“The

Lord Giveth and the Lord Taketh Away”

By Victor Sperandeo with

the Curmudgeon

Source: The Title phrase of this article has its origins in Job

1:21 of the King James Version of the Bible.

Introduction:

For the purposes of this article, the “Lord”

is the head of U.S. financial markets, which of course is the Fed! They poured “money created out of thin air”

into the markets after the coronavirus lockdowns in late March 2020, buying

corporate debt and junk bond ETFs with reckless abandon and initiating another

huge round of Quantitative Easing (QE).

In addition, the U.S. federal government gave the

public stimulus checks (i.e., free money), which was financed by yet another

round of Fed QE. The consequences of

that “free money party” is now clearly reflected in rising prices of goods and

services (aka “inflation”).

Being late to recognize and combat accelerating

inflation in 2021, the Fed is now trying to play catch-up by talk that is

lowering the value of all assets as a way to lower inflation (please see “Goldfinger

Killing Mr. Bond” closing quote in a recent

Curmudgeon column).

Discussion – Fed Targeting the Markets:

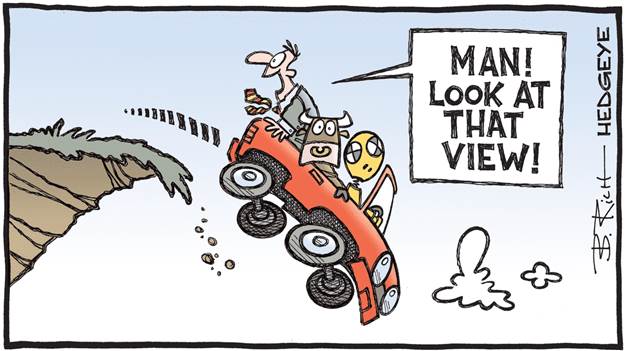

The Fed is slowly, but surely, causing a rolling

crash of the equities market in a waterfall of red ink rhetoric every time the

market shows any signs of rally. The Dow Jones Industrials have declined every

week beginning March 25, 2022. That’s

eight weeks in a row, the highest number of consecutive weekly declines since

1923 (which started as a recession in May 1923 to July 1924).

On May 17th, Fed Chairman Jerome Powell spoke late in

the afternoon at “The Wall Street Journal’s Future of Everything Festival.” At that time the S&P 500 was closing up over 2.0%.

Powell’s message was loud and clear: “the Fed will do whatever it takes

to bring inflation down.” (Here he really means the markets!)

"We know that this is a time for us to be

tightly focused on the time ahead and getting inflation back down to 2%,"

Powell said. "No one should doubt our resolve in doing that... What we

need to see is inflation coming down in a clear and convincing way." And

to get there, interest rates will have to rise further, even if that means

going beyond the level that is understood as "neutral," commonly

thought to be around 2.5%.”

To do this, Fed Chair Powell has targeted the

markets, not the money supply, or interest rate increases. Here’s the proof:

The next day, the DJI declined -3.57%, S&P 500

declined -4.04%, and the NDX 100 declined -5.06%!

The essence of my critique of the Fed is that it’s

trying to talk the markets down using THREATS THAT WILL NOT OCCUR to address

“inflation” (which to Powell means “CPI Price Increases”). Such nefarious tactics have never been done

before in American history (as per my reading of Fed meeting minutes from

1959 to date). It is a flawed, reckless, and fraudulent policy, in my

humble opinion.

For the last 108 years, the standard way for the Fed

to determine its monetary policy goals and accomplish its strategy/tactics was to

deliberate with FOMC members at scheduled meetings several times (currently

eight) per year. Previously, there was

no forward guidance. Instead, the Fed would discuss, evaluate, and debate the

economic data that was empirically collected by their current staff of over 400

PHD’s. Then to make a policy decision as to whether or not

to ease or tighten credit and by how much.

Again, that occurred meeting by meeting with no advance guidance given

for future FOMC meetings.

What happens in the future is unknown. Jay Powell is not Nostradamus or a fortune

teller! For quite some time, he said inflation would be

"transitory." He was dead

wrong. How does he know inflation will

be high this July? What if inflation declines on its own?

So for Powell to publicly

talk about future Fed Funds rate increases, BEFORE FOMC meetings, is a

blatant abuse of the Fed’s power!

Is the Fed’s goal to make everyone poorer to fix the problem

of rising prices they created (by spectacularly increasing the money supply

from March 2020-March2022)?

I believe the Fed will never raise rates seven to nine times

as they (and several investment banks) have forecasted. That’s a ruse to scare

investors and traders.

They will be lucky if they get one more 50 bps increase in

before the financial markets are down 50% or more (equity indexes declined 2%

per week on average in May 2022). Also,

unemployment could jump to 5-6%. That is where we are headed.

If politics are involved, one might ask if the Fed will

continue to raise rates up till the November 2022 elections?

Everyone in economics knows that Fed Funds rate

changes take 12-18 months to have any effect in the real economy. So, the Fed is now trying, for the first time

in history, to threaten the markets with making investors poorer if they don’t

obey and stop spending. Else they will

cause a decline into an unknown abyss to help the Fed solve their problem of

getting consumer prices down via “the reverse wealth effect” we

discussed in a recent Curmudgeon blog post.

In particular, the Fed’s new method of “fighting”

inflation is to cause a “reverse wealth effect,” which will scare people into

spending less (consumer spending accounts for ~70% of U.S. GDP).

Is the Fed Unconstitutional?

The U.S. Constitution does not mention the need for a

central bank, nor does it explicitly grant the government the power to create

one. Some critics think the Federal Reserve is too tied to the private sector

to be constitutional, noting that the presidents of the 12 regional Federal

Reserve Banks are appointed by a board of directors mostly drawn from the

private sector.

