Startup

Funding at 15 Year High While Capital Efficiency Drops Sharply

by the Curmudgeon

The Money Tree Report:

Venture capitalists and other institutional investors put

$17.5 billion into startup companies during the 2nd quarter- the

highest level in nearly 15 years, according to the most recent Money Tree report

from Pricewaterhouse Coopers (PwC) and the National Venture Capital

Association.

As expected, the majority of

the funding went into software and media/entertainment companies. The software industry raked in more VC

funding during the 2nd quarter than in any time in the report's

20-year history. Software investments have led for 23 quarters straight,

according to Tom Ciccolella, U.S. venture capital

leader at PwC.

Some data points from the Money

Tree report:

- VC's invested $17.5 billion in

startups during the quarter. That's the highest since the fourth quarter

of 2000 when VC investments totaled $21.97 billion.

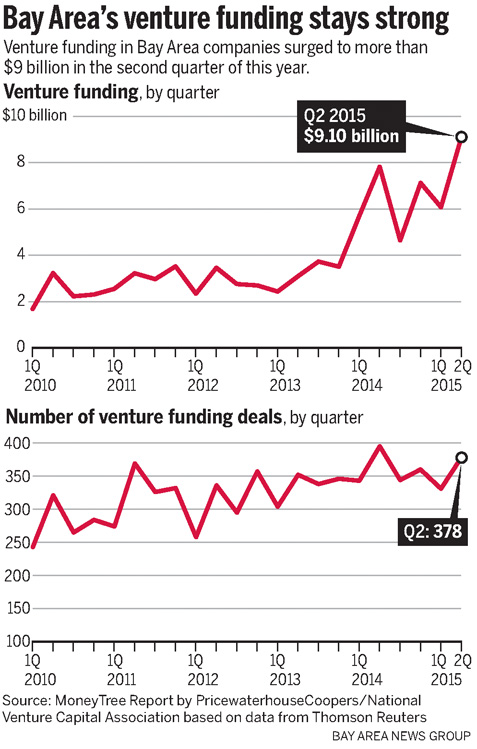

- The $9.1 billion raised by Silicon

Valley startups represents a 50% increase over the 1st

quarter this year and a 16% increase over the same three-month period a

year ago.

- An

interactive chart showing investments by industry can be viewed here.

- Airbnb, the online

marketplace, received the most funding across the board: $1.5 billion.

- Photo

messaging start-up Snapchat raised $537.6 million in VC funding

during the quarter, leading all other software startups.

- HR software developer Zenefits Insurance Services was the

second largest, with a total of about $500 million.

- Pinterest (categorized as media/entertainment) received $186

million in new funding.

Here's a chart showing

Silicon Valley startup investments:

Dow Jones VentureSource Survey:

An even higher amount of VC spending in the 2nd

quarter was reported by Dow Jones VentureSource (password protected

website). The $19.19 billion invested from April through June 2015 was a 24%

increase over a year earlier and nearly matched the fourth quarter of 2000, when

$19.72 billion was invested.

Total investment in the first half of this year was $35.92 billion, more than the $35.71 billion put into U.S. venture-backed companies in all of 2013. Last year’s total was $57.02 billion.

Investors in the second quarter pumped $11.62 billion into

358 late-stage financing rounds, an amount that was 15% higher than in the

second quarter of 2014. The largest

investment was a $1.5 billion financing for home-rental service Airbnb, which

The Wall Street Journal said valued the company at $25.5 billion and

included public-market investors such as mutual-fund firm Fidelity

Investments.

The hot later-stage market has put pressure on deal

valuations at all financing levels, venture investors say. For some VC firms, the bigger rounds mean

fewer investments -- and bigger risks. When investing partner Tomasz Tunguz joined Redpoint Ventures

in 2008, the average investment for the firm was about $3 million to $5

million, he said. Now, it's $10 million.

Capital Efficiency Declines Across

the Board:

Startups are raising more money, but exiting for less than

in previous years, says CB Insights in this blog

post. Between 2012 and 2014, the

capital efficiency ratio for $1B+ exits has been cut in half, according to the

VC/startup investment tracking firm.

