Analysis

of a Disappointing Jobs Report; Where Do Jobs Come From?

By Victor Sperandeo with the Curmudgeon

Jobs Numbers Disappoint with Forecasters Way Off:

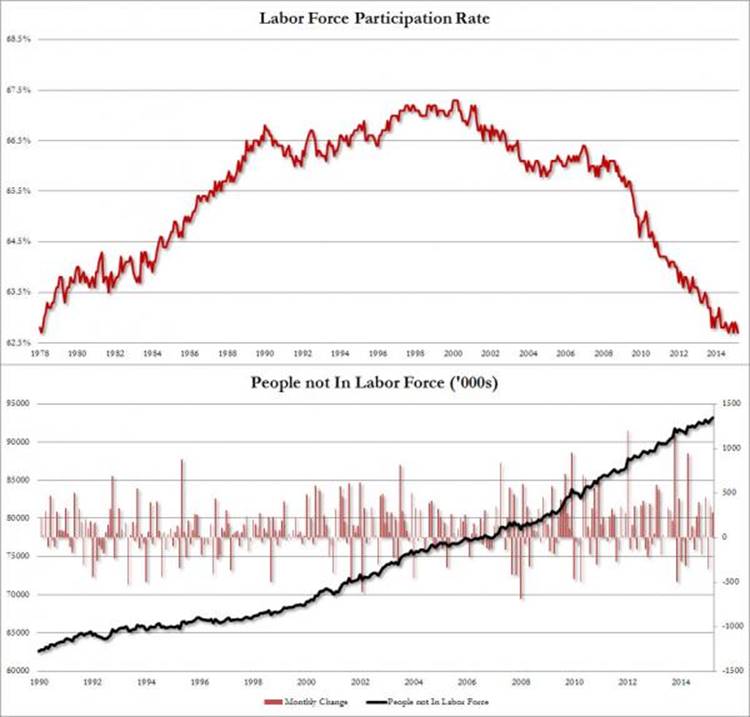

The March BLS non-farm payroll report came in at a reported +126,000 (=126K) jobs added with the unemployment rate unchanged at 5.5%. That's the weakest new jobs number in 15 months. The two previous months hiring gains were revised downward by 69,000 -- a 13% error. Worst of all, the labor-force participation rate ticked down in March to 67.8% -- its lowest level since 1978.

Curmudgeon Note: The most likely reason the jobless rate hasn't increased is that many people have dropped out of the work force and are not counted as "unemployed." ShadowStats John Williams wrote in his April 4th commentary (more below): "Counting All Discouraged Workers, March 2015 Unemployment Was 23.1%." Williams notes that to be included in the official definition of "unemployed,” an individual has to have looked for work actively within the four weeks prior to the unemployment survey. If the active search for work was in the last year, but not in the last four weeks, the individual is considered a "discouraged worker" by the BLS, and not counted in the official labor force, which decreases the headline unemployment rate.

..............................................................

The headline in the Dallas Morning News reads "Hiring lost sizzle in March - Dull economy, harsh winter may have cooled growth, experts say." Yes weather played a role in the weak economic numbers, but the key comment "dull economy" is the more interesting question.

The non-farm payroll estimates were above 235K to 240K. Why so high? Considering that every jobs forecaster already knew about the bad winter and early spring weather, why were they so wrong? Also, the downward revision for February from 295K to 239K was not foreseen by the high paid forecasters.

The Household Employment Survey had even more dreadful results. It showed only 34,000 more people employed than last month with only 130,000 more people employed YTD. That compares with 390,000 added jobs YTD in the Establishment Survey.

Also keep in mind that most of the new jobs created are second jobs or part time jobs (40 hour full-time jobs have been decreasing due to Obamacare, as we've noted in many prior Curmudgeon posts). In fact, the economy has disproportionately added lower-paying jobs in the retail and restaurant sectors since the economic recovery began in mid-2009.

Phantom Jobs Created by "New Companies" Which Don't Really Exist:

Even though we know that more companies are closing than opening, the BLS tells us that 72,000 of the 126,000 jobs created in March were from net new business hiring. That false assumption comes from the BLS "Birth-Death" model of net new businesses being created. This added mirage originated from the "good old days" of the early 1980's when net new businesses were really being created. Yet today, many more businesses are closing than being formed according to a Washington Post article: "More businesses are closing than starting. Can Congress help turn that around?" It's important to note that "Net New Business" creation is critical to U.S. growth, but it's not happening.

