How Long Can

the Fed Monetize Debt and Perpetuate So Many Asset Bubbles?

By the Curmudgeon with Victor

Sperandeo

Introduction:

U.S. budget deficits, corporate and federal debt keep

rising to surreal levels, yet fixed income investors don’t

seem to care. The public debt of the United States went from $8.68 trillion in

2006 to $28.43 trillion now. [You can

view the ever-increasing U.S. debt (and federal revenues) here.]

Meanwhile, real yields across the Treasury maturity

spectrum are deeply negative, credit spreads are at decade lows, and

complacency reigns supreme (please refer to charts).

The bond vigilantes, who were expected to enforce

discipline on fiscal spending/excessive budget deficits (by going on bond buyer

strikes), have all disappeared.

Accelerating inflation or expectations of a stronger

economy have not driven yields up/bond prices down, as the fixed income market

evidently expects inflation to be “transitory.”

In fact, the U.S. bond market rallied on Friday, despite a much better

than expected jobs report.

How long can this go on?

Will there ever be any consequences of the Fed

monetizing so much debt and creating so many asset bubbles (which we’ve chronicled in many previous posts)?

We discuss these questions in this article with

Victor providing his answer. But first a

bit of background information.

Backgrounder on U.S. Debt and Deficits:

The level of outstanding corporate bonds in the U.S.

is the highest in history at approximately $10.6 trillion. This represents

almost half of annual U.S. GDP.

That's on top of record U.S. debt to be auctioned this year in

order to finance $3T+ budget deficits (~ 13.4% of GDP). The U.S. Treasury Department regularly

borrows to finance the Federal Government's debt and a big increase in

supply previously caused yields to rise sharply.

In decades past, when budget deficits were much

lower, there was a concern that strongly increasing public debt would “crowd

out” private sector borrowers and make it very difficult

for many companies to issue corporate debt.

Well, that fear is long gone with the Fed buying AT LEAST $80B of

Treasuries and AT LEAST $40B of mortgaged backed bonds each month.

Charts of the Week:

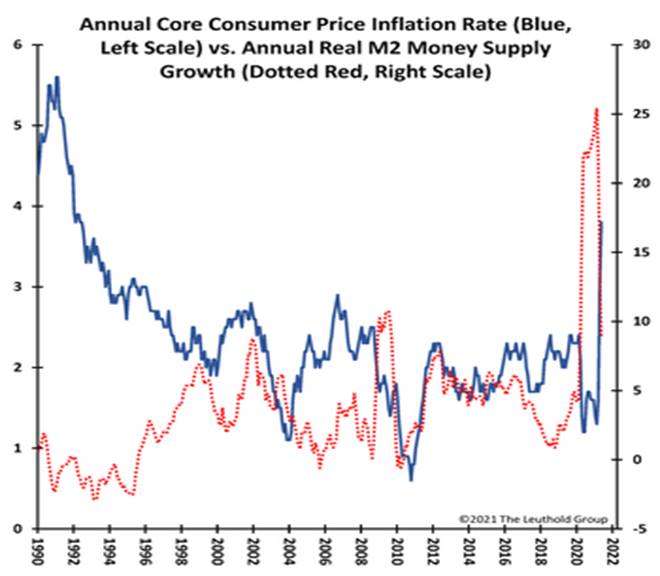

Here are a couple of charts, courtesy of Leuthold

Group, which illustrate rising inflation/money supply growth (chart 1) and

recent 10-year Treasury Note yield with comments (chart 2).

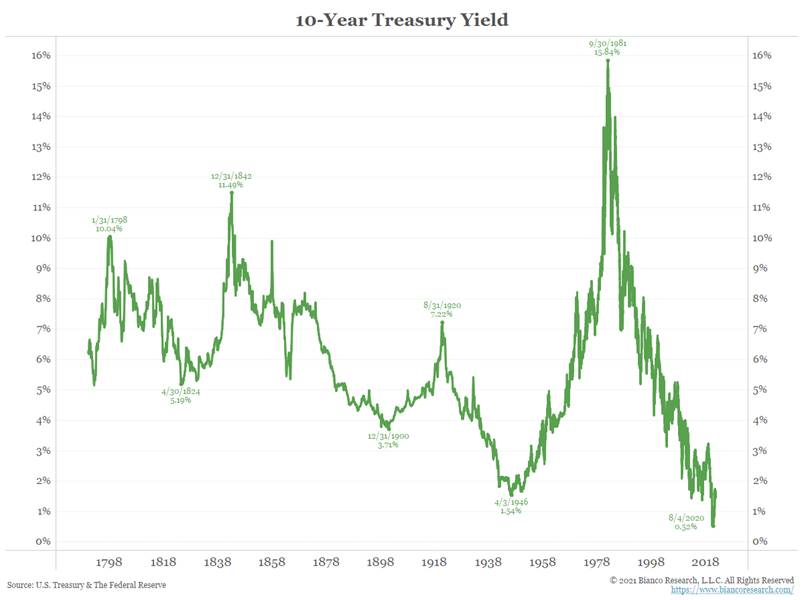

And a great chart from Bianco Research, depicting the very long term history of 10 year Treasury note yields:

As you can clearly see from the above chart, we’ve had the lowest interest rates of all time for the last

12 years! With negative real rates for most of that time.

