How Does the

Bull Market Look Now?

By the Curmudgeon with Victor Sperandeo

Introduction:

Is the bull

market over? Has the tech stock bubble

burst? What's next for the market? These are questions many people are asking in

the wake of last week's volatility and sharp declines on Thursday and Friday,

which followed a big up move on Wednesday. While we don't have the answers (we

don't think anyone does), Victor and I would like to share our thoughts on the

five+ year bull market in U.S. equities and the outlook going forward,

especially for tech stocks.

A Healthy or Artificial Bull Market?

We strongly

believe that this has not been a bull market based on solid economic

fundamentals, as we've pointed out in so many posts related to the "Great

Disconnect" between the real economy and the equity market. Instead, this bull run

has been fueled, aided and abetted by Federal Reserve monetary policies (ZIRP

and QE), record high margin debt and corporate share buybacks. We'll focus on the latter two in this

article, as past posts extensively covered the Fed and the markets.

1. Margin Debt:

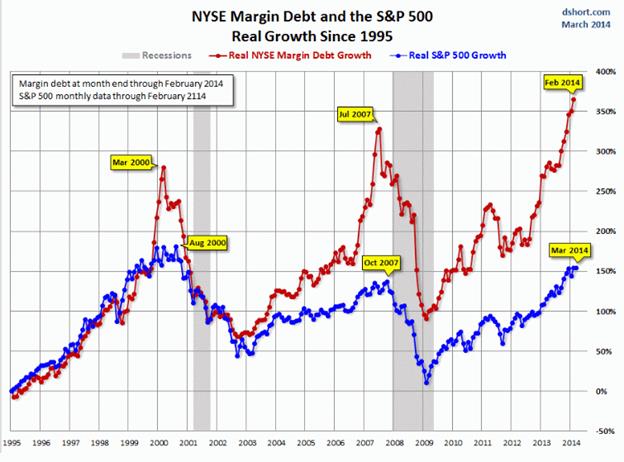

The chart below

shows the tight correlation between end of month NYSE margin debt and the

S&P 500. Note that NYSE margin debt

now is substantially above the previous peak in July 2007- even though share

volume is a fraction of what it was then.

That implies that today's stock market is much more heavily leveraged

than any time in decades.

Chart courtesy of dshort.com

If one were to include NASDAQ margin debt, it would show even more leverage has been used to buy stock. As we've pointed out in a Curmudgeon post almost one year ago, Margin Debit is a Double-Edged Sword. It’s important to note that the topping of margin debt in March 2000 and July 2007 preceded a significant drop in the S&P by several months (the caveat is that Margin Debt reported data is always a month old).

2. Share Buybacks:

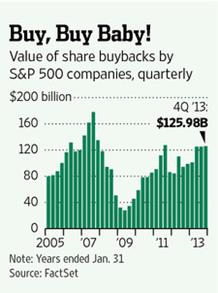

What effect

have corporate share buybacks had on stock prices and earning per share? They

boosted demand while contracting the supply of stock and made earnings per

share higher than they'd otherwise be.

In his WSJ

Ahead of the Tape column on April 7th (on line subscription required),

Spencer Jakab wrote:

"During

the reporting season that just ended, earnings growth slowed to a crawl and

likely would have been negative without buybacks. The bang for the buyback buck is diminishing,

though, requiring more cash to remain effective. During the 12 months through

January, S&P 500 companies spent a whopping $478 billion to repurchase

3.1% of shares outstanding. A year

earlier, they spent about $90 billion less for the same percentage reduction.

Given today's higher values, companies will have to spend tens of billions

more. If buybacks slow, so will earnings growth, all else being equal."

Jakab notes that

during the previous bull market (which ended in October 2007), buybacks peaked

in the same quarter the stock market did. Less than two years later, during the

quarter in which stock prices bottomed, companies spent 83% less on buybacks.

That is despite the fact they would have gotten far more earnings-boosting

effect at those low prices for each dollar spent. Please see chart below:

Decline in

Tech Stocks:

We think the

rout in tech stocks is just getting started.

This week's Barron's cover "The Tech Stock Bust Should be no Surprise" calls attention to what we

wrote about this past January: Tech Bubble 2.0 Will End Badly

Just Like the First Tech Bubble. And that was BEFORE Facebook's $19B

acquisition of WhatsApp (mobile messaging) and $2B purchase of Oculus VR (virtual reality game headwear).

What's happened

since then: In the past few weeks, an abrupt

change in sentiment has caused falls of 20%-45% in former tech darlings like

Netflix, Facebook, Twitter and LinkedIn. The tech-heavy Nasdaq

composite index closed at nearly 4,358 early last month, its highest level

since the 2000 peak, and has shed nearly 360 points - or 8% - since then.

Other Voices

on the Tech Stock Decline:

This weekend's

Financial Times Lex column noted: "Without a clear catalyst for the

sell-off, one implicit marker should be Facebook’s second recent billion-dollar

acquisition, Oculus Rift. Founder Mark Zuckerberg threw down $2bn for the

virtual reality headgear (goggles) concept on March 25th. Facebook shares since

that day are down over 10%."

