BofA

Recession Call, Market Update, Gold’s Favorable Seasonality

By Victor

Sperandeo with the Curmudgeon

Introduction:

Today’s column is shorter than

usual because the Curmudgeon is leading an Abrahamic

Alliance volunteer project at the Salvation Army to benefit homeless

and poor people.

We’ll be back in full force

next week. Please let us know what you think of our work (email the Curmudgeon

at ajwdct@gmail.com).

BofA Global Research on

Recession, the Fed and Inflation:

BofA Global Research’s new US

economist, Michael Gapen, is now forecasting a mild recession this year.

A number of forces have coincided to slow economic

momentum and the economy appears to have a weaker trajectory, particularly in

services.

BofA sees a combination of

lagged effects from tighter financial conditions, a persistent inflation tax on

household spending, and acknowledgement by the Fed that labor markets need to

soften to restore price stability, tipping the balance of risks toward

recession later this year.

With a sharper slowdown and

higher unemployment, BofA expects inflation to moderate faster than before.

Our forecast puts inflation broadly in line with the Fed's 2% mandate by the

end of 2024. While 100bps is possible, we think the Fed will opt for a 75bp

increase with an additional 50bp in September, with the Fed funds rate ending

the year at 3.25-3.5%. As inflation pressures moderate, we expect the Fed to

begin cutting rates in the second half of next year.

Victor’s Comments:

The BLS reported this week

that the June Consumer Price Index (CPI) was at a hotter than expected

9.1% Year over Year (YoY) increase (not seasonally adjusted) and a 1.3% monthly

increase (seasonally adjusted).

The June Producer Price

Index (PPI) for final demand was also higher than forecast. It increased 1.1% percent in June. Prices for

final demand goods rose 2.4% while the index for final demand services advanced

0.4%. Final demand prices moved up 11.3% for the 12 months ended in June.

With that hotter than expected

inflation news, one would’ve expected commodities and gold prices to rise. However, they are both in significant

downtrends.

- Commodities topped on June 9th - the day

before the previous May CPI release date.

They are since down 17.1% using the CRB Commodity Core Index.

- West Texas Crude Oil (August futures) peaked/closed on

June 8th at $119.78 and closed on July 13th at $96.30 - down

19.6%.

- Gold has performed horribly in 2022, in sharp

contrast to its historical correlation with rising inflation as noted in last

week’s column. Spot

Gold peaked/closed at $2043.83 on March 8th and closed at

$1707.27 on July 15th for a loss of $336.56 or 16.5%.

- The yield curve inverted (2yr T-note

yields higher than 10 yr. T-note yield) on July 6th and has accelerated

the spread from +4 bps to +20 bps on Friday. That’s a clear sign a recession is

imminent.

- The Atlanta Fed’s latest projection of second

quarter GDP is -1.5%,

indicating a “technical recession” (two consecutive quarters of

negative real GDP growth).

Considering weak commodities,

lost wealth from multiple bear markets, and a “technical recession,” I

believe the CPI has peaked for now. In particular, oil

and gas prices have come down quite a bit in July after rising sharply in June.

Meanwhile, On July 27th the Fed

will increase the Fed Funds rate by 75 or 100 bps. That will be it till the

next FOMC meeting on September 20-21st.

In my view, the Fed’s July rate hike will be the last action till after

the November elections.

The 30-year T-Bond and

S&P 500 made their lows on June 13th and 14th,

respectively. I believe the financial markets will rally from here as

the economic news gets worse and it becomes apparent that the Fed must stop

raising rates. Gold should also

rally after the 2nd quarter GDP Advanced Estimate is released on

July 28th.

Whether the June lows for

stocks and bonds were long term or intermediate term bottoms remains to be

seen. It’s all based on what the Fed

does with respect to rate increases and Quantitative Tightening (which

is expected to increase in September unless the Fed pivots).

Sentiment Trader

- Gold is entering a seasonally positive period:

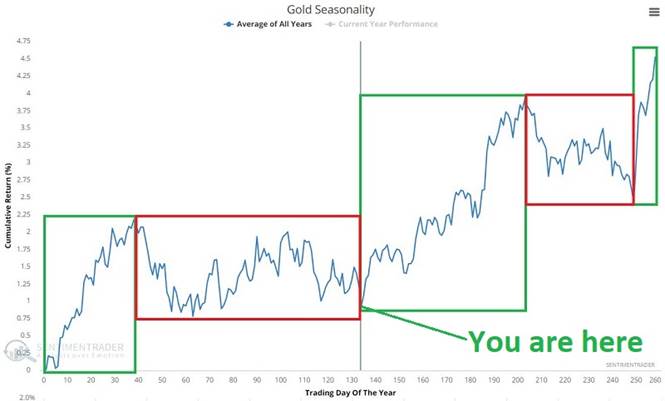

There are two periods during

the calendar year that tend to favor gold. Jay noted that one occurs between

mid-summer and early fall; the other happens near year-end into the new year.

The remaining time of year has seen gold register a net loss in value.

The chart below displays the annual

seasonal trend for gold futures. The green boxes highlight the seasonally

favorable periods, while the red boxes highlight the seasonally unfavorable

ones.

Chart

courtesy of Sentiment Trader

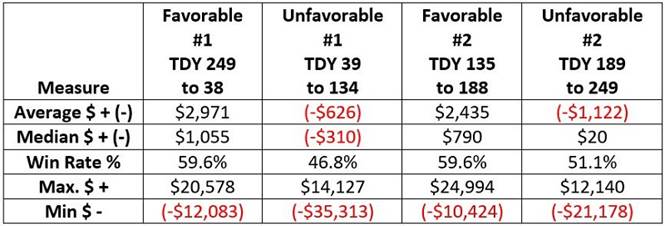

The table below summarizes

gold’s performance during each favorable and unfavorable period.

Table

courtesy of Sentiment Trader

Curmudgeon Comment:

Despite

favorable seasonality, we believe Gold’s price will be largely dictated by the

U.S. dollar index (the DXY is +12.52% YTD and +16.5% YoY). And the DXY will be determined by the

“perception” of real interest rate differentials in the U.S. vs the Eurozone

(the Euro accounts for 58% of the DXY).

If the

Fed raises rates less than expected and/or defers QT, expect Gold to

rally. If not, don’t expect much from

Gold.

End Quote:

This quote from “When Money

Dies: The Nightmare of Deficit Spending, Devaluation, and Hyperinflation in

Weimar Germany,” Adam Fergusson is worth pondering at

this time.

“Undoubtedly, though,

inflation aggravated every evil, ruined every chance of national revival or

individual success, and eventually produced precisely

the conditions in which extremists of Right and Left could raise the mob

against the State, set class against class, race against race, family against

family, husband against wife, trade against trade, town against country.

It undermined national

resolution when simple want or need might have bolstered it. Partly because of

its unfairly discriminatory nature, it brought out the worst in everybody —

industrialist and worker, farmer and peasant, banker and shopkeeper, politician

and civil servant, housewife, soldier, merchant, tradesman, miner, moneylender,

pensioner, doctor, trade union leader, student, tourist -especially the

tourist. It caused fear and insecurity among those who had already known too

much of both.

It fostered xenophobia. It

promoted contempt for government and the subversion of law and order. It

corrupted even where corruption had been unknown, and too often where it should

have been impossible. It was the worst possible prelude — although detached

from it by several years — to the great depression; and thus, to what

followed.”

……………………………………………………………………………………………………

Be well, stay healthy, try to

find diversions to uplift your spirits (Curmudgeon goes to live concerts and

does volunteer work), wishing you peace of mind, and till next time………

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2022 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).