Inflation

and Debt are Systemic Threats to the U.S. Dollar

By Victor Sperandeo with the

Curmudgeon

Introduction:

In the first sentence of a recent

Curmudgeon post we wrote, “Inflation is

indeed a worry that the Fed continues to ignore.” That was followed by this comment: “Inflation is baked into

the 24% increase in money supply, which will continue to rise with the Fed’s

financing U.S. government debt with no tapering of QE in the near future.”

We expand on that theme in this article and explain

the effect it might have on the U.S. dollar as the world’s reserve currency.

Money Supply and Inflation:

The money supply has dramatically increased to more

than +20% Year over Year (YoY), while the Fed’s balance sheet is +91% from

February 2020 ($4.16 trillion to $7.94 trillion).

Chart of U.S. Money Supply (M2) over last 12

months:

Therefore, the Fed’s suggestion that inflation is

“transitory” cannot be true as long as it maintains its QE/ZIRP monetary

policy.

Although price increases may slow a bit in July, they

will likely reoccur again shortly thereafter. The reason (rarely talked about)

is the hoarding of the existing supply of goods. That is something that the

proponents of Modern Monetary Theory (MMT) do not understand.

The lack of investing in productive assets will also

contribute to a rise in prices.

Companies are often reluctant to “invest” in inflationary environments,

as no one knows how high prices will rise to be able to sell their manufactured

product(s) at a profit. But companies do speculate on prices. This is why you

see them buying back their shares, rather than building manufacturing facilities.

Inflation (courtesy of money printing; aka “keystroke entries”) will continue

to increase until money supply growth stabilizes in the 6% range.

CPI and PPI at Multi-Year Highs:

The Bureau of Labor Statistics (BLS) April

2021 CPI report states:

·

Over the last 12 months, the

all-items CPI increased 4.2% before seasonal adjustment- the largest 12-month

increase since a 4.9% increase for the period ending September 2008.

·

Nearly all major component

indexes increased in April. Along with the index for used cars and trucks, the

indexes for shelter, airline fares, recreation, motor vehicle insurance, and

household furnishings and operations were among the indexes with a large impact

on the overall increase.

·

The index for all items less

food and energy (core CPI) rose 0.9% in April, its largest monthly increase

since April 1982. Nearly all major component indexes increased in April.

The BLS April

2021 Producer Price Index (PPI) report states:

·

The PPI increased 0.6% in

April, seasonally adjusted, 1.0% in March and 0.5% in February.

·

On an unadjusted basis, the

final demand index moved up 6.2% for the 12 months ended in April, the largest

advance since 12-month data were first calculated in November 2010.

Commodity Trends Indicator:

Commodities are still an important driver of rising prices,

despite the U.S. becoming more of a “service economy.” Oil, copper, lumber, cement, etc. all go into

making new houses which are an important part of inflation indexes.

It may be interesting to see how an actual commodity

index did going back to 1985. The Commodity

Trends Indicator (CTI) was created by Alpha Financial Technologies LLC (AFT)

– a firm I control. That index was

branded by S&P in 2004. It traded on the NYSE as an ETN for a time, which

was sponsored by HSBC.

If you look at the annual results (with T-Bills

included) the highest annual return going back to 1985 was 33.6% in 2004. In

the first five months of 2021 (without T-Bills which yield 2 bps) the CTI is up

+18.5%.

Of course, the CTI will fluctuate, and could turn

down. But as a guide to the reality of commodity prices so far this year

(versus what the BLS is reporting) may be of interest to readers.

Assessment of U.S. Policies:

The ramifications from the current U.S. monetary and

fiscal policies are varied and often misunderstood. I believe the world sees

the U.S. in decline with self-made problems.

“The Duran,” an objective geopolitical analytical

service is very knowledgeable about international affairs. It’s run by Alexander Mercouris

(a former MP of English Parliament who lives in the UK) and Alex Christoforou

(an American who lives in Greece). They

recently did a podcast titled “Russia Dumps U.S. Dollar. Fed Printing Out of Control.”

The subhead is: “Russia’s $186 Billion Sovereign Wealth Fund Dumps All Dollar

Assets.”

The upshot of that podcast is that nations see the

U.S. as losing control of their money supply because of too much money printing

and spending. And that is causing price

increases that cannot be stopped without causing a recession or depression. They mention Russia dumping dollar assets

along with China and predict other nations will follow suit.

