US Economy Stuck in the Muck and Profits are Declining

By the Curmudgeon with Victor Sperandeo

Introduction:

We look at

the U.S. GDP revision, bad weather as a never ending excuse for economic weakness,

other U.S. economic reports this past week, along with a punctured

"profits party." With tongue

in cheek, we wonder if the U.S. should follow the lead of Italy and the UK to

include black market activities in U.S. economic output. Finally, Victor provides his keen perspective

on the economic events of the week and the important long-term trend changes he

foresees for a better economic future.

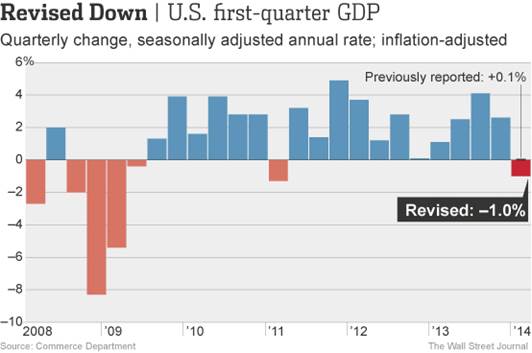

U.S. GDP

Revised Down

The U.S.

economy contracted in the 1st quarter of 2014, with GDP revised down to -1%

from an estimated 0.1% rate, according

to the Commerce Department. That's a

pretty hefty markdown and it's the latest stumble for a "recovery"

that has struggled to gain traction since the recession "ended" in

June 2009. Moreover, the negative 1st

quarter GDP reading is only the second quarterly GDP contraction in five years

[GDP declined at a 1.3% pace in the first quarter of 2011]. It compares with a reported 2.6% GDP gain in

fourth-quarter of 2013.

It doesn't end

there. Before inflation adjustment,

nominal first-quarter annualized GDP growth of 0.3% was the weakest

contemporary reporting since the "end" of the last recession. The N.Y. Times reports that an alternative and more accurate measure

of U.S. economic output, called Gross Domestic Income,

shrank at an annual rate of 2.3% in the 1st quarter.

Does the chart

below look like a healthy U.S. economic recovery to you?

"The

probability of going negative is much higher when the economy is growing slowly

and the growth rate is close to zero even before the hiccup," said

Stanford University economist Robert Hall, chairman of the National Bureau of

Economic Research committee that formally decides when recessions begin and

end.

Was it due

to Bad Weather?

While many

economists continue to blame the weak economy on "bad weather,"

Shadowstats John Williams thinks

differently. In a May 29th note to subscribers, Mr.

Williams wrote:

"Today’s

downside GDP revision from plus 0.1% to minus 1.0% was fully accounted for by a

revised reduction in inventory growth (a 1.62% negative contribution to the

aggregate headline contraction), which was more a function of the effects of

limited consumer liquidity, and businesses adjusting for same, than it was a

function of unseasonable weather. In

like manner, the 0.95% negative contribution to the first-quarter contraction

from the widening trade deficit largely was independent of weather

effects."

Lakshman Achuthan of the Economic Cycle Research Institute (ECRI)

agrees. He wrote in his latest commentary:

“We think there

is more to this (1st quarter U.S. GDP contraction) than just weather. Our

leading indicators were already weakening late last year. We may get a

snap-back in the second quarter but I don’t see us reaching escape velocity.

The economy is below stall-speed, according to the Fed’s own model."

ECRI says the housing recovery has rolled over

and is now in a “cyclical down swing”, with the building permits for

single-family homes falling to a three-year low. There will be less “fiscal drag”

this year as austerity fades but this is more than offset by the drag of excess

inventory.

Mr. Achuthan said the economy may muddle through, but

recoveries have been getting weaker with each cycle for the past 40 years. The

US now seems caught in a Japan-style trap, endlessly masking the effect by

stealing a little extra growth from the future with artificial stimulus.

