Moral Hazard 2.0: Why Work When You Can Earn 30% in

the Market?

By the Curmudgeon with Victor Sperandeo

Introduction

by Fiendbear:

The Fed's easy

money policy since 2008 has finally silenced almost all contrary or bearish

opinion. About the most bearish thing

you might here now is a prediction of a 5% or 10% drop in the stock

market. Even so-so economic news is

hyped up to be very positive and any bad news (e.g. negative GDP revision) is

explained away. That is why there are so few interesting contrary articles out

there to post these days.

It is also why

I'm very impressed with the efforts of the Curmudgeon and Victor

Sperandeo. To me, their well-researched

weekly articles make them like "the Spartans holding off the Persians at Thermopylae

against overwhelming forces." They don't get paid for their work and are

not beholden to the mainstream media (MSM) so they can give their honest

opinions without mincing words. There is almost 100 years of financial market

experience between the two of them.

A lot of MSM

writers today can't really remember how things were prior to the

"activist" Fed monetary policy starting with Greenspan. It will be a

total shock and surprise to them when it all ends in disaster.

New All Time

Highs Amongst Eerie Complacency:

On the heels of

Friday's non-farm payroll report (with FEWER jobs added than economists

expected), the S&P 500 made its sixth consecutive all-time high in the last

seven trading sessions. There were no

down trading days in the last seven, as the S&P was flat Tuesday-the only

non-new high day. The DJIA also made a

new all-time high almost every day this week.

In percentage terms, the more speculative NASDAQ and Russell 2000 did

even better - for the day and week.

Volume was relatively subdued as it has been for weeks, months and

years.

Meanwhile,

volatility continued its yearlong decline.

The CBOE Volatility index (VIX), Wall Street's preferred "fear

gauge," ended down 8.1% at 10.73, its lowest level since February 2007. The VIX tends to move higher when volatility

increases or the market drops. It's been

on the decline for months and is well below its historical average of 20, which

some see as a sign that investors are ignoring concerns that could derail the

rally.

The CURMUDGEON

has NEVER seen such complacency in any market. It comes in the face of a weak economy,

geopolitical tensions, artificially pumped up profits (now in decline), an

aging bull market with sky high valuations (the P/E on the Russell 2000 is

84.39 vs 42.70 one year ago). “If this

market was any less tense it would be absolutely sound asleep,” said Yahoo

Finance’s Jeff Macke."

Why Work

When You Can Earn 30% in the Market?

Given the

steady, uncorrected advance in stocks why bother working for a living when you

can earn 30% in the market (that was the return of the S&P 500 without

dividends last year). That easily tops

the 2% or 3% wage gain you might expect in the coming year. And who needs a hedge fund when there is no

volatility in the markets and nothing to hedge against?

Everyone knows

the Fed, ECB, BoJ, BoE, etc. will always bail out

stock investors. That has created what

we refer to as Moral Hazard 2.0. This

time around, the Fed has not bailed out banks or other companies (e.g. GM and

GE) like it did during the 2008 financial crisis. Instead, the Fed and other central banks

have inculcated and nurtured a belief that there is no risk in owning stocks,

because they will do "whatever it takes..." If investors and asset managers have not gotten

that message before, they surely know it after this week's stock market

action.

Market

Cheers any Good News (even if pre-announced); Ignores Bad Numbers:

Global stock

markets had another "free money" party this past week, courtesy of

ECB President Mario Draghi. The ECB cut

the interest rate it pays to European central banks to 0.15%, imposed a -0.1% charge on overnight bank

deposits, and said it would make up to €400 billion ($545 billion) in cheap

loans available to banks later this year—providing they lend more to the

private sector.

Brian

Blackstone of the Wall Street Journal (WSJ) wrote: "The

interest-rate cuts and bank loans that the ECB put in place are variations of

tools it has used before—with little success."

Draghi himself indicated

the bank may need to do more to protect the region's fragile economic

recovery. "Are we finished? The

answer is no. If need be, within our mandate, we aren't finished here," he

said, adding that broad-based asset purchases remain an option.

Several

economists wrote that Draghi's remarks were just a lot more empty promises of

actions. Pundits had already forecast a

negative interest rate on European bank deposits. Yet global stock markets -

including the U.S. - rallied sharply after the ECB monetary easing was

announced on Thursday. It's as if the

ECB news was not already anticipated and discounted (the CURMUDGEON stated several years ago

that the stock market is no longer a discounting mechanism).

In the U.S.,

the non-farm payroll number came in slightly less than expected (total nonfarm

payroll employment rose by 217,000 in May, and the unemployment rate held

steady at 6.3%). That news was good

enough for Wall Street, as the U.S. stock market continued its grinding,

uncorrected, multi-week rally on low volume and low volatility.

