In

Search of Unicorns and One-Trick Ponies: Bubble In Private Tech Start-Ups

By the Curmudgeon

Start-up Acquisition of the Week:

Last Thursday, April 9th, LinkedIn paid $1.5B to

acquire online education company Lynda.com. That's by far its largest acquisition

ever! Lynda.com provides video courses

to paying subscribers hoping to learn online, with tutorials on a wide range of

business subjects from Web design to 3-D animation. It’s one of a number of

companies working in this space, including well-known startups like Coursera

and Codecademy that were both founded in the past

five years.

LinkedIn appears to believe in a scenario like this: you

search for a job, see the skills required for that job, and then are directed

to a course from Lynda.com that will train you in those skills. Alternatively,

a recruiter could search for available candidates based on the courses they’ve

taken. You can already add courses to your profile, but courses endorsed by

LinkedIn may carry more clout. Fine

and dandy, but is that worth a cool $1.5B?

Who Says There's a Bubble in "New IT" Start-ups:

Dallas Mavericks owner Mark Cuban last month blogged

that the current tech bubble in privately funded startups is worse than the dot

com bubble of 15 years ago.

Cuban should know. He sold his startup Broadcast.com to

Yahoo! for $5.7 billion, just before the dot com bubble burst. He wrote:

"So why is this bubble far worse than the tech

bubble of 2000? Because the only thing

worse than a market with collapsing valuations is a market with no valuations

and no liquidity."

The key point is that start-up company valuations are

fictitious, based solely on perceived value by lemming-like VCs, angel

investors, crowd source founders, and acquiring companies. Even hedge funds (and some mutual funds) are

getting into the start-up funding business, willing to pay dearly for a piece

of the action as per a Bloomberg piece titled: Hedge

Funds Are Boosting Tech Valuations to Dangerous Heights.

Here's what Zero Hedge had to say about tech

start-up valuations in a blog post titled: Surprise

- Tech Company Valuations Are Completely Made Up.

"Well, now that everyone is jumping on the “there’s

no way that app is worth $50 billion” bandwagon, Bloomberg is out with a

startling revelation: “Snapchat, the photo-messaging app raising cash at a

$15 billion valuation, probably isn't actually worth more than Clorox.”

“So while we thought “valuations” were numbers that

indicate how much something is worth, what they actually are complete shots in

the dark which, if necessary, can be “adjusted” later to reflect economic

realities."

Zero Hedge followed that up with an even stronger

assertion that private tech is in a huge bubble: Tech

Startup Bubble Has America's Retirement Funds Chasing Unicorns.

Examples of "New IT" start-up valuations:

Let's look at a few examples of highly over valued

"new IT1" tech start-ups:

1. Snapchat

is part of a breed of startups with multibillion-dollar valuations, with

investors falling all over themselves to offer financing. Alibaba plans to

invest in the one trick pony company (a mobile app for sending disappearing

photos), at a valuation of $15 billion, according

to Bloomberg.

With Alibaba's investment, Snapchat would be ranked behind

only mobile car-booking application Uber Technologies Inc. and Chinese

smartphone maker Xiaomi Corp., according to data compiled by researcher

CB Insights. Xiaomi is pegged at $46 billion, while Uber’s latest round valued

it at $41.2 billion.

2. Last October,

Facebook completed its $22 billion acquisition of WhatsApp, a mobile

messaging app company (note that you can send mobile texts for free using

Google Voice).

3. Web storage start-up Dropbox has plenty of competition, including Google, Microsoft, Box and other young companies in the same space. Dropbox was reportedly valued at $10 billion when it raised $350 million in its Series C funding round. CBC Insights (which maintains we're in a private tech boom--not a bubble) thinks Dropbox's is way too pricey. In a blog post titled: The Dropbox Valuation Is Irrational they wrote:

"Assuming Box’s multiple doesn’t expand, Dropbox

would need to grow its annual sales to ~$1B (or 150%) just to justify its

private market valuation of $10B. This would mean it would trade like Box at

~10x sales."

