Would Be Philosopher King Topples Markets;

What’s Next?

By Victor

Sperandeo with the Curmudgeon

Introduction:

Plato was first to use the

concept of a “Philosopher King” (around 375 BC) as a hypothetical ruler

with political skill combined with philosophical knowledge. He argued that Philosopher Kings should be

rulers of a city – state.

From the Middle Ages onwards, Islamic and Jewish authors

expanded on the theory, adapting it to suit their own conceptions of the

perfect ruler.

Plato’s Kallipolis is a

beautiful city where justice prevails. It is a just city where political rule

depends on knowledge, which philosopher kings possess, and not power.

A philosopher is a “lover of wisdom” from the Greek thinker Pythagoras.

That’s the exact opposite of Fed Chairman Jerome Powell as we’ve

discussed many times, most recently in last week’s post: Welcome

to the Greatest Show on Earth – Presented by Jerome Powell.

Let’s review what this would be Philosopher King (the Fed)

has done to the markets, the costs of “demand destruction” and what’s likely to

happen just before the November 8th U.S. mid-term elections.

Review of Market Tops and Subsequent Declines:

In the last two weeks, beginning on June 9th, the

Fed’s rate rising rhetoric managed to (temporarily) end the uptrend in commodities

- the latest market to succumb to the force of the Fed’s recent “making you

poorer” monetary policy.

This will of course make these “quasi-Kings” happy as

finally they are making the prices of things people buy begin to decline. The

money supply growth has also started to decrease. Big spending bills (like the

Dem’s “Build Back Better”) have not become law, and so don’t have to be

monetized by the Fed buying newly issued U.S. government debt to finance such

programs.

Here is the general sequence of markets that have topped,

beginning in late 2021, when Powell finally admitted inflation was not

“transitory” and started to “talk the talk” of larger than expected Fed

interest rate hikes:

- Bloomberg

Corporate Bond Index (AGG) in August 2021;

- Bitcoin, NDX 100,

Midcap stocks, Dow Jones Transports and Russell 2000 in November 2021;

- 20-year U.S. bond

index ETF (TLT) in December 2021;

- S&P 500, Dow

Jones Industrials, OEX (the S&P 100) in January 2022;

- Gold, Copper and

Livestock in March 2022;

- Lumber, Dow Jones

Utilities in April 2022;

- Crude Oil on June

8th;

- CRB Commodity

Index on June 9th (the day before the May CPI report was

released).

Copper in a Bear Market:

Let’s zero-in on Dr. Copper -used in everything from

electrical contracting and electronics to construction and is therefore a

leading indicator of the health of the global economy. Copper’s selloff accelerated last week:

·

The New York Mercantile

Exchange (NYMEX) continuous futures contract closed Friday at $3.74 per pound -

the lowest level in 16 months! [Compare

that with its March high of $5.03]

·

The benchmark London Metal

Exchange copper price has now fallen 24% from its peak above $10,700 a ton in

May 2021 to trade Friday at $8,255 a ton.

·

The industrial metal’s three

month and one-year returns are -20.28% and -13.44% respectively.

Copper is now in a bear

market, which has happened before each recession in the last 30 years. That’s yet another indication that an

economic downturn may be underway.

Here’s a three-month chart of Copper Futures:

The Cost of Demand Destruction:

“If demand can move back down, then inflation could

move to back along that path just as quickly as it went up,” Powell told the

Senate Banking Committee Wednesday during his semi-annual testimony before

Congress.

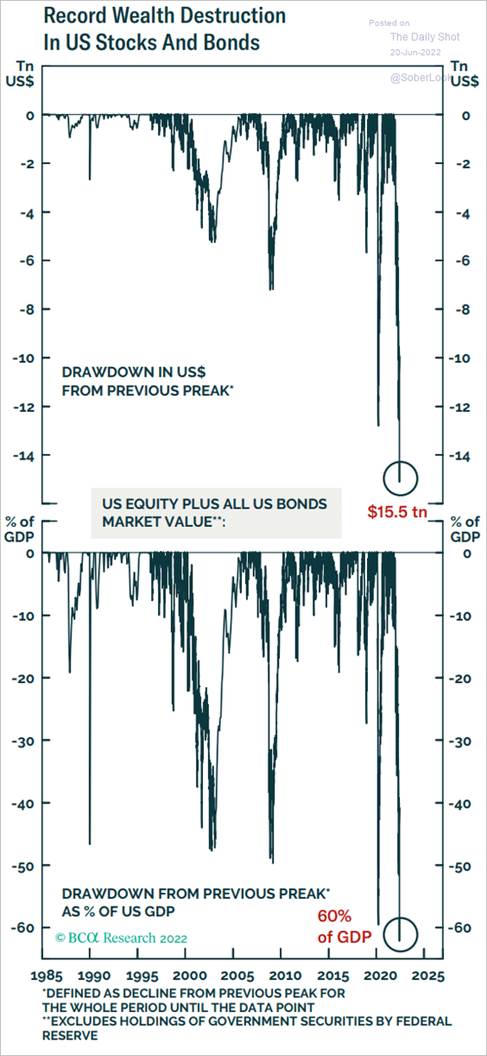

Of course, the stated goal of The Fed was to curtail

inflation, but they never considered the COST of “Demand Destruction.” It’s

$15.5 trillion or 60% of U.S. GDP!

Consider this chart from BCA Research via the Daily

Shot:

Putting Out Fires or Adding Fuel to the Fire?

Cartoon Courtesy of Hedgeye

……………………………………………………………………………………………..

Victor’s Conclusions:

A commodity and financial futures index (without equities)

that I created in 2004, named “the diversified trends index” or DTI by

Standard & Poor’s is an intermediate trend following long/short index. I met with the Curmudgeon in November 2005 in

San Francisco, CA to discuss it and he subsequently bought a DTI based Rydex

mutual fund and Wisdom Tree ETF for himself and his RIA managed account

clients.

The DTI is now short everything except the U.S. dollar

and the oil complex. That’s a telling sign trends have changed to BEARISH for

almost all markets.

As we’ve previously stated in past Curmudgeon posts, we

believe the Fed’s “reverse wealth effect” has pushed the

U.S. and Europe into a recession (unofficially). While hard to believe, I think the CPI will

decline to a 4-to-5% level by election day - November 8th. However, the November CPI won’t be reported

by the BLS till December).

I believe the Fed will flip (announce it has ended rate

increases) before the election to give the Democratic Party a chance to stop a

Red Tsunami wave -as polls say will occur.

Note that President Biden’s average approval rating and consumer

confidence are both at all time new lows, which does

not augur well for the Dems in the mid-term elections.

However, if the Fed continues with its stated goal on

interest rate increases this will turn out to be the worst recession in

history.

Curmudgeon End Note:

We suggest you follow the CME Fed Funds Tool which currently

forecasts an 83.8% probability of a 75 bps Fed Funds rate hike at the July FOMC

meeting.

End Quote:

“We’re opening up a Pandora’s box.

Be careful what you wish for.” – James

Waters

…………………………………………………………………………………

Be well, stay healthy, try to find diversions to

uplift your spirits, wishing you peace of mind, and till next time………

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2022 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).