Welcome

to the Greatest Show on Earth Presented by Jerome Powell

By Victor

Sperandeo with the Curmudgeon

Introduction:

The Fed attempts to explain and sell the public on what it

makes them believe is good for the economy and Americans. However, they are

really conning you into an agenda which they hope will appease their

undisclosed owners (the richest 1% of Americans) and masters (the US

politicians they must answer to)!

We ask a rhetorical question about the cause(s) of US

inflation. Do you trust the Fed is our

next topic (three guesses but the first two dont count). Next, we examine if the US will be in a recession

this year or is already in one. We then

suggest what the famous School of Chicago economist Milton Friedman would

do. Key observations from Sentiment Trader

follow (we recommend you subscribe to this excellent service). Our conclusions are from former US Treasury

Secretary and Harvard President Larry Summers.

-->Please let us know if you like our work and any future

topics youd like us to cover [email the Curmudgeon at ajwdct@gmail.com].

What Caused US. Inflation?

The answer is simple: Inflation was caused by a compounded

15% increase in the broad money supply (M2) [1.] from 2019 till this

year. Not the Russia-Ukraine war which

just added fuel to the fire (more below).

And certainly not the COVID pandemic which caused lower prices and

reduced economic activity due to shutdowns of many small and medium businesses.

Note 1. M2 is a measure of the US money stock

that includes M1 (currency and coins held by the non-bank public, checkable

deposits, and travelers' checks) plus savings deposits (including money market

deposit accounts), small time deposits under $100,000, and shares in retail

money market mutual funds.

...

The Feds response to the pandemic induced shutdowns was to

launch a series of buy everything expanded QE programs which ballooned its

balance sheet to $9 trillion and greatly increased the money supply. That is what caused all asset bubbles and

rising prices, respectively.

Energy price increases were mostly due to the sanctions on

Russia which caused a rise in crude oil prices from $91 dollars a barrel on

February 24th to the current $110 per barrel. If the punishment of Russia for its attack on

Ukraine had a different penalty oil prices would surely be much lower.

The increase of Russian assets does not prohibit them from

borrowing based on the increase in oil reserve values. They dont even have to sell the oil.

On February 23rd the ruble was 0.012 to the dollar

and today it is 0.017 thats a 42% increase in just four months! Thats

almost entirely due to the oil and gas price increases which boosted Russias

trade surplus with the rest of the world.

Do You Trust the Fed?

If you examine Fed Chairman Powells June 15th statement

(which we analyzed in yesterdays post), Overall economic activity appears to have picked up after edging

down in the first quarter, one must conclude he

is a fool, grossly incompetent, or a liar.

You might as well listen to TOYKO ROSE World War II propaganda then

statements of the Fed, which give them an excuse to raise interest rates in

order to reduce inflation.

The Fed press conference Q&A is like a circus show

which is intended to make the public believe the Fed is doing something

useful.

Is that Jerome Powell or Joe Biden below who has fallen off

his bicycle? It really doesnt matter!

Cartoon Credit: Tom Stiglich - Monday, June 20, 2022:

In reality, the Feds new rate rising strategy and rhetoric

is killing the economy and crashing financial markets. That makes people poorer, so they curtail

spending which will decrease or eliminate price rises due to reduced demand. In

essence, that is the reverse wealth effect scenario. Unemployment will also rise as the economy

weakens.

Increases in interest rates work with a six months (or

longer) lag to the real economy. That coupled with continued supply chain

bottlenecks/ shortages and the war in Ukraine imply that inflation will not be

coming down anytime soon, despite recent and future Fed rate hikes this year.

Heres an analogy:

If you gained 100 pounds in the last year and in order to lose weight

quickly cut off both your legs you would weigh 60 pounds less. Would you consider that a success?

Is the US in a Recession?

As noted in yesterdays

post, the US is going to be in be in a recession or is

already in one due to last Wednesdays 75 bps increase in Fed Funds rate and

the strong forecast of that same rate increase at the July FOMC meeting. Its

important to realize that the Fed rate increases were based on a CPI that was

up 8.58% Year over Year (YoY) ending in May, compared to an end of March YoY

increase of 8.54% (thats only a +.04% difference!).

As weve repeatedly stated, the CPI is a 100%

subjective index which is calculated by BLS bureaucrats using substitution and

hocus pocus magic to make up what they think actual prices are.

The reverse wealth effect weve been talking about

this year has now been picked up by the mainstream media (e.g., this weeks Barrons)

as the likely cause of a US Recession.

Desmond Lachman, an economist and fellow at the American Enterprise

Institute agrees with us. He

wrote in a June 16th CNN article:

One reason to think

that the Fed's shift to a more hawkish policy stance could bring on a recession

is that it has already caused the asset and credit market bubbles it created

last year to burst. Since the start of the year, equity prices have fallen by nearly

25%, bond prices have declined by about 11% and the cryptocurrency market is

crashing, with Bitcoin losing a quarter of its value since Friday and Ethereum losing

about a third of its value.

