U.S. Economic Weakness, Bear Market Rallies, Unfavorable

Seasonality

By the

Curmudgeon with Victor Sperandeo

Introduction:

We examine a myriad of

important topics this week in two related posts. Please let us know what you think of our

work. We reply to all reader comments.

U.S. Economic Weakness

Persists:

On Friday, FedEx cut

its revenue forecast by half a billion dollars and warned that volumes were

slowing down as “macroeconomic trends significantly worsened.” The package delivery company is a bellwether

for the economic outlook and is highly sensitive to global monetary

conditions.

The news sparked fears of a

global recession and sent FedEx stock tumbling almost 22% - the biggest single

day decline in the company’s history (even worse than the October 19, 1987,

stock market crash)!

FedEx CEO Raj Subramaniam,

explained the reasons why his company decided to retract earnings/revenue

guidance during an interview with Jim Cramer of CNBC.

“I’m very disappointed in the

results that we just announced here, and you know, the headline really is the

macro situation that we’re facing, We are a reflection

of everybody else’s business, especially the high-value economy in the world,”

he concluded. The volume decline in

every sector around the world...and the weekly numbers are not too good.”

Cramer then asked the new

FedEx CEO whether the global economy is “going into a worldwide recession.” Subramaniam replied, “I think so. But you

know, these numbers, they don’t portend very well, the U.S. is slowing down

too,” he concluded.

Earlier this past week, CEOs

of General Electric Co. and Verizon Communications Inc. also

noted signs of economic troubles. GE’s Larry Culp said managing supply chains

remained difficult, threatening to slow deliveries and push up costs. Verizon’s Hans Vestberg said there had been a

pickup in customer churn, or cancellations, after a recent price increase. Vestberg told a Goldman Sach’s investor conference,

“On the consumer side, we're still going have a negative net ads on phones in

the third quarter.”

The manufacturing sector is

also weakening. Industrial production fell 0.2% in August, coming in below

consensus. While manufacturing output climbed 0.1%, it was also revised

downward in July, more than erasing any gains.

The

Fed’s Beige Book, released on Wednesday, found the U.S. economy was

“unchanged, on balance, since early July.” The housing market tumbled as

mortgage rates soared. Companies showed less demand for office space. Auto

sales were “muted.”

“The

outlook for future economic growth remained generally weak, with contacts

noting expectations for further softening of demand over the next six to twelve

months,” the Beige Book said. Evidently,

that won’t stop jumbo sized Fed Funds increases.

On inflation,

nine of the 12 Fed regions across the U.S. reported “some degree of moderation

in price increases.” Yet prices are still rising. Most business contacts “expected price

pressures to persist at least through the end of the year.”

Separate

surveys from the Federal Reserve Banks of Philadelphia and New York,

published on Thursday, both showed negative growth in manufacturing, as well.

For Philadelphia, August marked the third contraction in four months; New York

notched its second straight contraction and fourth in five months.

Meanwhile, Housing has

“hit a brick wall,” Comerica Bank chief economist Bill Adams stated this

week. Mortgage rates passed 6% for the first time since 2008, Freddie Mac data

released Thursday showed, while mortgage applications have plummeted to their

lowest level since 1999.

“We’re

beginning to observe the lagged impact of past policy hikes by the Fed,” says

Joe Brusuelas, chief economist with the economic consulting firm RSM. And the Fed intends to keep up its fast pace

of jumbo-sized rate hikes at each FOMC meeting this year. Sorry readers, no Fed pivot in sight!

Goldman's

chief economist Jan Hatzius just raised his Fed Funds rate forecast by 75bps over

the last two weeks, and now expect that the FOMC will hike by 75bps in

September, 50bps in November, and 50bps in December to reach the bank's

terminal rate forecast of 4-4.25% by the end of 2022 (other banks have the

terminal rate rising as much as 5.0%).

In

keeping with the Fed's stated intention of crashing the economy via a “reverse

wealth effect,” Hatzius wrote that "this higher rates

path combined with recent tightening in financial conditions implies a somewhat

worse outlook for growth and employment next year."

Victor

has repeatedly explained the danger to the economy (and markets) of aggressive

Fed rate hikes. He now says, “Today,

we either have the dumbest FOMC members in history, or a Fed agenda we don’t

know about or understand?”

Bank of

America Global Research:

From an

email to the Curmudgeon on Sunday (September 18th):

“Our

suite of 38 proprietary growth indicators depict a grim

outlook for global growth, yet we are staring at one of the most

aggressive (central bank) tightening episodes in history, with 85% of the

global central banks in tightening mode. The Fed’s overarching focus on price

stability raises the risk of policy error, especially as inflation surprises

have trended down. And this tightening comes as many of our indicators,

including the Global Wave, the Global News Pulse, and sector indicators from

Truckload Demand to the BofA Memory Indicator, suggest weakness.

