Managed

Earnings, Tech Bubble Talk, and IPOs With No Earnings

By the Curmudgeon

Author's

Note: Victor has been out of the country for most of the

past week and so was unable to contribute much to this article (see his

"comment from the airport" at the end). He will be back next week with his insightful

comments and observations along with a few history lessons.

Introduction:

We examine

several themes in this article: 1]

Reported corporate earnings, sales and the weather, 2] Tech Bubble comments by

hedge fund manager David Einhorn, and 3] IPOs without earnings nearing their all-time

peak in February 2000. The combination

of these issues leads us to believe the stock market is living on "Fantasy

Island," with a tremendous amount of risk that's not reflected in current

stock prices.

The Earnings

Mirage:

On the surface,

the earnings season doesn't look too bad this quarter. According

to FactSet, of

the 240 companies that have reported earnings to date for Q1 2014, 73% have

reported earnings above the mean estimate and 53% have reported sales above the

mean estimate. But looking beneath the

surface reveals a very different picture.

·

FactSet

reports that the blended earnings growth rate for Q1 2014 is only 0.2%. The

blended growth rate combines actual results for companies that have reported

with estimated results for companies that have yet to report. This marks the first time that the earnings

growth rate for Q1 has been in positive territory since the week ending on

March 14 (also 0.2%). Is that something

to cheer about?

·

For

Q2 2014, 36 companies have issued negative EPS guidance and 15 companies have issued positive EPS

guidance. This continues the trend of

managed earnings (more on this topic below).

·

53%

of companies have reported actual sales above estimated sales while 47% have

reported actual sales below estimated sales. The percentage of companies

reporting sales above estimates is below both the 1-year (54%) average and the 4-year average (58%). We maintain that after years of cost cutting

to boost profits, companies must now show top line/sales growth to increase

real earnings and thereby justify very high stock valuations.

·

In an

article titled An

Improving, But Still Weak Earnings Picture, Zacks Investment

Research estimates that overall earnings will be down 0.9% for the

quarter compared to last year and down 4.6% from last quarter.

We have

maintained for some time that reported "after tax earnings per share"

are higher than "real earnings." That's due

to accounting tricks, untaxed overseas profits, and (for companies buying back

shares) fewer shares outstanding.

Moreover, companies "manage earnings" by providing

lower guidance which they know they can beat.

For example, the estimated earnings growth for Q1 2014 was negative

at -1.2% on March 31st, according to FactSet.

That was then followed by upside earnings "surprises" and

upward revisions to earnings estimates, led by the Utilities sector. How could any serious analyst not realize

this charade?

Zack's Sheraz

Mian commented on corporate guidance and managed earnings:

"There is

still plenty that is disappointing about the Q1 earnings. The most notable

disappointing aspect of the Q1 earning season thus far is the lack of any

improvement on the guidance front. Management guidance has been on the weak

side for almost two years now, keeping the revisions trend firmly in the negative

direction. We haven’t seen any improvement on the guidance front thus

far..."

“We’ve had some

good earnings announcements, yes, but the expectations were very low.

The broad picture is still weak.

Guidance for the second quarter and beyond remains tentative to the weak

side,” Mian added.

Jim Reid, macro

strategist at Deutsche Bank said, “Whilst earnings per share expectations were

lowered as we entered earnings season, it’s still been a relief to the market

that we’ve had a large number of ‘earnings beats.'” Again, we ask: who's kidding whom?

In a USA

TODAY article titled Earnings

are a Mirage, Matt Kranz wrote:

"Apple,

Facebook and Gilead can’t do it alone. Just over 35 companies in the S&P

500 contribute more than a third of the index’ total profit, so how these

companies fare as a group is what’s important." Kranz says the reasons why investors aren’t

ready to start celebrating a "miraculous turnaround" in corporate

profit include:

* Low

expectations. Companies love to temper expectations, so it’s easier to beat

at reporting time. Apple was a classic example. Analysts had expected it Apple

to report just 0.8% growth for the quarter, minuscule growth for a tech

company. The fact Apple beat is simply a relief, not a point of victory, says

Moshe Cohen, professor of finance at Columbia Business School. “Results were

better than feared,” he says.

* Unique

issues. Gilead Sciences’ results came in 62% ahead of expectations, getting

and got the Wall Street’s attention. Shares of the biotech stock are up 4% this

week. But much of its advance is due to its breakthrough hepatitis drug, not

the economy, Mian says. Also, Apple’s stock is getting a bump largely due to

financial maneuvers; it’s using, including a stock split, dividend hike and a

stock buyback, Cohen says, not new products.