4. Let's not forget

the granddaddy of U.S. "new IT*" tech start-ups--Uber. CBC Insights wrote in a blog post:

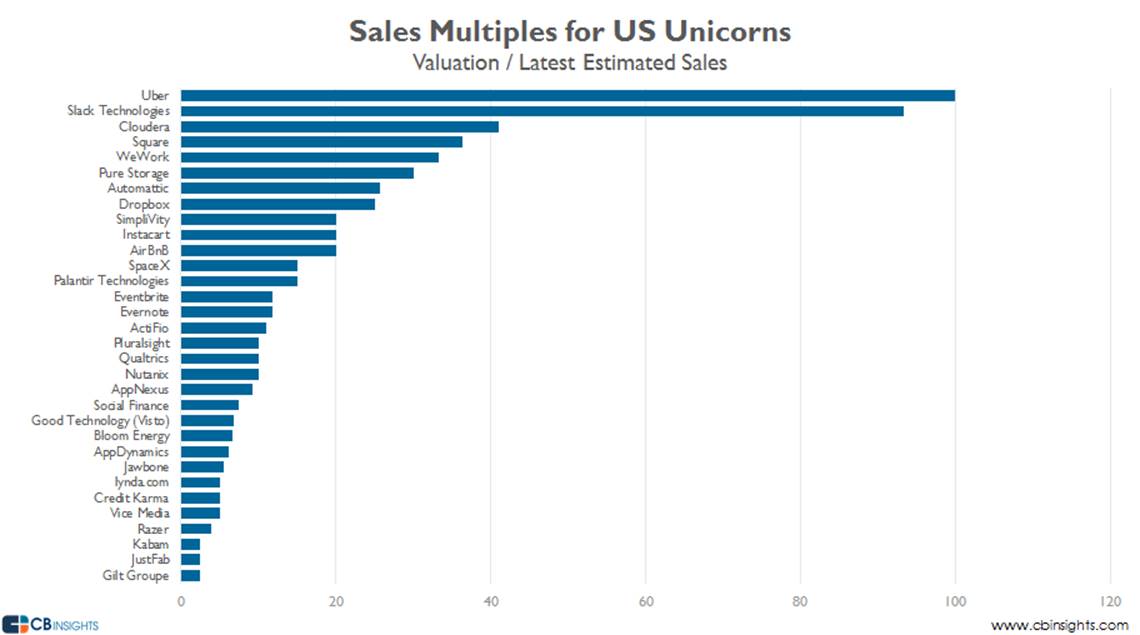

"Uber had the highest sales multiple of any of the

Unicorns, as the $40B valuation company’s last rumored net revenue figure was

$400M (on about $2B of gross revenue). And while this may seem very high, for a

company growing as fast as Uber, this sales multiple may be viewed as

completely rational by investors."

5. In the above referenced blog post, CBC Insights noted:

"Slack also sits atop the price/sales multiple

rankings as well along with Uber driven in part by its explosive growth (which

has given it a lofty valuation) with still relatively modest revenue."

Slack is yet another one trick pony with an

internal communications/messaging app designed to allow businesses to chat and

collaborate at work. It's in the process

of raising a new funding round that values the company at $2 billion, according

to Bloomberg.

Just one year old, Slack is used by about 500,000

people every day, a number that is rapidly growing. Revenues not disclosed and for sure no

profits. Is a one year old company

worth $2B? Here's what Slack CEO Stewart

Butterfield told

Business Insider:

“We still have a long way to grow to justify the

valuation. But it’s largely on the basis

of the trajectory that we’re on, and most of all, because that’s just been

happening organically.”

6. Let's close with

Pinterest, the social bookmarking site which is now worth north of $11

billion. And there's more: the company is still seeking an additional $211

million to close its latest funding round, according to a regulatory

filing.

[Pinterest is a website that allows you to "pin"

things online, just as you would pin them on a real life bulletin board, but

instead, Pinterest saves all of your pins on your account so that you can

access them easily.]

