The Fed is Managing the Inflation Narrative Versus

Actually Managing Inflation

By Victor

Sperandeo with the Curmudgeon

Introduction:

We cover a lot of ground this week with informative comments and opinions, many

of which challenge U.S. government propaganda.

Please let us know what you think of our work.

Assessment of Fed Rate Increases:

The Fed did what was expected by raising rates 75 bps

on Wednesday. Importantly, they changed

their forward guidance (AKA talking down the markets with threats of

rate hikes) for additional Fed rate increases to being data dependent.

There are six weeks before the next Fed meeting

(which is very close to the November mid-term elections). As I stated in a recent

Curmudgeon post, the Fed will not increase rates at the September

meeting, as the economy will continue to deteriorate.

.

Mea Culpa:

Let me confess, I did not believe the Fed would do

more than two rate increases this year (they did four to date). My assumption was they would not want to

cause a recession, especially with President Bidens poor approval ratings. I never expected Fed Chairman Jerome Powell

to change from a dove to a hawk with respect to raising rates.

.

The July CPI, scheduled for August 10th release

should be lower, which many economists will then say that inflation has

peaked. That will provide more

justification for the Fed to NOT raise rates in September.

U.S. Stock Market Comments:

As I wrote in last

weeks Curmudgeon column, the equity market rally is worth playing,

but I dont know if its the start of a new Bull Market or a Bear Market

counter trend bounce?

Moreover, I assume the mid- June lows are in for the

year. Hopefully, the rally will be slow and steady. If it gets overheated, the Fed will likely

say something to stop it. Heres a

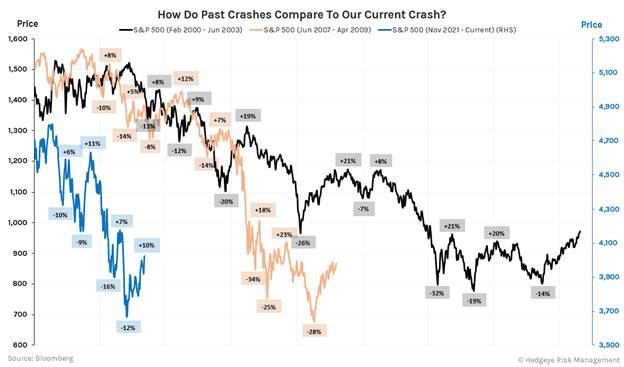

chart which depicts the current Bear Market vs the two others in the 21st

century:

Chart Courtesy of Hedgeye

BofAs Market View:

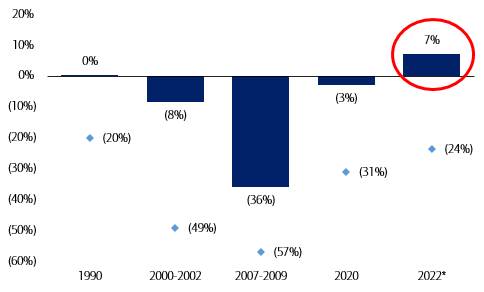

During the last five recessions, the S&P 500

bottomed after estimates were revised down, except in 1990 when forward EPS

remained flat. Earnings estimate cuts are just starting now and even with those

modest cuts, 2022 forward EPS is still up 7% since the market peak.

Market bottoms during prior recessions have typically

occurred after earnings estimate cuts.

The graph

below shows S&P 500 peak-to-trough price declines and forward EPS revisions

at market bottoms:

Source: BofA Global Research

Our bull market signposts also indicate its premature

to call a stock market bottom: Historical market bottoms were accompanied

by over 80% of these indicators being triggered vs. just 30% currently.

Moreover, bear markets always ended after the Fed cut, which likely is at least

six months away (BofA house view: first cut in 3Q23).

..

U.S. Recession or Not?

The U.S. is officially in a recession now (two

consecutive quarters of negative real GDP).

Further rate increases could possibly cause a depression? Therefore, the

markets are likely to be free from future Fed rate hikes this year due to a

weak economy, the election, and the Christmas holiday season.

I believe the ongoing recession will hurt the

Democratic Party badly. The loss of

power (i.e. seats in House and Senate) will last for a

decade.

The ongoing recession debate is absurd! The Fed and Biden

administration are denying that the U.S. is currently in a recession. Despite

two consecutive quarters of declining GDP growth, National Economic Council

Director Brian Deese said Thursday, "virtually nothing signals this period

in the second quarter is recessionary."

This is the same guy who last year told staffers to

create talking points about inflation being transitory.

The NBER defined a recession as two down

quarters of GDP in the 1970s. The

definition was changed so that a recession is marked by a significant decline

in economic activity that is spread across the economy and lasts more than a

few months. Well, that guidance was

not followed for the 2020 recession, which the NBER said was only one month!

Some say the U.S. cant be in a recession with such

strong employment numbers. We disagree!

The so called strong employment data is bogus as weve pointed out in several

previous Curmudgeon posts. The Seasonally

Adjusted payroll numbers are 40% above the Non-Seasonally Adjusted

numbers, largely due to the estimated Birth Death Model (BDM) statistics for

the first six months of 2022!

Also, the employment data is a lagging economic

indicator. On the other hand, the Index of Leading Economic Indicators

(LEI) is intended to predict future economic activity. The LEI

decreased by 0.8% in June 2022 to 117.1 (2016=100), after declining by 0.6%

in May. The LEI was down by 1.8% over the first half of 2022, a sharp reversal

from its 3.3% growth over the second half of 2021.