* Financial

problems. One of the biggest anchors is financial firms, expected to report

9.3% lower first-quarter earnings, says S&P Capital IQ. Financial companies

account for about 18% of expected earnings.

We've

previously called attention to corporate profits growing much faster than the

real economy and that stock prices were increasing even more than profits. Please see: How Long Can Profits Continue

to Outpace Sales, Productivity, and GDP Growth?

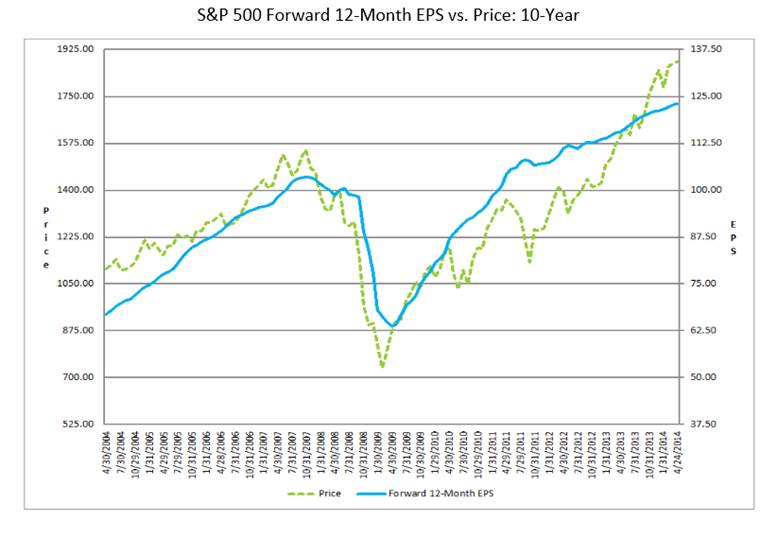

That's clearly

depicted in this chart from FactSet:

Bottom

line: We think that 2014 is yet another year of

cost-cutting, accounting gimmicks, and share buy-backs to boost earnings per

share, with no actual growth in real earnings over the previous year. Yet the stock market is up (on average) over

30% from where it was last year on only a 2.9% overall growth in EPS! Should anyone worry about that or is it

already priced into the market? You be the judge!

Whither the

Weather?

For two

consecutive quarters, companies and analysts have been using bad weather as an

excuse for the slow growth economy and lower earnings. According to FactSet, 93 of the 154 companies

that have reported Q1 earnings as of last Wednesday (April 23rd) mentioned the

weather during their earnings conference calls. Talk of the elements dominated

at FedEx, whose call was littered with 41 mentions of the weather, according to

the firm. Railroads Union Pacific and Norfolk Southern tied for second place at

39 apiece. UPS, McDonald's, Ford,

Verizon and Dunkin' Donuts also cited the weather as a headwind in their Q1

earnings reports.

That extends

the trend seen a quarter earlier, when companies blamed the weather for

disappointing fourth-quarter results twice as much as they did a year earlier,

according to FactSet. To us, this is yet another trick to fool shareholders

into thinking things really are better than they seem.

David

Einhorn - Tech Bubble Redux:

The "Tech

Stock Bubble" debate was renewed this week by Greenlight Capital’s

David Einhorn.

Note: We highly recommend you read the bottom

of page 2 and all of page 3 of Einhorn's April

22nd letter to his hedge fund's limited partners.

In that letter,

Einhorn wrote that "there is a clear consensus we are witnessing our

second tech bubble in 15 years. What is

uncertain is how much further the bubble may expand and what will pop

it." Einhorn said that this second

tech bubble is "an echo of the previous tech bubble, but with fewer large

capitalization stocks and much less public enthusiasm." The Greenlight hedge fund went short a

basket of high-flying momentum stocks. Einhorn wrote that "we estimate

there to be at least a 90% downside for each stock (in his bubble basket of

shorts) if and when the market applies traditional valuations to these

stocks."

The hedge fund

manager also complains about companies counting stock option grants as an expense

to artificially lower corporate taxes and thereby improve after tax

profits. That's yet another accounting

gimmick we referred to in the managed earnings section (above) of this article.

As expected, several analysts argued that while some pockets of tech are overvalued, that does not mean they are in a bubble. We stand by our previous conclusion that Tech Bubble 2.0 Will End Badly.

High Flying

IPOs Without Earnings:

On page 3 of

his aforementioned letter to his fund's partners, Einhorn called attention to

"Huge first day IPO pops for companies that have done little more than use

the right buzzwords and attract the right venture capital."

