How to View Gold and Why It Might Be Bottoming Now!

by Victor Sperandeo and The Curmudgeon

Introduction:

In a previous

CURMUDGEON post - Q&A

On Gold—Past, Present and Future, Victor and I expressed our view that Gold was

money and should be considered as a long term investment for most

individuals. (For CTAs and managed

futures funds, gold is a trade or long/short speculation). We also examined gold market drivers and said

that the cyclical bear market in gold had ended this past June with an

intra-day print low of $1188. We hinted

that there was manipulation and control of the gold market and we still feel

that's the case. This article provides

an update on our views on gold as well as those of several newsletter writers

and analysts. We also examine the

current technical position of gold since its June 2014 intermediate low. Victor's closing comments are especially

relevant at this time.

Sperandeo views

gold from a different point of view than most analysts. "Fundamentally,

gold should be held as a part of an investment portfolio to hedge one's net

worth against a "long tail" (unexpected negative) event and to

protect against long term inflation."

Victor suggests 10-20% of a total portfolio being allocated to physical

gold.

Why shouldn't

gold be a short or intermediate term trade?

It's because few people can make money doing trading gold. Considering a variety of technical trading

methodologies, Victor’s firms have extensively tested 214 different algorithms

and found that only one was profitable trading gold since 1985! [It's a simple long term 12 month Moving

Average (MA) that's weighted 1.1 times.] As a result, he says that short term

systematic trading in gold is a losing proposition for the majority of

investors and speculators too.

What's Happened to the Gold price since June 2013?

Gold's rally

off the June lows ($1188 intra-day and $1200 for spot gold close) was

unsustainable and the yellow metal has retraced its rally that topped out at

$1420 intra-day. To date, spot gold and

Feb 2014 Comex Gold futures have held above the psychologically important $1200

support level (with an intra-day print low of $1218). Friday (December 6th) closing price for spot

gold was $1230.

The Curmudgeon

believes gold's rally failure and subsequent selling is due to Exchange Traded

Fund (ETF) liquidations (e.g. GLD, IAU, DGL, etc.) and short sales of those

same ETFs as well as Comex Gold futures contracts. The buying is coming from physical gold

buyers (especially in Asia) and foreign central banks.

We believe the

rising price of gold over the past decade had lured many "investors"

(individuals, money managers, mutual funds and hedge funds) into the paper gold

market through ETFs. Those investors

mostly viewed gold as an alternative to common stocks for short term capital

appreciation, rather than for long-term capital preservation. As a result, they sold their Gold ETFs which

caused the spot price to drop. By the

end of September, gold ETFs had sold off about 700 metric tons of physical gold

- more than half of it in just the second quarter of 2014.

On December

6th, Bloomberg reported that "Investors cut holdings in exchange-traded

products backed by gold every month this year as prices tumbled, erasing $69.4

billion. Some lost faith in the metal as a store of value as inflation failed

to accelerate, while equities and the dollar rallied."

We think the

gold ETF selling might be overdone. GLD - the largest volume Gold ETF-has

consistently traded at a 3.5% to 4.5% DISCOUNT to spot gold during the recent

price decline. That discount tends to narrow as the spot gold price increases.

Victor is

cautiously optimistic that the $1200 support level for gold will hold. "Using the long-term MA, gold is still

bearish. So from a technical basis there is no evidence of a bullish reason to

be long the yellow metal. However,

classical technical analysis suggests that gold will test the intermediate

-term lows set on 6/8/13 at ~$1188 and make a (double) bottom around that level

or higher. But it is not there yet, so

one must be cautious."

Sperandeo's

View of Gold and Gold Miners:

Many

(worldwide) gold mines will shut down if the price settles under $1200. The

high cost producers will have to wait for prices to go up to make a

profit. Also, sovereign states will

start to print money to buy gold. In

effect, they will take advantage of the current "low inflation, zero (or

negligible) interest payment" time period to exchange paper money for real

money (i.e. gold).

Why not? There

is apparently no inflation? If I ran the printing press of a country, I

would do this all day to buy real physical gold. But not paper gold or futures contracts,

unless I was planning to take delivery.

