Inflation is

Decreasing While Regional Banking Crises Persists

By Victor

Sperandeo with the Curmudgeon

Inflation Numbers Are Improving:

U.S. inflation numbers came in slightly better than

expected last week.

1. The BLS reported on Wednesday that the

April Consumer Price Index (CPI) for All Urban Consumers increased 0.4%,

seasonally adjusted, and rose 4.9% over the last 12 months, not seasonally

adjusted. The index for all items less food and energy (core CPI) increased

0.4% in April (SA); up 5.5% over the year (NSA).

2. On Thursday, the BLS said the Producer

Price Index (PPI) for final demand rose 0.2% in April. Prices for final

demand services increased 0.3%, and the index for final demand goods advanced

0.2%. Prices for final demand were up 2.3% for the 12 months ended in April.

Victor’s Perspective on the CPI:

As Curmudgeon readers know, Victor’s belief is that

the CPI is not a representation of prices, but really a political propaganda

talking point to assist in a larger government agenda. This is true for both U.S. political parties.

The CPI should be called the CONSUMER POLITICAL INDEX.

The CPI is by far the worst constructed “index” in

the history of economics. It is 100% subjective

and thereby worthless. If you study the construction, it represents nothing of

reality. In that vein, an innovation has just been released called “TRUFLATION INDEX,” which I respectfully

suggest you investigate.

What Drives Precious Metals Markets – Inflation or

the Fed?

The precious metals, especially silver, declined

after the PPI was reported to be lower than expected on Thursday.

Well, if price index increases are bearish (because it would

cause the Fed to tighten), and prices increase lower than expected are also

bearish, then precious metal markets should never rally?

The precious metals and the markets are in limbo with

the Fed, and for the economy to declare itself.

The key question is...are we going into recession, or not? Is the Fed

pausing or not?

Victor’s Perspective on the Fed:

The Fed still wants all markets down to induce a

reverse wealth effect which they believe will reduce inflation. On Friday May 5th and repeated

Monday May 8th, the Fed’s designated hit man James Bullard

again came out with his rant calling for higher interest rates…this is the new

and abused “threat weapon” of the Fed to talk markets down!

As expected on May 3rd, the Fed raised the

Fed Funds rate 25 bps, to 5.00%-to-5.25%. That was during a regional banking

crisis, which was an incredible mistake in my view.

It is hard to understand why the Fed would raise

rates again, when banks are failing, and the potential for the continued

defaults are accelerating with higher short term interest rates. It’s causing depositors of regional banks to

take their low yielding interest savings out of banks and buy higher yielding 1

month to 2 year yielding U.S. government debt (no commission using Treasury

Direct account).

The Fed believes it solved the banking problems with

the Bank Term Funding Program (BTFP) facility. “The BTFP offers loans of up to one year in

length to banks, savings associations, credit unions, and other eligible

depository institutions pledging any collateral eligible for purchase by the

Federal Reserve Banks in open market operations (see 12 CFR 201.108(b)), such

as U.S. Treasuries, U.S. agency securities, and U.S. agency mortgage-backed

securities. These assets will be valued at par. The BTFP will be an additional

source of liquidity against high-quality securities, eliminating an

institution’s need to quickly sell those securities in times of stress.”

However, the issue is depositors want higher yields

as well as safety. As the Fed raises rates, yields increase on short term U.S.

government paper and the banking system deteriorates (bank depositors redeem to

buy higher yielding Treasury Bills or Notes). There’s also the risk of

commercial real estate loans that are not “mark to market” on the bank’s books,

which is very foreboding!

U.S. Recession or Not?

Victor believes it’s a 99.99% guarantee that the U.S.

is now in or going into recession (or worse a depression-my view). However,

until unemployment increases, and GDP decreases in headline statistics the

markets are still in a waiting game.

A NY Fed model agrees with me….

The odds that the United States will fall into a recession at some point over

the next 12 months have risen to a 40-year high, according to a probability

model from the New York Federal Reserve.

The probability that the country will enter a recession

within the next year has risen to 68.2%, according to the New York Fed. That’s the highest level since 1982.

The NY Fed’s recession risk indicator is now greater

than it was in November 2007, not long before the subprime crisis, when it

stood at 40%. The NY Fed recession model is based on the spread between the

three-month and 10-year yields on U.S. Treasury’s.

Market Comments and Risks:

Victor continues to believe U.S. bonds and gold/silver are in

up trends, while stocks are topping from the long rally starting from the

October 2022 lows. In his view, stock

indexes will test and break those lows when the recession shows itself.

The Curmudgeon

wonders what’s keeping stock prices up? Institutions have pulled a net

$333.9 billion from stocks over the past 12 months, according to S&P

Global Market Intelligence data, while individual investors have yanked

another $28 billion. Billions have flowed into cash equivalents, driving total

assets in money markets to a record $5.3 trillion as of May 10th,

according to the Investment Company Institute.