Warmer

weather and higher expectations haven't caused a surge in home sales. Signed contracts to buy existing homes

increased just 0.4 percent in April, according to Thursday's monthly report

from the National Association of Realtors. The expectation had been for

at least a 2% gain sequentially. The National Association of Realtors' pending

home sales index is now 9.2% lower than in April of 2013.

Other

Economic Reports this Week:

There were

other economic warning signs in this past week's reports:

·

Retail

sales slowed sharply in April, up just 0.1%, compared to 1.5% in March.

·

Consumer

spending slipped 0.1% in April, the first decline in one year.

·

Wages

and salaries grew only 0.2% in April- the weakest monthly increase this year.

·

Personal

consumption declined 0.1% in April vs consensus estimate of 0.2%. Adjusted for

inflation, consumption declined 0.3% in April.

·

Personal

income is up 3.6% in the past year, while spending is up 4.3%. [i.e. spending

grew faster than income]

·

New

housing starts exceeded 1M in April due to a big jump in apartment building

starts, but new single family home starts were up only 1%.

·

Existing

home sales increased 1.3% in April, but were down 6.8% from the same period a

year ago.

·

The

University of Michigan's consumer sentiment index was 81.9 in May, below the

82.5 reading that economists had expected and down from 84.1 in April.

·

The

Conference Board’s Consumer Confidence Index ticked up to 83 in May from 81.7

in April, but remains well below the triple-digit levels of economic good

times. Within the report: those who plan to buy a home within six months

declined to 4.9%- the lowest level in 21 months. Those who plan to buy major

appliances fell to 45.1% -the lowest level since September, 2011.

·

The

Dallas Fed’s General Business Activity Index declined from 11.7 in April to 8.0

in May. The Production sub-index fell from 24.7 in April to11 in May. The new

orders index fell sharply to 3.8 - its lowest level this year.

·

Just

27% of Americans think the U.S. is headed in the right direction, compared with

63% who say things are on the wrong track, according to a Wall Street

Journal/NBC News poll conducted in April.

Corporate

Profits Down Despite Accounting Tricks:

Not mentioned

by the mainstream news media was that the GDP report revealed corporate

profits fell 9.8% in the first quarter - the biggest decline since 2008.

The Commerce Department's GDP reported:

"Profits from current production (corporate profits with inventory

valuation adjustment (IVA) and capital consumption adjustment (CCAdj)) decreased $213.4 billion in the first quarter, in

contrast to an increase of $47.1 billion in the fourth." 1st quarter corporate profits on an after-tax

basis, without inventory valuation and capital consumption adjustments, were at

$1.88 trillion. That was down from $1.905 trillion in the fourth quarter.

More

importantly, we submit that real profits are much less than what's reported as

"after tax profits per share." In last week's Curmudgeon post, Victor commented

that HP continues to lay off employees to cut costs in order to fund their

stock buy backs, which increases earnings per share (due to fewer shares

outstanding). There are also untaxed

overseas profits (that are not repatriated), inventory gimmicks and accelerated

depreciation write-offs which artificially boost after tax earnings.

In his Stealth

Stocks newsletter,

Dennis Slothower of Alpine Capital points to companies that are playing

accounting games to boost earnings per share and attract investors. Those companies are buying back stock,

raising dividends and issuing corporate debt to finance those buybacks and dividends.

Slothower notes

that Apple has increased its share buybacks to $90 billion from $60 billion,

while raising its cash dividend by 8%.

They've also filed

a debt offering with the S.E.C. for at least $17 billion. Why would they do

that when they have lots of cash? Answer:

Apple decided to issue corporate debt (at a very low interest rate) to

help fund its increased dividend, rather than bringing cash from overseas

profits back to the U.S. which would be taxed.

The latter would result in lower "after tax profits" for

Apple- something anathema to the company.

Fred Hickey,

editor of the High-Tech Strategist newsletter says: "IBM is the

poster child for financial engineering, in my world.” Business Week reported

that IBM's maneuvers to boost earnings per share as revenue declines includes

share buybacks as well as more esoteric tactics like designating major costs as

“extraordinary” and devising ways to pay lower tax rates. In defense of those tactics, Steven Mills,

IBM’s senior vice president for software and systems said, “You’d be criticized

for not doing a good job of managing your tax rate or not doing a good job with

disposition of your cash and managing how you most effectively use it to

deliver shareholder value.”

