China’s

Economy Outpaces All Other Developed Countries in 2020

By the Curmudgeon

Introduction:

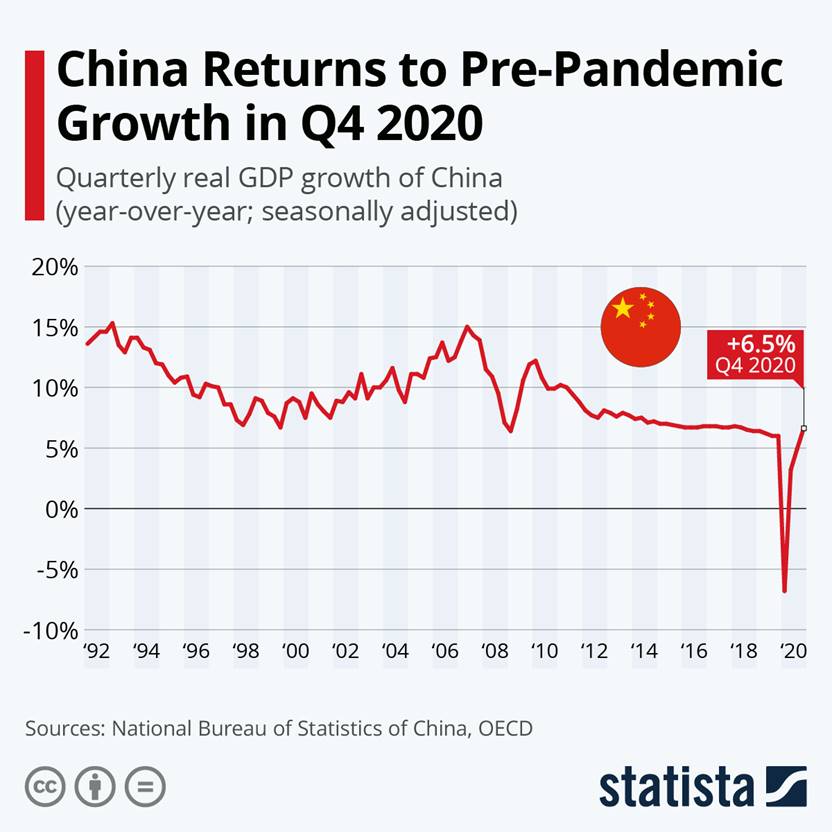

What Coronavirus? China’s economy ended last year on a high

note – as if there was no pandemic or lockdowns in 2020. 4th Quarter

growth was reported at a very impressive 6.5% year on year (YoY), bringing the

country’s overall gross domestic product (GDP) growth for all of 2020 to 2.3%.

-->China is the only

developed country to avoid an economic contraction last year!

In this brief post, we look

behind China’s numbers and provide analysis and commentary.

Yes, we know many of you don’t trust any economic statistics from the Communist

controlled country. We share your

concern.

For example, the government

said it created almost 12 million new urban jobs last year. But the official jobless rate only tracks

people who have been resident in cities for at least six months. The millions of temporary or migrant workers

that didn’t return to urban areas after lockdowns were

lifted are not counted as unemployed.

Yet official data showed the number of rural migrant workers dropping by

5.2 million in 2020 from 2019.

Analysis and Perspective of

China’s Economy:

Recall that China GDP

declined in early 2020 (-6.6% in the 1st Quarter) for the first

time in more than four decades after authorities imposed an extensive lockdown

to stem the pandemic’s initial outbreak. After effectively controlling the

spread of the virus, China’s economy recovered quickly. Indeed, the pace of China's recovery exceeded

expectations, as the IMF and World Bank had predicted 1.85% and 2.0% growth for

2020 in their latest economic outlooks, respectively.

The 6.5% 4th Quarter

growth was the highest of any quarter since 2018. Nonetheless, the 2.3% growth for all of 2020

was the worst YoY GDP result since 1976.

The chart below clearly shows a “V” recovery for China’s economy,

probably the only country that’s achieved such a sharp

rebound.

The GDP figures were released

days after China recorded its highest-ever monthly trade surplus in

December, stoked by three consecutive months of double-digit exports growth.

Exports, which have been supported by demand for medical equipment and

lockdown-related products, rose 18% last month compared with the same period in

the previous year.

"Amid all the noises on

de-coupling and de-globalization, somewhat unexpectedly, the pandemic has

deepened the ties between China and the rest of the world," wrote Larry

Hu, chief China economist for Macquarie Capital, in a research report for

clients.