To be sure, Fed “money printing” (aka “keystroke

entries” or “creating money out of thin air”) is UNCONSTITUTIONAL as per Article

1 Section 8 Clause 5.

Why is it then used today as an instrument of the

federal government? Because it serves

the interest of “lawmakers” to buy votes.

The richest Americans get an enormous privilege by being first in line

in the receipt of newly created Fed money ($9+ billion Fed balance sheet) via

rising asset prices. So, politicians

look the other way. while ignoring the law of the land (the U.S.

Constitution).

No one has ever challenged the Federal Reserve Act

of 1913. However, as we now approach this systemic risk to our whole system

of government that could change.

Sidebar- Consumer Credit is so huge it forced a

reporting change:

Americans are racking up debt at record rates.

Consumer credit in the United States increased by $52.43 billion in March of

2022, up from a downwardly revised $37.7 billion gain in the prior month, and

well above market expectations of a $25 billion rise.”

A little over a week ago, when looking at the latest

consumer credit data from the Federal Reserve, we were shocked to learn that in

March, credit card debt soared by a record $52.4 billion, the biggest

monthly increase on record and more than double the expected change.

-->Does such consumer credit card borrowing

indicate a strong economy to you?

On May 6th, the Fed’s website stated: Beginning with the April

2022 G.19 Consumer Credit release, scheduled to be published on June 7,

2022, the release will no longer report the Commercial Bank Interest Rates for

48-month New Car Loans. Instead, the release will report the Commercial Bank

Interest Rates for 72-month New Car Loans. For more information, please see the

announcement posted on March 7, 2022.

Bear Market is Intact:

To stress the obvious (as we have stated repeatedly

this year) we are in a bear market for global equities and most other

asset classes. Furthermore, the U.S. is

heading for, or is already in, a recession!

For some perspective, let’s look at the price of the Walt

Disney Company (DIS). According to

BARCHARTS, the high price for DIS for the week of March 8, 2021, was

$203.07 on the NYSE. Compare that to its

Friday closing price of $102.43 – a loss of -49.6%. Yet Disney’s P/E ratio is

still 69.73!

At a historical norm it would be 15 times earnings

with a price of $22! High P/E stocks are great with zero interest rates, but

P/E’s collapse with higher interest rates.

When we go into a recession the Google’s, Facebook’s,

Twitter’s, and other high-tech flyers will get their P/Es crushed.

We haven’t had a real recession (forget the February-April

2020 recession, which was a joke) since the 2008-2009 financial crisis. Advertising is the first expense to be cut by

companies during a recession. That does

not augur well for tech giants which get the majority of

their revenues and profits from electronic advertising.

Curmudgeon– An Invisible Hand Appears after a -20%

Decline?

At 3:12pm EDT on May 20th, the S&P 500 was at

3812 (more than a -20% decline from its January 3, 2022, high), but the index closed up a fraction at 3901. Was there a mysterious, invisible hand at

work to prevent a -20% drop at Friday’s close? (Yes, we know Friday was

options expiration.)

Recall Oct 4, 2011, action in last 45 minutes of trading when

all market averages were down 20% or more intraday but then popped with noticeably

huge volume in stock index ETFs.

In the past 70 years, there have been five occasions

where the S&P 500 decline ended at -19% after being down -20% or more

intraday: 1978, 1990, 1998, 2011, 2018. Could that be more than a coincidence?

Conclusions:

Last month, William Dudley, former New York Fed

president said, “It’s hard to know how much the U.S.

Federal Reserve will need to do to get inflation under control. But one thing

is certain: To be effective, it’ll have to inflict more losses on stock and

bond investors than it has so far.”

This is like getting cancer and attempting to take

three times the prescribed chemo to end it quickly, which it does- by killing

the patient. Whomever doesn’t understand

this wicked scheme becomes “collateral damage.”

As I’ve repeatedly stated, the U.S. is in “Dire

Straits” and Fed market spooking talk is a new dimension of political

wickedness.

Can you imagine the Founding Fathers giving 12 FOMC

members the power to create a depression for the entire nation?

Bottom Line Forecast:

When these three Corporate Bond ETFs (JNK, LQD, and

HYD) decline 10% or more, the U.S. will be in recession and the Fed will change

their threatening rate rising rhetoric to calm the markets.

Closing Quotes from Louis T McFadden:

The Feds greatest critic was Louis T McFadden, a

House Republician Representative from Pennsylvania. He served as

Chairman of the US House Committee on Banking and Currency during the 66-71

Congresses. Attempts on his life were made three times - one by a gun two by

poison. The last one was alleged to have killed him. His anti-Fed activism and rhetoric makes Ron

Paul look like Boy Scout

“We have, in this country, one of the most corrupt

institutions the world has ever known. I refer to the Federal Reserve Board.

This evil institution has impoverished the people of the United States and has

practically bankrupted our government. It has done this through the corrupt

practices of the moneyed vultures who control it.”

― Louis T. McFadden

His greatest prognostication:

“The Federal Reserve Bank of New York is eager to enter into close relationship

with the Bank for International Settlements....The conclusion is impossible to

escape that the State and Treasury Departments are willing to pool the banking

system of Europe and America, setting up a world financial power independent of

and above the Government of the United States....The United States under

present conditions will be transformed from the most active of manufacturing

nations into a consuming and importing nation with a balance of trade against

it.”

Louis Thomas McFadden (July 1876-October 1936)

Be well, stay healthy, try to find diversions to

uplift your spirits, wishing you peace of mind, and till next time………………………...

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2022 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).