John Crudele of the NY Post questioned the accuracy of the March jobs report before it was released: "...there is an issue with rogue seasonal adjustments that have made job growth look stronger in recent months. To add to the confusion, Labor starts adding very optimistic guesstimates to its job totals in spring for companies it thinks — but can’t prove — are just coming into being." The latter refers to the above discredited "birth-death" model.

Expert Opinions on Accuracy of BLS Job Reports and

Where Jobs Come From:

1. In an April 4, 2015 commentary to ShadowStats subscribers, John Williams wrote: "Today's sharp deterioration in the headline labor reporting for March 2015 remained well shy of reality, well shy of properly reflecting the current, rapid downturn in broad U.S. economic activity. The weak reporting of March 2015 headline data was despite all the overstated, upside biases built into the current labor reporting process."

2. Jim Clifton, CEO of Gallup also recognizes something is awry. In a Feb 3, 2015 opinion piece "The Big Lie: 5.6% Unemployment," he states the way the BLS calculates the unemployment rate is "extremely misleading," if not specious.

Clifton writes: "There's no other way to say this. The official unemployment rate, which cruelly overlooks the suffering of the long-term and often permanently unemployed as well as the depressingly underemployed, amounts to a Big Lie."

"Currently, the U.S. is delivering full time jobs at the horrific low rate of 44%, which is the number of full-time jobs as a percent of the adult population 18 years and older. We need that to be 50% and a bare minimum of 10 million new, good jobs to replenish America's middle class."

3. In early October 2010, Robert J Samuelson (not to be confused with Paul Samuelson, the Nobel Prize winner in Economics) wrote an article in Newsweek titled "The Real Jobs Machine...Without Startups We're Sunk." It was a very accurate analysis and projection of a weak recovery and job growth in the U.S. This Samuelson graduated from Harvard University, wrote three books and is currently a columnist for the Washington Post. His main points were the following:

"Conventional

analysis blames today's poor performance on weak demand. Because people aren't

buying, businesses aren't hiring. Though true, this omits the

vital role of entrepreneurship...over longer periods almost all growth comes

from new businesses."

A similar article

appeared in the October 2, 2010 Washington Post titled: The

Real Jobs Machine: Entrepreneurs

4. A 1992-2005 study by John Haltiwanger of the University of Maryland, Ron Jarmin and Javier Miranda of the Census Bureau suggests that job creation is via new startups, as opposed to large established companies.

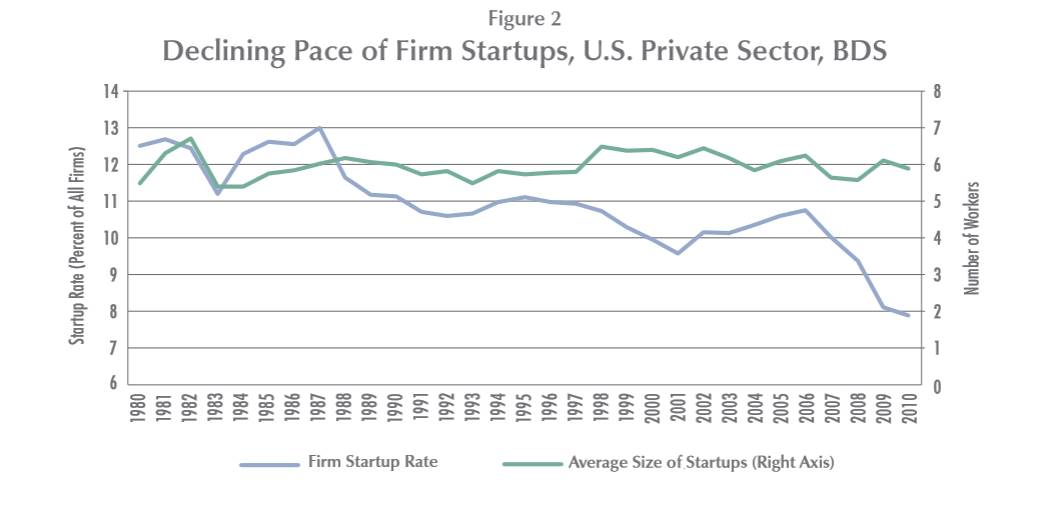

In a related 2012 Census Bureau report: Where Have All the Young Firms Gone? the same three authors note the declining job creation from business startups reflects a declining firm startup rate. The figure below shows that the startup rate of firms has declined from as high as 12 to 13% percent (as a percentage of all firms) in the 1980s to just 7 or 8% in 2012 (it's probably lower now). That doesn't augur well for job creation!

