Fed’s

Talk of Extensive Rate Hikes in 2022 is Just Talk

By Victor Sperandeo

with the Curmudgeon

Disclaimer:

We are not going to comment on world events or analyze

markets, as anyone who follows the news can judge what is going on. Anything we’d write would be drowned out by

what you’ve already read, heard and/or viewed.

Introduction:

We take a quick look at the markets, the Fed’s agenda, inflation

prospects in light of the Russia/Ukraine conflict, and

future U.S. economic growth in this post.

We hope you find it informative and provocative. Please let us know what you think.

Market Scores:

First, a recap of equity markets and some other important

secondary markets.

Stock Market Drawdowns:

·

Dow Jones Industrials -9.97%

from peak 1/4/22-2/23/22 Friday (+1.46% from the yearly low on March 4th).

·

Dow Jones Transports -14.77% high

11/2/21-2/23/22

·

S&P 500 -11.67%

1/3/22-2/23/22 (we use the SPY ETF as a proxy)

·

NDX 100 -18.46%

11/19/21-2/23/22 (we use the QQQ ETF as a proxy)

Victor’s Comment: I deeply

disagree with the CNBC (and other news outlets) classification of stock market

corrections and bear markets, which are based on arbitrary percent declines of

>=10% for a correction and >=20% for a bear market. Instead, I use Dow Theory and long-term

moving average classifications. Those

gauges do not suggest a bear market at this time.

Year-to-Date Returns of Selected Markets:

- Gold +9.11%

- CRB COMMODITY

INDEX +29.08% (does not include T-Bill Interest)

- Crude Oil May

2022 futures (CLK22): +50.73%

- U.S. government

bonds -3.0%

- Investment grade

bonds -5.2%

- High Yield bonds

-5.5%

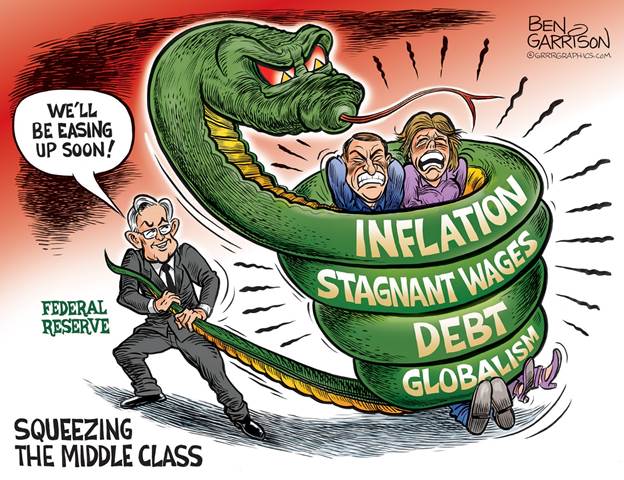

Fed Monetary Policy Dictates Stock Prices:

The key to equity market direction of LONG-TERM stock market

trends for the last 14 years has been Federal Reserve Board Policy.

To this day, the Fed has done nothing to fight

inflation. Instead

they have talked the talk about raising rates while slowly reducing their buying

of U.S. Treasury’s and mortgage backed securities (the latest round of QE).

It’s widely expected that Fed will be raising rates in the smallest way –

likely 25bps at the March 17th FOMC meeting. Wow and whoopy-do!!!

This is telling! When the

Fed knew inflation was a huge problem last year, they said it was “transitory”

and so it did not stop QE (which creates inflation by increasing the money

supply).

Why did the Fed continue to cause inflation when all could

see it was accelerating?

Reason: The Fed did NOT want markets to FALL! One must conclude that the Fed cares more

about keeping markets up than controlling inflation (which is one of their two

mandates).

What is the Fed’s Agenda?

I believe the Fed’s agenda is greatly influenced by the mid-term

elections. As I’ve stated in previous posts, the Democrats would lose badly

if the Fed caused a recession by raising rates too much. In our Feb

21st column, I wrote:

I estimate the Dem’s

will lose 50 to 60 House seats and 4 to 5 Senate seats in the November midterm

elections. However, if a recession takes

place, my estimates show a loss of 80 -90 House seats and 8-10 Senate seats as

even some Dem’s will vote for GOP candidates. This is why

I think the Fed is bluffing on multiple rate increases.

Curmudgeon on Inflation Outlook:

Inflation will only get worse due to the war in Ukraine. We’ve already seen oil prices skyrocket and

very strong commodity price increases this year.

In the U.S., the biggest impact will be felt at the gas pump

(the average price of regular gas in the SF Bay area is now over

$5/gallon). Higher oil and gas prices

are expected to add to inflation already running at the fastest rate in over 40

years. Russia was the third-largest source of oil products sold in the U.S.

last year — behind only Mexico and Canada — and responsible for 8% of all

imports. Russia is also the United States’ second-largest supplier of platinum,

a metal used to build exhausts for automobiles.

