U.S. Treasury

Yields and Inflation to Stay High into 2024

By the

Curmudgeon with Victor Sperandeo

Introduction:

Last week we opined that the Fed

would keep interest rates higher for longer. Indeed, that’s what Fed Chair Jerome Powell

said during his September 20th post FOMC meeting press

conference. Shortly thereafter, U.S.

bond yields rose to hit new multi-year highs (since 2007) and stocks sold off

sharply, especially the tech dominated NASDAQ. The media referred to Powell’s

comments as the “Fed’s hawkish pause.”

What’s next for interest rates and the markets?

U.S. Treasury Yields and Inflows:

The 10 Year T-note yield closed the week at 4.44% on Friday,

compared to 4.49% the previous market day and 3.70% last year. This is higher than the long-term average of

4.25%.

BoA notes that the 10-year

U.S. Treasuries are on course for their third year of total return losses. That’s never happened in U.S. history, dating

all the way back to 1787!

ING Financial Markets LLC this

week said it sees the risk of a further selloff that drives 10-year yields to

5%.

Despite the persistent rise in yields, U.S. bond money flows

have been positive for quite some time.

According to BofA Global Research, last week marked the 32nd

straight week of U.S. bond inflows with a net + $2.5B added!

Astonishingly, U.S. equities experienced the largest

weekly outflow ($17.9B) since December 2022.

U.S. Debt Breakout to New All-Time Highs:

As Victor noted in last week’s column (and many others), the

rise in yields is largely due to increased Treasury auctions which are the

result of massive U.S. budget deficits and debt. In fact, U.S. government debt is now above

$33 Trillion (see Chart 3)!

This debt breakout comes with no debt ceiling until

2025. It’s a very troubling benchmark as lawmakers show little interest in

reining in spending, let alone a balanced budget. The milestone comes as

Congress faces a deadline of September 30th to pass another spending

measure or face a federal government shutdown which seems very likely.

“$1 trillion more debt… SINCE JUNE!” Rep. Dan Bishop,

R-N.C., wrote on social media. “Now $33 trillion. Your family’s share is over

$260,000,” he added.

“The U.S. national debt has exceeded $33 trillion for

the first time in history,” Sen. Marsha Blackburn, R-Tenn., wrote on social

media. “Biden’s reckless spending has created an economic crisis.”

Earlier this month, the U.S. Congressional Budget Office

(CBO) published its estimate of the deficit 11 months into the fiscal year

which reported that the U.S. budget deficit hit about $1.5 trillion. At the

same point last year, the deficit was under one trillion dollars.

Secular Bond Bear Market?

BofA Global Research and the Fiendbear

believe that U.S. bonds are now in a secular bear market. BofA goes so far as to classify it as the 3rd

greatest bond bear market of all time (see Chart 9. below).

Two-year T-note yields above 5% haven’t been that high since 2006, while

10-year yields eclipsed 4.5% on Friday for the first time since 2007.

“The resounding selloff in front-end Treasuries we have seen

in this cycle isn’t done yet, with yields likely to reach the highest in more

than two decades should the Federal Reserve follow the path of its latest dot

plot.” ---Ven Ram, Bloomberg Markets Live Strategist

Victor’s Comments:

In my opinion, the objective of all market commentators

should be to propose to readers and/or listeners how to benefit or profit from

the ideas espoused, which are in effect suggestions, for each Investor to

accept or reject.

In that vein, I’ll stick to what I believe is the path to the

most profitable economic and market forecasts in my comments this week. First, a brief review.

In last

week’s Curmudgeon column, I showed what historical U.S CPI trends looked

like. Then I compared that to

Argentina’s 124% inflation rate and 118% interest rate, opining that the U.S.

is headed in that same direction unless Congress can drastically reduce deficit

spending. That’s not likely to happen

anytime soon.

To “keep the game/ruse going,” the U.S. government must

continue to spend, borrow, and thereby “print” money, or the economy and

financial system will crash. This has

been the case since the last real recession which ended in June 2009.

