Market Review; Seasonally Adjusted Numbers; Gold as an

Inflation Hedge

By Victor

Sperandeo with the Curmudgeon

Stock Market Comments:

The intermediate trend (bear market correction) rally

from the end of September till the 2nd of February may have run its course. U.S. stocks pulled back sharply on Friday,

notching their worst weekly performance of the year, as reported hot economic

data rekindled worries that a more restrictive Federal Reserve policy will

persist. It seems the Fed is hell bent on driving stocks down (to produce a

reverse wealth effect) and are now talking 5.5%+ Fed Funds rate.

The S& P 500 fell 42.28 points, or 1.1%, to

3970.04. The Nasdaq Composite dropped 195.46 points, or 1.7%, to 11394.94. The

blue-chip Dow Jones Industrial Average shed 336.99 points, or 1%, at 32,816.92.

The three indexes all dropped more than 2% in the holiday-shortened week, each

posting their biggest weekly declines of 2023.

“The market is re-calibrating and acknowledging that

the path toward price stability is fraught with obstacles,” said Quincy Krosby,

chief global strategist for LPL Financial. “The market is telling us to

be careful, with a Fed that has to vanquish inflation and hurt the economy to

do it.”

I believe stocks are still in a bear market

based on Dow Theory and the direction and slope of the 200-trading

day moving average of key stock market indexes.

When the recession becomes obvious and reported jobs

start to decline along with earnings, the impact on the equity markets will be

more pronounced. I expect 3,200 on the S&P 500 before any meaningful rally.

As previously stated, I believe the U.S. has been in

a recession since January 2022 or going into recession soon. The NBER,

who are the official classifiers of recession start/end dates has not spoken

yet and will likely do so well after the fact.

Review of Other Markets:

Precious Metals have

made their lows. Gold and the 2x more volatile Silver have sold

off recently due to the stronger than expected economic data which imply higher

interest rates. Gold as a long-term inflation hedge is discussed later in this

article.

………………………………………………………………………………………..

Strong economic numbers have caused a rally in the

U.S. Dollar (USD) this month. The

USD made a low on 2/1/23 and was -2.17% YTD at that time. It’s now +1.85% (YTD) so the USD is now in an

uptrend. BofA Global Research agrees:

“The recent streak of positive economic data and renewed

inflation concerns has pressured U.S. yields higher and lifted the USD off

its 10-month lows. Sticky inflation

implies near-term stability and further upside for USD. That said, any

signs of softening in the labor market or accelerated disinflation could prompt

a reversion to the dollar's downtrend. Investors should expect the USD to be

supported in the near term, followed by moderate depreciation towards the end

of the year.”

Recent higher inflation readings and strong economic data

imply a higher Fed Funds rate (~5.5%) then originally projected. And

those higher rates are expected to persist for a longer period. Fed governor Philip Jefferson said Friday

that he saw greater evidence that the central bank would face a long inflation

battle because strong hiring and wage gains could sustain firmer price

pressures.

“The ongoing imbalance between the supply and demand

for labor, combined with the large share of labor costs in the services sector,

suggests that high inflation may come down only slowly,” he said at a

conference in New York.

-->Fed Funds have a very high inverse correlation

to the U.S. dollar. Higher rates attract

foreign capital to U.S. financial markets.

……………………………………………………………………………………...

Bonds have given

up early 2023 gains, but I believe they’ve made their lows for this cycle. The 10-year Treasury yield started

February at 3.39%. It recently traded at 3.948%, a big jump in a short time.

The iShares Core U.S. Aggregate Bond exchange-traded fund (AGG) was up

3.3% at the end of January, including interest. It’s now up just 0.6%,

relinquishing nearly all its year-to-date gains. The yield on the two-year Treasury note rose

to 4.803% on Friday, the highest since 2007.

Check out this round trip in bond prices this year:

The bond market seems worried that inflation isn’t

cooling nearly fast enough to reach the Fed’s comfort zone at a 2% annualized

rate and rates will therefore have to rise further and longer than expected.

“We’ve had a reality check,” said Michael Metcalfe,

head of macro strategy at State Street, adding that the easing of

monetary policy expected by markets a few weeks ago “looked a little fanciful.”

“Early this year, markets got ahead of themselves in

terms of pricing in Fed cuts, hoping this cycle would end sooner,” said Idanna Appio, a portfolio manager at First Eagle Investment

Management. “Things were priced for perfection — investors were betting

that the Fed was going to get inflation down successfully and quickly. I think

this process is going to take longer than people thought,” she added.

……………………………………………………………………………………...

The CRB Commodity Index is hitting new lows

from 2022 due to a stronger dollar and belief that the recession is imminent

(if not here already). The energy crises

in Europe were averted by a warm winter and the heavy use of Coal for

fuel. That’s resulted in new lows for Natural Gas. The US was charging

an incredible amount for liquefied Natural Gas, so coal is back for now.

…………………………………………………………………………………………...

Beware of “Seasonally Adjusted” Numbers:

We’ve discussed the U.S. government fabrication of

economic numbers many times before, but especially in last week’s column Sperandeo/Curmudgeon:

Finagled U.S. Economic Numbers Explained.

We noted that the huge (fictitious) employment gains (+517,000 Seasonally

Adjusted jobs added in January) should be producing an incredible amount of

tax revenue. Yet the U.S. Treasury Dept

stated that tax revenues decreased by $44 billion or 3%, while the

Congressional Budget Office (CBO) says projects 2023 tax revenues to fall by 2%

to $4.8 trillion.

