company, bought the luxury suite for the 2021 A’s baseball

season.

Incredibly, there are at least 15,909 Bitcoin ATMs

in the U.S. To find one near you, look here.

No one really knows if Bitcoin is a store of value

during inflationary times. For sure, it does not possess the many features of

Gold.

Most importantly, government(s) could easily cause

the value of Bitcoin and other crypto’s to decline with new regulations. For

example, requiring taxpayers to check a box on their tax return (to collect a “Crypto

Tax”) for holding Bitcoins or other crypto’s would be a deterrent for

ownership. It could also precipitate

fraud or perjury. Some believe that when

governments earnestly begin serious regulatory oversight, it will be the end of

the boom in digital Bitcoin and other crypto’s.

Also, competition is widespread. Investopedia says that there are more than

4,000 cryptocurrencies in existence as of January 2021. Please see next sub head of this post for

more on this theme.

In summary, Bitcoins are mainly used as a speculative

“investment” and not as an alternative currency and medium of exchange. That said, Bitcoin has created great wealth

for the speculators that bought and held it.

For those who want to view a Bitcoin debate, I

recommend Real Vision: “The Best Bitcoin Debate Ever Recorded

(Anthony Pompliano vs Mike Green).” While I don’t know Mr.

Pompliano, Mike Green is as intellectually sophisticated as anyone on Wall

Street. No exaggeration.

I wish I was part of the debate as they don’t cover

the points I’ve made in this and other Curmudgeon blog

posts.

……………………………………………………………………………………..

Other Crypto’s and Coinbase (Crypto Currency

Exchange):

While being the oldest and most successful crypto to

date, Bitcoin was soon followed by many others, including Ethereum,

Litecoin, Dash, Ripple and many more.

The big tsunami on Wall Street last week was the

direct listing of Coinbase -the crypto currency exchange. With 261.3 million

diluted shares outstanding, Coinbase now has a market capitalization of about $86

billion, according to Barron’s.

That eye opener was quickly topped by the Dogecoin cryptocurrency

surging to an all-time on Friday morning – almost tripling its value

in just 24 hours. The Dogecoin cryptocurrency

started as a joke in 2013 based on a Shibu Inu meme. It exploded in value this past week.

