Steep Stock Decline on Thursday Possibly

Linked to Leaked Bad CPI Data

By Victor Sperandeo

with the Curmudgeon

Introduction:

Having traded equities, options, and futures since 1968, I’ve

learned a great deal that is not taught in schools. Identifying suspicious

market movements is one such item. Let’s

examine that theme and assess the CPI report along with the markets.

Steep Stock Decline due to Possible Corruption?

Last Thursday afternoon, the U.S. equity markets were trading

in a narrow range with the S&P 500 at 4106.91 at 1pm EDT. Without

any material news, the market started a steep sell off, where every single 15-minute

bar chart was down till 4:15pm EDT! The

S&P closed at 4017.82 on Thursday with the selloff accelerating on Friday

after the CPI number came in hotter than expected (see CPI Analysis below).

Could that market impacting CPI number coming out the next

morning have been leaked by a BLS employee to financial institutions/hedge

funds?

That is what the Curmudgeon asked via a text message after

the market closed on Thursday. Let’s

examine that theme a bit further.

Relevant Historical Incident:

An actual experience serves to prove my corruption

thesis. In 1988 I had a very well-known

reputation, after being profiled in Barron’s in August 1983 and

September 1987 (“The Man for All Markets” and “Trader Vic,” respectively). A famous hangout for traders was Michael’s

One. It was less known than Harry’s,

but far less crowded. So, every night after the market closed, my partner

Norman Tandy of Rand Management (a money management firm) and Hugo

Securities (a market making firm employing 42 traders) would meet for

drinks and street talk.

One evening, we were approached by a gentleman named “John I,”

who offered to buy us a drink. He

appeared to be a shady character, but very well connected. His proposition was straight forward: we pay

$50,000 cash a year and get the following days economic numbers from the BLS

(Bureau of Labor Statistics).

Norman and I looked at each other with eyes locked and

agreed. We immediately concluded that this proposition was illegal and so we

refused it. Norman gave an answer I’ll always remember, “John, we decline your

offer because we don’t like our meals served under a door (e.g., in a jail).”

Note that $50K is about $200K in today’s dollars. Also, that BLS states on the CPI

release website: “Transmission of material in this release is

embargoed until 8:30 a.m. (ET) June 10, 2022.”

Most analysts expected the CPI to come in at 8.3% Year over

Year (YoY), but it was reported to be 8.6% - a new 42 year high!

Perspective on the CPI:

The

published CPI number can be anything the BLS bureaucrats want it to be,

depending on how it is calculated.

Please see “Common Misconceptions about the Consumer Price Index:

Questions and Answers.” In

particular, “Some critics charge that by reflecting consumer substitution the

BLS is subtracting from the CPI a certain amount of inflation that consumers

can "live with" by reducing their standard of living. This is

incorrect: the CPI's objective is to calculate the change in the amount

consumers need to spend to maintain a constant level of satisfaction.”

-->So, you can clearly see that U.S. government policy is all

about the politics of what they want to achieve.

Analysis of

the May 2022 CPI Report:

From the BLS

website:

CONSUMER

PRICE INDEX - MAY 2022: The Consumer Price

Index for All Urban Consumers (CPI-U) increased 1.0% in May on a seasonally

adjusted basis after rising 0.3% in April, the U.S. Bureau of Labor Statistics

(BLS) reported today. Over the last 12 months, the all

items index increased 8.6% before seasonal adjustment.

The May CPI

numbers were not really that bad, especially since the core CPI (excludes food

and energy prices) came in at 6% YoY vs an estimated 5.9%. Yet the stock and bond markets took the

slightly higher CPI number as horrible.

Stocks sold off sharply while bond prices declined on Friday, especially

the 2-year T-Note where the yield climbed more than 24 basis

points to 3.065%, reaching its highest level since 2008!

Fed Funds

Forecast:

The closely

watched CME Fed Funds tool now forecasts a

77.2% probability of a 50 bps rate hike Wednesday, with a Fed Funds rate of 125

to 150 bps (current range is 75 to 100 bps).

It shows a 52.1% probability of Fed Funds at 200bps-225bps after the

July FOMC meeting. One week ago, that

probability was only 11.3%! There’s a 34.4% probability of 175-200 bps Fed

Funds rate at that time, which implies two consecutive 50bps rate hikes in June

and July.

Market Comments:

Every stock market sector was down last week with the

economic sensitive Dow Jones Transport index -7.5% on the week.

Based on Friday’s close, we consider the secondary equity

bear market correction (which occurred after the May 20th intra-day

lows) was less than two weeks, so is considered “minor.” Therefore, the same downtrend is still in

place.

However, there are many divergences in place (S&P 400 and

Russell 2000 are above their yearly lows) and investor sentiment is very bearish

(which may be a contrary indicator).