The CBO now estimates that receipts in January 2023 totaled $448

billion—$17 billion (or 4%) less than the amount recorded in the same month

last year.

So, the disconnect between strong “seasonally adjusted” jobs gains and

declining Treasury tax receipts continues.

Again, whenever you see “Seasonally Adjusted”

government numbers without any context you are being scammed.

Another example is the “Manheim Used Vehicle Value Index” for

wholesale used car prices. It was

reported as +4.1% Seasonally Adjusted for the first 15 days of February which was the largest

February increase since 2009’s full-month 4.4% gain. Yet the non-seasonally adjusted price was

down -5.9% year over year!

Is the Fed looking at Supercore Inflation?

“Supercore inflation” has been in the news lately.

It’s an economic measurement that strips away volatile items from the

traditional Consumer Price Index (CPI), such as food, energy, and housing. It

is an alternative method for tracking inflation and is said by some to provide

a more accurate snapshot of underlying price pressures.

“Supercore inflation was a strong 6.4% on a

year-over-year basis through December 2022, but it is moderating,” said Mark

Zandi, Moody’s chief economist. For the three months through December,

supercore inflation is up only 2.4% annualized, and just 0.9% annualized in the

month of December. Wage growth is also moderating, Zandi said, a good sign for

future supercore inflation.

“The Fed focuses on supercore [1.] because it

includes those prices that are more likely to be driven by the cost of labor,

which the Fed can more directly impact through changes in interest rates,” he

said. “Supercore inflation is still way

too hot, but it has begun to cool off, and all signs point to it and overall

inflation getting back to something more comfortable over the coming 12-18

months,” Zandi told CNN.

Note 1. Neither Fed Chair Jerome

Powell or any other Fed official we know of has said they were using

“supercore” as a gauge to measure inflation.

The Fed’s favorite metric is the core Personal Consumption

Price Expenditures (PCE) index, which excludes food and energy prices. January’s price index released Friday by the Commerce

Department, overshot economists’ expectations. The core reading excluding

food and energy, considered the Fed’s preferred gauge of inflation, rose 4.7%

year on year. That was ahead of consensus forecasts for a 4.4% increase.

Yet with all the buzz about “supercore” inflation, one has to

wonder if the Fed will use that gauge to claim it got inflation down to its 2%

target rate.

Gold as an Inflation Hedge?

Here’s an interesting study on Gold as an

inflation hedge. From January 1914 till the last CPI report in January 2023

(109 years and one month), the CPI has increased 3.14% compounded

annually. Gold has increased 4.17% using June Futures close

Friday from the fixed price of gold of $20.67 in January 1914. That is a

higher return for Gold by 32.8%.

The CPI is not inflation (money supply growth is) and

thereby Gold is not correlated to its rising prices in the short run.

What is Collective Stupidity?

The Fed may not be evil, but just plain

stupid. In that light, kindly consider

this historical analogy:

In 1943, the Lutheran pastor and member of the German

resistance, Dietrich Bonhoeffer, was arrested and

incarcerated in Tegel Prison. There he meditated on the question of why the

German people—in spite of their vast education, culture, and intellectual

achievements—had fallen so far from reason and morality. He concluded

that they, as a people, had been afflicted with collective stupidity.

Bonhoeffer was not being flippant or sarcastic, and

he made it clear that stupidity is not the opposite of native intellect. On the

contrary, the events in Germany between 1933 and 1943 had shown him that

perfectly intelligent people were, under the pressure of political power and

propaganda, rendered stupid—that is, incapable of critical reasoning.

-->Could that type of stupid group think be

prevalent among FOMC members who continue to make hawkish comments to take down

the markets?

End of a Sad Story:

After a failed July 20, 1944, coup attempt in

Germany, Bonhoeffer connections to the broader resistance circles were

uncovered and he was moved to the Gestapo prison in Berlin. In February 1945,

he was taken to Buchenwald and in April moved to the Flossenbürg

concentration camp. On April 9, 1945, he was hanged with other conspirators.

His brother Klaus Bonhoeffer was also executed for resistance activities, as

were his brothers-in-law Hans von Dohnanyi and Rüdiger Schleicher.

Victor’s Closing Comment:

In the U.S. today, the largest corporations use their

money to buy politicians for laws that favor their interests and are against

the people. One must consider if the Constitutional Republic we have in the U.S. is a

failure?

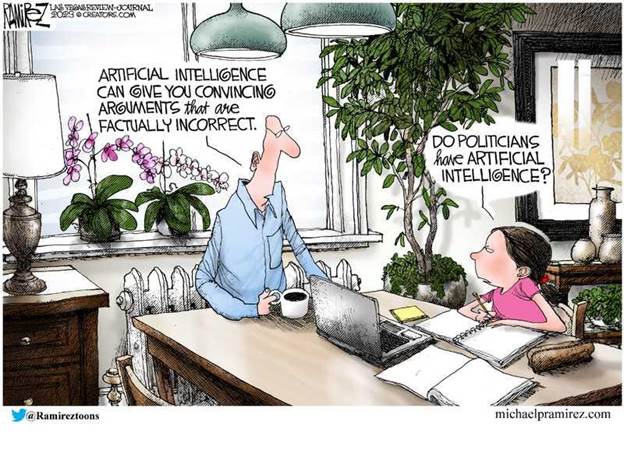

Cartoon of the Week:

………………………………………………………………………………………………

Be well, stay healthy, warm, and dry. Please email

the Curmudgeon (ajwdct@gmail.com)

if you have any comments, questions, or concerns. Till next time…...

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2023 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).