The Trend Towards World

Socialism as THE Economic Problem of our Times!

by Victor Sperandeo and the Curmudgeon

In

our 2013 year-end

Curmudgeon post, Victor stated that the trend towards socialism is the

greatest economic problem facing the U.S. and rest of the world. He expands on that theme in this article.

Background:

The

U.S. economy has experienced a significant (negative) political change in the

last five years. The move to a very

progressive (or even "Socialist")

fiscal policy and agenda, accompanied by a misguided monetary policy has

greatly increased income disparity in our country.

The

negative effects on the U.S. economy from President Obama's moribund fiscal

policy, combined with Congressional gridlock, has led the Federal Reserve Board

to take extraordinary steps in an effort to fulfill its second mandate- full

employment (the Fed's first mandate is price stability). The Fed has been printing money (QE) --at a

hitherto unimaginable rate--to buy U.S. government and mortgage debt, in an

effort to keep the U.S. from sliding into another recession.

As

we've documented in numerous Curmudgeon posts, the Fed's QE has not

significantly helped the real economy.

Rather, the Fed's reckless and misguided monetary policy has greatly

harmed the poor and middle class. But it

has been a huge benefit to large corporations and to wealthy individuals.

Income Disparity in

U.S. is at an Extreme:

Income

inequality or disparity in the U.S. has gotten much, much worse in the last

five years despite the Fed's QE being increased. There have been extreme declines in median

family income (down 8.5%) versus a stupendous increase for the top 10% of

income earners (who own stocks and other forms of equity).

We

think the widening income disparity is entirely due to the Fed's QE and

ZIRP. We've repeatedly argued that those

policies greatly benefit the rich, while penalizing the poor and middle class

(if it still exists?).

Why Isn't the U.S.

Creating More Jobs?

Success

in creating more jobs and increasing wages is only possible by boosting GDP

growth. Concurrently, the CRITICAL

FACTOR for increasing wages is the competitive bidding for workers. That's largely a function of capital

investment/ spending by existing companies and creation of as many new (small)

businesses as possible. Therefore, anything that is an obstacle to creating new

businesses is harming the average worker.

This means whatever raises the costs of doing business - or lowers the

incentives to go into business - is a detriment to US worker jobs and

income. In particular, increased taxes,

health care costs and laws/regulations (such as “Sarbanes Oxley”) have been a

huge impediment to business formation and economic growth.

Socialism and Fascism

Explained:

Socialism is an economic system

in which the government owns the "means of production." Italian dictator Benito Mussolini offered a

more efficient method of Socialism, which he called "Fascism." The Fascist

party ruled Italy between 1922 and 1943.

"Italian

Fascism promotes a corporatist economic system whereby employer and employee

syndicates are linked together in associations to collectively represent the

nation's economic producers and work alongside the state to set national

economic policy."

Source: Modern Political Ideologies. Third edition, by Andrew Vincent. Malden, Massachusetts,

USA; Oxford, England, UK; West Sussex, England, UK: Blackwell Publishers Ltd.,

2010. Pp. 160.

In

an economic sense, Fascism meant that the government did not have to

"own" the means of production, but merely "control"

it. This is what we think has been

happening in the U.S. for MANY YEARS and especially in the last FIVE years.

There

have been tax increases (and tax breaks for politically favored industries and

companies), burdensome regulations, and fines for non-compliance. For example, JP Morgan recently paid $20+

billion in fines to avoid the threat of criminal prosecution.

Mussolini

called this "Corporate Fascism"

or "Corporatism" (AKA

"Crony Capitalism"). He wrote:

"Fascism should more properly be called corporatism because it is

the merger of the state and corporate power."

That

same economic system is used in Denmark today, although it's not called

(corporate) Fascism. Individual tax

rates are over 51%. Corporate tax rates are now 22% vs 26.3% in 2012. Like in

the U.S., those who give the most to politicians get the best tax deal and the

most benefits from the government.

A

look at history is full of evidence and real examples that show neither Socialism, Fascism, nor Communism bring about

economic growth or raise employment. Conversely, those command economy systems

result in declining standards of living and greatly reduce individual freedom,

which is sometimes lost completely (e.g. in Communist states like North Korea

and Cuba).

Only

in idealistic and pure communism (which

doesn't actually exist) is virtual equality achieved. Yet in a very poor country like Cuba, Fidel

Castro's net worth is estimated to be $900M.

A Cuban worker makes approximately $18 per month with a very sparse

selection of food and staples that can be purchased. Meanwhile, government ministers are

multi-millionaires with vacation villas and other luxuries. Is that real equality or the greater good of

communism?

The Inexorable Trend Towards Socialism in the U.S.

In

a previous CURMUDGEON post,

we concluded that the U.S. is becoming a Socialist country. As a result, the

very way of life the United States was founded on is now at risk.

What

should our government due to reverse this movement toward socialism? We suggest a return to as much l'aissez faire

capitalism, as possible with minimal government interference in the private

sector economy. In particular, we

advocate: lower taxes, no tax breaks for political favorites, fewer burdensome

regulations and controls and lower government spending (the CURMUDGEON would

like to see federal government spending on infrastructure projects increase).

When Laissez-Faire

Capitalism Was Good for the U.S.

From

1789- 1913, the US had an economic system of "Laissez-Faire

Capitalism." The US economy grew at an estimated 4.12% compounded rate

during those years with only 0.00125% annual inflation (note that the U.S. was

on the Gold standard during those years).

Source: Interpolated from "Historical

Statistics of the US: Colonial Times to 1970 Part 1 and 2," published by

the US Department of Commerce Census Bureau).

Victor's Closing

Comments:

The

whole issue of inequality is a "straw man" argument in an attempt to

overturn Capitalism and thereby limit individual freedoms. Inequality of wealth is a natural byproduct of

Capitalism (which creates freedom instead of "statism"). It is not a bad thing, unless the rich abuse

their power, e.g. by buying special favors from politicians or elected

officials to limit competition in their industry.

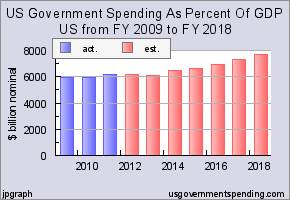

We

think the debate in Congress should focus on determining what percent of GDP

the federal government should spend. In

1903, total government spending (Federal, State and City) was 3% of GDP. Contrast that with the chart below, which

shows that federal government spending was estimated at 40% of GDP last

year.

There's

no doubt that continued growth of U.S. government spending will ensure secular

stagnation in the future. The movement

to "Statism"

will further reduce economic growth and curtail individual freedoms. We believe that government spending should

decrease--at least as a percentage of GDP.

In its place, we'd like to see private sector spending (i.e. capital

investment and hiring more employees) increase to make up the difference... and

then some.

It's

imperative for the U.S. to reverse these pathological trends and adopt

responsible fiscal and monetary policies that produce real economic growth,

more jobs and thereby less income inequality.

Till next

time........................

The Curmudgeon

ajwdct@sbumail.com

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo

is a historian, economist and financial innovator who has re-invented

himself and the companies he's owned (since 1979) to profit in the ever

changing and arcane world of markets, economies and government policies.

As President and CEO of Alpha Financial Technologies LLC, Sperandeo overseas

the firm's research and development platform, which is used to create

innovative solutions for different futures markets, risk parameters and other

factors.