Industrial production rose a

brisk 7.3% in December, 7.1% in the 4th Quarter compared with 5.8%

in the previous quarter. Indeed, China

has become an industrial powerhouse as its industrial economy hit new records

in 2020. Crude steel output rose above 1 billion tons, and the production of

rolled steel, pig iron, and aluminum also hit new highs as exports and

investment in infrastructure and real-estate climbed, spurring demand for

metals.

“China’s economy seems to be

firing consistently on all cylinders,” said Eswar

Prasad, a China finance expert at Cornell University, who added that it was

“leaving other major economies in the dust.”

Ning Jizhe,

head of the National Bureau of Statistics, was not as sanguine. He said the economy “recovered steadily” last

year but cautioned that the “changing epidemic dynamics and external

environment pose a multitude of uncertainties and that the foundation for

economic recovery is yet to be consolidated.”

Retail sales have lagged behind the industrial sector, adding 4.6% in the 4th

Quarter. December’s reading was also 4.6% which was a bit below the 5% per cent

year-on-year growth in November and below expectations. That underscores the reality that China

cannot yet rely on its domestic market as much as it would like to.

More politically troubling for

China’s Communist Party (CCP) is that income inequality has widened

substantially in recent years. Bloomberg reports that the poorest Chinese

still earn only a fraction of the income of the wealthy. The richest 20% of Chinese had an average

disposable income of more than 80,000 yuan ($12,000) last year. That was more

than triple the median and 10 times what the poorest 20% received, according to

data released by China’s National Bureau of Statistics.

Stronger Economic Growth Forecasts:

Economists at Credit Suisse

upgraded their forecasts for China’s 2021 growth to 7.1% from 5.6%, noting

domestic consumption as the main driver of growth.

-->That would be quite a

change as retail sales are slowing as noted above.

Chaoping Zhu,

global market strategist at JPMorgan Asset Management, suggested that domestic

economic activities are “likely to improve in 2021” with further support from a

global economic recovery. “Particularly, in the first quarter of 2021, we

expect to see strong growth readings as the escalating pandemic control

measures start to take effect,” he told the Financial Times.

The International Monetary

Fund (IMF) said this month that China should maintain some policy support

for the economy this year, but steps are needed to spur private demand and

achieve more balanced growth over the medium term.

Nomura Holdings had

estimated China's economy would surpass the U.S.'s in 2030, but China's

economic performance in 2020 caused the firm to shorten that timeline to 2028,

extrapolating from International Monetary Fund projections, or to as early as

2026 if renminbi appreciation continues.

China's GDP will grow 5.7% per

year until 2025, followed by 4.5% annually until 2030, CEBR estimates,

while the U.S. economy will grow 1.9% per year from 2022 to 2024 and then 1.6%

per year "for the rest of the forecast horizon."

China Wins Trade War with

U.S.:

We’ve

commented on this topic extensively in the context of the so-called U.S. -

China “trade deal.” Please reference

previous Curmudgeon posts, like this

one and this one.

China’s blow out export numbers “seal the deal” in that China's trade

relationship with the United States has become more imbalanced than ever.

In

particular, China's trade surplus with the U.S. rose to

$317 billion in 2020, a 7% increase from the year prior and the second highest

amount on record, according to Iris Pang, chief economist for Greater China at

ING. The amount is just $7 billion shy of 2018 levels, when Trump launched a

blistering trade war to right what he called a lopsided relationship with the

world's second largest economy.

"Judged by the surge of

U.S. imports from China in 2020, it seems fair to say that Trump's trade war

with China has failed," said Louis Kuijs, head

of Asia economics at Oxford Economics.

"After having recovered

from its own Covid-19 crisis, China was open for business when the pandemic

triggered huge demand in the U.S. (and other countries) for Covid-19 related

goods. As [China] plays a critical role

in many supply chains and remains a fundamentally very

competitive place to produce, it is much easier said than done to

'decouple' from it," Kuijs added.

Closing Quotes:

“The pandemic dealt a much

larger blow to the U.S. economy than to China's economy. Time will tell, but in

our view, there is a high likelihood that 2026 will be the milestone at which

China re-emerges as the world's largest economy." Nomura Holdings Report to clients.

"For some time, an

overarching theme of global economics has been the economic and soft power

struggle between the United States and China.

The COVID-19 pandemic and corresponding economic fallout have certainly

tipped this rivalry in China's favor." CEBR report.

Good health, stay calm, safe,

persevere under stress, and till next time….

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned

(since 1971) to profit in the ever changing and arcane world of markets,

economies and government policies.

Victor started his Wall Street career in 1966 and began trading for a

living in 1968. As President and CEO of Alpha Financial Technologies LLC,

Sperandeo oversees the firm's research and development platform, which is used

to create innovative solutions for different futures markets, risk parameters

and other factors.

Copyright © 2021 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).