2013 Wrap-Up and Invitation to Vote on Your Favorite

Article

by the Curmudgeon and Victor Sperandeo

†

Introduction:

We

hope readers have enjoyed the original themes and commentary in our CURMUDGEON

articles this year.† Victor and I

meticulously research the topics we agree to write about and then augment our

remarks with quotes from seasoned financial professionals to support our

position(s).

There

were quite a few important subjects we wrote about in 2013, including:

-Much

more leverage in the market & more concentrated control among fewer players

-U.S.

Equity and Gold markets might be manipulated by the Fed and/or its Primary

Dealer/owner banks

-What

is Gold and Where Gold is now in the investment cycle

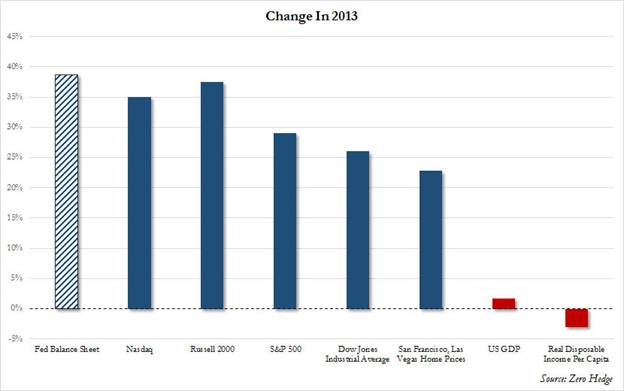

-The

great disconnect between ever rising U.S. stock prices and a stagnating economy

is wider than ever (see bar chart below for a wake-up call)

-The

U.S. is exhibiting many of the attributes of a socialist country

-Is

the Fed a Ponzi scheme or a no-risk hedge fund

-Fannie

Mae and Freddie Mac accounting appear to be another U.S. Ponzi scheme

-And

many more..............................................

We invite readers to

vote for their favorite Curmudgeon article and let us know what topics they'd

like to see addressed in 2014.†

Email the CURMUDGEON

at: ajwdct@sbumail.com

†

What to Watch for in

2014:

As

you might expect, our thinking for next year (we don't make market forecasts or

price/time predictions) is quite different from the mainstream media.† For example, it's quite likely that the

economy- particularly housing- will slow due to less QE.† As a result, new Fed Chief Janet Yellen might

be forced to abort tapering and increase QE.††

Also,

we think the U.S. $ will hold the key to many investment markets next year,

e.g. gold, oil, bonds, and stocks.†

That's especially true if it breaks down or falls sharply.† Victor thinks the global trend towards

socialism is a major problem (see his comments below).

The

Curmudgeon believes the greatest global financial threat is unchecked global

bank lending and nation-states' failure to co-ordinate monetary policies.† This is especially true in China, where state

owned banks make loans to entities/well connected individuals who then loan

that money out at much higher rates.† A terrific

article on that topic appeared in this Saturday's NY Times.

"Official

bank lending has more than doubled since the global financial crisis, growing

nearly twice as fast as the overall economy. The even bigger problem, however,

appears to come from the rise of a shadow banking system that has allowed a

number of companies and individuals, often with political connections, to

borrow from state-controlled banks at low interest rates and relend the money

at much higher rates to private businesses desperate for credit at almost any

price."

In

his December 19th NY Times op-ed Stumbling

Toward the Next Crash, former UK Prime Minister Gordon Brown made

several eye opening statements regarding China's credit expansion and global

debt build-up to seemingly unsustainable levels:

"Chinaís

total domestic credit has more than doubled to $23 trillion, from $9 trillion

in 2008 ó as big an increase as if it had added the entire United States

commercial banking sector. Borrowing has risen as a share of Chinaís national

income to more than 200 percent, from 135 percent in 2008. Chinaís growth of

credit is now faster than Japanís before 1990 and Americaís before 2008, with

half that growth in the shadow-banking sector. According to Morgan Stanley,

corporate debt in China is now equal to the countryís annual income."

"Emerging-market

economies in Asia and Latin America have seen a 20 percent growth in their

shadow-banking sectors. After 2009, Asian banks expanded their balance sheets

three times faster than the largest global financial institutions, while adding

only half as much capital."

