Junk Bonds, Hot IPO Market, and “Unexpected Events”

Compared

By the Curmudgeon with Victor Sperandeo

Introduction:

Last week's Curmudgeon post, Victor noted the tight credit spreads and

low yields on junk bonds are signs of extreme “investor” complacency. We expand on that theme in this article and

also look at the resurgent IPO market in the light of GoPro's

successful debut this past week. Victor

weighs in with his insightful comments and analysis, particularly related to

the current IRS scandal becoming a lot bigger.

He then wraps up by challenging the reader to think of "what could

possibly go wrong" amidst all the warning signs being ignored by the

financial markets.

Note: The

Curmudgeon and Victor Sperandeo put quotes around "investor," because

we believe that term has lost its meaning.

The current financial markets are dominated by asset managers who are

"investing" other people's money and are subject to tremendous

pressure to beat their benchmark. The

sense of fiduciary responsibility seems to be a thing of the past. The public mistakenly believes that their

asset managers can protect them from huge losses during a severe market

decline. We think that view is naive

and preposterous.

Junk Bonds

are No Longer High Yield:

Junk bonds are

low rated, corporate debt instruments with the least attractive balance sheets

and therefore the highest risk of default.

They're most vulnerable to declines in principal as fears of default rises

in a weak or stagnant economy like we've had for the past several years. Yet this past week, the Merrill Lynch 100

High Yield Index was 4.33% [Source: WSJ Data Center] while Barclays

Capital High-Yield Index was 4.83% [Source: USA Today]. Those are the lowest yields for junk bonds in

history! Meanwhile, the number of rating

downgrades for junk bonds is outpacing the number of upgrades. Could that now be a bullish sign in the

convoluted investment environment we're in?

The Curmudgeon

finds it remarkable that “investor” memories are so short. The fear of a huge decline in asset values

has been completely forgotten. In 2009,

"investors" were deathly afraid of junk bonds as yields spiked to

over 20% (see chart below). In the

2007-2008 junk bond meltdowns, the average junk bond mutual fund fell over 30%,

including reinvested interest payments. In contrast, the average

intermediate-term government bond fund rose 2.33% [Source: USA TODAY].

Today, with

yields of less than 4.5%, "investors" can't get enough junk. Merrill Lynch's High Yield 100 Index is up

over 5% this year while junk bond funds continue to attract new money. High-yield fund inflows totaled $437 million

in the week ended June 11th, according to Lipper and $2.8 billion over the past

six weeks.

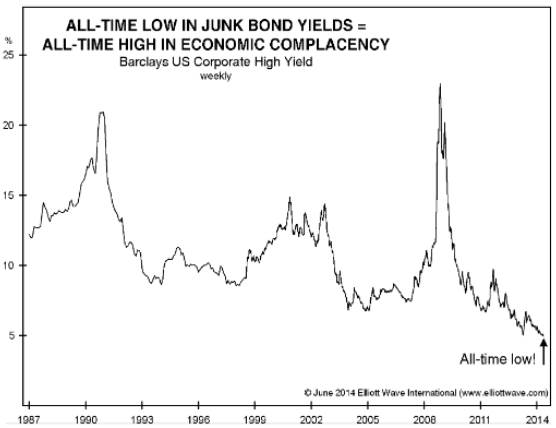

The chart below

illustrates extraordinary complacency (or lack of fear) with junk bond prices

at record highs (i.e. yields at record lows).

Chart

Courtesy of Elliott Wave International

Another problem

emerges in serious junk bond sell offs.

When everyone heads for the exits, fund managers must sell bonds to pay

redeeming shareholders. But in a panic, there are no buyers. The lower quality junk bonds become totally

illiquid. Managers must sell their highest-quality bonds, often at steep price

reductions, to meet redemptions. As a result, the overall quality of the bonds

in the fund's portfolio deteriorates, leaving shareholders with an even riskier

investment--one more vulnerable to future price declines.

As Victor and I

have repeatedly stated, an "illusion of safety" has been created by

the Fed (and foreign central banks) which has caused “investors” to ignore

numerous financial, economic and geo-political warning flags (i.e. bells

ringing) that in normal times would cause them to nervously sell "at

risk" assets and head for the sidelines in cash.

IPO Market

Heats Up and Will Get Hotter this Summer:

GoPro's successful

IPO this past week was the largest public market debut by a consumer hardware

company in over two decades. The San

Mateo, CA based videocam gadget maker raised $427.2

million to become largest consumer electronics IPO since Duracell, which went

public in 1991 and raised $433 million.

Out of 53 companies from Silicon Valley that went public since January

2013, GoPro raised more money than all but Twitter.