Jobs Come From Start-Ups; Not Listed Public Companies:

In an August 2011 paper titled: Who Creates Jobs? Small vs. Large vs. Young the same three authors state: "We find that firm births contribute substantially to both gross and net job creation. Importantly, because new firms tend to be small, the finding of a systematic inverse relationship between firm size and net growth rates in prior analyses is entirely attributable to most new firms being classified in small size classes."

"Our findings emphasize the critical role played by startups in U.S. employment growth dynamics. We document a rich “up or out” dynamic of young firms in the U.S. That is, conditional on survival, young firms grow more rapidly than their more mature counterparts."

There are 3,698 listed companies in the Wilshire 5000 stock index, as of 9/30/14. Vanguard's Total Stock Market (open end mutual fund) includes 3,798 companies. Existing public companies are much larger than private startups, but don't create as many new jobs. Even though many existing listed companies are expanding their work force, much of the hires are outside the U.S.

Curmudgeon Note: IBM is a great example. For years, they've been laying off U.S. workers while hiring in India, China and other developing countries where labor costs are lower.)

The key to creating startups as Robert J Samuelson says: "It's necessary to keep tax rates low and to stop government disincentives of complex accounting, employment and health-care regulations imposed by federal and state agencies that consume scarce investment funds and time."

"There's also a bureaucratic bias, unintended perhaps, against startups." Also and finally he says: "It's all about risk taking." Which is based on after tax reward for the time, energy and effort expended on the job.

The good news is American's have a powerful entrepreneurial instinct and spirit. The bad news is venture capital for startups is quite scarce (except in the lemming-bubble industries of the new IT: web/cloud software, e-commerce, social tools, mobile apps, big data/analytics, software defined everything, etc.).

Curmudgeon asks: Do you know of ANY U.S.

semiconductor, electronics module, circuit card or IT hardware equipment

companies funded by VCs in the last few years?

Our political leaders seem largely oblivious to burdensome government policies which discourage new business formation. This needs to be addressed for our economy to experience sustained growth.

Samuelson wrote: "Entrepreneurship won't instantly cure America's job deficit, but WITHOUT IT THERE WILL BE NO STRONG RECOVERY." (emphasis added) In my opinion, Robert J Samuelson gets an A+ for this observation and economic call in October 2010!

Companies Formed Then and Now:

Importantly, many companies founded in the 1970's and 80's could not be created today and thereby workers not hired. For example, Office Depot founders Berrnie Marcus and Ken Langone have stated they could never start Office Depot today due to not being able to entice "Angel Investors."

In major part that's due to the "Sarbanes Oxley Act" of 2002, which was passed after Enron's demise. What did the fraud of Enron and allowing investors to raise money for new business pre-Enron rules have to do with each other? Just more government control of companies and people for political reasons.

Are Small Businesses Good or Bad for Job Growth &

Wages?

The reality is that net new companies are declining, while the BLS falsely assumes they are increasing (using 1982 models that were then creating new businesses and massive new jobs). How is such "head in the sand" thinking possible for so many years? Look no further than the BLS Commissioner of Labor Statistics Erica L. Groshen, a former New York Federal Reserve Board employee. She is in charge of reporting the unemployment numbers among many other BLS releases.

Ms. Groshen is not fond of "small

business." She co-authored an

astonishing article for the Economic

Policy Institute think tank in 1998 titled: "SMALL

CONSOLATION:THE DUBIOUS BENEFITS of Small Business for Job Growth and Wages." (emphasis added).

The essence of the article is that small business' are not

worth bothering with as they pay less tax than large corporations. Here's one of her conclusions that is so

obvious it's irrelevant: "Average quarterly earnings are greater in large

than small firms." How could it

be any other way when there are many more employees at

large firms?

And a couple of cop-out conclusions:

· "The combined effect of these (small business job) creation and destruction forces reveals a much more distinct moving target of employment opportunity within the small business sector than in larger enterprises."

· "With respect to the bottom line issue of net job creation, this database reveals no apparent pattern with respect to business size class."

Perhaps this is why the government gives huge tax

breaks to big business and has higher tax rates for small business? It certainly looks that way in action under

Obama-who appointed Groshen.

The Fed is also a Culprit in Weak Job Creation:

The poor jobs picture has been heavily influenced by The Fed as well. Monetary policy has caused much of the problems of wage declines and slow wage growth, while the equity markets have boomed. Why?

As Henry Hazlit explains in the

popular book Economics

in One Lesson:

"The effect of keeping interest rates artificially low, in fact, is eventually the same as that of keeping any other price below the natural market. It increases demand and reduces supply. It increases the demand for capital and reduces the supply of "real" capital. It brings about a scarcity. It creates economic distortions. It is true, no doubt, that an artificial reduction in the interest rate encourages increased borrowing."