“An

earnings shock is likely coming, indeed past economic

recessions have always resulted in earnings contractions, an average of

-24%. Leading indicators suggest a cool

off to -1% global growth and while all U.S. sectors but

energy have seen cuts this quarter, we could be in for a lot more pain in case

of recession.”

BofA’s latest Global Fund Manager Survey suggests

allocations to global stocks are at an all-time low as depicted in this chart:

Market

Comments:

Many

investors (and your authors) thought inflation had peaked and was headed

significantly lower. They all got a rude

awakening from Tuesday’s higher than expected consumer price index (CPI)

report. It battered stocks and sent the S&P 500 to its worst week since its

June bear market bottom.

The hot

August CPI reading prompted fears of a full percentage point Fed Funds rate

increase at next week’s FOMC meeting.

According to the CME Group’s Fed Watch Tool, there is now an

18% probability of a 1% (100bps) Fed Funds rate increase on September 21st. That’s up from 0% prior to Tuesday’s CPI

report!

The

Fed’s aggressive monetary policy has crashed markets this year. There’s been no place to hide as all markets

have declined in lockstep. So much

for the diversified balanced portfolio.

The

only saving grace is that you can now get 4% on a one year

T-Bill, which yielded only 0.07% 52 weeks ago!

Obviously, that’s due to the Fed’s super aggressive monetary policy this

year which no one expected.

The

Curmudgeon has been buying 26 week T-Bills, 2-year and

3-year T-Notes on Treasury Direct where there is no commission or bid-ask

spread. Sentimentrader notes that “smart money commercial hedgers in

2-, 5-, and 10-year Treasury note futures have built up near-record long

exposure in those contracts.’

……………………………………………………………………………………………………...

Emotional

Pain of Bear Market Rallies:

Rallies in bear markets are

often sharp and swift. They convince

many that the “bull is back,” only to be disappointed when the bearish trend

resumes in full force. There is much

emotional turmoil when hopes for the bear’s end are dashed, as occurred last

Tuesday (September 13th). All

major market indexes dropped over 4% after the CPI came in “hotter” than

expected. The declines continued through

Friday’s close.

The chart below depicts three

significant counter trend rallies in the current bear market which started in

early January 2022.

Chart

Courtesy of Elliot Wave International

………………………………………………………………………………..

Victor on Bear Market Rallies:

In a Bear Market most novice

traders focus on PRICES, not VOLUME, which is relatively low on counter trend

rallies. In contrast, volume is

relatively high in a Bull Market. This is best determined using a 20-day moving

average of volume.

Short covering in a Bear

Market is on light volume, as traders are quick to buy to cover short position

and take profits. Only if you look at the volume will you get a very good

indication of what the price move is based on, e.g., investors buying, traders

looking for a quick trade or taking profits from short covering.

For more on using volume to

confirm stock market bull/bear trends, see our companion post: Using Volume to Confirm

Market Trend; What’s the Fed’s Goal?

Unfavorable Seasonality:

Even the calendar is against

anyone looking to buy equities. September is the weakest month for the S&P

500 Index in data going back to the 1950s, and the index is already down more

than 2%.

“Clients and the markets are

very nervous,” said Victoria Greene, founding partner at G Squared Private

Wealth, who says the US benchmark may push as low as 3,400, a 12% fall from

current levels. “It’s too early for us to be dip buyers.”

October is the stock market’s

most volatile month. Since World War II, the average volatility in October is

36% above the average for the other 11 months of the year, according to

investment research firm CFRA. One reason is markets tend to struggle in the

lead up to midterm elections, and this is a midterm election year.

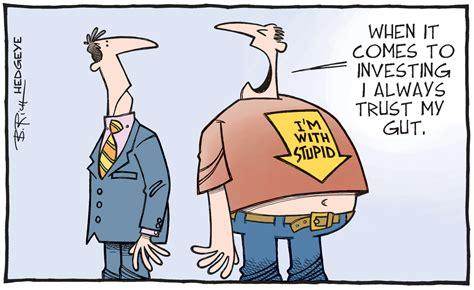

Cartoon of the Week:

End Quote:

“The Fed needs to see

inflation come down and is headed near its 2% target, but we’re a long way from

that,” said Stephanie Lang, chief investment officer at Homrich Berg,

who recommends being defensively positioned in favor of consumer staples and health-care

companies.

…………………………………………………………………………………………………………….

Be well, stay healthy, try to

find diversions to uplift your spirits. Wishing you peace of mind, and till

next time………

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2022 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).