Investors Flee Stock Funds, Bond Funds Benefit, Recession and Inflation Watch

By the

Curmudgeon

Stock Outflows, Bond Inflows:

Despite a super strong stock market in January,

investors have been net sellers of equity funds in 2023. There’s been a net outflow of $31 billion

from U.S. equity mutual funds and exchange-traded funds (ETFs) in the past six

weeks, according to Refinitiv Lipper data through February 8th.

That marks the longest streak of weekly

net outflows since last summer and the most money pulled in aggregate from

domestic equity funds to start a year since 2016.

The Investment

Company Institute (ICI) reported that equity funds had estimated outflows

of $12.65 billion for the week ended February 1st, compared to estimated

outflows of $4.27 billion in the previous week. Domestic equity funds had

estimated outflows of $9.08 billion.

World equity funds had estimated outflows of $3.56 billion were $3.76

billion for the week.

Meanwhile, bond funds have been winners this

year. The ICI said that bond

funds had estimated inflows of $9.73 billion for the week, compared to

estimated inflows of $7.51 billion during the previous week. Taxable bond funds

saw estimated inflows of $8.26 billion and municipal bond funds had estimated

inflows of $1.47 billion. Lipper data

shows that for 2023, a net $24 billion has been invested in taxable bond funds

and nearly $3 billion into municipal bond funds.

Behind the

Numbers:

The exodus from U.S. stock funds underscores the

divergence between investors skeptical of the market’s year-to-date rise and

those eager to ride the wave higher. Some investors are putting money into

ultra-safe fixed-income assets and choosing funds of cheaper stocks abroad.

“The sense of opportunity certainly lies elsewhere,”

Cameron Brandt, director of research at fund-flow and allocation data provider EPFR,

said of U.S. equity funds. “It’s

definitely a sign that markets are still cautious, certainly for a segment of

the investing public,” Mr. Brandt added.

Among individual investors, net purchases of single

stocks have climbed since the start of the year, while net buying of ETFs has

stagnated, according to Vanda Research data.

Bank of America

clients have made net purchases of more than $15 billion in single stocks year

to date, while ETFs have seen more than $10 billion of net outflows. The preference toward individual stocks

reflects a more supportive backdrop for active management, according to Jill

Carey Hall, U.S. equity strategist at Bank of America.

Emerging market and Europe-focused equity exchange

traded funds both enjoyed their highest monthly net inflows for a year, according

to Blackrock. Investors put $7.3bn

into ETFs focused on European equity — predominantly from the U.S. — the

highest figure since January 2022, according to the BlackRock data.

Emerging market ETFs were even more popular,

attracting a net $15.9bn, again a 12-month high, with buying led by funds

listed in the U.S. ($9bn) and the EMEA region ($5.3bn).

Estimated Flows* to Long-Term

Mutual Funds

Millions of dollars (ICI)

|

|

2/1/2023 |

1/25/2023 |

1/18/2023 |

1/11/2023 |

1/4/2023 |

|

Total equity |

-12,646 |

-4,270 |

-1,390 |

-6,143 |

-16,318 |

|

Domestic |

-9,082 |

-2,869 |

-812 |

-1,049 |

-6,097 |

|

World |

-3,564 |

-1,401 |

-578 |

-5,093 |

-10,221 |

|

Hybrid |

-842 |

-1,550 |

244 |

-721 |

-3,340 |

|

Total bond |

9,729 |

7,506 |

4,255 |

4,758 |

-11,358 |

|

Taxable |

8,255 |

4,564 |

2,173 |

2,776 |

-8,203 |

|

Municipal |

1,474 |

2,942 |

2,082 |

1,982 |

-3,155 |

|

Total |

-3,759 |

1,687 |

3,109 |

-2,105 |

-31,015 |

The Case for Bonds:

Higher interest rates have led some investors to add

to their bond funds, as fixed-income assets offer the highest yields in

more than a decade with minimal risk. The yield on the Bloomberg U.S. Aggregate

Bond Index is 4.5%, outpacing the 1.7% dividend yield on the S&P 500. Others, like the Curmudgeon have been buying 3-,

6-, and 12-month T-bills which all yield over 4% with no state income tax.