As of

Thursday's market close, GoPro had a valuation of $3.86 billion, tying it with

San Jose-based semiconductor company Atmel as the 58th largest market cap among

all Silicon Valley tech firms, according to an analysis by the San

Jose Mercury News.

Many analysts say

that Go Pro has warmed up the market for bigger IPOs, such as Alibaba, and emboldened tech firms to price their shares

higher. It's likely a prelude to what

could be the busiest summer for IPOs in years.

"The GoPro

IPO is a great sign for the IPO market in general, and now market conditions

are great for Alibaba to come (public) in early

summer," said Matthew Turlip, senior analyst at

Privco. The successful GoPro debut may also begin to push

up the price on public offerings, Turlip added.

"The deal

activity has been just huge, and it's been broad-based—[real-estate investment

trusts], energy, biotech, tech—so we've been participating quite a bit,"

said David Chalupnik, head of equities at Nuveen

Asset Management, which oversees $120 billion.

"This is a

great year to IPO," said Jacqueline Kelley, who oversees U.S. IPOs for

research and consulting firm Ernst & Young. "It's not just

companies that are mature businesses. This market is open for innovation and

really welcoming entrepreneurs," she added.

In June 2014,

31 companies have floated shares for the first time in the U.S., raising $9.2

billion, according to Dealogic. By both the number and dollar volume of

offerings, that marks the most active month since October. This month, 81% of IPOs have priced within or

above the company's expected range.

91 companies

went public in the 2nd quarter of 2014- up from 62 during the same quarter last

year and 33 in 2012, according to a report out Thursday from Ernst &

Young. In this year through Monday,

there have been 144 U.S. IPOs raising $30 billion. That puts the IPO market on

pace for the busiest year since 2000, both by dollar volume and number of

deals, according to investment research and data provider Dealogic. For the week ended Wednesday, 21 companies

had filed initial IPO paperwork, according to Renaissance Capital.

"We are

experiencing one of the rare instances of an IPO market that can support a very

full and varied collection of companies from different sectors and of different

sizes and stages of development," said James Palmer, head of Americas equity capital markets at UBS.

The Curmudgeon

must be having a senior moment, as he's sure he's seen this movie play

before. It was titled, "The DOT

COM Boom & Bust." Does

anyone remember pets.com?

Victor's

Comments:

The very low

yields on junk bonds and the buoyant IPO market are strong indications that the

tolerance for market risk is very high.... One indicator means nothing in market

analysis. What counts is a number of historically correlated measures of high

risk vs low risk markets.

When a company

goes public, management and VCs either want to cash out of that investment or

raise capital to expand operations.

Today, when companies can borrow at the cheapest rates in U.S. history,

why go public? If you are a private

company, have a good business and need capital for future growth, you can

borrow at ultra-cheap rates.....Unless you want to transfer equity risk to

someone else (the "investors" who buy your IPO shares), because you

believe that the economy will be weak in the future and the IPO window of

opportunity will close.

According to

this week's Barron's, the S&P 500 trailing P/E ratio is 19.57, while

the S&P 500 Industrials P/E is 20.52.

I don't buy into "forward P/E's," because the projections of

future earnings is soothsaying or pure guess work. No one knows what the future earnings and/or

P/E ratio will be? Therefore, the

comments of $116.00- $132.00 of future S&P 500 earnings are very naive,

IMHO.

Also, the

"Quality" of earnings is critical ... Firing and/or laying off

employees, buying back stock (especially

with borrowed money), accounting tricks/shenanigans, reshuffling operations to lower tax rates in

different countries lead to higher after

tax earnings per share, but the quality of earnings is very low. That is not what "investors"

should pay 16-20 times earnings for.

Curmudgeon

Note:

IBM has been

called the poster child of such financial engineering that artificially boosts

after tax earnings per share. This

weekend Barron's reported its list of top 100 respected companies. IBM fell to number 52 this year, down from

number 10 in 2013 and number 2 in 2012. "Investors"

no longer seem willing to cheer the company's negligible top-line growth or

earnings-per-share gains that owe largely to stock buybacks and accounting

tricks.

This topic was

comprehensively covered in the Curmudgeon post titled, "Managed Earnings, Tech Bubble

Talk, and IPOs with No Earnings."

We think this

market is currently in "weak hands" ......There are probably many

"investors" who are prepared to sell on a moment’s notice if an

"unknown event" occurs. This

would be an event that the Fed couldn’t counteract with easy or free

money. Such "unknown events"

come in many forms.

