Message to

the Fed: Grave Dangers of a Hard Landing

By Victor

Sperandeo with the Curmudgeon

Introduction:

In the words of Oliver Hardy of the famous Laurel and

Hardy comedy duo: HERES ANOTHER FINE MESS YOUVE GOTTEN ME INTO!

Fed Shocks Markets:

At a news conference last Wednesday, after the Fed

raised rates the expected 75 bps, Chairman Jerome Powell said the Fed had

increased its Fed Funds dot plot from 3.4% in June to 4.4% by year-end,

implying another 125 bps of hikes over the next two FOMC meetings in November

(six days before the U.S. mid-term elections) and AGAIN at its December meeting

(Merry Xmas)! That would bring the Fed Funds rate much higher (4.4% or

4.25-4.50%) than expected by the end of 2022. In addition, the Feds 2023 dot

plot was bumped up by another 20 bps.

The Fed also raised its 2023 unemployment estimate to

4.4% from 3.9% and its core PCE projection from 2.7% from 3.1% (which is probably

optimistic). Equally important, the

Fed cut its 2022 GDP forecast to almost zero at 0.2% from 1.7% and by 500

basis points to 1.2% in 2023.

We believe a failure to restore price stability

would mean far greater pain later on, Jerome H. Powell, the Fed chair, said.

He acknowledged that the Feds rate increases would raise unemployment and slow

the economy.

-→Thought Fiona was bad? Get ready for Hurricane Fed!

..

Professionals React to the Feds News Conference:

1. Bill Zox portfolio manager at Brandywine Global

said, As the Federal Reserve vows to continue raising interest rates to tamp

down on inflation, investors should brace for additional hikes of 75 basis

points in the future.

I believe 75 is the new 25 until something breaks,

and nothing has broken yet, Zox said. The Fed is not anywhere close to a

pause or a pivot. They are laser-focused on breaking inflation. A key question

is what else might they break, he added.

2. Goldman

Sachs cut its year-end 2022 target for the S&P 500 index by about 16%

from 4300 to 3600.

"Based on our client discussions, a majority of

equity investors have adopted the view that a hard landing scenario is

inevitable, and their focus is on the timing, magnitude and duration of a potential

recession and investment strategies for that outlook," wrote Goldman

analyst David Kostin. He said inflation

has proved more persistent than expected and is unlikely to show clear signs of

easing in the near term, leading to even higher estimates of Fed tightening.

"Most portfolio managers believe that in order

to corral inflation the Fed will have to hike rates sufficiently high that it

will result in a U.S. recession at some point during 2023," Kostin

added. His remarks early Friday morning

likely contributed to the markets big selloff with the DJI making a new yearly

low.

3. BofA

Global Research strategists wrote in a client note that the dramatic losses

in bonds (much more below) imperils the worlds most crowded trades: the dollar, U.S. tech stocks, and private

equity. The threat of a credit eventthe polite term for a crashalso

looms. The preconditions that led to

the October 19, 1987, crash are mostly present,

BofA warned. These include a volatile geopolitical backdrop, abnormal U.S.

markets far outperforming the rest of the world, and the lack of international

coordination.

Curmudgeon: Unlike

1987 when the U.S. dollar was weak, this time its super strong (DXY +21.1% in

last year), which could precipitate a currency crisis. Developing countries could default on their

sovereign debt while overseas inflation (especially for oil which is priced in

dollars) would accelerate till something breaks.

BofA thinks there is more pain for markets ahead and

they dont see an ultimate stock market low until yields peak.

...

Victors Analysis:

Since the U.S. is currently in a RECESSION (or ZERO

economic growth as the Fed forecasts) further rate increases coupled with QT

(Feds balance sheet to decline $95 billion per month until further notice),

ensures a hard landing or serious recession. It could get worse. We should be prepared for a Depression

and the markets to thereby CRASH!

Conversely, what would make the markets (stocks,

bonds, gold, commodities, etc.) rally? Let

us know if you have an answer!

Once a nation is in a Depression it does great

harm, as large amounts of capital are lost, especially to small businesses

which go bankrupt. That greatly increases unemployment as small businesses hire

the most workers. Therefore, getting out of a depression economically is very

difficult.

Rosenberg Research:

The die is cast. The Conference Board's LEI fell 0.3% in August and is down

six months in a row at -5.3% SAAR. This has a 100% track record of

predicting recessions back to 1959. Same pattern we saw from June-November

'07. Recession started in January.

The problem we face is not an economic issue. It is

due to the politicians at the Fed that want to change reality. Jerome Powell is a Federal Reserve Chairman

who casually dismisses the monetary lessons of Milton Friedman and does so not

only at his own peril, but the country's.

The Feds fantasy of wanting to cure inflation

quickly is by hiking interest rates at record rates and driving markets down. A

better course would be to limit money supply growth to 4-5% annually without

jumbo rate hikes at every FOMC meeting.

Sidebar Unemployment is a Lagging Indicator:

In August 1929 before the October stock market crash

the unemployment rate was 0.04%. That was the month the NBER classified the top

of the economic cycle. In June 1930, or 10 months later, the unemployment rate

was the same as today in the US or 3.77%. However, in December 1930 it jumped

to 11.89%. A year later 19.1%! So please understand the concept that the

unemployment rate is a LAGGING INDICATOR.

The amount of propaganda to fool the public on this

not being a recession reality is like listening to TOYKO ROSE, as it repeats

over and over.

.

2022 YTD U.S. Bond/Notes: Worst Decline in 97 Years:

What new mess has Fed Policy caused in 2022? Using

the Feds power to crush the people, under the excuse of lowering inflation?