The CURMUDGEON wonders why Draghi's pre-announced monetary easing and a decline from 282,000 new jobs in April to 217,000 in May (less than the consensus forecast) are something the market would celebrate, especially when there were many disappointing reports and downgrades. We itemized many of those in last Sunday's post US Economy Stuck in the Muck and Profits are Declining.

This past week

saw more downbeat U.S. economic reports, following last week's negative

revision of GDP:

·

1st

Quarter productivity (the life blood of living standards) was revised

down sharply to 3.2%- its lowest level in six years- and worse than the

-1.7% reading in 4th Quarter of 2013. That's two consecutive quarters of

declining productivity. [Labor

productivity is a measure of the amount of goods and services that the average

worker produces in an hour of work. The level of productivity is the single

most important determinant of a country’s standard of living, with

faster/slower productivity growth leading to an increasingly better/worse

standard of living.]

·

The U.S.

trade deficit for March was revised up by 10%-- from the originally

reported $40.4 billion to $44.2 billion.

·

The

trade deficit for April unexpectedly surged still higher too - to $47.2

billion versus the consensus forecast for a decline to $41 billion. [Increases in the trade deficit result in a

lower reading of GDP, because less goods and services are produced in the U.S.]

·

Construction

spending was up only 0.2%

in April, missing the consensus forecast of 0.8% and down from 0.6% in March.

But the market

paid no attention. It yawned, ignored

the bad reports (or rationalized them away) and continued its advance. We think that was the result of Moral

Hazard 2.0 as described above.

The Real

Intent of the Fed and other Central Banks:

In our opinion,

the Fed has tried to prop up the markets NOT because they really believe in any

trickle-down theory or wealth effect.

Rather, they are concerned that consumers will stop spending if they

hear or read about steep stock market declines-even if they themselves don't

own stock.

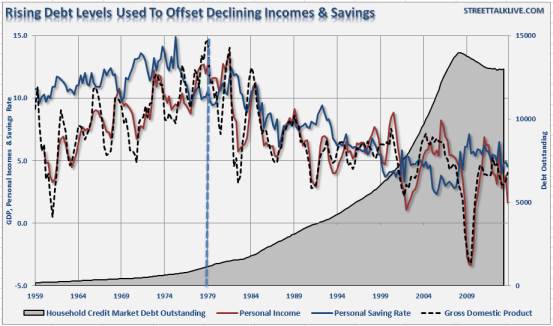

Phil Davis of Phil's

Stock World wrote:

"People are

making less money and their savings are being destroyed which forces them to

borrow more and more money from the banks (who make more and more profits –

especially as they don't pass on the ultra-low rates they are getting when they

borrow) until the people are what we call "wage slaves" - essentially

working their whole lives just to try to pay off their debt as per this chart:

We think the

Fed is monitoring the housing industry very closely. It's a major driving force of the economy and

a leading indicator as it stimulates other sectors. In previous economic

recoveries, construction spending and payrolls led overall spending and jobs

increases. That's not the case this time

around as home construction has severely lagged other sectors of the

economy. While the stock market hasn't

paid much attention to this, the Fed is closely watching. In a paper titled "The

Economic Recovery with Malfunctioning Sectors" Fed Research

Officer Carlos Garriga wrote:

“One notorious

case of malfunctioning is in the construction sector, which currently has a very different pattern of recovery compared to other

sectors, and compared to its impact in previous recoveries. The plunge in the

housing market and impact of a malfunctioning constructions sector, which is

largely interconnected with other sectors, has important implications for aggregate

economic activity. This is because the production of residential and

non-residential real estate requires not only physical goods, but also

financial intermediation and services.”

This implies to

us that the Fed will do whatever it takes to prevent any further deterioration

in the housing/construction sectors of the economy. If that means keeping interest rates at zero

forever, so be it!

Phil Davis

seems to agree. He wrote that "for

now, the Fed, the ECB, the BoJ, and the People's Bank

of China (PBoC) will do whatever it takes to prop up

the economy (and markets) and keep the money flowing to the top 1% (of the

population)." Of course, that's why

income inequality has widened so precipitously in the U.S. over the last

several years.

[The ECB says

they're worried about deflation, which precipitated this week's monetary easing

moves. The BoJ's

QE programs under Prime Minister Abe (AKA Abenomics)

were similarly undertaken to end deflation in Japan. The PBoC has been

easing monetary policy to counter an economic slowdown in China and make loans

more available to small businesses]

Michael Feroli, an economist at J.P. Morgan Chase, told the WSJ

that rising stock markets and rebounding home prices aren't pumping up the

economy the way they used to, largely because many of the gains are going to

affluent Americans, who tend to save. Indeed, the so-called wealth effect—the

extent to which rising wealth leads to consumption and growth—is roughly half

as strong as that of previous economic expansions, he said. So much for the wealth effect and trickle down theories.