According to the Duran “the de-dollarization of

America is the biggest story of our lifetimes.” This is coupled with the “end of the rule of

law,” the destruction of U.S. institutions and elections.”

Permit me to add the promotion of chaos and defunding

of police (an unheard-of tactic), which is causing the loss of confidence in

the U.S. all around the world.

U.S. Fiscal Policy and Debt as threats to U.S.

Dollar:

President Biden is attempting to restructure America

and to create an economic boom so that Democrats win the 2022 mid-term

elections. Yet he doesn’t seem to

realize that out of control money printing and debt (now at 130% debt to GDP ratio)

are systemic threats to the U.S. dollar.

A proposed $6 trillion dollar budget for fiscal 2022,

was not in the CBO projections till fiscal 2027. That is five years ahead of

schedule from September 2021!

By the end of September 2021, the “stated” U.S.

government debt will be $30 trillion. That

is a rise of 9% a year compounded for the last 50 years (since 1971). Compare that U.S. debt increase to real GDP

which grew 2.68% over the same period (lower than 2% since 2009). Shockingly, U.S. debt is increasing at 3.5

times the rate of economic growth over the last 50 years!

What does all this mean? In 10 years, the U.S. debt

to GDP ratio will be 2.67 (rounded), which is more than Japan’s 2.50% today.

Debt will be $72 trillion in 10 years at the 50-year trend and GDP will be $27

trillion, based on the projected growth of 2.1% after this fiscal year by the

Congressional Budget Office (CBO).

Highlights of Bill Gross’ Op-Ed in the Financial

Times:

Here are a few excerpts of Bill Gross’ FT article

titled “The real bond kings and queens sit on the

Federal Reserve throne.”

Even

enthusiasts of the Fed’s policy must wonder whether hundreds of

cryptocurrencies or a boom in special purpose acquisition vehicles are the

result of continuing financial innovation or the product of cheap and plentiful

credit demanded by deficit spending and an accommodating Fed chair.

Five-year

US Treasuries currently yield just 0.80%, not much in a world where inflation

expectations over the same period are above 2.5%. That is reflected in the

negative real yields, which have the effects of inflation stripped out.

Five-year US inflation protected bonds now trade at a yield close to minus 2

per cent.

And

how long can the Treasury continue to require near-costless Fed financing for

$2tn, $3tn and $4tn deficits without sinking the dollar? In a historical

gold-standard world, Fort Knox would have been emptied long ago, implying the

bankruptcy of the world’s reserve currency.

