Powell and Yellen

Conspire to Ignore Dodd-Frank Law to Bailout Some Depositors

By Victor

Sperandeo with the Curmudgeon

Introduction:

The U.S. governments response to the unexpected

bankruptcy of Silicon Valley Bank (SVB) and (two days later) Signature

Bank has turned into a potential Constitutional breaking point!

The important question to be asked is who makes

U.S. laws - Congress or unelected, appointed bureaucrats? Astonishingly an important law has been

changed without even any discussion in Congress!

We discuss whats happened in depth in this article,

which is a follow up to last weeks column.

U.S. Government Reverses Itself on SVB Failure:

March 10th (Friday) was a stressful day for many in

the banking and investment industries due to the shocking closure of SVB. Stock trading was halted on Friday morning;

by midday SVB had been taken over by the FDIC. Regulators shuttered Silicon

Valley Bank and seized its deposits Friday after depositors withdrew more than

$42 billion by the end of Thursday.

On Sunday morning, U.S. Treasury Secretary Janet

Yellen said the U.S. government will NOT BAILOUT Silicon Valley Bank:

"Let me be clear that during the financial crisis

(2008), there were investors and owners of systemic large banks that were

bailed out, and the reforms that have been put in place means that we're not

going to do that again," Yellen told CBS' Face the Nation. She

added

"but we are concerned about depositors and are focused on trying to

meet their needs." She has been working "to address the situation in

a timely way," but said that a major government bailout is not on the

table!

Her comments were not just an opinion, they were

based on the Dodd-Frank Wall Street Reform and Consumer Protection Act. That legislation was passed by the U.S.

Congress on July 21, 2010 (Public Law No: 111-203) in response to erratic

financial industry behavior that led to financial crisis/ mortgage meltdown of

2007-2008.

The bail-in portion of that law states that

a U.S. bank may take its depositors funds (i.e., checking, savings, CD's, IRA

& 401(k) accounts) and use those funds when necessary to keep itself, the

bank, afloat.

But by Sunday evening, the Dodd-Frank law was ignored as the

U.S. government said all SVB depositors (even those with over $250K in savings

or checking accounts- the FDIC protection limit) would have access to their deposits.

The U.S. announced emergency measures on Sunday night

to prevent contagion from the collapse of Silicon Valley Bank, promising to

backstop all depositors without using taxpayer funds.

Victors Opinion: Without using taxpayer funds, is a fraudulent statement, because all money used by the

government is directly or indirectly comes from the taxpayer.

The government on Sunday also closed a second

troubled bank, crypto-linked Signature Bank [1.]. The move came

hours before Asian markets opened for trading.

Note 1. About 90%

of New York-based lender's customer deposits were uninsured, but Signature Bank

was about half the size of Silicon Valley Bank.

"Depositors will have access to all of their

money starting Monday, March 13th. No losses associated with the resolution of

Silicon Valley Bank will be borne by the taxpayer, according to a joint statement by U.S. Treasury Secretary Janet Yellen,

Federal Reserve Chair Jerome Powell, and the Federal Deposit Insurance Corp.

Chairman Martin Gruenberg.

-->Of course, that directly contradicted what

Yellen said earlier that day on Face the Nation!

...

The Fed said in a Sunday evening press release:

"To support American businesses and households,

the Federal Reserve Board on Sunday announced it will make available additional

funding to eligible depository institutions to help assure banks have the

ability to meet the needs of all their depositors. This action will bolster the capacity of the

banking system to safeguard deposits and ensure the ongoing provision of money

and credit to the economy.

The Federal Reserve is prepared to address any

liquidity pressures that may arise."

"The financing will be made available through

the creation of a new Bank Term Funding Program (BTFP), offering loans

of up to one year in length to banks, savings associations, credit unions, and

other eligible depository institutions."

Analysis: A troubled bank owning U.S. government debt

(e.g., Treasury or mortgage-backed securities) trading at a discount to par

(e.g. when marked to market) can go to the BTFP facility and get the full

value of that debt in exchange for a market interest rate. It makes whole a

loss instrument for at least one year.

The estimated amount of money that will be advanced is $2 trillion. This

will in the Feds Balance sheet or as Treasury debt after the Debt Limit is

raised. Details not stated.

Are U.S. Banks to be Nationalized?

Investment banker Roger

Altman, founder of Evercore and a former U.S. Treasury

Department official said on Tuesday that American banks were on the verge of

being nationalized following the Friday collapse of Silicon Valley Bank and the

governments response.

What the authorities did over the weekend was absolutely

profound. They guaranteed the deposits, all of them, at Silicon Valley Bank.

What that really means and they wont say it, and Ill come back to that

what that really means is that they have guaranteed the entire deposit base

($18 trillion) of the U.S. financial system. The entire deposit base!

University Economists Study - 186 U.S. Banks in

Danger Zone:

A recent study by economists has

revealed a chilling reality: 186 U.S. banks are facing a potentially

devastating risk due to issues similar to those that caused the collapse of

Silicon Valley Bank. The study, titled Monetary Tightening and U.S. Bank

Fragility in 2023: Mark-to-Market Losses and Uninsured Depositor Runs?

suggests that with interest rates on the rise, many banks are finding their

assets diminished and their futures uncertain.

The study evaluated individual U.S. banks during the

Federal Reserves swift and out sized interest rate-hike campaign, assessing asset

books and market value losses. These assets including Treasury notes and

mortgage loans are decreasing in value, and banks are struggling to keep up.

This could be the beginning of the end for many financial institutions.