Pinterest’s now-astronomic valuation, which was previously

pegged at $5 billion following a $200 million Series F round last May, makes it

the sixth most valuable private company in the world, according to the Wall

Street Journal -- behind Xiaomi ($46 billion), Uber ($41.2 billion), Palantir ($15 billion), Snapchat ($15 billion) and SpaceX ($12 billion).

NY Times: The Rise of the ‘Unicorns’

"Venture capitalists invest in companies in search of

breakout hits that attract millions of users, billions in sales and enormous

valuations. These rarities, called unicorns, have grown in size and

number as investors chasing returns have bid up their value. More than 70

technology companies are now valued at $1 billion or more, and the number is

growing quickly. Several of the best-known Silicon Valley companies are worth

over $10 billion."

Note 1. "New IT" is software for

cloud, social, big data, e-commerce, mobile apps, etc. New IT companies don't make tangible products

or design hardware. They don't do real

engineering. Almost all the tech start-ups are in this category. An exception is GoPro (now public) which

makes "the world's most versatile cameras."

References:

1. For the complete list of highly valued start-ups along

with interesting graphs, click

here.

2. We highly

recommend readers also check out WSJ's Billion Dollar Startup Club.

3. Below are the sales multiples for the top U.S. "unicorns." Note how Uber and Slack are so far ahead of all the others.

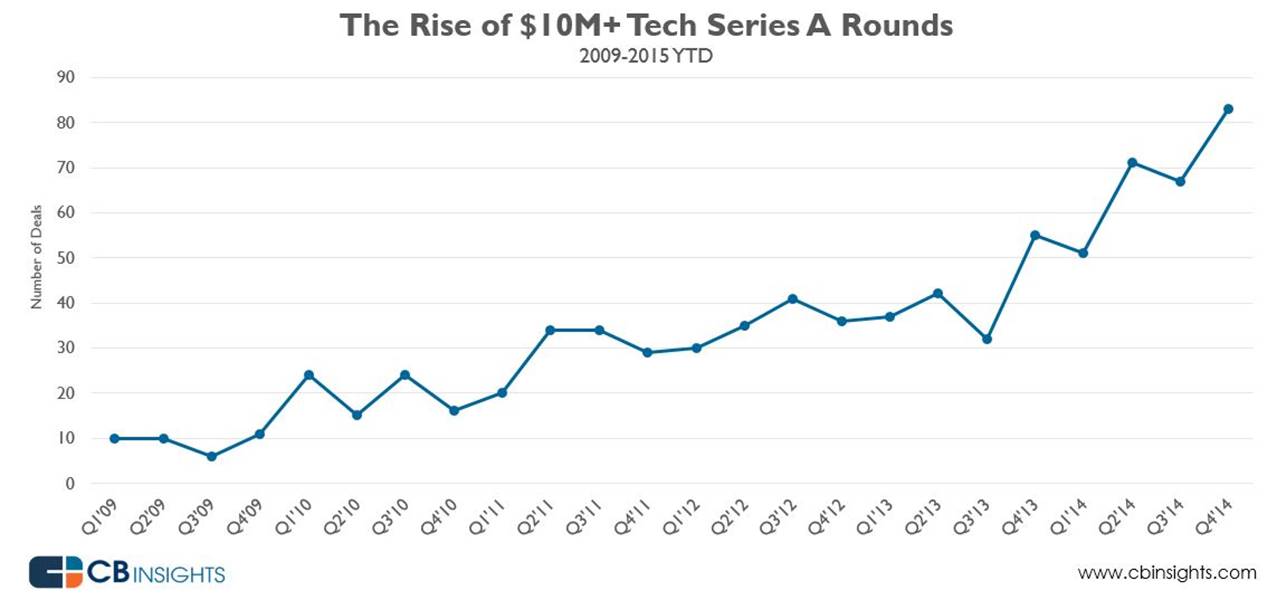

4. The graph below depicts the

number of series A (1st round) tech start-up deals

above $10M.

5. We close by

referring the reader to this provocative blog post: More than 10

Signs of a Tech Bubble.

Till next time...

The Curmudgeon

ajwdct@sbumail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2014 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing

article(s) written by The Curmudgeon and Victor Sperandeo without providing the

URL of the original posted article(s).