Fed’s Actions, Talk, and Ignorance Imply a Hidden

Agenda?

By Victor

Sperandeo with the Curmudgeon

Introduction:

After Fed chairman Jerome Powell’s comments at

Wednesday’s post FOMC meeting news conference, one must question if the U.S.

central bank has a hidden agenda. WHY? The actions of the Fed and non-stop

hawkish talk of its members are so strange that they defy logic and reason.

How can the Fed continue to raise rates in 2023 with

inflation declining, the economy weakening rapidly and a deeply inverted yield

curve forecasting a serious recession?

Let’s examine the evidence, which comes from recent

remarks by a current and a former FOMC member and Chairman Powell.

Fed’s Hawkish Drumbeat Continues:

1. Current FOMC member and San Francisco Fed

President Mary Daly said on Friday that she's not convinced that

inflation may be cooling yet. Really?

That’s after five consecutive declines in the CPI,

with the highest year over year peak taking place six months ago at June at

9.1% YoY. The CPI is now 7.1% YoY which

is a 22% decline from its peak.

The PPI has also declined as we showed via a chart in

last

week’s column.

Yet Ms. Daly says Fed rate increases “have a ways to go,” meaning they will continue throughout 2023. What’s

up with that?

Speaking virtually at the American Enterprise

Institute, Ms. Daly (a PhD economist) said the key to bringing down inflation

is re-balancing the labor market to bring wage growth down. That goes back to the 14th century “the world

is flat” theory or invoking the Phillips Curve [1.] employment vs

inflation relationship which was long ago discredited.

Yahoo Reporter Jennifer Schonberger wrote:

Daly,

like other Fed officials, says she thinks the unemployment rate will

need to rise to about 4%, or slightly higher, to restore balance in the job

market. She says wage growth is still running around 4 1/2% to 5% and

needs to come back down to 3 1/2% to 4%. Daly says that means higher (Fed

Funds) rates held longer.

Therefore, she is a true Phillips Curve believer

who is saying that more people must lose their jobs and workers need lower

wages…to stop inflation!

Note 1. The Phillips

Curve is an economic theory that inflation and unemployment have a stable

and inverse relationship. Developed by William Phillips, it claims that

economic growth results in inflation.

This was dis-proven with empirical evidence during the 1970-1981

stagflation when there were high levels of both inflation and unemployment. The U.S. unemployment rate went straight up

with the huge inflation of the 1970’s to early 1980’s (from 3.90% in January

1970 to 10.80% in December 1982.

………………………………………………………………………………………………

Victor’s Opinion: With absolute certainty, Daly is applying a 100% incorrect,

widely discredited theory as justification for the Fed to keep raising rates!

For the benefit of Ms. Daly, I quote Mark Twain: “It

is better to keep your mouth closed and let people think you are a fool than to

open it and remove all doubt.”

………………………………………………………………………………………………

2. From resigned

FOMC member Richard Clarida (the crook who front ran the Fed’s monetary

policies) via a tweet by WSJ reporter Nick Timiraos (@NickTimiraos):

“If financial conditions ease because markets price

in [2023] cuts, a peak policy rate of 5.25% may not be sufficient to put

inflation on a path to return to 2% over time.”

This is a unique threat from a former thief and FOMC

member, which effectively warns, “if you dare buy stocks in the future, we will

have to raise rates more than our original plan.”

3. And from

the “BIG BOSS” who parrots this type of “statism” rhetoric: Fed Chair Jerome

Powell said at the Brookings Institution on November 30th:

“We do not want to over-tighten, because we think

cutting rates is not something we want to do soon. However, if financial conditions ease

(MEANING IF STOCKS AND/OR OTHER FINANCIAL ASSETS RALLY), a peak policy rate of

5.25% may not be sufficient to put inflation on a path to return to 2% over

time.”

Powell would not answer one important question asked

of him: “What if Stagflation occurs?”

Powell’s answer: “I don’t like to deal in hypotheticals.” That’s

despite the evidence that Stagflation has characterized all of 2022!

Jeremy Siegel Critiques the Fed:

Here’s a comment the Curmudgeon and I wholeheartedly

agree with:

Wharton Emeritus Professor and Wisdom Tree Sr.

