A

Historical Review of Money and Gold in the U.S.

By Victor Sperandeo with

the Curmudgeon

Introduction:

With gold at all-time highs against the U.S. Dollar as well

as against all fiat currencies and silver finally breaking out to the high

$20s per ounce, a detailed summary of the history of money in the U.S. seems

like a worthwhile discussion. As usual,

the opinions expressed herein are those of idea man-historian Victor

Sperandeo.

This recap will be followed by an article which examines the

current U.S. debt buildup and what the end game might look like. Well include ShadowStats John Williams

views as well as Victors insightful analysis thoughts and comments.

Preface Gold is Money!

In many previous Curmudgeon posts, we have maintained that Gold

is MONEY and this certainly holds true today as the dollar continues to be

debased by unimaginably easy Federal Reserve monetary policy and unchecked

federal government spending as a result of the pandemic.

History of Money:

The U.S. was on a bimetallic standard for its first

hundred years (meaning the currency was tied to both gold and silver). With the ratification of the U.S.

Constitution in 1791, and the passage of the Mint Act of 1792, the

ratio of gold price to silver price was set at 15:1.

The 1834 Coinage Act moved the gold/silver ratio to

16:1. During the Civil War (1861-1865), inflation rose to over 40%, which

pushed the price of silver to $2.94 an ounce.

The 1873 Coinage Act, which has also been referred to

as the Crime of 1873, [1] was signed into law by President U.S. Grant. This act was ostensibly passed to change the U.S.

Mints fundamental structure. Actually, the main purpose was to remove the U.S. Dollar

from bimetallism, adopting the Gold Standard. As a consequence,

the standard silver dollar would no longer be minted by the U.S. government.

Note 1. Crime of 1873 (see image below)

refers to the omission of the standard silver dollar from the coinage law of 12

February 1873.

Illustration of the Crime of 1873

..

In 1884 we come to the important Supreme Court case of

Juilliard v Greenman. In an

8-1 ruling, the Legal Tender acts of the 1860s were found to be

constitutional. The legal ramifications

of the courts ruling was that it was now accepted precedent that the U.S.

Federal government had the power to borrow money and establish a national currency,

establishing that paper money was now legal tender and must be accepted for

payment of public and private debt.

-->Under these guidelines, the government was free to

print paper currency in any amount, and for any reason. This is one reason paper currency is

often referred to as fiat money.

The U.S.

Treasury issues debt and then paper money (or bank credit) is used to buy that

debt.

You might

ask Why doesnt the U.S. Treasury simply print paper money without issuing

debt or having to make the associated interest payments? In particular, is

there any difference between 1.] the U.S. Treasury printing dollars to spend or

2.] the selling of U.S. debt to obtain dollars to spend?

I maintain

that nothing is different, except in #2 the money supply (monetary inflation)

is actually higher. Readers are invited to email the Curmudgeon (ajwdct@gmail.com) for a more

detailed explanation.

Fed Debt

Monetization and Counterfeit Money:

Ever since the

2008 financial crisis, the Federal Reserve (the Fed) and its member banks are

purchasing an ever-increasing amount of U.S. debt (and other fixed income

securities), thereby creating money out of thin air.

I have often

referred to that newly created currency as counterfeit money. If so, the Fed should be punished as

per Article 1, Section 8, Clause 6 of the U.S. Constitution (please

refer to discussion below which references the Constitution):

To provide

for the Punishment of counterfeiting the Securities and current Coin of the

United States.

Sidebar - Paper Money, BEP, and the Fed:

The U.S. Treasury Department's Bureau of Engraving and

Printing (BEP) designs and manufactures all paper money in the U.S. (The

U.S. Mint produces all coins.)

However, the amount of currency printed by the BEP each year

is determined by the Fed, which then submits an order to the BEP.

The Fed then distributes that currency via armored carrier to

its 28 cash offices, which then further distributes it to 8,400 banks, savings

and loans and credit unions across the country.

For the 2020 fiscal year, the Fed's Board of Governors

ordered 5.2 billion Federal Reserve notesthe official name of U.S. currency

billsfrom the BEP, valued at $146.4 billion.

U.S. Central Banks:

The first central bank after the ratification of the

U.S. Constitution was commonly called the First Bank of the United States. It was chartered in 1791 for a period of

twenty years and was promoted heavily my Alexander Hamilton when he was

Secretary of the Treasury. Its charter expired in 1811.

The Second Bank was formed in 1816, and again

chartered for twenty years. Its charter

ended in 1836 (when it became privately owned), but by 1833 it was effectively

shut down by President Andrew Jackson, who had the Federal deposits moved to

state and private banks.

Fast forward to 1913, when the Federal Reserve Act

created another central bank to create fiat currency, set interest rates, and

control the money supply by buying U.S. government debt. Understand that except for minted coins, all

money would now be loaned into existence.