The findings suggest that if even half of uninsured

depositors (with over $250k in deposits) were to withdraw their funds rapidly

from any of these 186 U.S. banks, even insured depositors might face

impairments. This is a ticking time bomb that could spell disaster for the

entire banking industry.

..

Crisis at First Republic Bank:

On Thursday, eleven of the biggest U.S. banks

announced a $30 billion rescue package for San Francisco based First

Republic Bank (ticker symbol FRC) in an effort to

prevent it from becoming the third to fail in less than a week and head off a

broader banking crisis. JPMorgan Chase,

Bank of America, Citigroup, and Wells Fargo have agreed to each put $5 billion

in uninsured deposits into First Republic. Morgan Stanley and Goldman Sachs

will deposit $2.5 billion each into the bank. The remaining $5 billion would

consist of $1 billion contributions from BNY Mellon, State Street, PNC Bank, Trust and US Bank.

Playing favorites? The

U.S. government did not say they would guarantee deposits in

excess of $250K (the FDIC limit) at FRC as they did for SVB and

Signature Bank. Therefore, U.S. banks

noted above came to its rescue.

Yet faith in FRC was not restored as its shares fell

Friday by almost 33%, to $23.03, after the bank suspended its dividend. On Sunday, S&P Global Ratings cut the credit

rating on First Republic for the second time in the past week.

Yellens Shocking Testimony:

At a Senate hearing on March 16th, U.S.

Treasury Secretary Janet Yellen was questioned by Oklahoma Senator James

Langford on these bailouts. Please see

this video with commentary. Senator Langford asks

Yellen if his local Oklahoma banks will be bailed out and she says that Not

all banks will receive an automatic bailout. Only the ones deemed necessary

by super-majorities of the Fed the FDIC.

In other words, youre fully insured if you have

deposits at a big bank, but NOT if theyre in a community/regional bank.

Cartoon of the Week:

Image Credit: Townhall Daily

Victors Conclusions:

A law used to be like a holy covenant. Without laws we are by

definition an anarchy state (lawlessness or political disorder due to

the absence of governmental authority).

Its important to note that all Federal Reserve Board

officials and the Secretary of the Treasury (Janet Yellen) are ALL APPOINTED

(none are elected). Since the SVB

failure, they are making unilateral decisions and choices without consideration

of the Dodd-Frank law or consultation with Congress.

Sadly, this implies that laws on the books are a

farce as Dodd-Frank was overruled.

Instead, an unelected ruling class of men and women circumvent the law

at will and decide who wins and losses for political advantages. Incredibly, not one elected U.S.

representative, or lawyer, or judge has said a word?

Treasury Secretary Yellens comments portend the end

of regional/community banks or about 4,834 banks in the U.S. over

time. Smaller, community banks wont get

insurance (for deposits over $250k), but the big money center banks get it for

free. Consequently, big depositors will

move their money from small regional banks to the big banks where they

will be fully protected. That would be a massive transfer of power to

the elites!

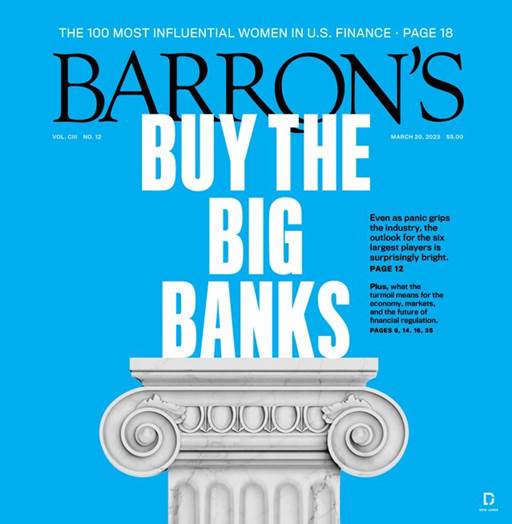

Barrons seems to

agree as per its cover story this week: Buy the Big Banks.

Meanwhile, selling in a broad group of regional banks

sent the Invesco KBW Regional Bank ETF (KBWB) down by -5.18% on Friday to a new

low for the year. That ETF lost 15% in the past week, and nearly 30% in the

past two weeks, as bank failure contagion concerns spread.

From Looney Tunes: Thats all folks! Regional

banks are done, and the rule of law is blatantly gone.

Late Breaking News:

1. Late Sunday, the Fed and five major central

banks announced a coordinated effort to improve liquidity by moving U.S.

dollars among themselves each day, starting Monday, instead of once a week. The

central banks then lend those dollars out to financial institutions, in an effort to backstop other countries funding needs

should strains emerge in global markets.

2. After the Credit Suisse takeover by UBS was

announced Sunday, Treasury Secretary Yellen and Fed Chair Powell welcomed the

deal while also trying to reassure U.S. investors. The capital and liquidity

positions of the U.S. banking system are strong, and the U.S. financial system

is resilient, the two said in a joint statement.

...

End Quotes:

Nobody has a more sacred obligation to obey the law than

those who make the law. - Jean Anouilh, French dramatist.

No country has become rich without the rule of law. No country has remained

rich without the rule of law. Allan Meltzer, Professor of Political Economy at

Carnegie Mellon Universitys Tepper School of Business and Institute for

Politics and Strategy Pittsburgh PA.

.

Be well, stay healthy, wishing you peace of mind.

Please email the Curmudgeon (ajwdct@gmail.com) if you have any comments,

questions, or concerns. Till next

time

...

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2023 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).