To sum up, the discrepancy between what the public

sees versus how policymakers see the U.S. economy could not be more stark.

U.S. Propaganda is Off the Wall!

The dichotomy between economic reality and the U.S.

governments rosy talking points is an example of propaganda in politics. Its somewhat due to a change in U.S.

propaganda law: The Smith

Mundt Modernization Act

- introduced in May 2012 and passed by Congress in 2013. That law:

Amends the United States Information and

Educational Exchange Act of 1948 to authorize the Secretary of State

and the Broadcasting Board of Governors to provide for the preparation

and dissemination of information intended for foreign audiences abroad

about the United States, including about its people, its history, and the

federal government's policies, through press, publications, radio, motion

pictures, the Internet, and other information media, including social media,

and through information centers and instructors. (Under current law such

authority is restricted to information disseminated abroad, with a limited

domestic exception.)

In effect, that law has allowed the U.S. government

to use propaganda (lie, mislead, make-up, distort, deceive, fabricate, and

falsify any information it wants) without legal liability. (See cartoon below)

This 1948 law used to apply to foreign countries

only, but the 2013 Smith Mundt Modernization Act broadened the

dissemination of information to also include a U.S. audience.

Its sort of like the 4th Amendment disallowed

spying on U.S. citizens by the CIA until the October 2001 Patriot Act

allowed spying on U.S. citizens ever since then.

Opinion - Inflation Reduction Act:

The new tax and spend proposal by the Democrats

called The Inflation Reduction Act (love these catchy, marketing

titles!), if passed, would be a head shot to the U.S. economy. The Dems say in their summary:

The Inflation Reduction Act of 2022 will make a

historic down payment on deficit reduction to fight inflation, invest in

domestic energy production and manufacturing, and reduce carbon emissions by

roughly 40 percent by 2030.

Not mentioned much by the Dems is that this act

includes a significant tax increase for U.S. corporations at a minimum

of 15% for companies earning $1B or more. It also eliminates a great deal of

the 2017 GOP tax cuts, which will hit hard during the ongoing recession!

.

Raising Taxes During a Recession:

The last major U.S. increase in taxes during a

recession was 1931 (the worst year for equities in U.S. history). Herbert

Hoover gets my award for the dumbest President in U.S. history! He proposed

raising marginal tax rates from 25% to 63% (+152%) in 1931 (it passed in 1932).

The excuse was to lower the U.S. budget deficit!

The deficits began in 1931 and never had a year of

surplus till 1947, according to the Office of Management and Budget.

Global Recession and Central Bank Responses:

The European Union (EU) is in a recession or

guaranteed to be in one due to their climate change agenda and sanctions on

Russian gas and oil.

The UK and Japan are also heading towards

recession, while Chinas economic growth is slowing precipitously from pandemic

induced lockdowns.

Global central banks are committing economic suicide

by raising rates while the global economy is weakening. Do they know something

we dont?

Central banks fix the price of interest rates, that

effects all other prices. The also control the money supply, which creates

inflation when it grows more rapidly than GDP. Thats been the case at least since March

2020 when the coronavirus pandemic started.

Importantly, theyve been monetizing debt via various bond buying

programs.

Now, those same central banks are trying to overcompensate

by raising rates too quickly and by large amounts while the global economy is

slowing. Both the World Bank and IMF recently reduced their global

growth forecasts for 2022 and 2023.

The IMF said the worlds economic outlook is gloomy and more

uncertain.

Main Street is Struggling!

Heres are a few signs of the stress currently on

American households:

·

The Conference Boards

Consumer Confidence Index has decreased for three consecutive months.

The Index now stands at 95.7 (1985=100), down 2.7 points from 98.4 in June.

·

The Present Situation

Indexbased on consumers assessment of current business and labor market

conditionsfell to 141.3 from 147.2 last month.

·

The Expectations Indexbased

on consumers short-term outlook for income, business, and labor market

conditionsticked down to 65.3 from 65.8.

·

Real average hourly

earnings for all employees on private nonfarm payrolls

decreased 3.6% from June 2021 to June 2022. The change in real average hourly

earnings combined with a decrease of 0.95 in the average workweek resulted in a

4.4% decrease in real average weekly earnings over this period.

·

Inflation [1.] (CPI and PPI) is at 40-year highs.

·

Consumers are plugging the

gap in consumption capacity by increased borrowing (consumer credit

recently hit all-time highs).

Note 1. Since Nixon took the U.S. off the

international Gold Standard in August 1971, the official CPI annual

increase has been +3.97%. That means

prices double every 18.1 years. In a typical working lifetime (from age 20 to

65), prices will double 2.4 times.

Conclusions:

The Feds monetary policy directly effects both Wall

Street and Main Street. It is an example of central planning, which is a

critical aspect of socialism. It

has never worked in all of history. The reason it keeps being used is for

political power! What is the bottom line of this form of power?

America was built on Liberty and Justice for all but has now become a new type of Totalitarian State.

End Quotes:

If you destroy a free market, you create a black

market. If you make 10,000 regulations, you destroy all respect for the law.

Winston Churchill

No country has ever gotten rich or remained rich

without the rule of law. Allan

H. Meltzer

Be well, stay healthy, try to find diversions to

uplift your spirits. Wishing you peace of mind, and till next time

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2022 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).