U.S. Reached its Debt Ceiling; Catastrophic Default

Awaits if it Isn’t Raised by Summer

By the

Curmudgeon with Victor Sperandeo

Introduction:

We noted in last week’s column that

Treasury Secretary Janet Yellen had told Congress that the U.S. will hit its

debt limit on Thursday, January 19th and that the Treasury

Department would begin “taking certain

extraordinary measures to prevent the United States from defaulting on its

obligations.”

The U.S. Congress places a limit on the amount of

debt the country can issue, with a simple majority in the House and Senate

required to lift it. That cap, known as the “debt ceiling,” [1.] is currently $31.4 trillion. It needs to be raised to allow the U.S. to borrow to pay for obligations it has

already committed to, such as funding Social Security, Medicare and welfare

programs, interest on the national debt and salaries for the military and

government officials.

Note 1. The debt ceiling, also called the debt

limit, is a cap on the total amount of money that the federal government is

authorized to borrow via U.S. Treasury securities, such as bills and savings bonds,

to fulfill its financial obligations. Because the United States runs very large

budget deficits, it must borrow huge sums of money to pay its bills.

Institutional investors and bank economists are using

financial models to predict when the United States will run out of cash and not

be able to borrow. They are assessing what it could mean if the government is

unable to pay some of its bondholders and the country defaults on its debt.

We take a closer look in this article.

Investment

Banks Weigh In:

Ralph Axel, rates strategist at Bank of America, believes that a default in late summer or early

fall is coming. “We think it is likely

that by late summer or early fall, the federal government will temporarily be

forced to default on a portion of its daily obligations for a time ranging

between a couple of days to a few weeks,” he wrote in a commentary.

“If so, this would represent the first time in

history that the U.S. would default on any of its obligations due to the debt

ceiling law. We think such an event would include a fall in equity and bond

prices, potentially testing the U.S.

Treasury market functioning and liquidity.”

That could

be quite an understatement. It wouldn’t be

surprising if investors hit the panic button and dumped assets by the bucketful

if the Treasury market froze. That

happened in earnest after the coronavirus pandemic started in March 2020. Trading in the Treasury market broke down as

investors rapidly sold government debt which set off a chain reaction of asset

dumping, bedlam that stopped only as a result of Fed intervention.

Goldman

Sachs called the possibility that the U.S. government

would default on its bills a “greater risk” than at any time since 2011. When

the nation approached the brink in that debt ceiling episode, its credit rating

was downgraded, and wild market gyrations helped to force lawmakers to quickly

come together to raise the debt ceiling.

T.D.

Securities analysts think that the credit rating on U.S. debt

is likely to be lowered if negotiations go badly, which could spook some

investors. S&P Global Ratings downgraded U.S. debt in 2011 [2.], but other

major rating agencies still award the sovereign their top assessment. They also

expect that investors and traders will sell out of risky assets like stocks and

junk bonds if a default occurs, while fleeing to the perceived safety of longer

maturity Treasury bonds.

Note 2. In the month before

the debt ceiling was raised in the summer of 2011, U.S. T-bills swiftly fell in

value, pushing their yield — indicative of the government’s cost of borrowing

for three months — sharply higher. Stock prices fell, while the 10-year

Treasury note rose in value (yields fell), because it was seen by investors as a safe place to park their cash.

Victor’s

Comments:

In 1991, when Ross Perot ran for U.S. President, he

made the then spiraling U.S. debt an election issue. That year, the stated U.S. debt was $3.6

trillion vs. $31.4 trillion today (an increase of over 900%). It’s actually much worse than that-- the U.S.

debt explosion began 20 years earlier!

In August 1971 the U.S. went off the International

Gold Standard (aka the Bretton Woods Agreement) The “On Budget” Debt was $398

billion. At $31.4 trillion, today’s debt is 79 times higher! And that’s not

counting “off budget” items or unfunded liabilities. That is a compounded

yearly rate increase of 8.76% for 52 years.

Why was this

stupendous increase in the U.S. debt tolerated?

Why isn’t it a huge issue now?

The answer is that the U.S. Congress is allowing huge

budget deficits to be financed via a seemingly unlimited amount of fiat (paper

currency) dollar denominated debt.

The 14th amendment, section 4 of the U.S.

Constitution does not allow for a legal debt default:

“The validity of the public debt of the United

States, authorized by law, including debts incurred for payment of pensions and

bounties for services in suppressing insurrection or rebellion, shall not be

questioned. But neither the United States nor any State shall assume or pay any

debt or obligation incurred in aid of insurrection or rebellion against the

United States, or any claim for the loss or emancipation of any slave; but all

such debts, obligations and claims shall be held illegal and void.”

Section 4 of

the 14th Amendment was

intended to reassure holders of U.S. government debt incurred during the

ruinous conflict that all obligations would be met (except for those incurred

by the Confederacy). Whether the

section’s provisions even apply to current circumstances and the wrangling over

the “debt ceiling” is a vexed question at best.