Dave Fry of ETF Digest refers the

current bull market as "the central bank bubble." He wrote in his June 6th blog post:

"So as

stocks become more and more expensive it’s only the result of other

opportunities being unrewarding like cash or money under the mattress. Central

banks are forcing investors to be long risk (stocks) given how low yields

are in less risky (bonds) investments. It’s also allowed or forced corporations

to take advantage of low rates to borrow money and buyback shares. This makes

earnings look better on reduced shares and enhances the wealth of the one

percent; but, that’ another story for another day."

Michael Belkin

wrote in a note to subscribers: "This speculative bubble (in stocks) is

supported 110% by the Fed."

And so it goes..... In our opinion, the never ending "Fed put"

has removed fear from "investing" and nurtured some very bad habits

amongst asset managers. We elaborate on

that in the next section of this article.

Caution and

Cash Not in Vogue:

We saw a few

headline blogs this week that "Time in the Markets Wins," not

market timing or even reducing exposure when risk seems high. One would expect that after a multi-year

uncorrected advance with no sharp selloffs.

These days,

caution has become a dirty word to asset managers. They have to keep up with the market averages

to maintain their jobs, so any new cash gets immediately invested in stocks,

ETFs or stock index futures. What they

miss is that the longer the market marches higher, overshoots average

valuations and outpaces GDP, productivity and real profit growth, the greater

the downside risk.

Under current

conditions, expectations for future market returns should be downgraded, but

that's not happening. Even professionals

like Martin Barnes, Chief Economist for the Bank Credit Analyst (BCA) are bullish. Barnes

said in a recent interview with Kate Welling (subscribers only): "As

uncomfortable as it is, the stock market looks like the place to be.....you

can't be in cash in the long run, not when interest rates are at this level,

just waiting for a decline in the market that may or may not occur."

After

Wednesday's close, S&P Capital IQ's Investment Policy Committee —

which has been upbeat on U.S. stocks — raised

its 12-month target for the S&P 500 to 2100 from 1985 — a 9% price

increase.

Jon Hilsenrath of the WSJ wrote that Federal Reserve

officials are starting to wonder whether the tranquility that has descended on

financial markets is a sign that investors have become unafraid of the type of

risk that could lead to bubbles and volatility.

The Fed's growing worry--which could influence future interest rate

decisions--is that if investors start taking undue risk it could bring trouble

of the sort that led to the financial crisis.

"Volatility

in the markets is unusually low," William Dudley, president of the Federal

Reserve Bank of New York, said after a speech last week. "I am a little

bit nervous that people are taking too much comfort in this low-volatility

period. As a consequence, they'll take more risk than really what's

appropriate."

Richard Fisher,

President of the Federal Reserve Bank of Dallas, added to the chorus of concern

over complacency in an interview Tuesday with the WSJ. "Low volatility I

don't think is healthy," he said. "This indicates to me a little bit

too much complacency that [interest] rates are going to stay at abnormally low

levels forever."

The Fed has

given root to the sense of calm by offering investors assurances that interest

rates will stay low far into the future. Its policy statement says officials

expect to keep short-term rates near zero for a "considerable time"

after QE ends later this year. But there

are now signs that the market has taken the Fed's assurances further than the

central bank intended.

"It is a

problem of their own making. They can't have it both

ways," said Martin Barnes of BCA. "If they want to sustain zero

interest rates and push up asset prices, how can they expect to have that with

no excesses and no risk taking?"

Old Bull

Markets are Riskier than Young Bulls:

In a classic

interview: "Markets

Grow Old Too" with Jack Schwagger for

the latter's New Market Wizards book, Victor clearly stated that the risk

in an old bull market is much greater than in a young bull. An analogy given was that a doctor would

treat an 80 year old patient much differently than a 20 year old patient

experiencing similar symptoms.

Obviously, there is much more health risk in the older patient, so the doctor

would be much more cautious in his prescribed treatment. Same is true for older bull markets- much

more caution and risk reduction are required to protect capital from the

inevitable bear market (or steep correction) that always follows a long advance. The key messages from that interview

resonated with me then and still do!

Victor's

Comments:

My analogy

above is still true 23 years later - an older bull market requires more caution

as its "death" may be near.

Life in stock market terms is measured in three distinct trends: The short term trend (days to weeks); the

intermediate trend (weeks to months); and the long term trend (months to

years).