Victor's

Chart Analysis:

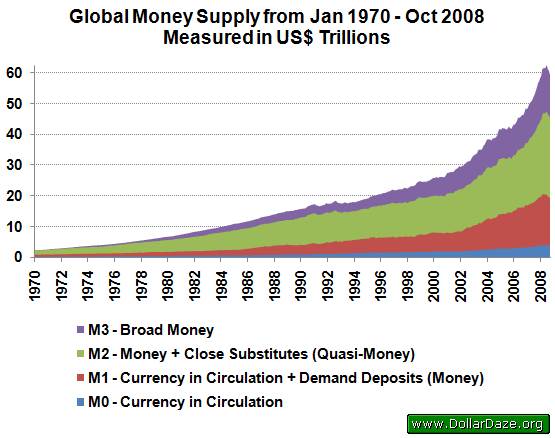

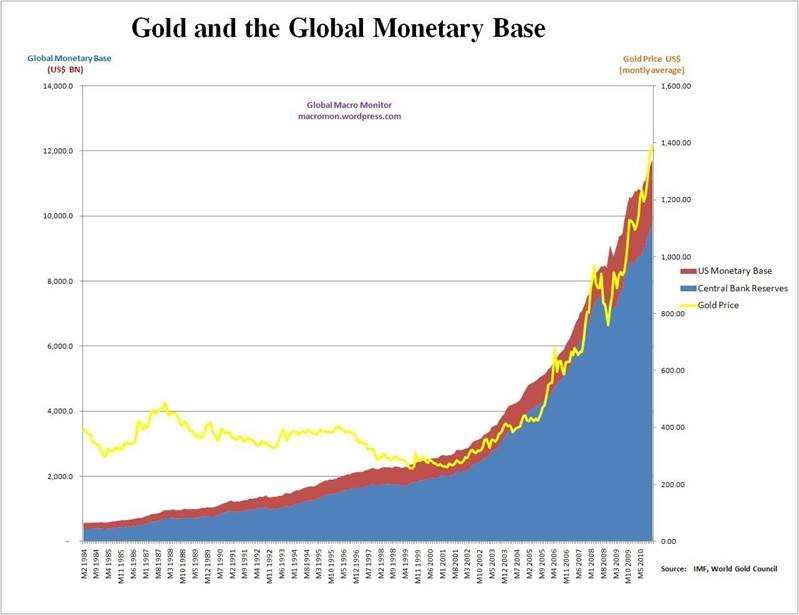

World money

supply is growing at 9.1 % compounded from August, 1971 - 2008 and probably

10.5% (estimated) from 2008 to the present.

The gold price

has increased at an 8.6% annual rate (in US dollars) from 1971-to- November 29

2013. So gold as real money is keeping up

with inflated fiat currencies, especially the U.S. dollar.

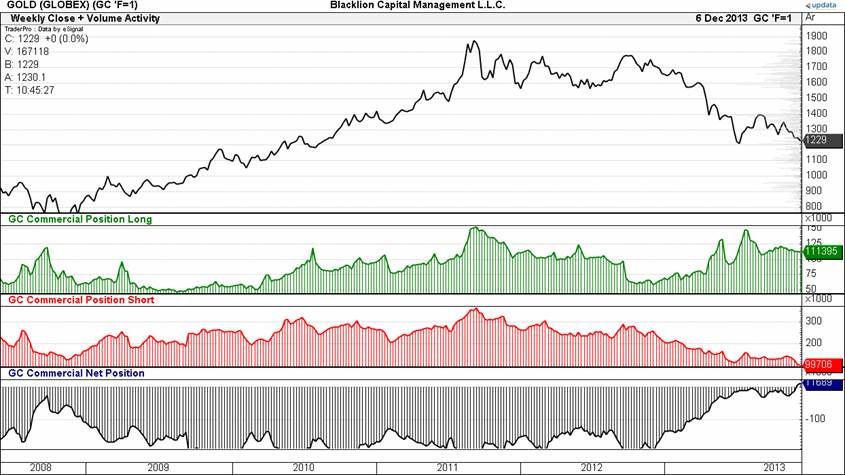

CFTC Commitment of Commercial Traders report for Gold indicates they are

the most net LONG in over five years! Meanwhile,

Large Speculators (chart not shown) continued to liquidate LONG gold

positions and are now net SHORT for the first time in at least five years. The CFTC reports that "Managed

Money" added 6,072 new short gold contracts in the week ended December

3rd.

This is a

sign that the bottom in gold is near. Commercials won't sell at these low

prices, while large specs are often a contrary indicator of market direction.

Other Views:

In his Dec 2013

Gold Letter, Peter Schiff wrote:

"By the end

of September, gold ETFs had sold off about 700 metric tons of physical gold -

more than half of it in just the second quarter. The World Gold Council reports

that the majority of these outflows have been absorbed by Asian demand."

"Western

selling was enough to keep the global spot price from recovering. Instead of

more capital flowing into gold, it was the gold itself which was flowing from

Western financial institutions to Eastern households."

