When Bad News is Good News; Market Review &

Outlook; Banana Republic?

By the

Curmudgeon with Victor Sperandeo

Introduction:

We provide a fresh perspective on banking system bad

news becoming good news for stocks. We

then review the markets 1st Quarter 2023 performance and outlook

going forward. Risks to the global

economy and Americas political system are assessed along with the threat of

the U.S. becoming a Banana Republic.

Curmudgeon comments, especially from Bank of America, provide additional

relevant data and food for thought.

-->Please let us know what you think of our work!

Bad News for Banks Becomes Good News for Equities:

The Bad News: Regional

banks are failing due to the largest and fastest rate hikes in the history of

the Federal Reserve. They have a reported $620 billion mark to market in bond

losses on their books.

Bank depositors are moving their money into U.S.

government short debt, (1-year T-bills are yielding 4.64%) for a combination of

safety and yield. They are also putting

their cash into U.S. money-market funds which have now reached a record $5.2

trillion, according to data from the Investment Company Institute, with

more than $300 billion of that added in the three weeks to March 29th.

Regional banks still have huge losses estimated at

-$2.2 trillion on their books for loans on Commercial Real Estate. Those losses are NOT marked to market.

The Good News: The U.S.

federal government created a new program called Bank Term Funding Program

(BTFP) which allows banks to exchange their U.S. debt with a loss for

the full value in cash with market interest rates for one year. The program was

announced on Sunday March 12th most likely to calm markets on

Monday.

...

Is that how capitalism works? The rules for bank bailouts are arbitrary, as weve discussed

in Powell and Yellen

Conspire to Ignore Dodd-Frank Law to Bailout Some Depositors. Meanwhile, the Dodd-Frank law

of bail-ins have not been applied to date. And now banks have an escape hatch

to avoid losses via the BTFP!

..

The BTFP program added $363 billion to the

Feds balance sheet (from 3/8/23 $8.342T to $8.705T on 3/31/23). The all-time

high for the Feds balance sheet was $8.939 Trillion on 5/4/22.

Evidently, the markets considered the BTEP and the

increase in the Feds balance sheet as bullish.

From March 13th to March 31st,

the S&P was +6.42% while the NDX 100 gained +11.42% (with only three down

days out of 15).

1st Quarter 2023 Market Summary:

Lets recap the results of the 1st quarter

of 2023:

S&P 500 +7.03%; NDX +20.49% (~88% of the gain

come from 10 stocks); Dow Jones Industrials +0.38%; Russell 2000 +2.34%; TLT

Bond ETF +6.84%; AGG corporate bond ETF +2.73%; Gold +8.76%; Silver +1.24%;

Bitcoin +72%; Crude Oil -5.72%; US Dollar Index (DXY) -6.29%; CRB Commodity

Index -3.61%.

For comparison, here are the 2022 annual % returns

for selected markets:

S&P 500 -19.33%; NDX -33.10%; Dow Jones

Industrials -8.78%; Russell 2000 -21.69%; TLT -32.82%; AGG -14.98%; Gold

-0.11%; Silver +2.75%; Bitcoin -63.87%; Crude Oil +19.33% (May Futures); US

Dollar Index +8.00%; and CRB +19.53%.

Curmudgeon Comments:

1. We don't know of

any stock market cycle where the previous industry group leaders were the

leaders after a -20+ decline followed by a market gain of more than +20%. Yet

that is the case now with tech stocks way outperforming all other industry groups.

It comes despite MAJOR LAYOFFS across the entire tech ecosystem! For example:

S&P North American Technology (SPGSTI) +21.32%

YTD; Dow Jones U.S. Technology Index (DJUSTC) +24.35% YTD; Tech heavy NASDAQ

100 (QQQ ETF) +21%.

2. Bank of

America global investment strategist Michael Hartnett notes: In the

past six months, U.S. budget deficit is up $700bn (war, infrastructure, Social

Security) while in the past four weeks Fed balance sheet up $370bn.

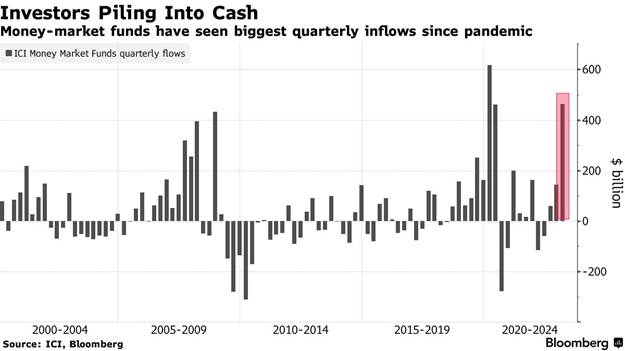

3. During the

first quarter this year, investors poured $508 billion into U.S. money funds in

their largest quarterly inflow since the early days of Covid-19 three years

ago, according to Bank of America Corp. strategists citing EPFR Global data. More than $100 billion have flocked into

money-market funds in the past two weeks alone, they said. For sure, most of those money fund

investments came from bank account redemption's (the Curmudgeon has done

exactly that with savings he had at online banks and large commercial banks).