The stock market rout

has caused around $10tn in US household wealth to evaporate. In addition, at

least $3tn in bond and $2tn in crypto-currency wealth has been wiped out by the

rout in those markets... On the assumption used by the Federal

Reserve that a $1 sustained destruction in wealth leads to a 4-cent decline in

consumption, if sustained, the recent loss in wealth could reduce

consumer spending by almost 3 percentage points of GDP.

Also, housing demand

is starting to crumble as mortgage rates climb again. Meanwhile, many

emerging markets are on the cusp of default, as higher US interest rates

cause capital to be repatriated out of their economies, which is putting real

pressure on their currencies.

Powell might do well to

heed his own advice of needing to be humble and nimble, especially given

today's highly fragile financial markets. If not, he risks going down in

history as not only the one who let the inflation genie out of the bottle, but

also as the one who steered the US economy into a recession.

What Would Milton Friedman Do?

He would set the money supply growth at 5% on a systematic

basis for three years and let the markets determine interest rates. If the US

government wants to borrow what it spends and is less than the taxes it

collects, interest will rise. If it has small deficits interest rates will

fall. Price increases will be based on GDP growth less what prices increase

which is approximately 1.5-to-2.5% over the compounded growth rate in three

years.

The Fed is composed of a group of men and women who think

they can set the price of the cost of credit and control the money supply for

340 million Americans. It cant be done!

That is why Friedman said that ideally, he would prefer to

"abolish the Federal Reserve and replace it with a computer." He preferred a system that would increase the

money supply at some fixed rate, and he thought that "leaving monetary and

banking arrangements to the market would have produced a more satisfactory

outcome than was actually achieved through government involvement.

.

Observations from Sentiment Trader:

·

Stocks suffered a historic

bout of selling pressure this past week. Curmudgeon: Thats 100% due to the

Feds abrupt change in rate hike policy (e.g., Powell said 75 bps was off the

table in May, but rates were raised by that amount last Wednesday at the June

FOMC meeting. Fed Funds are forecast to

be raised by that same amount (75 bps) at the July FOMC meeting.

·

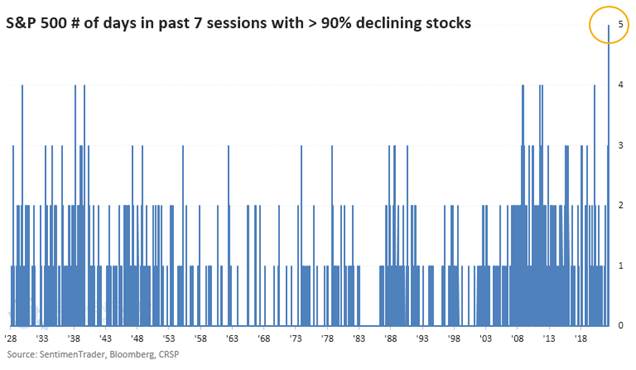

It got even worse, and over a

7-day stretch, the S&P's internal damage was the worst-ever. Please see chart below.

·

The selling pushed almost all

stocks into short-, medium-, and long-term downtrends.

·

More than 90% of tech stocks

have fallen into bear markets.

·

High-yield bonds saw some of

their worst selling in 17 years.

·

Much of this can be blamed on

the Fed and "three steps and a stumble"

·

Inflation may get a reprieve

if some commodities follow through on seasonal trends.

The table below shows the S&P 500 risk/reward skew over

the next week to the next year.

Source: Sentiment

Trader

...

Conclusions from Larry Summers:

The Curmudgeon and Victor are NOT the only Fed bashers! Among them is Larry Summers,

a Harvard University professor, and former US Treasury Secretary. He has criticized the Fed for failing

to account for its mistakes and to realize the damage to its credibility after

the June inflation report led the Fed to believe that larger rate hikes were

needed (we disagree).

Summers said the US jobless rate would need to rise above 5%

for a sustained period to curb inflation thats running at the hottest pace in

41 years.

We need five years of unemployment above 5% to contain

inflation in other words, we need two years of 7.5% unemployment or five

years of 6% unemployment or one year of 10% unemployment, said Summers said in

a speech in London Monday. These are numbers that are remarkably discouraging

relative to the Fed Reserve view.

He said the central bank should move away from providing

communication to the public about the likely future course of monetary

policy. The return to humility, the

abandonment of forward guidance as a policy tool is entirely appropriate,

Summers said.

End Quote:

What the Fed practices is Socialism. They are the monopolists who control the cost

of everything.

HL Mencken [2.] defined a

Socialist as: A man suffering from an overwhelming conviction to

believe what is not true.

Note 2. H. L. Mencken was a 20th century journalist

and satirist famous for his literary and political commentary. The Baltimore

author and editor was well known and respected from the 1920s to the late

1940s.

..

Be well,

stay healthy, try to find diversions to uplift your spirits, wishing you peace

of mind, and till next time

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2022 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).