3rd Quarter GDP EST Adjusted Up 800% Overnight!

By Victor

Sperandeo with the Curmudgeon

Introduction:

“Sometimes people don't want to hear the truth

because they don't want their illusions destroyed,” Friedrich Nietzsche

Atlanta Fed’s Latest estimate of 3rd quarter GDP:

+2.4 % on September 30th vs +0.3% on

September 27th.

Backgrounder: “GDPNow is not an official forecast of

the Atlanta Fed. Rather, it is best viewed as a running estimate of real GDP

growth based on available economic data for the current measured quarter. There

are no subjective adjustments (really ???) made to GDPNow—the estimate is

based solely on the mathematical results of the model.”

Statement from the Atlanta Fed:

“The GDPNow model estimate for real GDP growth

(seasonally adjusted annual rate) in the third quarter of 2022 is 2.4% on

September 30, up from 0.3% on September 27. After recent releases from the U.S.

Bureau of Economic Analysis (BEA) and the U.S. Census Bureau, the

nowcasts of third-quarter personal consumption expenditures growth and

third-quarter gross private domestic investment growth increased from 0.4% and

-7.6%, respectively, to 1.0% and -4.2%, respectively, while the nowcast of the

contribution of net exports to first-quarter real GDP growth increased from

1.10 percentage points to 2.20 percentage points.”

Victor’s Comment and Analysis:

The BEA is a U.S. government bureau under the

Executive branch. So, all of a sudden GDP will be up for this year after being

negative for the first two quarters?

Opinion: Wherever you look in government you’ll find

corruption, mostly through bribery and government manipulation! This upward revision of GDP is a perfect

example of that. The data by the BEA

is purely lies for political purposes before the U.S. mid-term elections.

U.S. Economic Outlook:

Let me repeat my strong belief: IF the Fed completes

its projections to raise rates 75bps on 11/2/22 and 50 bps on December 14-15/22

the U.S. economy will be in a Depression. Regardless of the past changes by the BEA,

we’re in a recession now as I’ve repeatedly stated in these Curmudgeon posts.

For example, the PMI [1.] dropped from 51.8 to

45.7 on the last report. A PMI reading under 50 represents a contraction in

manufacturing.

Note 1. The Purchasing Managers Index (PMI) is a

measure of the prevailing direction of economic trends in manufacturing.

The Conference Board Leading Economic Index® (LEI)

for the U.S. decreased by -0.3% in August 2022 to 116.2 (2016=100), after

declining by -0.5% in July. The LEI fell 2.7% over the six-month period between

February and August 2022, a reversal from its 1.7% growth over the previous six

months.

“The U.S. LEI declined for a sixth consecutive month

potentially signaling a recession,” Ataman Ozyildirim, Senior Director,

Economics, at The Conference Board. “Among the index’s components, only initial

unemployment claims and the yield spread contributed positively over the last

six months—and the contribution of the yield spread has narrowed recently.”

Housing Deflation?

·

The Pending Home Sales

index for August was -2% which was its third straight monthly decline. That

index fell 24.2% from a year ago.

·

Meanwhile, the S&P

Case Shiller U.S. home price index decreased by -2.9% in July (the latest

month available). That was the fastest

rate of decline in the history of the index.

As Ayn Rand so aptly put it: “You Can Avoid Reality,

But You Cannot Avoid the Consequences of Avoiding Reality.”

BoE Reversal Sends Message to the Fed:

Like the Fed, the Bank of England (BoE) was

raising rates and doing QT when it suddenly flipped back to QE. It seems when rates were very low or zero, UK

Pension Plans needed more money to pay beneficiaries. They borrowed money as

rates were very low and bought more higher yield debt. For example, paying 25-50 bps to buy bonds

yielding 2.5-3%. As bond prices dropped, the Pension funds were crushed and got

huge margin calls. The BOE then started to buy Gilts to prop up the UK bond

market and thereby save the Pension Plans.

U.S. Pension Plans did the same thing by buying BBB

or higher yielding debt that was internally leveraged by the selling

corporations, which took the money to buy back their stock.

The risk here is best illustrated by U.S. high yield

ETFs like the iShares High Yield Debt (HYG), iShares Investment Grade Debt (LQD),

and Bloomberg High Yield Bonds (JNK). They are all trading below their March

2020 “closing” lows. Those intraday lows were panic sales until the Fed

stepped in to buy junk bond ETFs (which is not permitted in its charter).