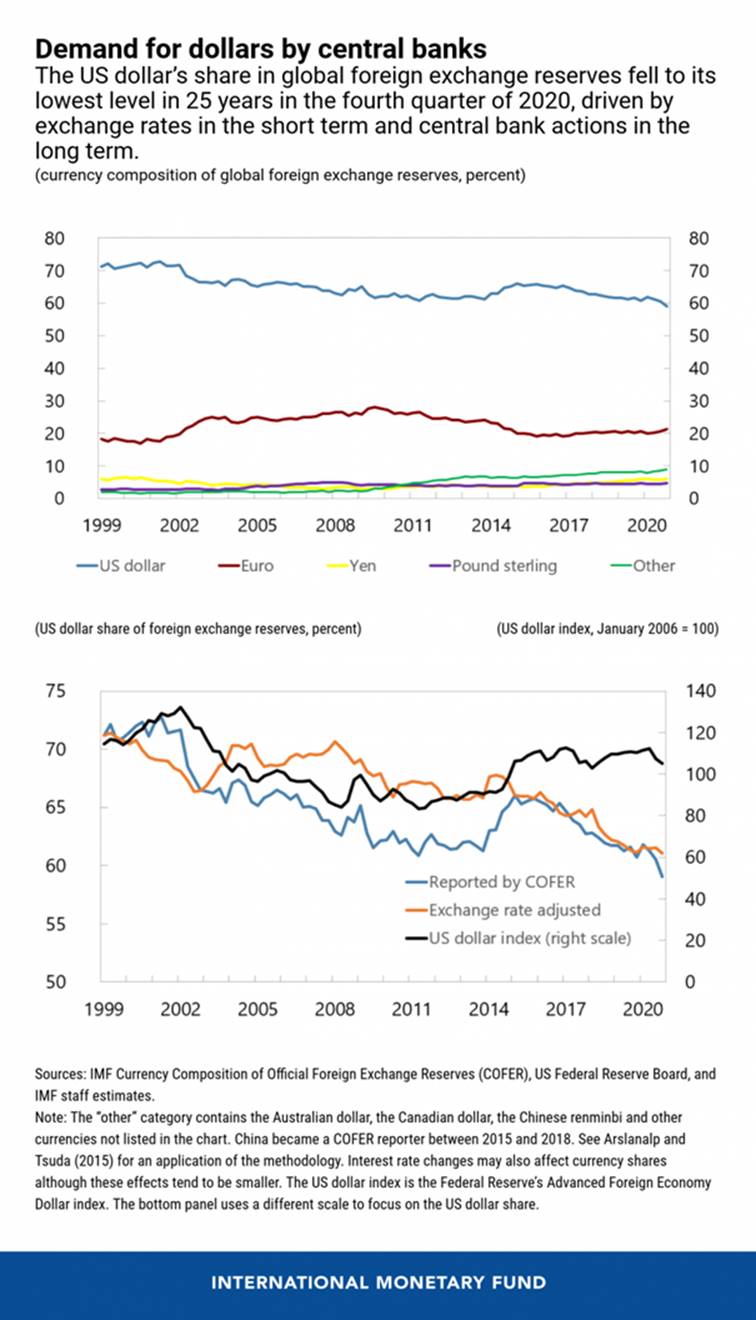

Fewer U.S. Dollars Held by Foreign Central Banks:

The IMF’s latest survey of official foreign exchange reserves shows that the share of U.S.

dollar reserves held by foreign central banks fell to 59% during the

4th Quarter of 2020 — its lowest level in 25 years (see chart

above). This compares with a 71% share when the euro was launched in

1999.

Some analysts say this partly reflects the declining

role of the U.S. dollar in the global economy, in the face of competition

from other currencies used by central banks for international transactions. If

the shifts in central bank reserves are large enough, they can affect currency

and bond markets.

Indeed, the latest IMF numbers confirm that the

dollar’s world reserve currency privilege is eroding as countries that trade

with and borrow from the euro area increasingly seek to hold euro reserves

rather than dollars. That process is now also happening with China and the

renminbi.

Former U.S. Treasury Secretary Larry Summers (a

Democrat) has said the Biden administration is pursuing “the least

responsible fiscal macroeconomic policy we’ve have had for the last 40 years.” In an interview with the FT, Summers implied

that the anti-inflationary credibility started by Paul Volker 40 years ago may

now be in question, causing foreign investors to worry that the U.S. will

inflate away the value of their Treasury holdings.

Indeed, the key threats to the U.S. dollar’s world

reserve currency status are U.S. fiscal profligacy and monetary debasement.

Chart of the Week:

Who would have thought that buying mortgages would

lead to a bizarre surge in house prices?

Conclusions:

In law, “insanity” is defined as: “unsoundness of

mind or lack of the ability to understand that prevents one from having the

mental capacity required by law to enter into a particular relationship,

status, or transaction or that releases one from criminal or civil

responsibility.”

By that definition, do you think our U.S. government

and Fed leaders are insane?

A friend once told me that if you see an elderly

person with crumbs in their lap and taking short steps to walk, don’t ask them

“How are you doing?” Does this mirror

the overall state of decline in the U.S. today?

If the dollar gets sold down to the low 80’s on the

U.S. Dollar index (it’s currently 90.12 in the June 2021 DXY Futures contract),

expect consumer and commodity prices to rise into the mid-teens. However, that will probably not be reflected

in the CPI (which we’ve often stated is not an accurate reflection of U.S.

consumer price changes).

As long as U.S. debt and dollar creation continue

unabated, foreigners are likely to lose confidence in the greenback. That begs this important question: When

will U.S. dollar dominance suddenly turn into a dollar rout?

End Quote:

“The Fed has now outpaced foreigners in terms of

market share in the U.S. Treasury market, which could clearly be seen as a

negative for the USD reserve status. If the Fed crowds out investors in the

bond market, the USD will turn less relevant to hold in an FX reserve. It is as

simple as that.”

Nordea Bank FX Weekly: A woke Fed should taper MBS

purchases ASAP

…………………………………………………………………………………………….

Stay safe, be healthy, take care of yourself and each

other, and till next time……

………………………………………………………………………………………………

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies and government

policies. Victor started his Wall Street

career in 1966 and began trading for a living in 1968. As President and CEO of

Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and

development platform, which is used to create innovative solutions for

different futures markets, risk parameters and other factors.

Copyright © 2021 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).