Individual

investors share institutions’ bearish view, according to the long-running

weekly survey from the American Association of Individual Investors. The

survey showed 41% of individual investors expect stock prices will fall over

the next six months, down from a recent high of 61% in September that preceded

this year’s rebound, but above the 31% historical average.

Due to the uncertainty of the debt ceiling

being raised by June 1st, the 1-month T-bill yields 5.5%, yet the

2-month T-bill is at 4.6%. Moreover, the

1-year U.S. Credit Default Swap (CDS) – a market-based gauge of the risk of a

default–is at 177 which is an all-time record high!

Charts courtesy of BofA Global Research

………………………………………………………………………………..

Market risks to be aware

of include the following:

·

The U.S. debt limit battle

appears to be deadlocked. Our assessment is here. We’re approaching the June 1st

deadline when the U.S. government could run out of cash to pay its bills unless

Congress allows it to borrow more. “If policymakers

fail to resolve the debt ceiling crisis, these dismal views over the economy

will exacerbate the dire economic consequences of default, “Joanne Hsu,

director of the Surveys of Consumers said in a statement.

·

The 150,000+ migrants from

all over the world that will enter the U.S. now that Title 42 has ended. This

will dramatically effect U.S. debt, medical treatment and costs, education

strains, jobs, voting, increase crime of all kinds, and it ignores the rule of

law (see Sidebar below).

·

Precarious position of the

Regional Banks (see chart above), due to depositor redemptions and commercial

real estate loans that are not marked to market. For example, PacWest stock lost 21%

this past week. That’s after the collapse of Silicon Valley Bank, Silvergate, Signature Bank and First Republic Bank

(acquired by JP Morgan Chase).

·

The escalation of the

Ukrainian conflict into war with the U.S. or NATO getting involved.

·

The de-dollarization

and de-globalization trends are accelerating.

·

The list of U.S. dollar

alternatives is long and growing daily. Examples include China testing

cross-border digital currency settlements with Thailand and the UAE, insisting

that sanctioned countries such as Russia, Iran and Venezuela accept yuan as

payment for oil. Saudi Arabia is considering doing the same (there are rumors

that Saudi is already selling oil for yuan and converting those yuan for gold

on the Shanghai exchange). India is buying some of its Russian oil in UAE

dirhams. The simplest method, which is becoming increasingly popular, is

bi-lateral agreements using local currencies. There’s also the rumored BRICs/OPEC+

issued currency which we’ve explained in several previous posts. This hypothetical currency has the potential

to usurp, or at least shake, the dollar’s place as the world’s reserve

currency.

·

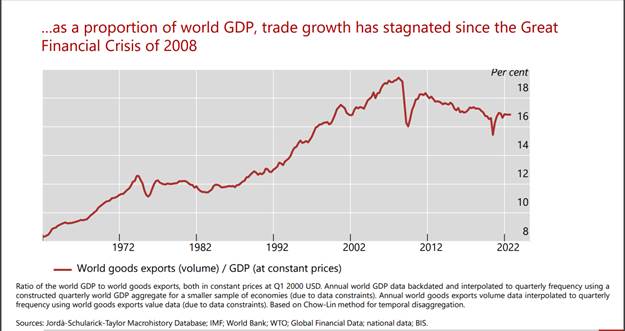

De-globalization is a movement towards a less connected world, characterized

by powerful nation states, local solutions, and border controls, rather than

global institutions, treaties, and free trade.

This trend has increased since Russia’s invasion of Ukraine on February

24, 2022. The chart below shows a steady

decline in world trade growth as a percent of GDP:

Sidebar – Rule of Law:

“Article 4, Section 4 of the US CONSTITUTION: The

United States shall guarantee to every State in this Union a Republican Form of

Government and shall protect each of them against Invasion; and on Application

of the Legislature, or of the Executive (when the Legislature cannot be

convened), against domestic violence.”

Historical Cartoon:

Cartoon critical of anarchist leader Johann Most by

Thomas Nast (Harper's Weekly, May 22, 1886):

………………………………………………………………………………

Victor’s Opinion:

The Biden Administration will impact everyone in the

U.S. in a negative way. President

Biden’s approval rating is only 37% as Americans are unhappy with his handling

of immigration and inflation. Republicans criticize unchecked government

spending, which has surged in recent years under Biden (but also under Trump).

What has happened to the representatives of the

American people in Congress and the courts, the Governors of the states, and

the people themselves in allowing this destruction of America?

Sadly, the U.S. continues its foreboding decline each

day.

End Quote:

Perhaps the Nostradamus who wrote 1984 [1.] should be

heavily pondered at this time:

“A society becomes totalitarian when its structure

becomes flagrantly artificial: that is, when its ruling class has lost its

function, but succeeds in clinging to power by force or fraud. Such a society,

no matter how long it persists, can never afford to become either tolerant or

intellectually stable.

Note 1. 1984 is a

dystopian social science fiction novel and cautionary tale by English writer

George Orwell.

―

George Orwell

………………………………………………………………………………….

Be well, stay healthy, wishing you peace of mind.

Till next time…...

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2023 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).