When analyzing yearly data, CB Insights found that large

exits are actually becoming less capital efficient over time.

- Between 2012 and 2014, the capital

efficiency ratio for $1B+ exits has been cut in half, dropping from 22x to

9x.

- The capital efficiency of exits in

the $500M-$1B range fell by 46% during the same time period, to 7.5x.

- Exits in the $100M to $500M range

also saw decreased capital efficiency, although the trend was less

dramatic.

For the full period 2009 to 2015 year-to-date, unicorns

stand out as having the most efficient exits, with a median capital efficiency

ratio of 15.3x, more than twice as high as the ratio for exits in the

$100M-$500M range, which had a median capital efficiency of 6.3x.

Comment & Analysis:

The involvement of hedge funds, private equity groups,

sovereign wealth funds, and even mutual funds continues to drive up the price tag

on funding rounds. It's not just VCs in the driver’s seat anymore!

Despite the dollar amount of funding going up, the number of

deals has remained fairly steady – somewhere between 300 and 400 each quarter

in Silicon Valley for the past few years and averaging 1,093 a quarter

nationally, according to the latest Money Tree report. The result is

that a handful of mature private companies are receiving a disproportionate

chunk of the money invested each quarter.

None of them makes any tangible products or real things!

Other Voices:

"The opportunities to disrupt and innovate only happen

every so often, so you need to be there in force," said Jeffrey Grabow, U.S. venture capital expert at consulting firm EY.

"You can't just wade in."

"With software companies continuing to disrupt

entrenched industries and in some cases creating new industries all together,

venture investment into the sector increased 30 percent from the first quarter

to $7.3 billion," Bobby Franklin, CEO of the National Venture Capital

Association, said in a statement.

"As valuations increase and more and more companies choose to stay

private longer, we are likely to see software's share of total venture

investment continue to rise."

"Software companies are easier to get up and running

and easier to scale in comparison to other industries that are a bit more

capital intensive," Tom Ciccolella said.

"Companies are generating significant revenue and changing and disrupting

entire industries ... they are changing the way people interact with different

industries."

Scott Sandell, a managing general

partner at New Enterprise Associates, one of the world’s largest venture firms,

said that valuations of midstage companies and the

amount of capital available to them continue to rise “in ways that make us

really nervous.” He added that his firm

sees lots of companies where “we like all the things we see, but the valuation

is just too high.”

Note: The median pre-money valuation of later-stage

rounds in the first half of this year was $310 million compared with $213.3

million for all last year.

Mr. Sandell said one thing that

worries him is the speed with which deals are getting done. Where two months

was once the norm, especially for later-stage deals, “what we’re seeing now is

sometimes the rounds come together in weeks and sometimes inside of a week,” he

said. His concern is that investors,

including those more accustomed to dealing with initial public offerings,

aren’t getting enough information about the companies they are backing.

Conclusions:

There are several important take-aways

from these three reports on startup investments:

- It's a software, media & entertainment world-

almost ZERO is going into IT infrastructure or electronics/ semiconductors.

- The capital efficiency ratio (which determines ROI)

has declined by >50% for unicorns and a bit less for other

startups. Yet none of the VCs

ever mention that.

- The median valuation of later stage investment rounds

has increased by almost 50% in the last year to $310 M.

- VC's are trying to outbid one another to put money

into “hot startups” so as not to miss the next big thing. That might be looking through the

rear view mirror!

- Deals are getting done a lot faster, with investors

not getting enough information on the companies they are pouring money

into. Is that indicative of a

mania?

As always, we present the evidence and let the reader be the

judge.

Till next time..............

Previous Curmudgeon posts on this topic:

http://www.fiendbear.com/Curmudgeon156.htm

http://www.fiendbear.com/Curmudgeon146.htm

http://www.fiendbear.com/Curmudgeon131.htm

The Curmudgeon

ajwdct@sbumail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2015 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing

article(s) written by The Curmudgeon and Victor Sperandeo without providing the

URL of the original posted article(s).