Finagled U.S. Economic Numbers Explained

By Victor

Sperandeo with the Curmudgeon

Introduction:

Have you noticed that recent economic data put out by

U.S. government agencies (e.g., BLS, BEA, etc.) has been very strong,

while private economic data releases have been very weak. For example, the Leading Economic

Indicators (LEI) from the Conference Board have been down for 10

consecutive months, while private company lay-offs have increased sharply

this year.

How does one resolve this discrepancy? That’s the

focus of this week’s column, although there seem to be more questions than

answers!

Discussion:

The one number that is more genuine than others is U.S.

tax revenues. If the U.S. economy is

as strong as reports indicate, tax revenues should be increasing at a healthy

pace. That’s not happening!

According to the U.S. Treasury Dept, the

federal government has collected $1.47 trillion in fiscal year 2023. Compared

to the federal revenue of $1.52 trillion for the same period last year (Oct

2021-Jan 2022) federal revenue has decreased by $44 billion or 3%.

Meanwhile, the Congressional Budget Office (CBO) says it

now expects tax revenues to fall in 2023 by 2% to $4.8 trillion.

Let’s now examine some recent strong economic

data.

1. On February 3rd, the BLS reported an increase of +517,000

jobs added in January 2023 compared with an average monthly gain of 401,000 in

2022. The unemployment rate of 3.4% was

the lowest since 1969 and 800,000 manufacturing jobs were created in the last

two years.

2. Retail

sales in January were reported to have increased +3% (more on this later).

3. U.S. real

GDP has also been on the rise the 3rd and 4th quarters of

2022 after two negative quarters to start the year.

4. The Atlanta

Fed GDP-Now [1.] projects this quarter’s GDP to be +2.5%

(annualized) vs last quarter’s +2.9%.

Note 1. GDPNow is not an official forecast of

the Atlanta Fed. Rather, it is best viewed as a running estimate of real GDP

growth based on available economic data for the current measured quarter. There

are no subjective adjustments made to GDPNow—the estimate is based solely on

the mathematical results of the model.

These are very strong economic numbers, so why are tax receipts declining?

Answer: The U.S.

government always tries to make the economic data look good and will fudge any

number to do so. One has to use private sources to

obtain an accurate reading of the U.S. economy, especially considering all the

“seasonal adjustments.”

Let’s dig a bit deeper:

·

We previously noted that the BEA

“adjusted” the base GDP number by making it lower. Thereby, the subsequent GDP numbers are

showing greater growth rate increases.

·

Note that the Blue Chip Economists Consensus for 1st quarter

2023 GDP has now declined to -2%, while the Atlanta Fed GDP Now estimate has

increased to 2.5%.

·

Retail sales were +3.0% last month, but they do not adjust for

inflation. According to David Stockman,

if you adjusted the +3.0% to inflation it would be -1.8%?

·

January’s +517,000 jobs added

was a SEASONALLY ADJUSTED NUMBER. The

non-seasonally adjusted number (actual “counted jobs”) was actually

negative! On an NSA basis, 2.5

million jobs vanished last month. That’s a 3+ million reporting

difference!

·

In its CPI calculation, the

BLS defines the cost of “shelter” as “owners’ equivalent rent.” That’s a make-believe subjective number that

has no meaning in the real world, but it’s 1/3 of the weighting in the CPI! The

BLS with this one meaningless category can make the CPI move anyway it wishes.

·

The debt to Gross GDP ($26.2

trillion) ratio is stated as “debt held by the public” at $24.6 trillion, but

that doesn’t include the Social Security trust fund (“intra-governmental holdings”) which

is $6.8 trillion as of 2/9/23.

·

However, U.S. debt subject to

the “debt limit” does include the Social Security Trust fund. That makes the

debt to GDP ratio > 120%!

--> It goes on and on like this. Not one number

is really truthful!

………………………….……………………………………………………………….

CBO Federal Debt Estimates vs Reality?

The CBO estimate for the increase in the federal debt

over the next 10 years goes from the current $31.4 trillion to $46.4 trillion.

Or a growth rate of 3.98% per year. However, the 52 year

trend (since Nixon took the U.S. off the International Gold Standard in August

1971) of US federal debt is 8.75% per year!

The main reason for this huge discrepancy is that the

CBO never estimates increases in debt from recessions. Astonishingly, the

CBO believes the business cycle has been repealed and there won’t be any

recessions in the future.

