Shockingly Weak Jobs Report Shows Fed is in Another

Dimension

by the Curmudgeon with Victor Sperandeo

Introduction:

The Curmudgeon reviews the disappointing May jobs report and submits that the

Fed's seemingly endless talk the talk is misplaced, while its economic survey

data on a tight job market is flat out wrong.

Victor expresses his candid opinions on the Fed's mind set and concludes

they're in the Twilight Zone. The

Curmudgeon certainly agrees!

Jobs Report Summary:

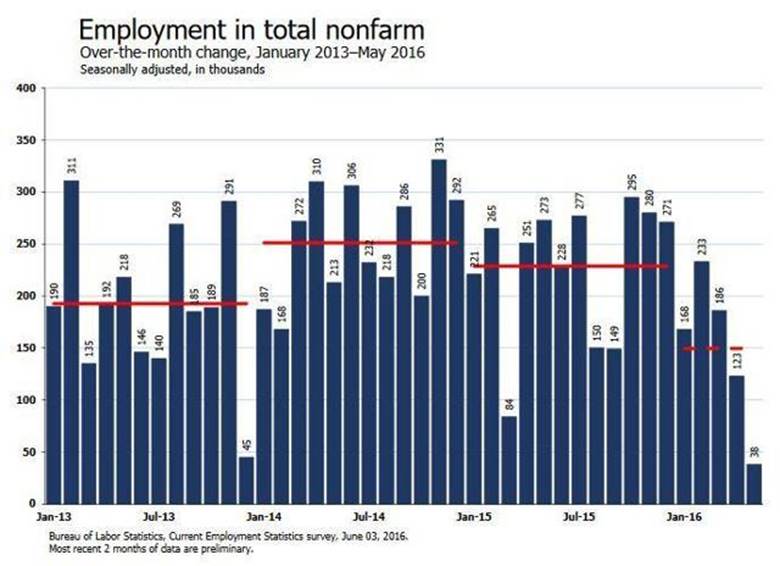

How could they have gotten it so wrong? Shortly before the BLS announced the

shockingly poor employment situation report Friday morning, economists and

market analysts surveyed by CNBC had estimated between +145k to 190k new non-farm

jobs were added in May 2016. In fact,

only +38K new jobs were created in May, which was the lowest monthly growth

since September 2010.

The Labor Dept. also revised down the March and Aprils

employment totals by 59,000. April's 160K new jobs, which already looked like a

downshift from 200K+ from previous months, was revised down to 123K. March was

also revised down from 208K to 186K. The average monthly gain for the last

three months was a puny 116,000 jobs. That was the lowest three-month average

level since 2012, according to Citi Velocity.

Despite the anemic job gains, the official unemployment rate,

(which is based on a separate survey of households), fell to 4.7%, its lowest

point in nearly a decade. But the decline was primarily a result of Americans

dropping out of the labor force rather than finding new jobs. The labor force participation rate declined

for the second consecutive month, to 62.6% while the number of people working

part time for economic reasons rose sharply.

The latest payrolls numbers were affected by a strike by 35,000

Verizon Communications workers that began in late April and stretched through

May. But even excluding that effect, the jobs report was very bad.

Victor Notes:

1. Barron's reports 664,000 people left the work force in

May. That figure is unusually high. This

now brings the worker participation rate to 62.6% (almost a four decade low)

and that caused a headline unemployment number 4.7%.

2. We've many times

called attention to the Birth Death Model, which adds approximately

72,000 jobs that are estimated, but never really counted. If that were subtracted, the result would be

a DECLINE in jobs of -34,000. Please

refer to the subhead: Phantom Jobs Created by "New Companies"

Which Don't Really Exist in this Curmudgeon post.

...

Fed Rhetoric Misplaced:

Boy, this is ugly, Diane Swonk, an independent economist in

Chicago, said about the jobs report.

The losses were deeper and more broad-based than we expected, and with

the downward revision to previous months, it puts the Fed back on pause.

Yet just last Saturday, headlines in leading newspapers screamed

the Fed would raise rates soon. The lead

story in the WSJ was titled: Janet Yellen Sees Rate Hike Coming Soon (on

line subscription required) with subhead stating Fed is on watch to

move as economy shows signs of pickup.

Its appropriate

for the Fed to gradually and cautiously

increase our overnight interest rate over time, and probably in the coming

months such a move would be appropriate, Fed Chairwoman Yellen said during a

panel discussion at the Radcliffe Institute for Advanced Study at Harvard

University.

Ms. Yellens comments on a possible rate increase echoed those

of other Fed officials who had said they see two or three rate increases this

year and could see moving in June or July.

Why can't Yellen and other Fed officials just keep quiet and stop

confusing the markets?

Moreover, the Fed's surveys don't seem to be accurate. The central banks anecdotal Beige Book

report,

released on Wednesday, indicated that tight labor markets were widely noted

in most of the Feds dozen districts around the country. Tight labor

markets, with the labor participation rate near a four-decade low of

62.6%? Who's kidding whom?