For example,

1973 was expected to be a very good year for the U.S. stock market, following a

solid 15% advance in 1972. In early

January 1973, Time magazine reported

that it was "shaping up as a gilt-edged year for the stock

market." Yet the market fell in

roller coaster fashion that year (the S&P 500 was down 14.66%, with a P/E

of 18.08 on January 1, 1973). The

decline was largely due to the OPEC oil embargo which caused huge lines

at gas stations and led to sharply higher inflation. The market had to contend with two other

"unexpected events" -- the Watergate hearings and Vice President's

Spiro Agnew's resignation.

The 1973 stock

market declined off a January 11th all-time high, rallied off an August low,

but then declined in earnest after Vice President Spiro Agnew was forced to

resign on October 10, 1973. That was

after the U.S. Justice Department uncovered widespread evidence of his

political corruption, including allegations that his practice of accepting

bribes had continued into his tenure as Vice President.

In 1974, the

market fell again (the S&P was down 26.47%, with a P/E of only 11.68 on

January 1, 1974). That decline was

primarily due to "Watergate" and accelerating inflation which had its

roots in the Arab Oil embargo of the previous year. Measured by the CPI, inflation jumped from

3.4% in 1972 to 12.3% in 1974.

Victor

Personal Note: I

successfully traded on the short side of the market during that 1973-74 time

period. My bearish bias was predicated

on President Richard Nixon causing a crisis and the question of what would

happen to the Constitution when the "crisis" actually occurred.

Curmudgeon

Counter Note: Like so many other non-professional traders,

I was mostly a buy and hold investor that suffered both financially and

psychologically during the great bear market of 1973-74. For many years thereafter, I was skeptical

that any stock market rally could be sustained.

Fiendbear Counter Note: The Fiendbear was just a cub in grade school but he did study

this particular bear market a while ago. You can see a summary of the 1973-74

bear at this link.

Watergate

and IRS Scandals Compared:

The

"Watergate" hearings and cover-up talk dominated the news during the

1973-1974 bear market. It was a simple

burglary of strategy papers (on June 17, 1972) at the Democratic National

Committee headquarters at the Watergate office complex in Washington, DC. President Nixon resigned (rather than be

impeached) on August 9, 1974 after he was caught as a liar and cover-up

leader--2.25 years after the crime had been committed.

Let's compare

"Watergate" to the IRS scandal of today. It looks highly likely that lies and an IRS

cover-up may have also occurred. This is

far worse a crisis, in my view. If proven

true, the IRS will be seen as discriminating against Conservative groups like

the Tea Party in order to "directly sway" the 2012 elections, while

also infringing on the Constitutional rights of U.S. citizens. Lois Lerner -- the IRS official who was

involved and pleaded the Fifth Amendment - is in the category of many mafia

bosses, IMHO.

Libertarian

Wayne Allyn Root thinks that Obama might be involved in the IRS-Tea Party

affair. He wrote in a blog

post:

"The real

scandal is that this was a widespread criminal conspiracy by the Obama White

House to use the IRS to target, persecute, intimidate and silence Obama’s critics

and political opposition.......Congress needs to ask Lois Lerner and other IRS

officials about the targeting of individual critics of Obama…good Americans

with names and faces and families…who they tried to destroy and

intimidate…people like me. That story will resonate with the American

people."

In light of the

above, we call your attention to a July 10th IRS

hearing presided over

by Judge Emmet Sullivan. That judge reportedly hates corruption and

has the power to force the IRS to answer questions they avoided during

Congressional testimony.

A few quotes on

this issue are well worth reading at this time:

“Internal Revenue

Service officials will have to explain to a federal judge on July 10th why the

tax agency didn’t inform the court that Lois Lerner’s emails had been

lost." ...The Washington Examiner.

“The IRS is

clearly in full cover-up mode. It is

well past time for the Obama administration to answer to a federal court about

its cover up and destruction of records.”…Judicial Watch President Tom Fitton.

“We the people

are the rightful masters of both Congress and the courts, not to overthrow the

Constitution but to overthrow the men who pervert the Constitution.”…Abraham

Lincoln

Conclusions:

Will the IRS

scandal be the "unexpected event" that trips up the market? Or will it be from geo-political tensions

that become a full-fledged war (e.g. Sunni militants vs. Shia in Iraq and

Syria)? No one really knows. Yet there are so many warning signs pointing

to danger that are being ignored by the markets. And so it goes...... until it isn't the same

anymore.....

Till next

time........................

The Curmudgeon

ajwdct@sbumail.com

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2014 by The Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing

article(s) written by The Curmudgeon and Victor Sperandeo without providing the

url of the original posted article(s).