It should be kept in mind that Medicare is supposed

to go broke in 2027 and Social Security in 2033. Does anyone believe those

programs will not be funded by borrowing printed currency?

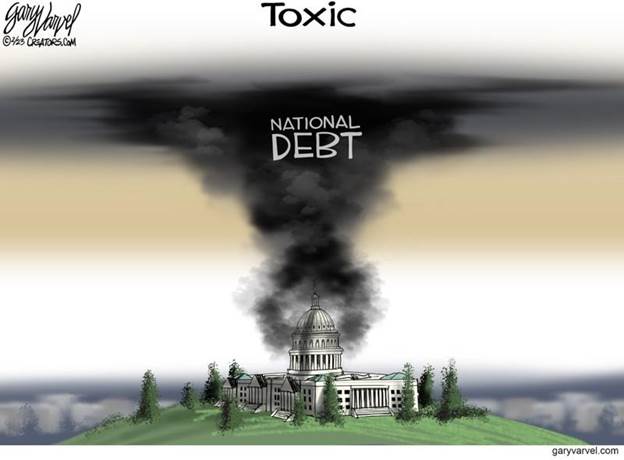

Using the 52 year trend rate the U.S. “Stated Debt”

- not including “off budget” items and unfunded liabilities – U.S. federal debt will be $72.65 trillion!

Do you think that’s toxic?

CPI, Inflation and the Fed:

The BLS revised the seasonal adjustment to the

consumer price index (CPI) data for 2022 and the weights for the basket of

goods in the index for 2023. The revisions boosted inflation measures in late

2022 and suppressed the rise in measured inflation in January 2023. The CPI

rose 0.5% in January, five times the upwardly revised pace of December 2022.

The net effect was hotter, more persistent inflation than previously reported. That will likely keep the Fed’s rate rises

going for the next two or three FOMC meetings.

The CPI 52 year trend shows

a reported official increase of 3.95% annually (it is actually much

higher). That means your paycheck has to double every 18.2 years just to keep even with

inflation (and that does not adjust for tax increases due to the U.S.

progressive tax system). It means if you start work after college (age 22) it

will double 2.4 times before age 65. This implies your children and

grandchildren will most likely be poor. Oh, but the Fed claims its goal is 2%

annual inflation. How’s that working

out?

To reiterate what we’ve stated in dozens of

Sperandeo/ Curmudgeon posts, inflation is not the CPI! It is the increase in the quantity of money (e.g.,

money supply).

The Fed totally controls the cost of credit/money and

the U.S. money supply. They are solely responsible for this “inflation tax” we

are all paying now. Supply chain

disruptions? War in Ukraine? They are only temporary, and prices should

decrease after the effects have diminished.

But that’s not happening. We haven’t really seen any big declines in

general prices? Instead, we have lower rates of price increases.

Curmudgeon’s Conundrum:

As most of you know, I’m a professional researcher

and a stickler for accuracy. Having done

an extensive online and print search in the library, I conclude that no one is

actively challenging the U.S. government economic numbers other than

Victor. How is that possible?

Has the mainstream media become lemmings which follow

what the governments says without further examination?

For example, I could find only one economist who

didn’t believe the strong BLS January 2023 jobs report.

Mark

Zandi, chief economist at Moody’s Analytics, warned that the BLS report might be

too good to be true. “Whoa! The BLS jobs report for January was VERY strong. So

strong, I don’t believe it. The BLS is likely having measurement issues. Most

likely, difficulty seasonally adjusting the data, which is especially important

in January.”

Zandi

advises not to take the BLS data at face value.

He expects future revisions based on complete employment counts from

unemployment insurance records to show that the economy actually

created fewer jobs in the past year.

However, Zandi’s skepticism was totally drowned out

by the lavish praise and loud clapping from the Wall Street Journal, NY Times

and other mainstream publications that did not even mention seasonal

adjustments as an issue for the strong January jobs report.

Please email the Curmudgeon (ajwdct@gmail.com)

if you have an explanation for the lack of questioning and investigation of

U.S. government reported economic numbers.

Closing Quotes:

When this system was created by the Rothschild’s they

understood the psychology of how it would survive. Here are two relevant quotes:

“The few who understand the system, will either be so interested from its

profits or so dependent on its favors, that there will be no opposition from

that class.”

— Mayer Amschel Rothschild

………………………………………………………………………………………………

Be well, stay healthy, warm, and dry. Till next

time…...

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2023 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).