The

Fed and the U.S. Government Can Not be Trusted!

By Victor

Sperandeo with the Curmudgeon

Introduction:

Once again, we probe beyond the headlines to reveal false

promises by the Fed and misleading jobs numbers by the BLS. The chicanery we’ve previously chronicled –

within the U.S. government and its agencies – of reporting misleading

information was in full force last week.

Please email the Curmudgeon (ajwdct@gmail.com) to let us know what you

think of our work. We believe it’s

original and way ahead of the mainstream media/talking heads on TV/Internet.

Fed’s Pledge to Stop Forward Guidance?

In last week’s column, we noted that the Fed

said it would end its “forward guidance” talk about the need for additional Fed

rate increases. Instead, they would be “data

dependent” at each forthcoming FOMC meeting.

However, the Fed did not follow through! As the markets continued to

rally on 8/2/22, comments from Fed officials indicated that additional rate

hikes were planned.

The following Bloomberg article notes how the Fed broke

its pledge to quit forward guidance talk:

U.S Treasuries sank, and

stocks dropped after Federal Reserve officials signaled the central bank is

still intent on raising rates until inflation is under control. Treasury yields rose across the curve, with

10-year rates climbing as much as 20 basis points to 2.77%. The yen, which was

on track for its fifth daily gain, fell as the dollar snapped four days of

losses amid a sudden turnaround in risk sentiment...and fresh commentary

from Fed officials making it apparent that a policy pivot was less likely….

Investors have been keeping an eye out for hawkish comments from Fed officials

about the need for higher rates to restrain elevated inflation.

San Francisco Fed

President Mary Daly said on Tuesday that the Fed is “nowhere near” done

with its efforts to tamp down on inflation, Chicago Fed President Charles Evans

said he expects the pace of rate hikes will start to slow later in the year.

“The Fed is not likely to announce they’re letting up on the brakes at this

point,” said Ellen Gaske, economist at PGIM Fixed Income. “They are still

seeing inflation numbers that have not started to recede.” Cleveland Fed President

Loretta Mester echoed this, saying that she wants to see “very compelling

evidence” that month-to-month price increases are moderating before declaring

that central bank has been successful in curbing inflation.

In a related follow-on CNBC article, Fed Governor

Michelle Bowman said she supports the central bank’s recent 0.75 percentage

point rate increases and believes they should continue until inflation is

subdued.

……………………………………………………………………………………….

Well, if future Fed monetary policy will be “data dependent,”

why are Fed-heads now talking about raising rates before they see the data at

forthcoming FOMC meetings? Note also,

Powell’s flip flop of a 75bps rate hike being “off the table” for the June FOMC

meeting, but Fed Funds were raised by that exact amount in June (and again in

at the July FOMC meeting).

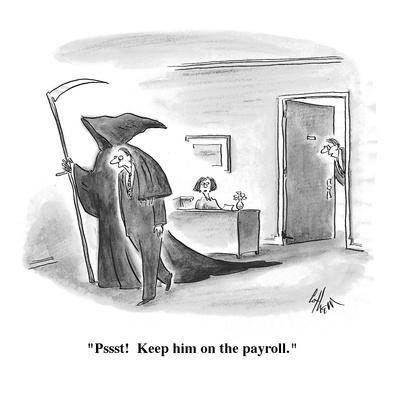

This begs the question: What is a con man? ANSWER: “A

person who tricks other people in order to get their money.”

Therefore, we must conclude that FOMC members are “con

men/women” and liars of the highest degree. Manipulation and propaganda are the Fed’s

specialty rather than honesty and consistency about their decision-making

process.

-->The conclusion is never trust what the Fed says it will do.

Analysis of July Jobs Report:

At first glance, the non-farm payroll numbers

reported Friday by the BLS were shockingly strong. The Employment Survey revealed that

+528,000 jobs were added in July vs. an estimated 250,000 and larger than the

average monthly gain over the prior four months (+388,000).

Economists at Bank of America called the report “a

double-edged sword,” implying lower recession risk but an increased risk of a

hard landing later (due to future Fed rate hikes).

It’s astonishing to us that the mainstream media did not

mention the “Non-Seasonally Adjusted” number of -385,000 jobs lost

in July.

Let’s compare the two: The actual “Non-Seasonally Adjusted”

jobs number was -385,000 vs. “Seasonally

Adjusted number of

+528,000!

Now add the

+309,000 Non-Seasonally Adjusted Birth Death Model (BDM) [1.] of

estimated jobs created and you have an even larger difference between a very

strong U.S. government adjusted report and a very weak one.