"The

latest data shows that consumer demand for physical gold in the first three

quarters of 2013 hit a historical record of 2,896.5 metric tons. 90% of the

year-over-year increase in this demand came from Asia and the Middle

East."

In his latest Commodity

Futures Forecast report, Philip Gotthelf wrote:

"Sovereign

(states) accumulation is more likely to play the pivotal role in determining

the net outcome from ETF liquidations and private sector abandonment."

"Here is

another reason gold is not likely to fall completely out of favor. Aside from

fancy color diamonds, there are no wealth preservation assets that work in the

Middle East. We may feel comfortable within the security of the United States.

Trust me… if you’re a citizen of any Middle Eastern country you do not have any

sense of security… physical or monetary."

Commerzbank’s commodity strategists:

"The

impetus for an increase in the gold price will probably have to come from

speculative financial investors. These investors were also the first to start

scaling back their bets about rising prices in summer 2011 shortly before the

all-time high was reached, thus heralding the end of the upward surge. The

chances of this group of investors returning to the market next year are good.

Speculative financial investors have now largely exited the gold market, as

evident from the fact that net long positions are at a 7-year low[.] The negative market sentiment towards gold is also

reflected in negative media reports and for the most part pessimistic price

forecasts. All of this may indicate a rapid reversal of the trend. After the

price has successfully bottomed out, gold ETFs should report inflows again from

the second quarter, supporting the price recovery."

Nicholas Larkin

of Bloomberg:

"Gold

analysts are bearish for a third week, the longest stretch since February 2010,

as prices approach $1,200 an ounce and a stronger U.S. economy improves the

chance that the Federal Reserve will reduce fiscal stimulus. Sixteen analysts surveyed by Bloomberg News

expect gold to fall next week, 11 are bullish and two neutral. Prices tumbled

26 percent this year, heading for the first annual drop in 13 years and the

biggest in more than three decades. Bullion last traded below $1,200 on June

28th."

Dennis Gartman of the Gartman

Letter:

"We remain

long of gold in Yen terms and that is the only way we shall buy gold at this

time, happier to note that we are joined in this trade by Mr. Kyle Bass of

Hayman Capital Management who has gone out of his way to say that Gold/Yen is

the trade he will most strongly support going into 2014."

Enis Tanner of riskreversal.com:

“I'm bullish

after that reversal, especially since the initial reaction was lower, but did

not breach recent lows. The chart looks like a double bottom.”

Brian Sullivan

of CNBC News in a video

interview with two analysts:

Victor's

Closing Comments:

First and

foremost, gold should be thought of as real money. As "JP Morgan" said before Congress

in 1913, "gold is money - nothing else."

Both gold and

silver have kept pace with inflation over the last 100 years. That's since the creation of the Federal

Reserve System in 1913. Meanwhile, paper

money (US dollar/reserve notes) has declined 96.25% in real purchasing

power. Or put another way, what cost

$100 in 1913 now costs $2,402.11.

From August 15, 1971 (when Richard Nixon took the U.S. off the gold

standard) until gold's peak price in September 2011, the yellow metal

compounded at a 10.23% annual rate. Compare

that to the S&P 500, which has compounded at 9.9% (including dividends)

over the same time period.

Notes:

1. The last 100 years of inflation: CPI 1/1

/1913 index 9.8 to 10/31/2013 234.877 +3.23% (Source: BLS).

2. Gold's average price $18.92 in 1913

(Source: World Gold Council) vs. $1230 on December 6, 2013 (Comex Feb 2014

futures), produces a +4.27% annual return.

3. Silver was 61.24 cents in 1913 (Source:

1913 The Silver Situation BLS) vs. $19.40 on December 6, 2013 (Comex March

futures), produces a +3.52% annual return.

4. Nixon made the decision to end dollar

convertibility to gold, because the U.S. was running out of the necessary gold

to back all the dollars it had printed. And

that was four decades before the Fed's QE programs and quadrupling of its

balance sheet!

If the long

term strategy of buy low /sell high is still relevant (or is it buy high and

sell higher?), it’s now time to consider accumulating gold for the long

run. Again, we don't recommend gold as a

trade or speculation for serious investors.

Till next

time........................

The Curmudgeon

ajwdct@sbumail.com

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo

is a historian, economist and financial innovator who has re-invented

himself and the companies he's owned (since 1979) to profit in the ever

changing and arcane world of markets, economies and government policies.

As President and CEO of Alpha Financial Technologies LLC, Sperandeo overseas

the firm's research and development platform, which is used to create

innovative solutions for different futures markets, risk parameters and other

factors.