In the first

quarter of 2014, S&P 500 companies spent a record

$160 billion on stock buybacks [Chart 2007-2014]. Despite that massive amount of capital, 1st

Quarter 2014 total earnings for 463 S&P 500 member companies were up just

1.3% over one year ago on a miniscule 0.9% increase in revenues, according to Zack's

Q1 Scorecard - dated May 15th, 2014. We think that total earnings would be higher

if the money used for stock buybacks was invested in R&D and/or capital

spending directed at real economic growth projects.

So much

for the profits party! Profits are declining and have been artificially

boosted by financial engineering and accounting shenanigans.

How about a

Solution to the U.S. Economy's Funk?

After careful

deliberation, Victor and I have a cure to boost U.S. GDP: include the underground economy in the GDP

numbers? We can't take credit for that brainstorm though, as Italy and the U.K.

have already decided to do this. USA Today reports:

"Italy is

changing how it calculates its gross domestic product, a measurement of the

overall economy, to include black market activity — everything from

prostitution to illegal drug sales to smuggling and arms trafficking.

Economists predict illegal sales will add 1.3 percentage points to GDP this

year. Hey, it's one way to boost growth."

The reason

Italy is becoming creative with its accounting is because it wants to (and the

European Union needs it to) improve its appearance. A larger overall economy will enable Italy to

lower its debt-to-GDP ratio, which is an essential part of meeting the EU's

financial standards. EU countries are not supposed to let their yearly bills

reach more than 3% of the overall economy (or their debt exceeds 60% of GDP.)

If they do, they're hit with hefty fines.

The U.K. has

decided to do likewise. On May 30th, the

Financial Times (FT) reported

that Britain would include prostitution and illegal drugs in its official

national accounts for the first time. In

its first attempt to measure illegal activity other than smuggling, the U.K.

Office for National Statistics said prostitution would add £5.3bn to GDP in

2009 and illegal drugs would add £4.4bn.

These additions are planned for September and will add up to 5 per cent

to the UK’s gross domestic product.

Joe Grice,

chief economic adviser at the ONS, said: “As economies develop and evolve, so

do the statistics we use to measure them.

These improvements are going on across the world and we are working with

our partners in Europe and the wider world on the same agenda. Here in the UK

these reforms will help ONS to continue delivering the best possible economic

statistics.”

Tim Harford, the

FT's Underground Economist, wrote in his May 31st column, "It cannot be

long before someone starts pointing at the pimps and the pushers, and blaming

their existence on the U.K. Office for National Statistics."

There are

precedents for such statistical tweaks in calculating national economic

output. In September 2006, Greece’s

economy grew overnight by 25% after the country’s official statisticians

included sex work and illegal drugs as part of their estimates of economy

activity. Last year, the U.S. BEA

expanded its definition of "investment" to include intangible

assets. That added 3.6% or $559.8bn to

U.S. GDP in 2012.

Victor's

Comments:

The change in

Italy and UK GDP calculations is "propaganda of politicians in power"

to make GDP look better. The U.S. did this last year by changing Hollywood

entertainment "intangibles"

into capital investments and revising/ adjusting GDP all the way back to

1929 in order "to look higher."

That accounting gimmick added $500 billion to U.S. GDP.

This

"statistical GDP fudging virus" has caught on as it's now taking hold

in Europe. Of course, saying the economy

is stronger, via a statistical change, is the highest form of trying to

"fool the people." The

citizens sense the reality and are not fooled.

Changing a calculation does nothing to directly affect them economically

or improve their standard of living.

However, under

the EU "Troika" rules (or dictates) the GDP additions allow for less

austerity and lower the Debt to GDP ratios of the effected countries. So although nothing really changes, the

nominal numbers look better and may create less tax increases (austerity). That would be a good outcome.