ShadowStats Report No. 810 - Labor Conditions, M3, Trade Deficit

and Revisions, Construction Spending:

In a June 5th report for subscribers, ShadowStats'

John Williams made the following observations on the Fed and the U.S. economy:

·

As Happy Economic Data

Evaporate, Chances for an FOMC Rate Hike and Perpetual Fed Propping up the

Dollar and Stocks Will Diminish

·

Plunge in the Headline

Unemployment Rate Came from Unemployed Leaving the Labor Force, Not from Finding Jobs

·

The Labor-Force

Participation-Rate Measure Favored by Fed Chair Yellen Shifted Negatively to

62.6% in May, from 62.8% in April

·

Despite Collapsing

April 2016 Real Construction Spending, Broad Activity Continued in Low-Level,

Stagnating Non-Recovery

·

Commerce Department

Moved to Reduce the Trade Deficit and to

·

Boost the Headline

Economy by Redefining and Gussying-Up the Trade Surplus in the Otherwise

Fluffy-Services Sector

·

Hard Detail from the

Real Merchandise Trade Sector Showed a Deeper Deficit and Weaker Economy in

Revision

·

While some elements of

April 2016 headline economic activity showed heavily-touted, relative monthly

pick-up, those gains arose largely from one-time events or seasonal-factor

distortions that should reverse or not be repeating in May.

·

Where some positive

reporting surprises are inevitable, downside surprises and negative revisions

to prior periods should become the dominant trend in the months ahead.

Victor's Comments and Opinions:

The English Poet Percy Bysshe

Shelley (1792-1822) concisely explains the Fed's seemingly incoherent

mindset (emphasis added):

"Government

is never supported by fraud UNTIL it cannot be supported by reason."

In the first week of May, the Fed did not want the dollar down.

I believe they were worried that a weak US $ might cause oil prices (inversely

correlated) to rise to a point that it would slow consumer spending.

We wrote about dollar manipulation in Potpourri of

Observations on Economy, Markets and Politics:

The US dollar

index dropped six days in a row from a trading high of 95.18...As the decline

began to accelerate on the broken support, two FOMC members saved the day by

talking (or jawboning) up the dollar. Fed members John Williams (San Francisco

Fed) and Dennis Lockhart (Atlanta Fed) said the markets are underestimating

rate hike odds and investors dwell on downside risks.

After the jobs report was released on June 3rd, the

DXM (June US $ futures contract) closed at 93.88, which was down -1.686 or

(-1.76%) for the day. Contrast that to

the May 31st DXM close of 95.88, which was the monthly high. Hence, the dollar gave back 41% of its May

rally in one day. Do you think the

Fed was pleased with that?

With 100% confidence we can now say that the much hyped talk of

a June rate increase won't happen, especially with the Brexit UK referendum a

week after the Fed's meeting. According

to the CME Fed Watch Tool, theres only a 3.8% chance of a Fed rate increase at

the June 15th Fed meeting.

As this is an election year, a rate increase in July or later

becomes a grave risk to the Democrats.

What if something else goes wrong with the global economy? Janet Yellen and her Fed cohorts are Democrats,

so it will not happen. Forget about a

Fed Funds increase this year!

Curmudgeon Note: The CME Fed Watch shows a 30.2% probability of the Fed Funds

rate increase of 25 bps at the July 27th Fed meeting.

...

The Fed continues to make "rope-a-dope" excuses for

what it says it is going to do, or when it changes its mind whimsically.

The Financial Times June 4th editorial (on line

subscription required) "The Fed faces bigger problems than Brexit"

is against increasing rates.

True, the Fed

has been paying more attention than usual to international events over the past

year, expressing concern about volatility in financial markets and the threat

of global economic turmoil." They

mean China!

The editorial stresses that the Fed should wait for inflation to

occur before raising rates, and not to jump the gun of anticipating it, which

they did on December 16, 2015 with their 25 bps increase. This was more than

having "egg on their face" as it reflects ignorance and arrogance.

The Fed claimed increased "inflation expectations" when they raised

rates last December, yet there were no signs anywhere of that.

Isn't the Fed's twin "mandates" price stability and

full employment? In this regard the Fed uses the mandates excuse when it's

convenient for them to con the public.

Also, they changed the definition of price stability to mean a

2% inflation rate per year. This is

really a yearly tax on "the people," but it cuts the US debt in half

every 36 years so who cares?

Victor's Conclusions:

The question to be asked is what is the true AGENDA of the Fed?

Consider the statement of Representative Louis McFadden,

Chairman of the House Committee on Banking and Currency in 1930 (emphasis

added):

The Federal

Reserve Bank of New York is eager to enter into close relationship with the Bank

for International Settlements

. The conclusion is impossible to escape that the

State and Treasury Departments are willing to pool the banking system of Europe

and America, setting up a world financial power independent of and above the

Government of the United States....

The United States under present conditions will be TRANSFORMED from the

most active of MANUFACTURING nations into a CONSUMING AND IMPORTING NATIONS

with a balance of trade against it.

- Rep. Louis

McFadden Chairman of the House Committee on Banking and Currency quoted in

the New York Times (June 1930)

What a soothsayer he was!

It seems that what the Fed says and what it does is to fool the

people. Karl Marx once said about people that could manipulated to his

advantage were "useful

idiots."1

Note 1. Karl Marx is often credited with coining the

term useful idiots, because of his statement: My adherents are useful

idiots. However, Lenin and Stalin also used the term "useful idiots.

...

Fed monetary policy has entered "The Twilight Zone." As Rod Serling, the producer and screenwriter

so aptly put it:

"You're

traveling through another dimension, a dimension not only of sight and sound,

but of mind. A journey into a wondrous land whose boundaries are that of

IMAGINATION (emphasis added). That's the signpost up ahead. Your next stop, the Twilight Zone!"

Hello Fed, you're right there now!

Good luck and till next time...

The

Curmudgeon

ajwdct@sbumail.com

Follow the

Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974

bear market), became an SEC Registered Investment Advisor in 1995, and received

the Chartered Financial Analyst designation from AIMR (now CFA Institute) in

1996. He managed hedged equity and alternative (non-correlated)

investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2015 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).