………………………………………………………………………………………………….

EXTREMELY accommodating monetary and fiscal policies:

From well-respected economist Nouriel Roubini:

For

now, loose monetary, and fiscal policies will continue to fuel asset and credit

bubbles, propelling a slow-motion train wreck. The warning signs are already

apparent in today’s high price-to-earnings ratios, low equity risk premia,

inflated housing and tech assets, and the irrational exuberance surrounding

special purpose acquisition companies (SPACs), the crypto sector, high-yield

corporate debt, collateralized loan obligations, private equity, meme stocks,

and runaway retail day trading. At some point, this boom will culminate in a

Minsky moment (a sudden loss of confidence), and tighter monetary policies will

trigger a bust and crash.

But

in the meantime, the same loose policies that are feeding asset bubbles will

continue to drive consumer price inflation, creating the conditions for

stagflation whenever the next negative supply shocks arrive. Such shocks could

follow from renewed protectionism; demographic aging in advanced and emerging

economies; immigration restrictions in advanced economies; the reshoring of

manufacturing to high-cost regions; or the balkanization of global supply

chains.

Making

matters worse, central banks have effectively lost their independence,

because they have been given little choice but to monetize massive fiscal

deficits to forestall a debt crisis. With both public and private debts

having soared, they are in a debt trap. As inflation rises over the next

few years, central banks will face a dilemma. If they start phasing out

unconventional policies and raising policy rates to fight inflation, they will

risk triggering a massive debt crisis and severe recession; but if they

maintain a loose monetary policy, they will risk double-digit inflation – and

deep stagflation when the next negative supply shocks emerge.

But

even in the second scenario, policymakers would not be able to prevent a debt

crisis. While nominal government fixed-rate debt in advanced economies can be

partly wiped out by unexpected inflation (as happened in the 1970s),

emerging-market debts denominated in foreign currency would not be. Many of

these governments would need to default and restructure their debts.

From longtime colleague Tim Quast of Modern

IR:

Rational

people have been complaining about government deficits and central-bank

policies my whole adult life. Heck, I

have! Yet what’s

befallen us? Nothing. Sure, I’d rather have a sound currency, and a real return on all

the money we’ve worked so hard to accumulate.

But

aside from making a sound contention that saving money doesn’t

matter because money created by the Fed has replaced the value of pooled

returns from product output, what can we say? The world goes right on turning,

and consumers go right on spending.

The

only cautionary tale is a biblical one. It’ll be as in the days of Noah. People were eating and drinking and marrying

and giving in marriage and the flood came and swept them all away.

Victor’s Response to Tim (edited for clarity and

brevity):

The empirical evidence is as Tim suggests: “The world

goes right on turning and consuming goes right on.”

Why has Tim’s observation been true to date? Because the dollar and the debt have been relatively

stable. I believe that is caused by

“confidence” in the United States. That, in turn, is largely due to having a

Central Bank which will back-stop the economy and financial markets at every opportunity. And a federal government that will use

“stimulus programs” to prevent severe recessions.

However, no one should assume that the debt and the

U.S. are Frankenstein’s which are like living zombies that never die.

First, nations can and have used their printing

press, and political power for long periods of time without consequence. For example, the USSR lived on for 73 years

before dying.

The U.S. debt problem began when Nixon canceled any

connection to Gold in August 1971 or 50.25 years ago ending September. Since then, the “stated" U.S. debt has

grown at 8.98% a year. Meanwhile, real

GDP growth has been a meager 2.69% annually over the same time

period.

A few more data points:

·

U.S. government debt is

assumed to be $30 trillion on September 30, 2021.

·

Federal government spending

is growing at 6.93%, using the $6 trillion proposed budget since 1971.

·

The CPI has compounded at

3.86% from 1971 to date, meaning the buying power of the dollar declined 87%.

If U.S. government debt continues to grow at the 50-year

trend rate, then in 10 years the “Stated Debt” (which excludes” off-balance

sheet” and unfunded liabilities) will be $71 trillion.

The CBO projects real GDP will grow at 2% and will be

$26.8 Trillion in 10 years. That’s with no recessions. [Since the end of the 2008-2009

downturn, the US will not allow recessions to persist].