Note 1. The Birth Death Model (BDM) consists of made

up, assumed, estimates, but not actually counted jobs. We explained the Birth Death Model hoax in this post.

Other

Voices:

From – "The Forest From The Trees"-- a well-respected

macro service I subscribe to:

After 27 years in this

business, it takes a lot to leave us speechless, but this jobs report did just

that, both because of how good it was and how little sense it makes given the

context of other data, which has been almost uniformly weakening notably.

Add John Williams’ Shadowstats comments:

What was not headlined

in the Payroll Employment “Recovery” was that the seasonally adjusted recovery

gain was just 0.02% (which rounds to 0.0%) or 32,000 +/-116,000 jobs [90%

confidence interval], in the context of heavily shifting and suspect

seasonal adjustment revisions.

July 2022 Payrolls also

held shy by about 3.6% (-3.6%) or by 5.8 (-5.8) million jobs of where they

would be, had the U.S. economy continued its relatively stable trends in place

before the externally driven Pandemic shut it down.

……………………………………………………………………………………………………...

The Bigger Picture in 2022:

For the year of 2022 to date, the BLS reported 2,928,000 jobs

“Seasonally Adjusted” being created vs. 1,897,000” Non-Seasonally Adjusted”

jobs… a difference of +1,031,000 (phantom) jobs.

Add the estimate from the BDM, which was +906,000 estimated

jobs created.

In summary, an average of 418,000 jobs per month were

reported for the first seven months of 2022, but only 129,000 jobs per month

were counted. That computes to 69.14%

fewer jobs added than reported by the BLS.

Obviously, such shenanigans are intended to fool the public

into believing the economy is much stronger than it is.

Implications: The

manipulated job numbers green lights future Fed rate hikes as the “strong job

market” enables the Fed to “safely” disregard the two consecutive quarters of

negative real GDP growth (“technical recession”) this year. Fed rate hikes, and

threats of same, stops any market rallies in its tracks, thereby making the

public poorer.

All this to make the Fed look like its fighting inflation?

More Job-Related Anomalies:

1. The Establishment

Survey and Household Survey on employment show huge discrepancies.

From Zero Hedge:

The closely followed

Establishment Survey came in red hot.

Not only did it soar despite the U.S. entering a technical recession

last week, but it also printed at a 5 month high of 528K, a six-sigma beat to

consensus expectations of 250K..... and with wages also coming in hotter than

expected, rising 0.5% M/M or 5.2% Y/Y, it was enough for many to conclude that

calls of a recession are premature because, after all, you can't enter a

recession when jobs are rising by over 500K.

True... but a problem

emerges for the second month in a row when looking at third-party data which

tracks the number of new employees laid off as well as new layoff events, both

of which have soared since May, yet which have unexpectedly not been

reflected in BLS data.”

In another important

non-sequitur to the strong jobs report, this week the U.S. Treasury said it

would increase its borrowing by $262 billion or 143% vs. expectations in

3Q-2022, in part due to a drop-off in U.S. tax receipts. The latest indications

suggest a drop-off in receipts and higher outlays, the officials said.

The Treasury’s debt

managers now expect to borrow $444 billion in the July-through-September

period, compared with the original estimate of $182 billion. The Treasury left

unchanged its cash-balance estimate for the end of September, at $650 billion.

One must ask what happened to the federal income taxes

from the 528,000 new jobs created in July?

ANSWER: Since 385,000 jobs were

really lost so tax receipts declined!

Current Fed Funds Rate of Change Defies History:

We suggest readers view the excellent commentary (with a

couple of great charts) shown by Mike Maloney in this video.

“Interest rates are something that should be set by the free market,” he says

(11:06 minutes into the video).

Here’s a chart of the Fed Funds Effective Rate from

1954 to 2022.

And a more alarming chart of the PERCENTAGE quarterly

change of the Fed Funds rate:

“We only one time exceed a 100% change… till now. In the last quarter it was + 525%. There has never been anything like this,”

Maloney said.

This begs the question of why has the Powell led Fed, just

increased the % RATE OF INCREASE IN FED FUNDS by 4.2 times the previous largest

increase in almost 70 years? Could it

have something to do with the November mid-term elections?

Victor’s Conclusions:

The U.S. is in deep decline in so many respects that there

are too many to list. (Please read my

previous opinions on this at fiendbear.com) The loss of power for the

Democrats will be massive if the November mid-term elections are honest?

If the people accept this form of Government, we are truly

serfs and slaves.

End Quote:

“Accepting fraud from our leaders means accepting fraud in

our personal lives.”

Be well, stay healthy, try to find diversions to uplift your

spirits. Wishing you peace of mind, and till next time………

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2022 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).