In the last 97 years when did the U.S. T-Bond/T-Note

markets act like today under all conditions?

NEVER!

Lets examine the Intermediate Treasury ETF (IEI)

compared to 97 years of history for a perspective of this years Fed monetary

policy. Reference: U.S. Treasury

Intermediate Notes- Total Losses (includes coupon interest) 1926-2022 (96

years 9 months) Ibbotson Associates.

·

The IEI (3-to-7-year Treasury

ETF) is down -10.74% as of 9/23/22. Thats 109% more than any full year versus

Intermediate Treasuries since 1926!

·

The T-Note Intermediate

Futures are down -14.74% YTD.

·

The Bloomberg Corporate Bond

Index ETF (AGG) is down -14.8% this year as of this Friday. The Bloomberg

U.S. Aggregate bond index declined -0.25% on Friday, September 23rd. Its down -4% in the last month and -14.08%

over the last year (there are no expenses like an ETF has).

·

The TLT (20 year + U.S. bond

ETF) is down -26.8% as of September 23rd.

·

Those numbers are by far the

worst in 96.75 years! The worst long

U.S. bond annual loss was over that period was -14.9% in 2009.

·

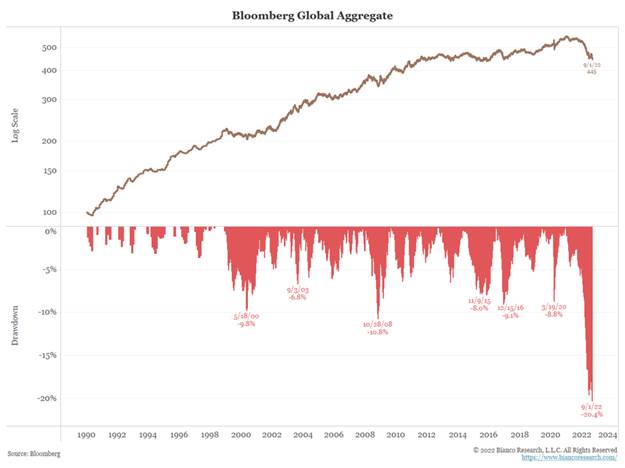

Global bonds have done

even worse, as per the long-term chart below. The Bloomberg Global-Aggregate Total

Return Index Value (Unhedged) declined -0.85% on Friday and is down -19.31%

YTD and -20.49% over the past year.

Chart courtesy of Bianco Research via Twitter

Curmudgeon Note:

In my 54 ½ year involvement with markets, Ive never

experienced anything like 2022! As noted

in previous fiendbear.com

posts, all asset classes are down this year.

Bear markets everywhere with no place to hide!

Only the U.S. dollar has risen, but that is a negative for

American investors in foreign stock and bond funds as well gold/ precious metal

funds!

Even oil, which increased strongly in the

beginning of the year, is now trending down in a big way. On Friday, December WTI Crude Oil futures

declined -$4.06 while the Profunds Oil and Gas 1.5X

index mutual fund (ENPIX) was down -11.33%.

Unleveraged gold and precious metals mutual funds were

down 4.5% to 5% on Friday and are deeply negative for 2022 after being up

through February. One of the oldest such

funds- VanEck International Investors Gold Fund Class A (INIVX) - is currently

at a 52-week low and -32% 2022 YTD.

--->Arent gold and gold/precious metal funds

supposed to increase in value when inflation is high and above trend?

Market Comments (Victor and the Curmudgeon):

While the financial markets have been pummeled in

2022, the global economy has just begun its bubble popping phase. As a result, expect a serious decline in

corporate earnings as FedEx, GE and Verizon warned two weeks ago.

Also, lower valuations due to higher interest rates

should take the S&P 500 P/E down to the 12- 14 times area, assuming the Fed

does not stop raising rates or end QT.

Jason De Sena Trennert, who

heads Strategas Research, sees a profit recession that could cut 2023

S&P 500 earnings to just $200. BofA has persistently warned that earnings

estimates are too high. The falling earnings estimates could mean the next leg

of the bear market is upon us, Trennert concludes.

Using Goldmans estimated 15 times P/E and Strategas

$200 earnings projection implies an S&P 500 target of 3000. That would be

an additional 18.8% decline from Fridays close of 3693.23, which already is

23% below the benchmarks closing high of 4796.56, hit on January 3, 2022.

Watch BBB and CCC Corporate bond ETFs which are now at (LQD)

or approaching (HYG and JNK) the lows of March 2020. The junk bond defaults

that would occur in a serious recession or depression would be much worse than

the Lehman Brothers bankruptcy in September 2008, which froze credit markets

for months.

Victors Conclusions:

Powell and his gang of Fed cohorts have no idea what

they are doing. Continuing with jumbo

rate hikes and QT when inflation is trending down and zero U.S. economic growth

this year? Be prepared for chaos and crashing markets!

The Road to Serfdom:

Society will develop a new kind of servitude which

covers the surface of society with a network of complicated rules, through

which the most original minds and the most energetic characters cannot

penetrate. It does not tyrannize but it compresses, enervates, extinguishes,

and stupefies a people, till each nation is reduced to nothing better than a

flock of timid and industrious animals, of which the government is the

shepherd.

. Alexis de

Tocqueville

Tocqueville (29 July 1805

16 April 1859) was a French aristocrat, diplomat, political scientist,

political philosopher, and historian.

.

Be well, stay healthy, try to cope with the financial

chaos to come. Wishing you peace of mind, and till next time

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2022 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).