Thereby, the U.S. Debt to GDP ratio will be 2.65%

in 10 years. Again, that does not include any recessions or unknown shocks

like the virus or the housing crises in 2008.

-->IMHO, it’s impossible

to see how this debt/GDP ratio is sustainable?

Yes, we know about Japan, but that country’s economic growth has

stagnated since 1990!

Looking at past great empires -they all have failed ...The

last was the British Empire, which ended in a debt crisis in the mid - 1940’s

after WW II. Will the U.S. be any

different?

The use of Keynesian economics by the U.S. federal

government goes beyond what Keynes recommended, i.e.

that governments should use deficit spending to recover from

recessions/depressions.

Today, the U.S. federal government uses huge deficit

spending (“stimulus programs”) to keep the U.S. economy from going into a

serious or prolonged recession.

And what about monetary policy? Where Milton

Freedman suggested that the Fed increase the money supply at a fixed 6% rate

(in lieu of a gold standard), the Fed today has increased QE to AT LEAST $120B

per month, increased the M2 money supply by 25%, and skyrocketed its balance

sheet to unimaginable levels. Fed debt

monetization continues, despite much higher U.S. GDP forecasts this year, e.g.

the IMF forecasts 7% real U.S. economic growth for 2021

(highest since 1984).

Now let’s talk about inflation,

which is caused by increasing the money supply (more or less). The extent of

actual price increases that arise are from increasing the paper money stock,

such that the velocity of money increases (which to a large extent is based on

the demand for loans and banks actually filling the

loan demand).

Note: We’ve

covered the inflation topic extensively in recent Curmudgeon blog posts

here and here, so we will not

reiterate why consumer prices have been below the Fed’s 2% target for so long.

Hyperinflation is caused

by the mass selling of a nation’s currency, as confidence is lost, e.g., Zimbabwean

dollar. The currency will

lose its stability and thereby its “store of value” function. All “fiat currencies” are based on such

confidence as they have no intrinsic backing (e.g., like with the Gold

Standard).

Victor’s Thesis:

IMHO, the end of the U.S. will be due to hyperinflation. This will begin with MMT (Modern

Monetary Theory), which is heavily promoted today. When UBI (Universal

Basic Income) kicks in it will cause inflation to skyrocket. That will greatly cheapen the U.S. debt and,

for all practical purposes, end the U.S. as an economic superpower. A recent example of this model is Venezuela,

which has gone from a strong to a very weak economy in the 21st

century.

Tim’s View:

Tim writes that “hyperinflation will come

after deflation. The supply of money is increased in response to crisis,

which inflates prices until nobody can afford them, and then prices fall, and

governments respond desperately to falling prices with yet more money, and

confidence in the currency is then lost. We’re still

in the first phase of that. But it can happen suddenly.

Rising prices and rising debt are always the first

signs of monetary trouble. Both tell you

the standard of living has peaked and will next decline. It’s

not apparent right now, any more than it’s apparent that somebody arriving in a

private jet is broke. You’d have to see

that person’s balance sheet to know.”

Victor’s Conclusions:

Extremely loose U.S. monetary and fiscal policy have

greatly inflated financial assets (art and real estate too), but also created

huge debt to be serviced. Yet there are

seemingly no consequences to date.

However, the financial shenanigans game in the U.S. has to come to an end someday, as it always has in the

past. However, one can’t

predict the psychology of “when.” The

ending is always delayed when a “printing press” (aka “keystroke entries”) is

used to monetize debt and other investable assets, as the last three Fed chairs

have done.

End Quote:

As Josiah Stamp said (Victor used this quote

in a previous Curmudgeon post):

"Banking was conceived in iniquity and born in

sin... Bankers own the Earth. Take it away from them but leave them the power

to create money, and, with the flick of a pen, they will create enough money to

buy it back again... Take this great power away from them and all the great

fortunes like mine will disappear and they ought to disappear, for then this

would be a better and happier world to live in... But, if you want to continue

to be a slave of the bankers and pay the cost of your own slavery, then let the

bankers continue to create money and control credit."

Josiah Charles Stamp, 1st Baron Stamp, GCB, GBE, FBA (21 June 1880 – 16 April

1941) was an English industrialist, economist, civil servant, statistician,

writer, and banker. He was a- director of the Bank of England- and chairman of

the London, Midland and Scottish Railway.

…………………………………………………………………………………………

Enjoy summer, go to an outdoor concert, read a good

book, visit with friends and family, and till next time…….

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned

(since 1971) to profit in the ever changing and arcane world of markets,

economies and government policies.

Victor started his Wall Street career in 1966 and began trading for a

living in 1968. As President and CEO of Alpha Financial Technologies LLC,

Sperandeo oversees the firm's research and development platform, which is used

to create innovative solutions for different futures markets, risk parameters

and other factors.

Copyright © 2021 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the original

posted article(s).