In my opinion, the term Federal Reserve was used to confuse

the public into believing it was a government institution instead of a private bankers cabal.

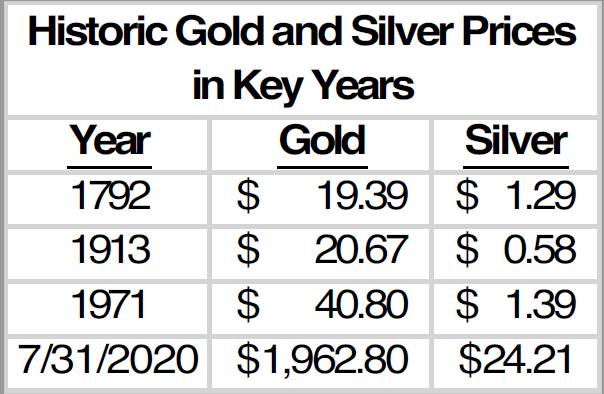

Gold Prices:

From 1792 to 1833, gold was priced at $19.39. From 1834

through 1933 it was $20.67 (not including a price spike during the Civil

War). During this period, inflation (as

measured by the price of gold) was 0.04% annually, an infinitesimally small

amount.

All of this changed in 1933.

Thats when F.D.R., via an Executive Order, later backed by the

1934 Gold Confiscation Act (legislation that

was very accurately named), ordered citizens to turn in their gold to the

Federal government, with some minor exclusions for business use, and a small

personal exception. In exchange, gold

holders received $20.67 in paper money.

Historians call this voluntary surrender despite the

threat of fines and prison for anyone caught hoarding gold. Immediately following the surrender period,

the price of gold was reset to $35 an ounce, resulting in a government

confiscation profit of 70% on all the gold the government had forcibly

collected. In effect, that was a profit

denied to the rightful owners who surrendered their gold to the U.S.

government.

In my view, both the Executive Order and the Congressional

legislation were both unconstitutional. It wasnt simply

the illegal confiscation of the gold, but also the entire position that the

government can print paper fiat currency.

U.S. Constitution defies Gold Acts:

Please refer to the U.S. Constitution, Article 1, Section

8, Clause 5 states: To coin Money, regulate the Value thereof, and of foreign

Coin, and fix the Standard of Weights and Measures. (For example, fixing the value of an ounce of

gold at $20.67).

Also, see Article 1 Section 10: No state shall enter into any treaty,

alliance, or confederation; grant letters of marque and reprisal; coin money;

emit bills of credit; make anything but gold and silver coin a tender in

payment of debts; pass any bill of attainder, ex post facto law, or law

impairing the obligation of contracts, or grant any title of nobility.

So where did FDR get the power to promulgate the Gold

Confiscation Act, with Congress his willing and obedient disciples and

servants?

In my opinion, the government made itself into a criminal

enterprise, colluding to take peoples wealth (in the form of gold).

All three branches of government played a part in this

nefarious scheme, as the Supreme Court refused to hear any of the

lawsuits. So much for the notion of separation

of powers, that our nations founding fathers envisioned.

Despite the constitutional restrictions on government

impairing the obligation of contracts, the Gold Confiscation Act

effectively resulted in all of the Gold Clause Contracts outstanding

to become null and void.

A Gold Clause agreement was a contract between

parties to borrow and repay in gold rather than in fiat currency. The only legal way to have enacted these laws

and orders was through a constitutional amendment. Instead the Supreme Court refused to enforce

the restrictions of the Constitution, and consequently what should have been

illegal decrees became the new law of the land.

U.S. Income Taxes:

In 1913, under President Woodrow Wilson, the U.S. implemented

what I believe was equivalent to the Second Plank of the Communist Manifesto - a heavy

progressive or graduated income tax.

This was exacerbated in 1933, when the Fifth Plank of the

Manifesto was instituted in the U.S.: Centralization of Credit in the

Hands of the State, by means of a National Bank with State Capital and

an exclusive monopoly. The U.S. Federal

Reserve is indeed such a "national bank" and it manipulates interest

rates, buys debt, and holds a monopoly on legal counterfeiting in the United

States. This is exactly what Marx had

in mind and completely fulfills this plank, another major socialist objective.

With the forced surrender of gold by the public, the official money of the

nation was now under control by the U.S. Treasury and the Fed.

U.S. Silver Certificates:

In 1963, President John F. Kennedy made the only modern move

away from the Federal Reserve system when he signed Executive Order 11110. This order decreed that the U.S. Treasury

would be solely permitted to issue Silver Certificates as currency,

backed by the silver held by the U.S. government. These United states Notes were very similar

in appearance to the fiat Federal Reserve Notes, and were issues in $2 and $5

denominations ($10 and $20 denominations were printed but had not been

distributed by the time JFK was assassinated less than six months later).

While Executive Order 11110 has never been repealed, the

Silver Certificates were taken out of circulation and have never again been

issued.

