Using

Volume to Confirm Market Trend; What’s the Fed’s Goal?

By Victor

Sperandeo with the Curmudgeon

Backgrounder:

When I started on Wall Street with Pershing &

Co. as a “quote boy” on January 2, 1966, I keenly observed a senior partner

named Milton Leeds (bow tie and matching suspenders with trim white hair). He sat on a high platform reading the tape

and day trading based on breaking news.

His primary skill was the speed of execution from the infrastructure of

Pershing -a brokers - broker set-up.

That was a precursor of the “High Frequency Trading”

of today, which we analyzed several years ago in Assessment

and Perspective of High Frequency Trading (HFT).

When news on a stock from Reuters or another wire-line

service was announced, Milton would quickly react. For example, if a dividend increase on

AT&T (T) was announced, he would shout: “Buy 5,000 Telephone A/C 99 (which

was the firm Account number). This meant the phone clerks standing below him

and nearest the NYSE trading floor connection to the T post should “drop

everything” and execute the “T” order for A/C 99.

This was done with earphones and a direct connection

to the clerk on the NYSE floor, who would then hand the order to a $2 dollar

floor broker…. Within 1 minute Leeds got

the report “bought 5,000 T@ 50 up from 49 3/4.”

After that order was executed, you would see an increase

in volume on the tape for T: 2,000

at 50.25, 3,000 at 50.50, 6,000 at 50 ¾, 5,000 at 50 5/8, 2,000 at 50 7/8,

3,000 at 51, 200 at 50 7/8, 300 at 50 3/4… You get the picture. The volume told the story of AT&T’s

positive news.

Volume Confirms Price Action and Trend:

A rising market should see rising volume. Indeed,

volume can indicate market strength, as rising markets on increasing volume are

typically viewed as strong and healthy.

Increasing price and decreasing volume might suggest

a lack of interest, and this is a warning of a potential reversal. The simple

fact is that a price drop (or rise) on little volume is not a strong signal.

Conversely, when prices fall on increasing volume,

the trend is gathering strength to the downside.

For example, the S&P 500 was down Friday’s

(September 16th) on very high volume of 7,954,650,000 shares. That’s compared to a daily average of

3,683,372,903 shares. That confirms the short-term

downtrend which started on Tuesday (September 13th) after the

“hotter” than expected CPI report.

The Week Ahead:

The Fed should increase rates 75 bps on September 21st

as widely expected. On September

22nd we get the August Leading Economic Indicators and Q2-2022

Current account deficit (% of GDP).

The markets will react to what Fed Chairman Jerome

Powell says at the press conference which follows the Fed rate hike

announcement next Wednesday.

Mea Culpa:

My original view was the Fed would be concerned about

the 2022 midterm elections and would NOT raise rates at its most aggressive

pace in history. I was dead wrong!

What is the Fed’s Goal?

It’s not really to lower inflation via rate hikes,

because that will not affect price rises due to supply chain bottlenecks, war

in Ukraine, manufacturing problems in China, and continued strong U.S. government

spending.

For those who naively believe the Fed is

“Independent,” please consider the words of William McChesney Martin -- the

longest severing Fed Chair (April 1951- January 1970) and best Fed Chairman in

history, in my view:

“We

are Independent WITHIN the government, not independent of the government.” Martin said on Milton Friedman’s TV series

“Free to Choose” in 1980.

Today, we either have the dumbest FOMC members in

history, or an agenda we don’t know about or understand?

My Speculation: drive

rates up as high as possible to sacrifice the House and Senate Democrats as

pawns (assuming the bulk of the midterm U.S. elections are honest) to set up to

lower rates for the 2024 Presidential election.

That could result in a recession/depression and

blaming the Republicans who would control Congress if they gain substantial

seats in the midterms.

That begs the question of how many House and Senate

seats will be lost in the midterms? You have to be your own gut-feel judge

about that, as the reading of the polls are like listening to “Tokyo Rose” in

World War II.

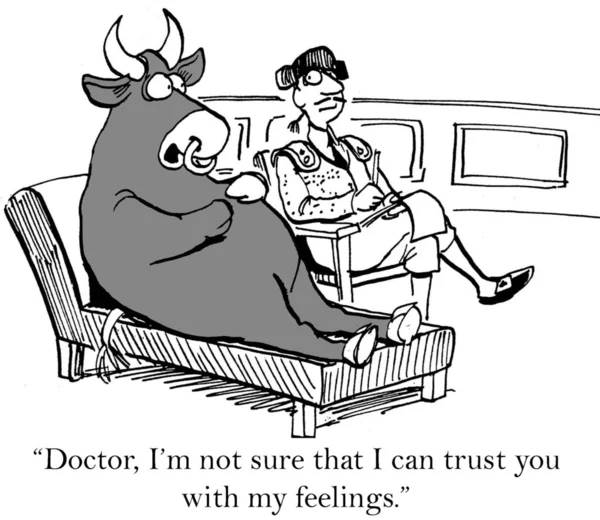

Cartoons of the Week:

……………………………………………………………………………………………….

End Quote:

Please reflect on these words of wisdom:

“If you would be a real seeker after truth, it is necessary

that at least once in your life you doubt, as far as possible, all things.”

René Descartes was a highly

influential French philosopher, mathematician, scientist, and writer. He has

been dubbed the "Father of Modern Philosophy," and much of subsequent

western philosophy is a response to his writings.

…………………………………………………………………………..

Be well, stay healthy, try to

find diversions to uplift your spirits. Wishing you peace of mind, and till

next time………

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2022 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).