Unicorn

Valuations Quadruple – Now Worth Almost $500B!

by the Curmudgeon

Introduction:

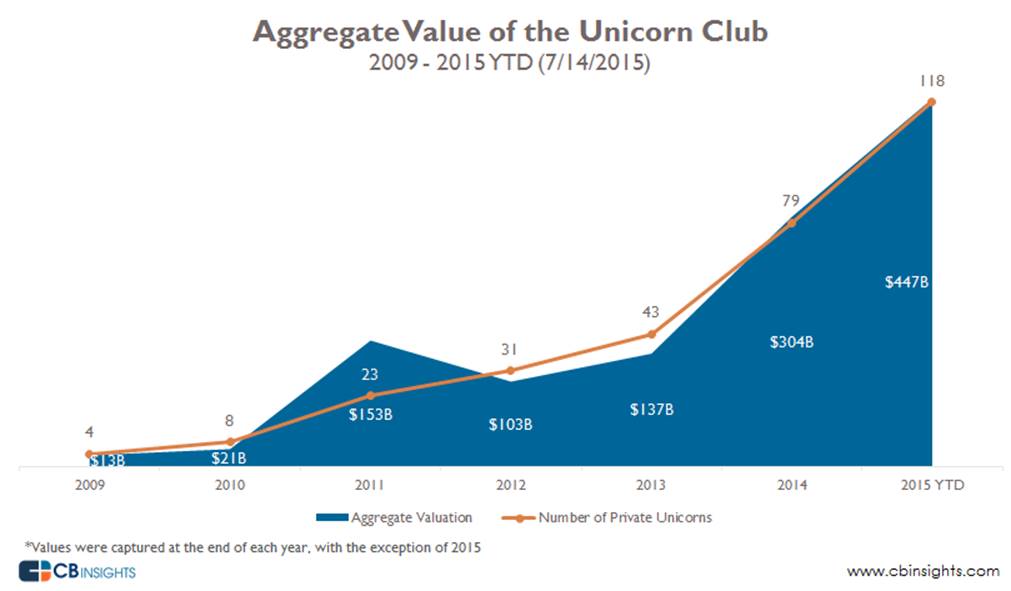

Unicorns (private start-ups worth over $1B each – see Note

below) have quadrupled in total value since 2012.

According to CB

Insights there are 118 private unicorns worth $447B, as of

July 14th, 2015. Nearly 40 start-up

companies joining the unicorn roster so far in 2015.

Note: The use of the term “unicorn” began with a blog from investor Aileen Lee of Cowboy Ventures in late 2013, when there were just 39 of the creatures and an average of four “born” each year. In 2014 the number rose to 48, according to CB Insights. The biggest percentage growth in total unicorn valuation occurred between 2010 and 2011, when those $1B and up valuations jumped by more than 7x due to Facebook’s Series E which valued the company at $80B (and subsequently fell at their IPO the next year).

2015 - The Year of the Unicorn:

2015 has been a stupendous year for growth in the number of

unicorns and their huge valuations.

Unicorns outside the U.S. have greatly contributed to the funding

frenzy. For example, Tiger Global

is making big bets on Indian start-ups. In

five months, the hedge fund has disclosed investments in more than 17 Indian

companies and has participated in rounds which total to about $1 billion.

According to CB Insights:

- 2015 has seen growth of $143B in

combined unicorn valuations year-to-date, a 47% jump over the aggregate

valuation at the end of last year.

- That means 2015 is not too far

from equaling the $167B in combined unicorn valuation added in full-year

2014, and this year is only half over.

- That number of still private

unicorns on the list has increased by 39 in 2015 YTD, a ~50% increase in

the number of unicorns in just ~6.5 months.

- Some $178B of the total $447B in

valuation comes from the 46 non-US companies on the unicorn list.

VC Perspective:

Obviously, Venture Capitalists (VC's) don’t see a unicorn

bubble, because they're the ones that are inflating it. They do see some areas of opportunity for investing.

At a Tech Brainstorm conference in Aspen, CO, Fortune

magazine asked VC's which sectors had opportunity for new

investments. The VC's cited life

sciences, the Internet of Things (IoT), and artificial

intelligence.

Angel Investor:

Unicorn Valuations Not Real

Unicorns may not really be worth as much as they appear to

be, prior to an IPO, angel investor Esther Dyson told CNBC

on July 15th. “The valuations

are not real,” she said. What will pop

the bubble? “It's predictable that it

will be something, but it's not predictable what it is (that will pop the

bubble).”

.

.

The real problem for start-ups considering going public is

there are just too many of them, Dyson said: "It's completely random. Some

get amazing valuations. Some can't raise money. There are too many founders and

CEOs and not enough actual workers."

Other Voices:

Caroline Craig of InfoWorld

writes:

“Yes, this time is different: Private investors will take

the bloodbath when -- not if -- this bubble bursts, the sky-high valuations for

many unicorns crash, and there's no exit strategy.”

Bill Gurley at VC firm Benchmark warns: "We're

in a risk bubble ... we're taking on a level of risk that we've never taken on

before in the history of Silicon Valley startups......I do think you’ll see

some dead startup unicorns this year....Companies are taking on huge burn rates

to justify spending the capital they are raising in these enormous financings,

putting their long-term viability in jeopardy.”

Darius Lahoutifard, founder of Business

Hangouts, accused VCs of being too focused on building unicorns while great

seed projects are denied. "We are not building the future anymore...Unlike

the 2001 bubble, this one is on late-stage private startups. These

billion-dollar startups don't even want to go public because they know they'll

not get the same valuations at IPO. The burst will definitely hurt these companies,

leading many of them to shut down. It will also hurt the venture capital funds

that have heavily invested in them.”

In a running Twitter conversation on the subject, Danielle

Morrill of the research firm Mattermark said

“I’ve narrowed it down to 61 potential dead unicorns. This is the stuff

everyone is talking about but no one will publish.” (That's why the CURMUDGEON columns exist!)

Closing Quote:

Dallas Mavericks owner Mark Cuban, an early dot-com

entrepreneur, wrote on his

blog that the current situation is “worse than the tech bubble of 2000″

because of “angel” investors investing in apps and tech firms with little

scrutiny.

“I have absolutely no doubt in my mind that most of these

individual angels and crowd funders are currently under water in their

investments,” he wrote. “Because there is ZERO liquidity for any of those

investments. None. Zero. Zip.”

We can't say it any better than that!

Till next time...

The Curmudgeon

ajwdct@sbumail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2015 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing

article(s) written by The Curmudgeon and Victor Sperandeo without providing the

URL of the original posted article(s).