The only way this would change is for foreigners to

largely lose confidence in the dollar and sell it OR for the amendment to be

repealed.

As long as

people and institutions continue to hold U.S. dollars (the world’s reserve

currency), the debt ceiling will be raised continuously.

Eventually, the U.S. will suffer the same fate as

every other nation that increases its fiat currency without any real backing --

confidence in the dollar will be lost, the currency will be sold, and hyper-inflation will result.

From a July 8, 2013 Curmudgeon post:

“Rather than default on debt, Victor

feels that governments will resort to printing money to fight the next global

recession and that will quickly lead to hyper-inflation.”

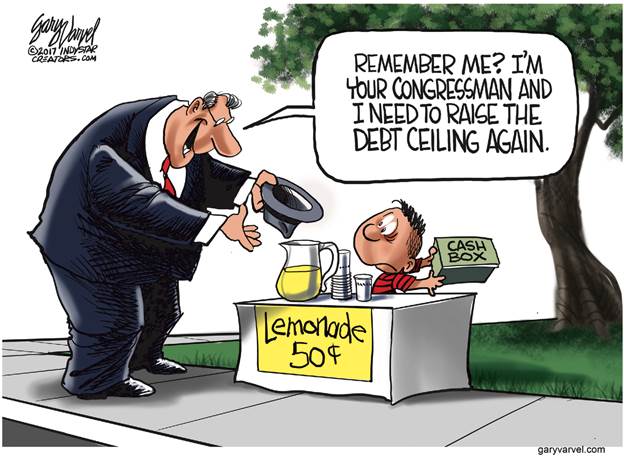

Cartoon of the Week:

……………………………………………………………………………………………….

What Might

the U.S. Treasury do to Prevent a Financial Market Meltdown?

Ms. Yellen said last week that she plans to take two

steps to buy lawmakers more time to reach a debt limit deal. The U.S. Treasury will redeem existing

investments and suspend new investments in the Civil Service Retirement and

Disability Fund and the Postal Service Retiree Health Benefits Fund. And it

will suspend reinvestment of the Government Securities Investment Fund of the

Federal Employees Retirement System Thrift Savings Plan.

If the initial steps that Ms. Yellen has outlined are

not enough, there are other tools at her disposal. For example, the Treasury

could prioritize payments,

something that was considered in past debt limit debates and which lawmakers

might push for. By paying back bond holders first, it could theoretically

forestall financial market disaster.

However, the

trade-offs could be crushing, forcing U.S. government officials to decide

between paying financial markets, disability rosters or health care systems.

Another option would be to suspend certain types of

investments in savings plans for government workers and health plans for

retired postal workers. The Treasury can also temporarily move money between

government agencies and departments to make payments as they come due.

A 2012

Government Accountability Office report said that to manage debt when the

borrowing cap is in limbo, the Treasury secretary could suspend investments in the Exchange Stabilization Fund (a large

amount of dollars that can buy and sell currencies and provide financing to

foreign governments).

The Treasury Department also oversees the Federal Financing Bank, which can issue

up to $15 billion of its own debt that is not subject to the debt limit. In a

debt ceiling emergency, Ms. Yellen could exchange that debt for other debt that

does count against the limit.

The Risks of

“Extraordinary Measures:”

Delaying the debt limit does not come without costs.

“Debt

limit impasses have also repeatedly disrupted implementation of Treasury’s cash

management policy — with knock-on effects for money markets,” Joshua Frost,

assistant Treasury secretary for financial markets, explained in a speech in

December at the Federal Reserve Bank of New York’s Annual Primary Dealers

Meeting.

“There were several instances when we didn’t have

sufficient cash on hand to meet even our next-day obligations. During the

course of that impasse, Secretary Yellen wrote eight separate letters to

Congress regarding the importance of acting to address the debt limit.”

Uncertain

Timeline for a U.S. Debt Default:

Christopher Campbell, who served as assistant

Treasury secretary for financial institutions from 2017 to 2018, said that

because there so many variables in play, it is often difficult to give a

precise estimate of the grace period

between when the debt limit is breached and when the United States potentially

defaults on its obligations.

“It depends on receipts, it depends on how the

economy is doing, it depends on how companies are doing,” Mr. Campbell said.

“There are some shell games and accounting games that go into it.”

In her letter to Congress, Ms. Yellen said ominously that

“Treasury is not currently able to provide an estimate of how long

extraordinary measures will enable us to continue to pay the government’s

obligations.” She added that it is unlikely that cash and extraordinary

measures will be exhausted before early June.

That aligns with Bank of America’s reckoning of a late summer or early

fall U.S. debt default.

End Quote:

“You can’t put Humpty Dumpty back together again if

you default on the debt.” …. William C. Dudley, the former president of the

Federal Reserve Bank of New York.

…………………………………………………………………………………..

Be well,

stay healthy, warm, and dry. Please let us know your interests for 2023. Till

next time…...

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2023 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).