Sanctions on Russia are starting to wreak havoc on global

trade, with potentially devastating consequences for energy and grain

importers. It has also worsened supply-chain problems. Since Russia’s invasion of Ukraine, hundreds

of tankers and bulk carriers have been diverted away from the Black Sea, while

dozens more have been stranded at ports and at sea unable to unload their

valuable cargoes.

Russia is also a leading exporter of grains and a major

supplier of crude oil, metals, wood, and plastics — all used worldwide in a

range of products and by a multitude of industries from steelmakers to car

manufacturers. Shortages will surely

cause prices of many items to rise even further than they would have if not for

Russia’s invasion of Ukraine.

Curmudgeon - Global Central Banks Can’t Help:

The Fed, ECB, BoE and other global

central banks are hopelessly trapped between inflation on Main Street (e.g.,

Euro producer prices up staggering 30.6% YoY pre-invasion: oil price spike,

military-sanctions escalation cycle, etc.) and deflating stock prices on

Wall Street. We believe that

financial market fall-out due to Russia/Ukraine could cause a global

recession. In that case, there would be

little the Fed/ECB or other global central banks could do to stop it.

Victor’s Conclusions:

I still believe there will only be two Fed rate increases

this year and that they have no real meaning as they are purely for show.

It’s important to note that the economy is slowing:

- The Atlanta Fed GDP Now model estimate for real GDP

growth (seasonally adjusted annual rate) in the first quarter

of 2022 is 0.0 percent on March 1st, down from 0.6 percent on February

25.

- The Conference Board Consumer Confidence Index®

fell slightly in February, after a decrease in January. The Index now

stands at 110.5 (1985=100), down from 111.1 in January.

- The

University of Michigan consumer sentiment for the

U.S. was 62.8 in February of 2022. That was the lowest level of consumer

confidence in the past decade, amid inflationary declines in personal

finances, a near universal awareness of rising interest rates, falling

confidence in the government's economic policies, and the most negative long-term

prospects for the economy in the past decade. Still, interviews to

consumers were conducted prior to the Russian invasion so its impact is

yet to be felt by consumers.

Meanwhile, the yield curve is not inverted yet, but it’s

very close. The two-year Note is at 1.50% vs ten year Note at 1.74%. The last eight times the yield curve inverted

it created a recession – there were no exceptions.

I estimate that a recession could cause a loss of perhaps 100

House Seats and 10 Senate seats. That is

what the Fed wants to avoid. It’s the

primary reason I believe the threats (and investment bank forecasts) of

multiple rate increases won’t happen.

Fed Chairman Powell, who started all the talk of rate hikes,

is just talk and bluster. Without really

fighting inflation by raising rates and decreasing the money supply, the U.S.

economy will not go into recession. Time will tell if my thesis is correct.

End Quote:

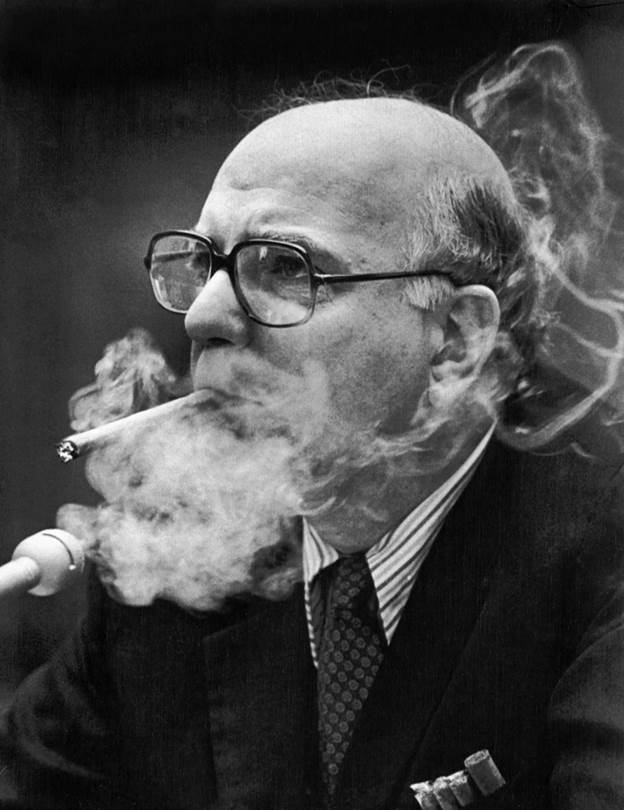

“It is a sobering fact that the prominence of central banks

in this century has coincided with a general tendency towards more inflation,

not less. If the overriding objective is

price stability, we did better with the nineteenth-century gold standard and

passive central banks, with currency boards, or even with 'free banking.' The

truly unique power of a central bank, after all, is the power to create money,

and ultimately the power to create is the power to destroy." Paul Volcker

Curmudgeon Tribute: Paul Volker was without a doubt the most

effective Fed Chairman of all-time. He

helped shape American economic policy for more than six decades. Here’s a photo of Volker from 1980:

Photo by George Tames/The New York Times

……………………………………………………………………………………………….

Stay healthy, enjoy life, success, good luck, and best

wishes. Till next time....

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2022 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).