December 2022 Fed Meeting Minutes Reveal Fed Policy Foibles

By the

Curmudgeon

Introduction:

Victor and I have been saying for a very long time that the

Fed’s been talking the markets down to produce a “reverse wealth effect.” By reducing asset prices, people feel poorer

which the U.S. central bank believes would decrease consumer demand and hence

lower inflation. We first wrote about

that last May in this piece.

Fed officials firmly believe they won’t be able to defeat

inflation unless they can slow the economy by tightening financial conditions,

such as by raising borrowing costs and lowering stock prices.

Conversely, any market rallies that ease financial conditions

threaten to hinder officials’ effort to cool hiring and wage growth. That, in

turn, could prompt the Fed to continue lifting rates or holding them at higher

levels for longer, increasing the risk of a deeper or longer economic downturn.

Fed to Keep Raising

Rates in 2023:

Seventeen of 19 Fed officials projected rates at or above

5.1% this year. By comparison, not a single official in September had forecast

rates above 5% in 2023.

Continuing the hawkish drumbeat, Minneapolis Fed President

Neel Kashkari said he expects the Federal Reserve will need to raise interest

rates by another percentage point over the next few months, despite signs that

inflation is decelerating.

“While I believe it is too soon to definitively declare that

inflation has peaked, we are seeing increasing evidence that it may have,” Mr. Kashkari said in an essay

published online Wednesday morning. “In my view, however, it will be

appropriate to continue to raise rates at least at the next few meetings until

we are confident inflation has peaked.”

Selected Quotes from

Fed’s Dec 13-14, 2022 Meeting:

The minutes of the Fed’s December 13-14, 2022 meeting,

released today, confirm our “reverse wealth effect” thesis and much, much

more. Please read on and ask yourself

why is the Fed so concerned with stock prices?

“Equity markets moved higher. However, equity market contacts

noted risks to growth ahead, and earnings expectations for coming quarters had been

marked down.”

“Broad stock price indexes increased, likely reflecting

reduced concerns about the inflation outlook and the associated implications

for the future path of policy. On net, the one-month option-implied volatility

on the S&P 500—the VIX—decreased notably and was around the middle of its

range since mid-2020.”

“In line with reduced investor concerns about the inflation

outlook, spreads of interest rates on corporate debt, mortgage-backed

securities, and municipal bonds to comparable duration Treasury yields all

narrowed over the inter-meeting period.”

………………………………………………………………………………………………………………………

“Regarding the outlook for monetary policy, both market- and Desk survey-based measures

indicated expectations for the Committee to maintain elevated policy rates

through 2023. Participants continued to

anticipate that ongoing increases in the target range for the federal funds

rate would be appropriate to achieve the Committee’s objectives.”

“No participants

anticipated that it would be appropriate to begin reducing the federal funds

rate target in 2023. Participants generally observed that a restrictive

policy stance would need to be maintained until the incoming data provided

confidence that inflation was on a sustained downward path to 2 percent, which

was likely to take some time. In view of the persistent and unacceptably high

level of inflation, several participants commented that historical experience

cautioned against prematurely loosening monetary policy.

àMeaning no Fed rate reductions in 2023 as long as stock and bond prices stay elevated!

“With inflation remaining unacceptably high, participants

expected that a sustained period of

below-trend real GDP growth would be needed to bring aggregate supply and

aggregate demand into better balance and thereby reduce inflationary pressures.”

“Participants noted that, because monetary policy worked

importantly through financial markets, an

unwarranted easing in financial conditions, especially if driven by a

misperception by the public of the Committee’s reaction function, would complicate

the Committee’s effort to restore price stability.”

“Looking ahead to year end (and 2023), market participants

anticipated limited pressures. The manager pro tem

noted that if transitory pressures emerged in money markets, the Federal

Reserve’s backstop facilities are available to support effective policy

implementation and smooth market functioning.”

àNO CONTINGENCY PLAN FOR A CREDIT CRISIS OR TREASURY

MARKET LIQUIDITY VANISHING?

Other Voices:

“A big concern of their messaging here is that the market is

pricing in cuts by the second half of this year,” said Michael Feroli, chief

U.S. economist at JPMorgan Chase & Co. With inflation too high, officials

“realize that the risk of overtightening is just something that they have to

swallow and stomach,” he said.

“They don’t see light at the end of the tunnel yet with

inflation,” said Derek Tang, an economist at LH Meyer in Washington. “They’re

so alert of financial easing that’s ‘unwarranted’ that the scale should tilt to

staying with 50 basis points in February. That’ll drive the message home.”

“It seems that there is more of a consensus view that they’ve

got to go above 5% than certainly I would have thought the numbers implied,”

said Kevin Cummins, the chief US economist at NatWest Markets in Stamford,

Connecticut.

Will Fed Continue to Raise

Rates as Inflation Falls?

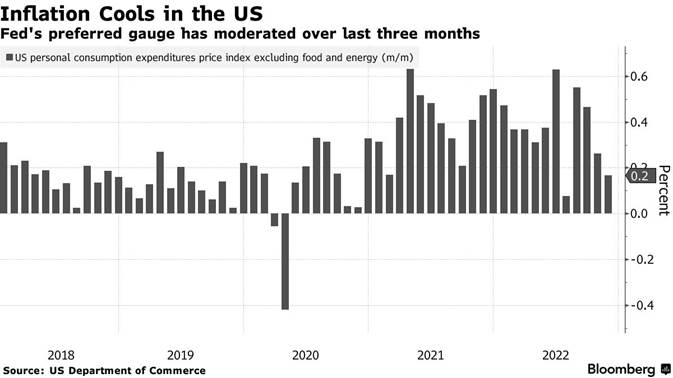

The Personal Consumption

Index (PCI) is the Fed’s preferred U.S. inflation gauge. As the chart below

shows, it’s been in a steep decline the last four months. That’s sure to continue in 2023 with the

economy slowing further due to previous jumbo rate hikes last year.

A much lower inflation expectation was bolstered by the most

recent reading on price pressures published by the Commerce Department on Dec.

23rd, which showed so-called core inflation — excluding food and

energy — rose just 0.2% in November. That was less than what was implied by the

Fed’s latest projections, and monthly readings of a similar size going forward

would be consistent with a return to the central bank’s 2% target.

……………………………………………………………………………………………………………………

Cartoon of the Week:

……………………………………………………………………………………………………………………Conclusions:

The December meeting minutes also show that the Fed is

unwilling to loosen monetary policy prematurely before its work is done. They

also are uncomfortable with rising stock prices which they think subverts their

inflation fighting mission.

Officials stressed that despite recent slowdowns in price

growth, “it would take substantially more evidence of progress to be confident

that inflation was on a sustained downward path,” the minutes say.

……………………………………………………………………………………………………….

Victor and I wish you

all the best for 2023! Till next

time…………………………

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2023 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).