With the

imminent IPO of Chinese internet behemoth Alibaba, it is shocking to learn that

more companies are going public with zero earnings than at any time since the all-time

peak in February 2000! Tyler Durden

wrote: "Confirming everything U.S. "investors" already knew but

were afraid to admit... earnings-less IPOs just hit peak greatest fool levels

in the most uncomfortable deja vu moment of the 'recovery'..."

The following IPO tidbits are from an article titled, Hidden Danger

Lurking Inside the IPO Market:

·

The number of companies that IPO’d in Q1 was

higher than any first quarter since 2000.

·

A total of 64 companies went public – double the

number of IPOs in Q1 2013.

·

Nearly 70% of the companies had no earnings

prior to their IPO.

·

The IPO pipeline now stands at 122 companies,

based on data from Renaissance Capital.

·

An additional 103 firms have recently submitted

filings, resulting in a 186% increase in IPOs quarter over quarter.

· Of those companies, only 26% boast any profits at all.

"Don’t expect the trend to reverse course, either. In

fact, it’s only getting worse," said author Richard Robinson. The

chart below shows how profitable companies that go public fare against firms

with zero earnings.

As one observes from the above chart, unprofitable companies outperform

in the first year of an IPO – due entirely to investor hype. By the third year,

though, they’re only up 36% – compared to 153% for profitable companies. But it's actually worse than that.

Analysis by SBA Research shows that fully one-third of unprofitable IPOs fail in three years. By year five, 55% hit the skids. And 61% are history by year 10.

Bottom line: The IPO market is clearly full of landmines right now. It’s going to get dicey, as we could see a total of 320 IPOs this year – the highest number since 1999. To the Curmudgeon, this is yet another dangerous sign of excess speculation in the market (along with record margin debt). But it is only one of many signs of excess.

Philip Gotthelf of Commodities Futures Forecast wrote in his latest weekly report (subscribers only): "Stocks are more of a Ponzi formula because the market is totally supported by liquidity and momentum. We all know that if investors head for the exit door at the same time, the system fails."

"Concepts of price/earnings ratios, dividend yields,

and prospective earnings have been augmented and, perhaps, offset by principles

of anticipatory investing," Gotthelf said.

Conclusions:

The list of other stock market negatives includes: that the economic growth (and profits) expected by the bulls is highly unlikely; that the market has yet to demonstrate that it can hold its own without the positive influence of the Fed's QE and ZIRP (which has been its main support throughout the 5+ year bull market); that stock prices are over-valued with the Shiller CAPE 10 P/E ratio at 25.3, which is 53.3% above its historic mean of 16.5; that we are in the 2nd year of the Four-Year Presidential Cycle, which since 1934 has seen an average decline of 21%; that the average length of the 11 bull markets since 1950 was 53 months; that only four bull markets lasted longer, including the current bull, which is now 62 months old. There's also the potential that Russia's involvement in Ukraine will spread to other areas in Eastern Europe and might cause war, which is always bad for stocks.

Gotthelf said that an investment banker this week was

explaining the foundations of the "acquisition value proposition."

He was trying to explain that a small cap stock could gain traction if the

company announced an acquisition regardless of any financial benefit

associated with the purchase. By old standards, such a move would spell

disaster. "But, now it's New Rules!" In other words, "this time it's

different."

It is these kinds of "new rules" to justify sky high stock valuations that are yet another concern to us. We saw that throughout the Internet stock bubble - right up till the time it burst. In the world of investing, things are always great until they're not....We advise extreme caution and awareness of risk that most "investors" have ignored.

Victor's Comment (from the airport en route to Dallas,

TX):

I see the greatest risks in the intermediate trend as geopolitical, especially Russia's involvement in Ukraine. There is also the failure of the U.S. and Japan to reach an agreement on a Pacific trade accord, China's territorial dispute with its Asian neighbors over islands in the South China Sea, the total collapse of Palestinian-Israeli peace talks due to the agreement between Hamas and Fatah, and the uncertainty of Iran giving up its nuclear weapons capabilities. Also, the UKIP party -AKA the Tea Party of England- under Nigel Farage is gaining ground going into the U.K.'s upcoming elections, to be held the third week of May. Any one of these could erupt into something that's very disruptive to the global economy and a threat to world peace.

Till next

time........................

The Curmudgeon

ajwdct@sbumail.com

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2014 by The

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing

article(s) written by The Curmudgeon and Victor Sperandeo without providing the

url of the original posted article(s).