Guns, Butter and Coinage Act of 1965:

Soon after he became President, Lyndon B. Johnson increased

the war efforts in Vietnam while asserting his guns and butter policies. Inflation accelerated, and silver coins began

to be hoarded as paper money declined in value.

In response, the Coinage Act of 1965 was passed and

signed. This eliminated silver entirely

from dimes and quarters and cut the silver content of half-dollars to 40%

(before silver was eliminated from those as well in 1970). With this one act, the composition of coins

in the U.S. was forever changed from the silver standards set in 1792.

Fiat Money System after U.S. Went off Gold Standard:

In August 1971 President Richard Nixon enacted

internationally what FDR has enacted domestically: Taking the U.S. currency

off the Gold Standard (as depicted in the image below).

The

Gold Standard backed a nations currency with Gold held by its Government.

Countries on the Gold Standard agreed to convert paper money into a fixed

amount of gold.

The

Gold Standard backed a nations currency with Gold held by its Government.

Countries on the Gold Standard agreed to convert paper money into a fixed

amount of gold.

.

Going off the Gold Standard gave rise to an exponential

increase in U.S. government debt. The

entire monetary system had become a fiat paper-based concoction.

U.S. Debt Explosion:

From June 1971 to the estimated for September 2020, total

stated U.S. Federal debt (not including unfunded liabilities and off balance sheet

items) will have grown at a 9.02% compounded annual rate. Compare that to Real GDP growth between June

1970 to June 2020 of only 2.54% compounded annually. Debt has grown at 3.6 times the rate of real

growth. And if this rate of debt

increase continues, by September 2030 the U.S. Federal debt will be $68.8

trillion.

When you start to talk about such vast sums of money, it is

difficult to understand exactly what it means.

Let me try to put a trillion into perspective. If you counted back just one trillion seconds

from today, you would be in the Paleolithic period, around the year 29,690

B.C. Weve had

a major ice age more recently than that!

Inflation Rate vs Gold Appreciation:

The official CPI rate from December 1913 to June 2020 shows a

3.1% compounded annual rate of increase.

Over that same period, gold has increased in value at a 4.28% compounded

annual rate (using the June 30th close of $1,800.50). Gold has beaten the official inflation

rate by 38% per year over this 106½-year period.

Yet theres been very little

inflation over the past decade. Weve provided the reason why in many previous Curmudgeon

blog posts. Please see Victors

Comments in this post.

Due to the Financial Services Regulatory Relief Act of

2006 authorizing the Federal Reserve to begin paying interest on bank

reserves, the Fed gave banks a huge incentive NOT to loan money. Without

loans to companies and individuals, the huge quantity of money lies dormant.

The base of inflation starts with increased money supply, but the velocity of

money (i.e. the turnover) is what cause prices to rise rapidly. Money velocity has crashed and is at an

all-time low. That can be seen in the St.

Louis graph of Velocity of MZM Money Stock. Once money velocity starts to increase, we

can expect inflation to accelerate.

Conclusions and End Quote:

Former Fed Chairman Ben Bernanke strategy, called the wealth

effect or trickle-down theory was to use ZIRP, QE, Operation Twist, etc. to

drive up financial asset prices. This

unconventional monetary policy continued under Janet Yellen and current Fed

Chair Jerome Powell (whose Fed is buying all sorts of fixed income assets,

including Junk Bond ETFs- see Curmudgeon Note below).

Unfortunately, this policy was a total failure for the REAL

economy as GDP growth was well under trend and the working mans wealth did not

increase. Instead, the policy served to

greatly widen wealth inequality in the U.S. which is now at an all-time high.

Was that not an outrage to main street for all the years

during President Obama and currently under President Trump?

Curmudgeon Note:

As of August 5, 2020, the Fed's balance sheet (the

best indicator of the Feds direct intervention in the U.S. economy) stands at $6.9

trillion vs $4.5 trillion at the previous QE peak on July 20, 2015. You can view a graph of the Feds balance

sheet for different time periods here.

.

Vladimir Lenin answers the outrage to main street question:

People always have been, and they always will be stupid

victims of deceit and self-deception in politics. Vladimir Lenin

.

Under Lenins leadership, Russia and then the wider Soviet

Union became a one-party communist state governed by the Russian Communist

Party.

Under Lenins leadership, Russia and then the wider Soviet

Union became a one-party communist state governed by the Russian Communist

Party.

.

Stay tuned for Part II on end game scenarios for the U.S.

financial system.

Good health, good luck, be safe and till next

time

.

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been

involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned

(since 1971) to profit in the ever changing and arcane world of markets,

economies and government policies.

Victor started his Wall Street career in 1966 and began trading for a

living in 1968. As President and CEO of Alpha Financial Technologies LLC,

Sperandeo oversees the firm's research and development platform, which is used

to create innovative solutions for different futures markets, risk parameters

and other factors.

Copyright © 2020 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).