As the inflation rate moderates, PIMCO argues

that “bonds are back” in this

video interview. Higher yields

(above the 20-year average) and lower volatility make a strong case for buying

bonds now, according to PIMCO portfolio manager Tony Crescenzi.

Global

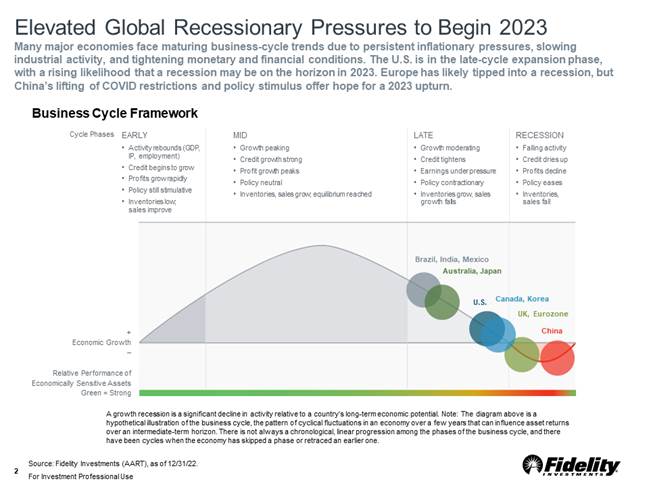

Recession Watch:

The nearly widespread view that most of the world

will be in a recession this year argues that inflation rates are expected to

decrease. That’s illustrated in this

chart from Fidelity:

What to Expect in the January CPI Report:

The consumer price index (CPI) report for January

will be released February 14th.

Annual inflation has been falling over the past several months from its

peak of above 9% in June to 6.5% in December.

Economists polled by the Wall Street Journal forecast

a 0.4% increase in the January CPI, which would slow the year-over-year rate to

6.2% from 6.5% in December. Year-over-year CPI peaked at a roughly 40-year high

of 9.1% last summer. Core CPI, which excludes volatile food and energy prices,

is expected to rise 0.3% in January, with the year-over-year rate at 5.4%

versus 5.7% in December.

The January CPI report will see the Bureau of Labor

Statistics (BLS) introduce new weightings for its calculation of the CPI for

the coming year. For this year, the bureau has changed its methodology from

using consumption data during a two-year period to only one year to weight the

CPI components.

As a result, the 2023 CPI reports will be only based on

expenditure data in 2021, when the spending was more heavily weighted toward

goods consumption instead of services, according to Richard de Chazal, macro

analyst at William Blair. The

January inflation data will also be weighted more towards goods expenditures,

which had been moderating, de Chazal wrote in a Friday note to clients.

The Owner’s Equivalent Rent calculation will also change. The

BLS

wrote:

“Beginning with January 2023 data, BLS plans to adjust the

weighting method for Owner’s Equivalent Rent (OER) in the CPI. The new

method will use neighborhood level information on housing structure types to

weight OER’s unit sample observations.

BLS will continue to sample and weight housing units to be

geographically representative. In some

neighborhoods, detached houses are underrepresented in survey responses so

additional unit weight will be given to underrepresented detached houses in the

OER index sample.”

OER accelerated from November to December. Michael J. Kramer of Mott Capital

Management wrote,

“OER is likely to continue to drive prices higher for some time, while the

impact of declining used car prices will be less pronounced.” That could keep the Fed in tightening mode

for longer than most investors expect.

Others, like Victor, believe the Biden administration

encouraged the BLS to recalculate the CPI in order to

make it lower than it otherwise would be.

Victor wrote in a

previous post:

“As the decline in the CPI is not happening fast enough for

the government’s liking, the BLS will artificially lower the CPI by changing

the way its calculated! I believe this

will occur in the coming months and will lower the CPI to 2 to 3% annually.”

Hopefully, the release of the January 2023 CPI numbers

(nominal and core rates) will not shock the markets.

Cartoon of the

Week:

Be well, stay healthy, warm, and dry. Till next

time…...

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2023 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).