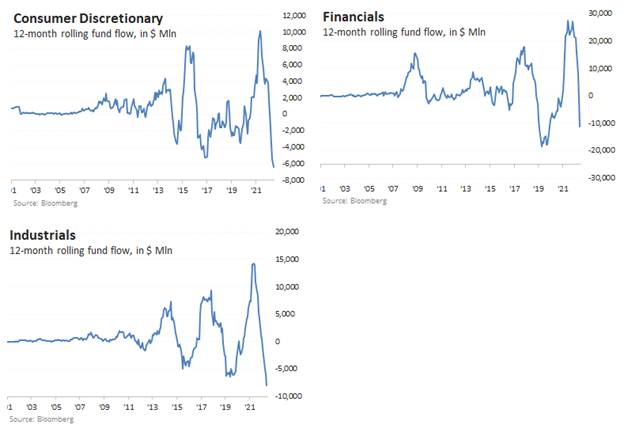

In May alone, investors pulled more than $10 billion from

sector ETFs. Financials bore the

brunt of the ETF redemptions, with more than $5.2 billion redeemed from funds

like XLF, VFH, and KRE.

The total outflow of $10.6 billion was the worst since at

least the year 2000. No month in over 20 years had seen a more concentrated

exodus. Markets have grown since 2000, but as a percentage of assets under

management, May's outflow was still substantial - the 6th-largest out of the

past 269 months.

Also, the ETF sector charts look terribly bearish and cry for

a relief rally.

So, depending on the Fed’s actions at their FOMC meeting next

Wednesday, there could be a reversal to the upside for equities.

Consumer Sentiment is Horrible!

The latest University Michigan Consumer Sentiment index

came in at 50.2% - the lowest level since the trough reached in the middle of

the 1980 recession. All components of the sentiment index fell this month, with

the steepest decline in the year-ahead outlook in business conditions, down 24%

from May. Consumers' assessments of

their personal financial situation worsened about 20%.

Don’t forget that consumer spending is largely based on

sentiment and makes up ~70% of U.S. GDP.

Chart Courtesy of University of Michigan

..........................................................................…........................…

Implications for the U.S. Bond Market:

With the economy weakening and consumer sentiment falling off

a cliff, the 30-year U.S. Treasury bond did not make a new low in price

(new high in yield) last week.

Depending on next week’s trading, long maturity U.S. bonds may have seen

their lows – at least for a while.

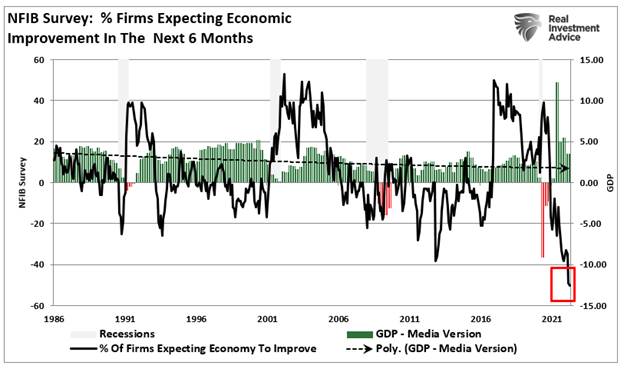

Chart of the Week:

Our chart of the week speaks volumes about business

pessimism.

Victor’s Conclusions:

America is now the land of corruption, with bribery the crime

of preference. It is so easy to make money if you know in advance a very

important market moving number.

I don’t know if “John I” is still alive, but I’m sure he has

many clones today. Please keep this in

mind when trading or investing.

It’s important to note that the S&P 500 closed at

3,900.86 on Friday, which is approximately the same level as this year’s

closing low of 3,900.79 on May 19th.

Therefore, this week’s trading will be critical to determine future

stock market direction.

Let’s see what the Fed does and says at this week’s FOMC

meeting. I believe they will be more concerned with recession, and that

inflation is less of a problem. That’s

especially in light of serious demand destruction

being caused by steep declines in financial markets and the all-time low

consumer sentiment.

Cartoon of the Week:

Cartoon Courtesy of Hedgeye

…………………………………………………………………………………………...

Relevant Lyrics:

Here’s an interesting song related to today’s society: The

Road to Hell, by Chris Rea (song writer and musician):

Stood still on a highway I saw a woman by the side of the road

With a face that I knew like my own, reflected in my window

Well, she walked up to my quarter light

and she bent down real slow

A fearful pressure paralyzed me in my shadows

She said: Son, what are you doing here?

My fear for you has turned me in my grave

I said: Mama, I come to the valley of the rich, myself to sell

She said: Son, this is the road to hell

On your journey 'cross the wilderness from the desert to the

well

You have strayed upon the motorway to hell

Well, I'm standing by a river but the

water doesn't flow

It boils with every poison you can think of

Then I'm underneath the streetlights, but the light of joy I

know

Scared beyond belief way down in the shadows

And the perverted fear of violence chokes a smile on every face

And common sense is ringing out the bells

This ain't no technological breakdown,

oh no, this is the road to hell

And all the roads jam up with credit and there's nothing you can

do

It's all just bits of paper flying away from you

Look out world, take a good look what comes down here

You must learn this lesson fast and learn it well

This ain't no upwardly mobile freeway

Oh no, this is the road, this is the road, this is the road to

hell

Source: LyricFind

……………………………………………………………………………………………………….

Be well, stay healthy, try to find diversions to uplift your

spirits, wishing you peace of mind, and till next time………

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2022 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).