.

Victors Markets Outlook:

Im still bullish on Bonds, Gold, and Silver,

while bearish on Stocks. The premise for those positions is lower

corporate earnings due to a coming recession (or worse). If that premise is

wrong, so will the investment positions.

Equities are still in a bear market, in my

opinion. The fact that a hand full of

tech stocks are relatively strong, while the bulk of stocks are doing poorly

(especially small stocks which usually outperform in a bull market) depicts the

true trend of the markets.

Risks to the Global Economy and Political System:

It should be emphasized the greatest risk to the

world is the Ukraine - Russia conflict turning into World War III.

In my opinion, the next critical risk is the

breakdown of the rule of law in the U.S. and in many Western nations.

..

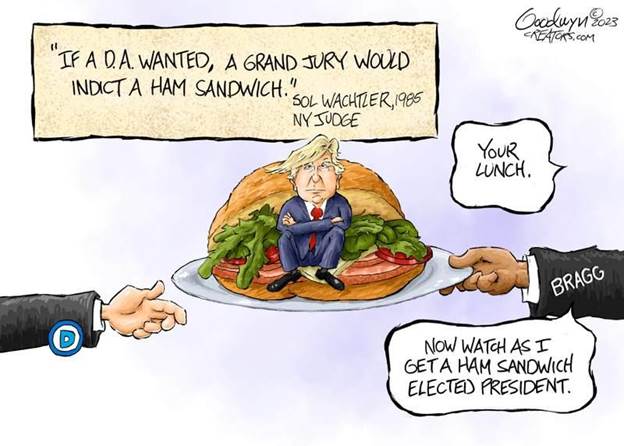

Sidebar: Trump Indictment

X-President Donald J. Trumps indictment this coming Tuesday for a

2016 hush money payment to a porn star is an example of that breakdown. Both the Curmudgeon and I agree its very bad

for America, which is already greatly polarized politically.

The weaponization of the legal system to advance a political agenda

turns the rule of law on its head. It is

un-American, Florida governor Ron DeSantis wrote

on Twitter. The

Soros-backed Manhattan District Attorney has consistently bent the law to

downgrade felonies and to excuse criminal misconduct. Yet now he is stretching

the law to target a political opponent.

For more than two centuries, American presidents were effectively

shielded from indictment. But the case against former President Trump breaks

that taboo and sets a new precedent. It

is not good for our political system or economy!

Weve discussed this rule of law breakdown in many previous

Sperandeo/ Curmudgeon posts, such as Political Corruption and a

New World Monetary Order.

A BRICS commodity-backed currency and the forthcoming

talk of the U.S. going to a Central Bank Digital Currency (CBDC) are also

great long term risks for the U.S. From

the above referenced Sperandeo/Curmudgeon post:

Credit Suisses Zoltan

Pozsaris note We are witnessing the birth of a new world monetary order

states: We are witnessing the birth of Bretton Woods III a

new world (monetary) order centered around commodity-based currencies in the

East that will likely weaken the Eurodollar system and also contribute to

inflationary forces in the West.

Has the U.S. Become a Banana Republic?

A Banana Republic is a politically unstable

country and its generally considered to be a very derogatory term. The societies of Banana Republics are

typically highly stratified, consisting of a small ruling-class of business,

political, and or military leaders, and a larger impoverished working-class.

Unless U.S. government leaders/representatives get

back to civilized discourse and judges once again follow the U.S. Constitution/

rule of law, America is headed into anarchy.

...

End Quotes:

The wealth of a nation depends on the extent of its

Liberty:

Democracy cannot exist as a permanent form of

government. It can only exist until the voters discover that they can vote

themselves largesse from the public treasury. From that moment on, the majority

always votes for the candidates promising the most benefits from the public

treasury with the result that a democracy always collapses over loose fiscal

policy, always followed by a dictatorship. The average age of the world's

greatest civilizations has been 200 years. These nations have progressed

through this sequence: From bondage to spiritual faith; From spiritual faith to

great courage; From courage to liberty; From liberty to abundance; From

abundance to selfishness; From selfishness to apathy; From apathy to

dependence; From dependence back into bondage.

Alexander Fraser Tytler (1747-1813) was a Scottish advocate, judge, writer, and historian who was

a Professor of Universal History, and Greek and Roman Antiquities at the

University of Edinburgh.

..

A man's natural rights are his own, against the

whole world; and any infringement of them is equally a crime, whether committed

by one man, or by millions; whether committed by one man, calling himself a robber,

(or by any other name indicating his true character,) or by millions, calling

themselves a government.

Lysander Spooner (1808-1887) was a legal theorist, abolitionist, and radical individualist

who started his own mail company in order to challenge

the monopoly held by the US government. He wrote on the constitutionality of

slavery, natural law, trial by jury, intellectual property, paper currency, and

banking.

Be well, stay healthy, wishing you peace of mind.

Please email the Curmudgeon (ajwdct@gmail.com) if you have any comments,

questions, or concerns. Till next

time

...

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2023 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).