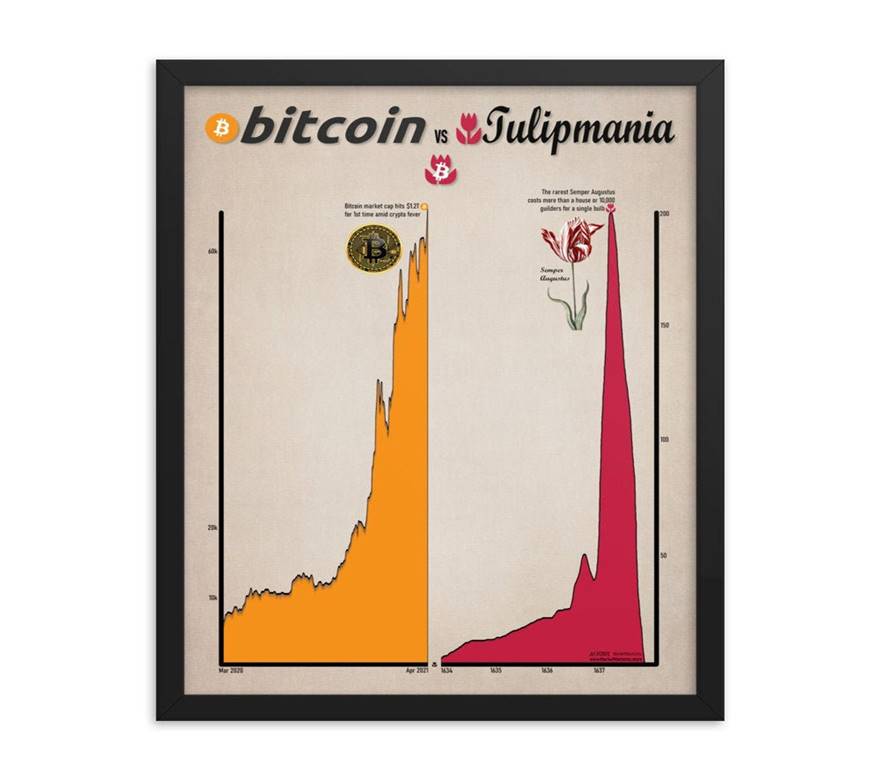

Tulip Mania vs Bitcoin:

At its peak in 1637 tulip bulbs were worth the

equivalent of two houses. Then its price collapsed! Please see chart below.

The fundamental value did not match its emotional

desired value. The risk is similar with

Bitcoin and other crypto’s. Have a look

at this chart:

Additional Gold Facts and Comments:

Not known to most market observers: Gold has

outperformed the S&P 500 in the last 21 years (from 12/31/99 to 12/31/20)

by 41%. S&P 500 +6.6% total return, Gold +9.3% vs. CPI +2.1%! As a huge

critic of gold, Warren Buffett’s Berkshire Hathaway underperformed Gold

by 9.0% over that time period.

Gold could drop to $1200 per ounce or slightly lower,

but then production ends. Fundamentally, there is a floor price for Gold.

Do you think there’s a floor

price for Bitcoin?

Victor’s Conclusions:

1. Bitcoin may continue to rise until something causes it to lose the

confidence of speculators. Then it could crash and be virtually useless as a

medium of exchange (with the exception of fraudsters,

criminals, and terrorist organizations).

It only has a few of the positive attributes of Gold and has no real

“staying power.” Thereby, it is not the equivalent of real money, which

Gold certainly is.

-->I’m not a

bitcoin buyer (neither is the Curmudgeon), as it is purely a concept rather

than a fundamentally based asset. On the

other hand, I love Gold and Silver.

2. It’s ironic that Alan Greenspan, who created the “FED PUT”

and knows so much about Gold, set the precedence for the Frankenstein Fed,

which has become the greatest monetary inflation creator in American history.

Each Fed Chair since Greenspan has launched

increasingly easy monetary policies which would previously have been thought to

be unthinkable.

“In

the absence of the gold standard, there is no way to protect savings from

confiscation through inflation. There is no safe store of value.” Alan

Greenspan

The oceans of newly created fiat dollars (the world’s

reserve currency) fueled bubbles in financial assets as well as Bitcoin and

other cryptos.

All bubbles eventually burst. The bigger the bubble the larger the pop and

subsequent crash damage.

Yes, we’ve said that many

times before…….

End Quotes:

“I know of only three people who really understand

money. A professor at another university. One of my students. And a rather

junior clerk at the Bank of England."

John Maynard Keynes

“Bitcoin is one of the most viral concepts I've ever

encountered.” Barry Silbert

“Bitcoin is like anything else: it’s worth what

people are willing to pay for it.”

Stanley Druckenmiller

“Bitcoin is absolutely the Wild West of finance and

thank goodness. It represents a whole legion of adventurers and entrepreneurs,

of risk takers, inventors, and problem solvers. It is the frontier. Huge

amounts of wealth will be created and destroyed as this new landscape is mapped

out.” Erik Voorhees

Read more Bitcoin quotes here.

………………………………………………………………………………………………

Stay calm, be healthy, optimism is the word, and till

next time……

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been

involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned

(since 1971) to profit in the ever changing and arcane world of markets,

economies and government policies.

Victor started his Wall Street career in 1966 and began trading for a

living in 1968. As President and CEO of Alpha Financial Technologies LLC,

Sperandeo oversees the firm's research and development platform, which is used

to create innovative solutions for different futures markets, risk parameters

and other factors.

Copyright © 2021 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).