The

S&P 500 intermediate term trend is now 571 days old -from 11/15/12 when the

index was at 1353.33. That's the fourth

longest since 1896 without a 10% or more "correction." Moreover, the current up move of 44.05% (not

including re-invested dividends) is in the top sextile

of all moves in appreciation. Certainly

stocks can move higher and for a longer period of time. The question is about risk versus reward -or

has that been forgotten by asset managers and "investors?"

Markets are

inherently "psychological." The reality of history is that investors

and speculators get nervous after long profitable up moves, especially with record

margin debt. How long do you let your

profits ride at a casino? When

confronted with truly unexpected negative economic news, nervous

"investors” may look to sell and take profits. After a long and steep up move, such selling

often feeds on itself and becomes a sharp decline. Today, stock market risk is very high, since

shorts are scarce (they've been eaten alive) and almost everyone is long with

record margin debt. Let's look at

another time when the stock market was vulnerable to steep selloff.

In October

1987, James Baker - then U.S. Secretary of the Treasury - threatened Germany to

lower their interest rates1 or the "U.S. would let the dollar

slide." That meant an unlimited

devaluation of the dollar and any foreigner who held U.S. dollar denominated assets would

thereby lose an unknown amount of money (in real terms).

Note 1. Treasury Secretary Baker wanted lower

German interest rates to stimulate European aggregate demand and thus increase

U.S. exports. The Bundesbank had raised

rates to combat inflation.

I am 100%

certain that Baker's threat to let the dollar fall set the stage for the

Monday, October 19, 1987 stock market crash2. Everyone versed in macroeconomics understood

the negative implications of his remarks.

It was one of only three times in 49 years that I shorted weakness (5

additional S&P 500 futures contracts on Monday's open with the S&P

already down 15 points).

Note 2.

Baker's threat to let the US dollar drop caused anger in Germany and

nervousness over the weekend (October 17-18, 1987). Many market watchers said Baker's comments

triggered urgent selling on Monday’s open.

That selling was exacerbated by "portfolio insurance," and

resulted in the worst single day stock market crash in history. The DJIA was down 22% that fateful day -

October 19, 1987.

The market was

on a tear since the first trading day of January in 1987. It was set up to decline, in much the same

way as the current stock market is potentially vulnerable. One important difference between 1987 and

2014 was that interest rates began to move up in September 1987, while the Fed

has successfully kept short term interest rates at zero and long term interest

rates exceptionally low for many years.

Rising interest rates offered competition to stocks in 1987, but not

now.

With the ECB's

Draghi willing to try negative interest rates on bank deposits and Yellen

saying the Fed will print unlimited amounts of "paper" (accepted as

money) the global bull move in stocks could be extended - until someone like

James Baker makes a critical mistake.

The mistake

this time could be if depositors are charged to keep their money in the

bank. Why would they do that? Better to

keep it in a safe (perhaps in gold?) - as a run on banks can cause very harmful results and

paralyze an economy. Banks would be

starved of capital and loans would dry up.

Global stock markets would likely plummet.

Laissez Faire Capitalism:

Here's a

testimonial to laissez faire capitalism, which I advocate as an antidote to the

creeping socialism that's becoming pervasive in the U.S. and elsewhere: In a referendum last week, the people of Switzerland

voted down a minimum wage of $25.

The initiative was opposed by 76.3% of voters. “People are again saying

they don’t want the state to meddle,” Swiss trade association director

Hans-Ulrich Bigler said. “It’s a vote of confidence

by the people in the economy.” I firmly

believe the U.S. needs to educate its citizens so they can differentiate

between what sounds good, but is totally destructive for the economy.

Who Needs a Gold Standard?

So much for

Milton Friedman's theory of monetarism, which says that we don't need a

"Gold Standard," because the Fed can add a "pre-set amount of

money" supplied via a mechanical formula into the system (e.g. 6% a year)

and all would be fine. The Austrian

School of Economics (led by Ludwig Von Mises and Friedrich Von Hayak) said that would never happen, because human beings

cannot affect this type of discipline when losing power was on the line. How

right the Austrians are!

In the words of

Von Hayek: "The curious task of economics is to demonstrate to men (and

now women) how little they really know about what they imagine they can

design."

In the

meantime, if risk is NOT your concern, and with the S&P 500 futures up 12

days in row, how can one not be long with the Fed's promise of unlimited money

printing? What can possibly go wrong?

Till next

time........................

The Curmudgeon

ajwdct@sbumail.com

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2014 by The Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing

article(s) written by The Curmudgeon and Victor Sperandeo without providing the

url of the original posted

article(s).