There's good news to

report this week from Europe! The

"trend" of the people who voted for Euro-skeptic parties is truly a

"game changer." Not for the

current equity markets or the short term economic/political landscape, but (far

more importantly) from a long run perspective.

I believe the move away from socialism and the EU-Brussels’s economic

model will help the majority of the people of Europe obtain a higher standard

of living.

France's avowed

Socialist President Hollande imposed a 75% top tax rate on income (an appeal to

envy), but the taxes collected were half the amount estimated. The higher tax rate also curbed spending and

slowed GDP growth materially from earlier predictions. That hurt workers who

are the most in need, rather than the "rich" who merely deferred

income.

As a direct

result, Hollande's party lost drastically in last week's European parliamentary

elections. The right wing "National

Front" party, headed by Marine Le Pen, easily won with 26% of the vote,

giving it one third of France’s 74 seats in the European Parliament. The National Front party wants France to

leave the EU, in order to end EU economic austerity rules enforced on member

countries. They also want to stop

immigration - which is stealing jobs and changing the culture of France. Ms. Le Pen promptly described the vote as

support for "France for the French," called on the government to

resign, and for Hollande to dissolve the French parliament. Were any lessons learned? We'll see.

The UKIP party

of the UK (like the U.S. Tea Party) led by Nigel Farage,

is the first "3rd party" in the UK in 100 years to win national

elections. They garnered more votes than

the Conservative party and Labor party.

The UKIP party victory in the UK is akin to the Libertarian Party winning

more votes than the Dems and GOP in the U.S.

[Today, Libertarian candidates typically get only 1.0% of the U.S.

vote.]

In my opinion,

Europe's elections are a bullish case for the long term survival of freedom and

opportunity for the average person in that part of the world.

In the U.S., a

high ranked government official- Eric Shinseki--Secretary of the Veterans

Administration (VA) --was forced to resign from office. This good news is a refreshing change in

the way federal government officials have been treated in the Obama

Administration (where if you did a poor job you'd be fully protected and

might even get a bonus).

The next major

political trend indicator will be the November 2014 U.S. mid-term elections

and, in particular, the Senate race. If the world is truly changing for

"Main Street," those elections will be a harbinger of the future for

the U.S.

I strongly

believe that our U.S. elected representatives have created a short term view of

governing that will eventually destroy the country - unless we start to change

our long term goals. Advocates of a

balanced budget are merely saying that (at some point in time) the U.S. will

have a major debt crisis unless budget deficits are reduced or eliminated. Even Ben Bernanke and Janet Yellen

acknowledge this. Yet no credible action

has been taken yet to reduce government spending. The U.S. needs new elected officials to

accomplish that, but they first have to be voted into office.

Let's

close with an historical example. The freest period in the history of mankind

was the 124 years between 1789 and 1913 in the U.S. There was no income tax, no government

agencies and virtually no regulations of any kind during that very long time

period. As a result, the U.S. real GDP

growth rate compounded at 4.12%. With

the U.S. under the gold and silver standard, inflation was only 0.0012% or 12

bps. In 1900, total Federal, State and

City government spending accounted for only 3% of GDP.[Interpolated from the

"Historical Statistics of the U.S. -- Colonial Times To 1970 Parts

1&2]

Most

progressives today would gasp and perhaps faint at the thought of no government

agencies and watch dogs to protect the people!

The Heinz Co. was a counter example of that thinking in the 19th

century. Henry J Heinz started his

company in 1869. It was

self-regulated. Mr. Heinz was very proud

of his great clean food environment which was maintained to high internal

standards. Great companies like that do

the right things to succeed. The poorly

managed companies die (corrupted government agencies like the U.S. VA would die

too if it they were private entities).

Freedom and self-responsibility without government regulations offer the

maximum potential for economic growth.

That's why I'm an advocate of l'aissez faire

capitalism.

Till next

time........................

The Curmudgeon

ajwdct@sbumail.com

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2014 by The Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing

article(s) written by The Curmudgeon and Victor Sperandeo without providing the

url of the original posted

article(s).