Now that

government-backed bond purchases (Fed's QE) are tapering off, people are starting

to realize "the only thing holding this balloon up is the Fed blowing air

in it," said Fred Hickey, editor of The High-Tech Strategist newsletter.

"It's the most insane pricing I have seen since 2000," Hickey said regarding

technology stock prices.

“March was a

wake-up call from the market to many long-short funds that had been relying on

certain stocks and sectors for the past couple of months,” says Matthew Elstrop, an analyst at Liongate

Capital Management, a fund of hedge funds with $7bn of assets invested in the

sector. “A lot of crowded trades, such as high growth tech stocks, just went

into reversal.”

John Paulson,

the hedge fund manager who built his reputation betting heavily against the

U.S. housing bubble before the financial crisis, saw his $2.8bn Advantage Plus

fund (which is focused on so-called event driven or momentum trading), drop by

7.4% in March, according to the Financial Times.

Research from Morgan

Stanley’s prime brokerage suggests that few hedge funds have started to offload

their so-called “new tech” shareholdings yet, although that may change if these companies

continue to fall in value. “So far we

haven’t seen big changes in hedge fund positions,” says Mr. Ince.

"In fact, they may actually like some of the technology shares even more

now they are cheaper.”

Curmudgeon's

Opinion: Such "buy

the dips" mentality implies to us that the tech stock decline is not over

yet. For that to happen, we'd like to

see much more pessimism and urgent selling.

The Smart

Money Flow Index (SMFI):

One measure of

sentiment that we've started to watch closely is Bloomberg's Smart Money

Flow Index (SMFI). It is calculated

by taking the price of the Dow Jones Industrial Average at 10am (Eastern Time)

on any given day, subtracting it from the previous day's close, and adding it

to the next day's closing price. The

first 30 minutes represent "emotional buying," driven by greed and

fear of the crowd; veteran traders (i.e. the smart money) typically wait until

the end of the day to place their orders.

As the chart

below shows the DJI and SMFI rallied in unison to make dual highs in May

2013. While the Dow continued to push

higher, the SMFI made lower highs and has collapsed since late Feb 2014. It is now at its lowest close since Nov 27, 2012.

It's the greatest gap since 2007.

Chart courtesy of

Bloomberg

Dennis

Slothower of Alpine Capital

wrote in an email to the Curmudgeon, "Smart money waits until the end of

the trading day and they very often test the market before then by shorting

heavily just to see how the market reacts. Then they move in the big way. These

heavy hitters also have the best possible information available to them and

they do have the edge on all the other market participants. To replicate this

index, just start at any given day, subtract the price of the Dow at 10AM from

the previous day's close and add today's closing price. Whenever the Dow makes

a high which is not confirmed by the SMFI there is trouble ahead."

Minyanville's Todd

Harrison: "There is no Holy Grail

when investing, but there are on occasion, signals that provide the right

insight at the right time. This (divergence) may be one of them."

Victor's

Closing Comments:

The bull market

must be taken into context of zero short term interest rates during the last

six years and well into 2015, according to Fed Chairwoman Janet Yellen. Add three QE's and other Fed schemes, such as

"operation twist" (which was done twice in an attempt to lower long

term interest rates) and you can understand how this bull market was nurtured

and sustained.

Yet despite

this extraordinary ultra-easy monetary policy, the U.S. economy has only grown at

approximately 2.2% since the "recession ended" in June 2009. The BEA said that "Real GDP"

increased 1.9% in 2013 compared with an increase of 2.8 percent in 2012.

Editor's

Note: By comparison, the S&P 500 rose 30% in

2013 and 13% in 2012.

But has U.S.

GDP growth really been as strong as reported?

We don't think so.

The U.S.

government stated annual inflation rate has been 2.2% since June 2009. If inflation is higher than that (we think it

is and others do too), then real GDP would be even lower than reported. That would make the "great

disconnect" between the super strong stock market and weak economy even

more glaring.

There are other

factors to consider when determining the "Real GDP." For example, the U.S. government includes

about 15% of "imputations" (goods and services that are not traded in

the market place) in the published

GDP rate, even though sales never really occurred. "GDP Imputations"

approximate the price and quantity that would be obtained for a good or service if it was traded in the market place. These "GDP Imputations" are

government manipulations of numbers on the highest order, in my humble opinion.

Together with

all the manipulations of interest rates, bonds, the dollar, gold and other

items (stock indices?) the government's flawed GDP numbers really make all

fundamental analysis and assumptions worthless!

The crucial

issue for today's stock market is to honestly and objectively analyze what has

happened, ask why, and attempt to determine if the market move has been based

on sound economic fundamentals or something more akin to a "tulip

bulb" mania?

Market timing

is something else and quite difficult, especially with unexpected Fed

intervention in the markets or moving to an even more dovish monetary policy

(like a stop in tapering). The onset of

a bear market in equities will truly occur when Janet Yellen can't control the

events. Other than that, everything is risky and very hard to predict. Being

hedged is the only prudent thought I have to recommend at this moment.

Till next

time........................

The Curmudgeon

ajwdct@sbumail.com

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2014 by The Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing

article(s) written by The Curmudgeon and Victor Sperandeo without providing the

url of the original posted

article(s).