Investment Advisor Jeremy Siegel is

not happy with the Fed's hawkishness which was telegraphed at

Wednesday's FOMC meeting. Siegel said the Fed is contradicting itself as

it focuses on crushing wages that are spiking due to supply side issues. Siegel

ultimately expects that the Fed will be cutting interest rates in 2023, not

raising them.

"Now he's saying there's supply-side problems in

the labor market that may raise wages, and we have to crush the wages in order

to stop inflation. That's just totally inconsistent as a part of monetary

policy," Siegel told CNBC on Thursday. "The Fed is not supposed to

act on structural shifts on supply-side problems."

Curmudgeon Analysis:

There are multiple risks associated with the Fed’s

continuing its rate rising rhetoric into 2023:

1. “Something breaks” in the sense of a 2008-style

meltdown of the financial system or the credit markets freezing for an extended

period.

2. A global

stock market crash triggered by the fear of a very serious recession (or

depression as Victor has forecast) due to rate hikes while the economy is

declining. That could be followed by an

epic economic collapse.

3. An emerging markets debt default crisis triggered

by a super strong U.S. dollar and rising global interest rates.

Even if the Fed can rescue the financial system from

a crisis, it can’t simultaneously fight a financial crisis and inflation. The likely result would be an immediate stop

of rate hikes and QT with new rounds of QE to follow.

Victor has opined for years that’s the end game with

hyperinflation to follow.

What Could be the Fed’s Hidden Agenda?

Welcome to the Fed’s version of the Gestapo! The

Fed’s actions and talk are too crazy to be normal, IMHO.

Raising rates seven times since March 2022; four

consecutive 75 bps rate hikes as the CPI was declining; non-stop talking down

markets with threats of more rate hikes for longer --- all while the Fed’s 2023

GDP and unemployment forecasts have worsened?

Nothing like that has ever been done before by ANY central bank!

Powell has acknowledged that aggressively raising

interest rates would bring “some pain” for households but that doing so is

necessary to crush high inflation. How

much pain is enough?

That brings us to what might be the Fed’s hidden

agenda? Just a guess, but it could be to

crush the economy and make people more dependent on U.S. government handouts. That would facilitate total government

control of what used to be the middle class.

Fed Ignores Effect of Money Supply on U.S. Economy:

Have you noticed that the Fed never mentions money

supply growth or curbing it over the long run? The fact is the money supply acts with lags

of 9-16 months. So, with the decline in money supply growth in 2022, the

material decline in economic activity has just begun and will get much worse

next year.

In the 12-month M2 chart

below, we can clearly see money supply growth DECLINING since March

when the Fed first started raising rates:

Conclusions:

If the Fed still believes in the Phillips curve

and does not realize that excessive money supply growth (like in 2020-21)

causes inflation, the U.S. central bank is doomed. It will never be able to get the economy back

to normal.

In other words, there is no hope for the Fed, because

it seems to have no idea what it is doing and the damage to the economy (and

markets) it has caused and will cause.

Boom and Bust cycles are built in by the Fed’s

ignorance of how the monetary system works.

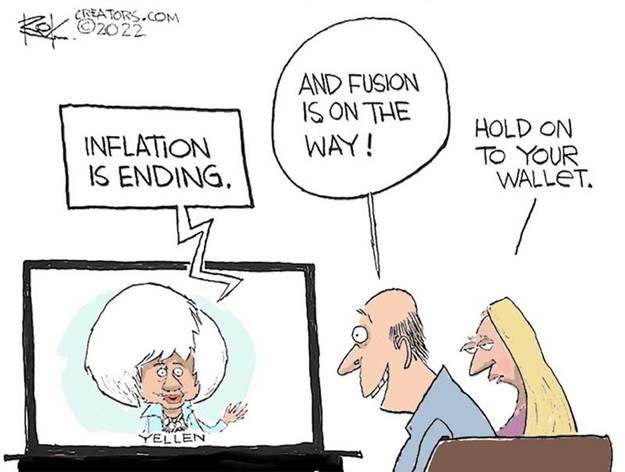

Cartoon of the Week:

………………………………………………………………………………………………….

Be well, stay healthy, do things that make you feel

good but don’t harm others. Wishing you a happy holiday season, peace of mind

and contentment. Till next time………

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2022 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).