The Markets:

All markets (except the U.S. dollar) are falling

rapidly, steadily, and consistently. Every asset class is down double digits

this year. There’s been no place to

hide other than cash.

U.S. stocks may not be adequately discounting the

potential for further earnings declines, as BofA has warned since the beginning

of this year. Latest BofA comment: Over

the past 100 years, when the S&P 500 was 20% below the 200-day moving average,

it has typically been a good entry point to get back into stocks. This would be

around 3374, a level that could force policy panic especially with the G20 on

November 16th.

To make matters worse, the Fed continued its

non-stop, hawkish drumbeat last week as per this article. If the FOMC member cockroaches continue to

come out of the woodwork to threaten the markets with higher rates, then

investors, traders and speculators will capitulate in a big way. That will result in a MAJOR CRASH as I

suggested in last week’s column - Message to the Fed:

Grave Dangers of a Hard Landing.

There could be a lot more margin calls for speculators

long stocks. As of August 31, 2022 (the

latest data available), total U.S. margin debt was $688 billion, which

represents a decrease of $299 billion year-over-year. Further market declines could feed on

themselves from long liquidations in margin accounts.

Fed’s Balance Sheet Trends:

Despite the accelerated pace of QT started in

September, the Fed Balance sheet is currently higher than it was when Jerome

Powell made his Mea Culpa speech that inflation was

NOT TRANSITORY. On 11/30/21, the Fed

Balance sheet was $8.664 trillion, but it is now $8.795 trillion as of 9/28/22!

Since inflation is a monetary phenomenon then why is

the Fed’s Balance sheet higher now than it was 10 months ago?

Answer:

Because the Fed is a function of U.S. federal government spending! As long as Congress and the Senate continue to spend more

than the government receives from taxes, the money will be financed by the Fed

and its member banks.

Note: Money supply

is flat this year as the Fed reverse repos (a drain of money from the system)

hit a new high of $2.425 trillion on 9/30/22. The increases in money don’t show

up on the Fed’s balance sheet but are in the Reverse Repo Facility.

What to Watch Next Week:

On Friday, the BLS non-farm payroll report for

September will be released. The

consensus forecast is for 275,000 jobs added vs. 315,000 the previous

month. I think it could drop to less

than 100K jobs added, because the seasonally adjusted data has to balance with the real jobs counted by the end of the

year. The seasonally adjusted number is 40% higher than actual jobs counted

because of the birth death model (as explained in numerous past Curmudgeon

posts).

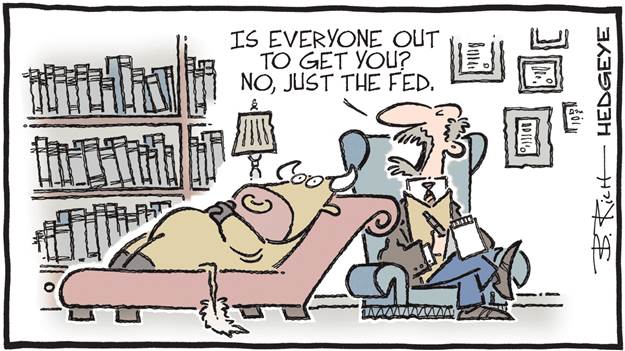

Cartoons of the Week:

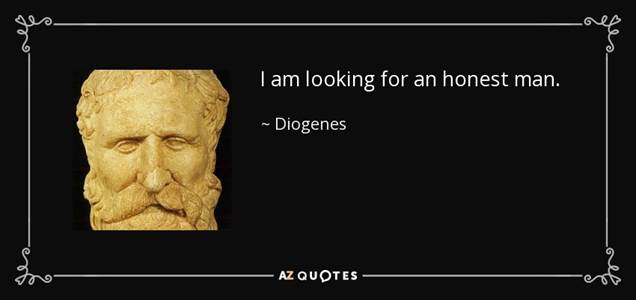

Closing Quotes:

“Freedom is for honest people. No man who is not

himself honest can be free – he is his own trap.” Unknown

Explanation: Centuries

ago, the Greek philosopher Diogenes walked the streets with a lamp held high in

search of an "honest man." His street theater suggested a quiet but

dramatic protest against what he viewed as a corrupt

society that smirked at government ethics and ignored personal responsibility.

……………………………………………………………………………………………….

Be well, stay healthy, try to cope with the financial chaos

the Fed has created. Wishing you peace of mind, and till next time………

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2022 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).