†

Follow-Up on Market

Manipulation:

After

reading our piece on stock market manipulation following the Fed's recent

announcement to begin tapering, Tim Quast of ModernIR

wrote in an email to the CURMUDGEON:

"Thereís

no question that machine-driven behavior is behind the big market gains.

Whether the Fed is intentionally driving it is impossible to substantiate.

We

track volumes through nearly all primary dealers Ė the firms required to make

markets at Treasury auctions of notes, bills and bonds.† Following the Japan Tsunami in 2011, we saw

coordinated intervention in markets by the biggest banks, a willful effort to

stabilize global financial markets.†

Thatís injecting liquidity.†

Here

lately?† It is hard to say. †We can see the behaviors setting price.† Bottom-up investors were not and are not now

the price-setters.† Itís all speculative

trading and index/ETF volumes that coincided with options-expirations 12/18-20

and index-rebalances 12/20.†

If

thereís an argument to be made that the Fed intervened and managed outcomes,

itís in the US dollar.† Leading into the

Fed's tapering decision, the dollar was weakening, suggesting the Fed may have

been injecting dollars into the system to purposely weaken the dollar ahead of

tapering, so that any rise in the dollar resulting from lessening liquidity

would be blunted.

Meanwhile,

the S&P 500 has been soaring as the dollar remains steady Ė thatís

inflation resulting from the injection of dollars.† Iím sure the Fed is as surprised as anyone by

how the equity market is soaring.† For

sure, itís not at all what they (the Fed) expected."

Victor's Closing

Comments:

All

investments (and life decisions) are about "risk versus reward."†† Without such a thought processing

evaluation, you will lose more money than you gain.†† This maxim is especially relevant for

today's U.S. stock market.

Although

a market can still appreciate in a high risk environment, lowering your

exposure is a critical consideration for maximum returns when the risk

ultimately manifests itself in a sharp price decline.†

The

chart below clearly show that after a 4.75 year bull market (which started

3/9/09), bullish sentiment is clearly excessive.

†

Greed

has overcome fear. In my authored books and interviews, I stressed a minimum of

1:3 risk vs reward ratio in order to justify an investment.† For example, if you think the market can have

a 10% correction, you need a 30% potential upside. That's not very likely in

today's U.S. equity market, especially after the unchecked advance since the

last 10% correction ended on October 4, 2011.†

While shorting stocks is a "very deadly sport' these days, being

long about 1/3 of your normal stock allocation is prudent.

The

beginning of tapering cannot be bullish in the long run; as printing money to

buy debt is the reason the Fed uses this "tool" to create what it

believes to be the "wealth effect."†

But it has not worked, as evidenced by sluggish GDP growth, miniscule

commercial loans, and still high unemployment.†

And that's after 4 1/2 years of the U.S. "economic recovery."

Overall,

my main concerns are the U.S. dollar's fall or collapse and the worldís trend

towards Socialism.† Austerity - higher

taxes and lower government spending - is what I refer to as "Socialism

Lite."†

With

this backdrop, how will the world economy really grow?† Not via austerity measures or huge government

deficits.† Huge amounts of debt lead to

defaults and/or hyperinflation.† So the

U.S. and Japan have resorted to printing money, while Europe stands ready to do

likewise.

With

few exceptions, governments around the globe really don't care about negative

consequences of their current fiscal/monetary policies (or lack of same), as

long as itís a "future problem" - not today's problem.† In my opinion, this is most immoral political

philosophy in history.††

My

only optimistic note is that ObamaCare is so bad, and (adversely) effects so

many people, it will change the perception of big government being good for the

people.

Till next year........................

The Curmudgeon

ajwdct@sbumail.com

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo

is a historian, economist and financial innovator who has re-invented

himself and the companies he's owned (since 1979) to profit in the ever

changing and arcane world of markets, economies and government policies.

As President and CEO of Alpha Financial Technologies LLC, Sperandeo overseas

the firm's research and development platform, which is used to create

innovative solutions for different futures markets, risk parameters and other

factors.