"It tends, in fact, to encourage HIGHLY SPECTULATIVE VENTURES (emphasis added) that cannot continue except under the artificial conditions that gave them birth. The money rate can, indeed, be kept artificially low only by continuous new injections of currency or bank credit in place of real savings."

His point is simply this: why start a new business, with all the problems associated with them, when you can simply buy stock in Apple, Facebook, LinkedIn and/or Google and get better returns and daily liquidity?

This economic "distortion" and financial bubble created by the Fed is done without fear of future consequences. Woody Allen might put Janet Yellen's Fed Policy in these words: "I have no idea what I am doing. But incompetence has never prevented me from plunging in with enthusiasm."

Sidebar: Ben

Bernanke 2012 quotes on Limits of Fed Monetary Policy and Labor Market

Stagnation:

1. In his July 18, 2012 Q&A after his House of Representatives testimony, Fed Chairman (at that time) Ben Bernanke said:

"Monetary policy cannot do much about long-run growth, all we can try to

do is to try to smooth out periods where the economy is depressed because of

lack of demand. Because of the financial crisis, the economy has been slow to

reach back to its potential and we are trying to provide additional support so

that the recovery can bring the economy back to its potential. But in the

medium and long term monetary policy cannot do anything to make the economy

healthier or growth faster, except to keep inflation low, which are committed

to doing."

2. At a speech

at the Kansas City Fed's August 31, 2012 Jackson Hole symposium, Ben Bernanke

said:

"The stagnation of the labor market in particular is a grave concern not only because of the enormous suffering and waste of human talent it entails, but also because persistently high levels of unemployment will wreak structural damage on our economy that could last for many years."

Curmudgeon's Assessment: It's almost three years

since the above quotes, yet the Fed continues its ultra-easy monetary policy

which has not boosted real economic growth (estimated to be ~1.3% in

1Q-2015). Meanwhile, the labor market

continues to stagnate with scant increases in good full time jobs and a 37 year

low in the labor force participation rate (see above chart). Isn't it time for something different from

the Fed (monetary policy) and the administration (fiscal policy)?

Preface of a book for Card Sharps with (Yellen's

Clarifications and Explanations):

Finally, all this meaningless double talk from the Fed boils down to a contrast of the brilliantly honest words of card cheat SD Erdnase who wrote a book titled The Expert at the Card Table in 1902. This book is for card sharps, mechanics, rounders, and/or cheats. In an attempt at light hearted humor, I added words shown in "(.......)" to the Preface to make it seem as if Janet Yellen were saying them, but telling the truth according to her.

· In offering this book (explanation of Fed policy to create jobs) to the public, the writer (Chairwoman Janet Yellen) uses no sophistry (like QE as printing paper money and ending "patience," but not being "impatient" to normalize rates?) as an excuse for its existence.

· The hypocritical cant of reformed gamblers, (investors, speculators, and traders) or whining, mealy-mouthed pretensions of piety, (this is good for the rich who hold large financial assets i.e. the top 5% of the U.S,) are not foisted as a justification for imparting the knowledge it contains.

· To all lovers of card games (playing the stock market) it should prove interesting, and as a basis of card entertainment (trading for fun like in Vegas) it is practically inexhaustible.

· It may caution the unwary who are innocent of guile, (caveat emptor when it all ends badly) and it may inspire the crafty (by always voting for Keynesians) by enlightenment on artifice (lying and deception of the highest order).

· It may demonstrate to the tyro that he cannot beat a man at his own game (HFT/Flash traders, insiders and Fed officials), and it may enable the skilled in deception to take a post-graduate course in the highest and most artistic branches of his vocation (Jeb Bush and Hillary Clinton please pay attention).

· But it will not make the innocent vicious, or transform the pastime player (investor) into a professional; or make the fool wise, (stocks are still cheap) or curtail the annual crop of suckers (money managers using other people's money).

· But whatever the result may be, if it sells (makes you buy stocks) it will accomplish the primary motive of the author (Fed Chairwoman Yellen) as he (in this case she) needs the money (to make the wealthy more rich, in order to spend their money via the trickle-down theory, which hasn't worked in the last six years.)

Upshot: Until new data on wages, labor participation and full-time hiring improve significantly, the Fed will be reluctant to raise interest rates, despite Yellen's rhetoric and double talk. So go ahead and play your hand at the card table…Good luck!

Till next time...

The Curmudgeon

ajwdct@sbumail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2014 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing

article(s) written by The Curmudgeon and Victor Sperandeo without providing the

URL of the original posted article(s).