The Fed’s

Campaign to Raise Interest Rates is Misguided

By Victor Sperandeo

with the Curmudgeon

Introduction:

We examine a fallacy which the Fed uses to mislead the public

by raising interest rates to “fight inflation.” Its agenda is largely based on

the Phillips Curve - an academic theory that inflation and unemployment

have a stable and inverse relationship. The Fed believes that raising rates will slow

economic growth causing higher unemployment which will result in lower

inflation.

In a previous

Curmudgeon post, we stated that the Phillips Curve was disproven

during the 1970-1981 period of stagflation, when there were high levels of both

inflation and unemployment. The U.S.

unemployment rate went straight up with the huge inflation of the 1970’s to

early 1980’s (from 3.90% in January 1970 to 10.80% in December 1982.

As we’ve explained

many times, the Fed also believes in a “reverse wealth effect” such

that rising rates will cause asset prices to decline, making people feel poorer

so they spend less which would theoretically lower inflation.

Effects of Fed Rate Increases:

Raising interest rates is like hitting the brakes on economic

growth: It slows consumer and business demand in order to

bring down inflation. However, rate

hikes don’t have much of an impact on large corporations, because they don’t

borrow much (except to buy back their shares) and can raise prices to offset

higher inflation.

-->It’s the small businesses, the middle class and the

poor that suffer when rates rise, and layoffs accelerate.

The overall economic slowdown caused by higher rates negatively

impacts small businesses. They are often forced to enact hiring freezes,

attrition without replacement and layoffs.

In some cases, they’ve been forced to close, especially in Santa

Clara, CA where the Curmudgeon has lived for 53+ years.

With higher interest rates on mortgages, car loans and credit

cards, people will have less discretionary money to spend and even less if

they’re laid off. Does the Fed care

about that? Evidently not!

Future Fed Rate Hikes?

“It wouldn’t have been thinkable to have a 5% (Fed Funds)

interest rate before the pandemic,” Jerome H. Powell, the Fed’s chair, said on

Thursday. “And now the question is: Is that tight enough policy?”

FOMC members expect to raise their Fed Funds policy rate two

more times in 2023, to 5.5% to 5.75% from just above 5% now. If those moves

happen at an every-other-FOMC meeting pace, that will mean rate

increases at the central bank’s meetings in July and November 2023.

Currently, the CME

Fed Watch Tool indicates an 84.3% probability of a 25bps rate hike (to 5.25

to 5.5%) at the July FOMC meeting.

There’s a 46.4% probability that Fed Funds will be 5.5% to 5.75% after

the November FOMC meeting. That’s the highest of any Fed Funds rate forecast

for that meeting.

The Fed’s 2% Inflation Target:

The Fed’s arbitrary goal of 2% inflation, using the Personal

Consumption Expenditure (PCE) Price Index [1.], is said to be

most consistent with the Federal Reserve’s mandate for maximum employment and

price stability.

Note 1. The PCE price

index, released each month in the BEA’s Personal Income and Outlays report,

reflects changes in the prices of goods and services purchased by consumers in

the U.S. While the Consumer Price Index

(CPI) assumes a fixed basket of goods and uses expenditure weights that do not

change over time for several years, the PCE Price Index uses a chain

index and resorts on expenditure data from the current period and the preceding

period (known as Fisher Price Index).

….……………………………………………………………………………….

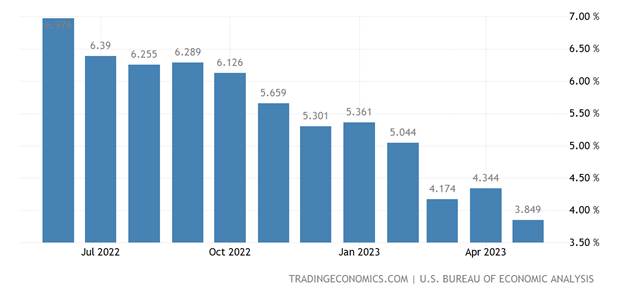

Recently, there have been huge declines in the PCE and CPI

rate of change from the previous month and year:

l The PCE increased 0.1% in May 2023 and 3.8% year over

year (YoY). That was the lowest reading

since April of 2021, while April 2023 advance was revised down to 4.3%. This

chart shows the declining trend in the PCE since it peaked in June 2022:

For more details, please refer to Table

9 in this latest BEA report.

l In the last 15 months, the rate of change in the CPI

declined by -56.1% (+9.1% to +4.0%). The Fed has consistently said that is not

enough and that “we must do more (rate hikes).” Based on what

standard?

The last period of high inflation was the 1970’s and early

1980’s. Here are the annual official CPI increases (PCE was not

available during those years) with the % change from the previous year:

l 1979 +13.29% (vs 7.59% in 1978 or -42.9%)

l 1980 +12.52% (-5.8%)

l 1981 +8.92% (-28.8%)

l 1982 +3.83% (-57.1%)

l 1983 +3.79% (-1.0%)

I’ll leave it to the reader to judge if the 15 month decline in the CPI rate of change is large enough for

the Fed to stop raising rates?

Evidently not! When

Jerome Powell was asked this week when inflation will return to the 2% target,

the Fed Chairman straight up said it won’t happen before 2025—a very long time

for a policy maker to concede failure. That now makes it crystal-clear

short-term interest rates are going to stay higher for longer.

Cartoon of the Week:

Inflation Definitions:

Please keep in mind that the CPI is not inflation, but a

highly subjective manipulation of prices the U.S. government puts out.

Inflation is classically defined as: “an increase in the

volume of money and credit RELATIVE to the available goods (and services)

-RESULTING - in a substantial and continuing rise in the general price level.” Merriam

Webster dictionary, 1965 edition.

Today, inflation is defined as “a continuing rise in the

general price level usually attributed to an increase in the volume of money

and credit relative to available goods and services.”

As

John Maynard Keynes so aptly put it (emphasis added):

“There is no subtler, no surer means of overturning the

existing basis of Society than to debauch the currency. The process engages all

the hidden forces of economic law on the side of destruction and does it in a

manner which NOT ONE MAN IN A MILLION is able to DIAGNOSE.”

Victor’s Conclusions:

1. The Fed employs

just over 400 Ph.D. economists, who “represent an exceptionally diverse

range of interests and specific areas of expertise. They produce a wide variety of economic

analyses and forecasts for the Board of Governors and the Federal Open Market

Committee.”

If they’re so smart and knowledgeable, why don’t they realize

the harm they’re doing to the economy by excessive rate increases?

2. The U.S. economy works well for everyone when there is stable

money supply growth (of 5-6%), balanced budgets with low government spending (mostly

for essentials), and low taxes (which enables people to keep more

of their money to save and invest).

That was the case during the Calvin Coolidge administration

(1923 to 1929) and the Reagan administration (1981-1988).

End Quote:

Calvin Coolidge has by far the best economic record in U.S.

history. The “Roaring Twenties” had negligible inflation (+0.25% compounded in

7 years), budget surpluses every year, stable government spending and low interest

rates. There were also tax cuts from 58%

to 24% during 1923-29.

Coolidge’s philosophy was:

“Unless the people, through unified action, arise and take

charge of their government, they will find that their government has taken

charge of them. Independence and liberty will be gone, and the general public will find itself in a condition of servitude

to an aggregation of organized and selfish interest.”

….……………………………………………………………………………………

Success, good luck and till next time………………..

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2023 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).