However, the chances of a recession next year increase

drastically if the Fed hikes rates at its November or December FOMC meeting and

maintains that 5.50-5.75% policy rate for most or all of 2024 (a Presidential

election year).

Sidebar: Recessions

that Start in Election Years

Economic downturns dash the re-election hopes of sitting U.S.

Presidents or the White House aspirations for the nominees of incumbent parties

when they coincide with an election year.

Let’s look at a few examples of Presidential election results when a

recession started before November of that same year:

l In 1920, a particularly severe recession started in January

and lasted 18 months. The incumbent Democratic Party nominee, James Cox, lost

the Presidential election to Republican Warren Harding.

l 1960: A mild recession began in April and lasted for 10

months. Richard Nixon, the incumbent Republican Party nominee and sitting Vice

President, lost to Democrat John F. Kennedy (JFK).

l 1980: A six-month recession started in January, kicking off a

miserable political year for Democratic President Jimmy Carter, who lost his

re-election bid to Republican Ronald Reagan.

Victor’s Conclusions and Market Forecasts:

While most analysts are expecting a recession in 2024 and

suggest buying bonds now in expectations of lower rates next year, I believe a

recession will be avoided at all costs.

It is quite likely the Fed will monetize most of the

additional U.S. debt coming to market in 2024 (i.e., end of QT and back to QE),

in order to avoid a recession during an election year.

Curmudgeon Note:

The increased U.S debt is a direct result of huge budget

deficits caused by uncontrolled federal government spending. We’ve complained about that for years, but

politicians haven’t done anything to reduce government spending.

What will they do next week with a U.S. government shutdown

looming on September 30th?

The U.S. House of Representatives' Rules Committee on

Saturday voted, 9-2, to progress four appropriations bills for debate on the

full House floor, the latest move in Republicans' last-ditch bid to prevent

government shutdowns after a Sept. 30th deadline.

….………………………………………………………………………………………….

Victor: To a lesser degree, the

U.S. is following the path of Argentina, where annual inflation has been above

100% since February (the highest level since 1991). According

to Fitch, markets forecasts are for 142% inflation in 2024.

U.S. bonds are likely to continue to decline in price, while

stocks should rise. BofA U.S. Strategist Savita Subramanian just raised her

S&P 500 year-end target to 4600 from 4300, implying +6% upside from

Friday’s close.

Commodities that are often thought of as money, i.e., gold

and silver, will rise in a big way under continued inflation. Oil is the next

best commodity to invest in. I continue

to be long Gold.

End Quote:

“Whoever controls the volume of money in our country is

absolute master of all industry and commerce...when you realize that the entire

system is very easily controlled, one way or another, by a few powerful men at

the top, you will not have to be told how periods of inflation and depression

originate.”

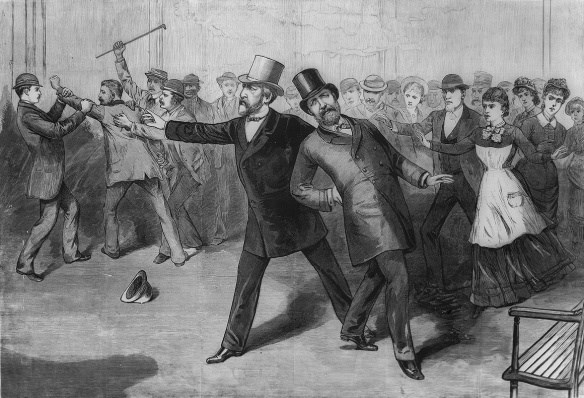

by James A. Garfield -20th President of the U.S. who

was assassinated on July 2, 1881, by Charles Guiteau after only four months in

office. He died three months later.

Source: U.S.

Library of Congress

….……………………………………………………………………………………………..

Be well, success, good luck and till next time………………

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2023 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).